Melania Trump, the First Lady of the United States, has become embroiled in a collective fraud lawsuit due to her promotion of the meme coin $MELANIA. This is not merely a case of market volatility, but a textbook example of a "pump and dump" scheme, reflecting the true nature of the crypto market amidst fervor, fraud, and regulatory absence.

1. From "First Lady" to "Fraud Promoter": The Controversy

Melania Trump made a series of high-profile promotions for the $MELANIA coin on her official social media accounts. Framing her narrative around "freedom of speech" and "charity," she encouraged her fans to "join the community," quickly bringing significant traffic to this obscure token. However, according to court documents submitted in the lawsuit, this was a carefully designed trap:

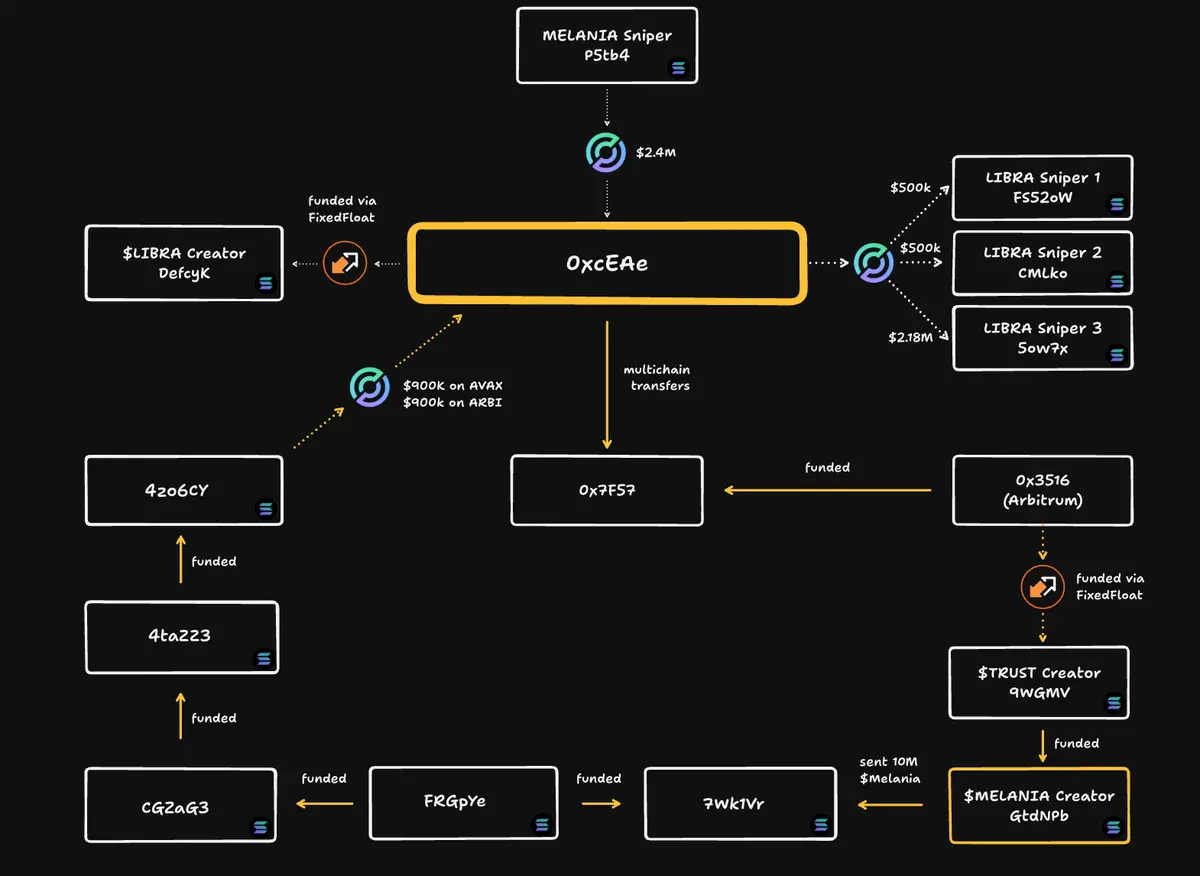

* Internal Manipulation: Insiders controlled the vast majority of the token supply from the project's inception. The address P5tb4 profited $2.4 million by targeting the Melania token, subsequently transferring the funds via a cross-chain protocol (CCTP) to 0xcEA, which was confirmed to be associated with the Melania token's creator. The team used insider information to buy tokens early and sold them at peak prices, creating a typical "pump and dump" model.

* False Prosperity: Under Melania's influence, data showed that the MELANIA token reached a peak of over $13.09 billion just hours after its launch, with a cumulative trading volume exceeding $1.36 billion. However, Apex Digital Asset Research's market strategist Sophia Lin analyzed that "automated trading bots and 'sniper wallets' created false trading volume and market enthusiasm, luring retail investors to flood in under FOMO, while what they saw was merely a mirage."

* Brutal Harvesting: When the price peaked, insiders began a ruthless sell-off. Data tracking revealed that internal wallets sold off tokens worth over $100 million in a short period, causing the price of $MELANIA to plummet by over 99%, with a market cap evaporating by about $9 billion, leaving countless retail investors with nothing.

2. A Trust Earthquake Affecting the Entire Industry

The shockwaves from this lawsuit extend far beyond the collapse of a single token; they are reshaping the entire crypto market ecosystem.

1. The "Avalanche" of the Meme Coin Sector

Following the news, the liquidity of the $MELANIA coin nearly dried up. More seriously, panic quickly spread throughout the entire meme coin sector. Data shows that the top ten meme coins (such as DOGE, SHIB, etc.) averaged a decline of 15% after the incident was exposed, with the sector's total market cap shrinking by over $5 billion. Any token associated with celebrity endorsements faced ruthless sell-offs from investors.

2. On-Chain Fundamentals: The "Revelation" of Fraud Models

The transparency of on-chain data has become irrefutable evidence of fraudulent behavior in this incident.

* Funding Paths Cannot Hide: All large transfers and sell-off records from internal wallets are permanently etched on the blockchain, providing indisputable evidence for the lawsuit.

* Traceable Patterns: Expert Ruiz pointed out that the operational methods of $MELANIA are highly consistent with at least 15 previously exposed fraudulent meme coin models, providing data samples for future identification and prevention of similar scams.

3. Funds and Liquidity: The "Great Escape" of Smart Money

The incident has shaken market confidence in high-risk assets. Data shows that some funds flowing out of meme coins are now shifting towards mainstream assets like Bitcoin and Ethereum, as well as certain blue-chip DeFi projects. Meanwhile, for traditional institutional funds preparing to enter the crypto space, this incident undoubtedly serves as a wake-up call, making them more cautious and delaying their foray into high-risk areas.

3. Industry Reflection Amidst the Fraud Scandal

In the face of this turmoil, industry experts have provided profound analyses from different perspectives:

Dr. Elena Vargas, a senior analyst at Quantum Encryption Analysis, stated: "$MELANIA is a typical price manipulation scam. The key point is that Melania's name was used to gain public recognition, but she may not have directly participated in the planning and execution of the fraud. This reveals the core vulnerability of the celebrity endorsement model."

Marcus Hale from the Blockchain Integrity Group commented: "The short vesting period and uneven token distribution have normalized high insider control of meme coins. This lawsuit has significantly weakened trust in celebrity-endorsed projects, and the industry needs to self-purify."

Sophia Lin from Apex Digital Asset Research analyzed from a market behavior perspective: "The scam expanded its reach from crypto enthusiasts to mainstream audiences by using a name. Investors must recognize that FOMO is the most powerful weapon of fraudsters."

4. Investor Survival Guide

The Damocles Sword of Regulation: This lawsuit is likely to become a "perfect case" for the U.S. Securities and Exchange Commission (SEC) to strengthen regulation of meme coins and the entire crypto market. Once regulatory actions are taken, the entire sector will face stricter scrutiny and potential compliance cost surges.

Liquidity "Black Hole": As exchanges may delist similarly structured tokens for compliance reasons, coupled with the loss of investor confidence, the liquidity of many meme coins may quickly dry up, rendering assets illiquid.

Contagion Liquidation Risk: The collective crash of the meme coin sector may trigger chain liquidations in the derivatives market and DeFi lending protocols, transmitting risks to the broader crypto market.

Key dynamics to track moving forward:

Lawsuit Progress and Regulatory Statements: Closely monitor the court's preliminary rulings and whether the SEC will issue official statements or enforcement guidance. The regulatory stance will determine whether this incident is an isolated case or the beginning of industry rectification.

Actions of Mainstream Exchanges: Observe the dynamics of trading platforms like Binance and Coinbase. The "self-cleaning" of exchanges is an important indicator of market health.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。