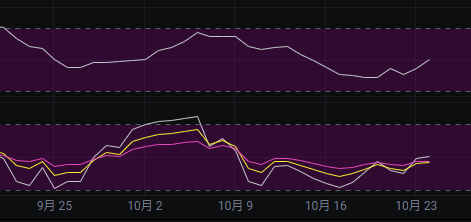

Yesterday we mentioned that the market had signs of a potential upward manipulation. Today, after a rise, the market has pulled back, which aligns with our judgment from yesterday. With today's rise and subsequent pullback, we have observed that the market has entered a consolidation zone, so there shouldn't be any major movements this week; we will have to see how it goes next week.

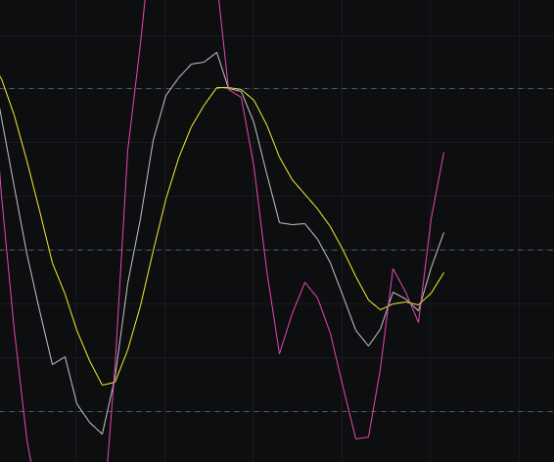

From the MACD perspective, the energy bars continue to retract, and the fast line is also turning upwards, which is favorable for the bulls. However, today's rise and pullback likely trapped some traders.

Looking at the CCI, yesterday's rise led to a certain recovery in the CCI, but it is still some distance from the zero line. To return to the zero line, we need to see at least a few days of bullish candles; we will have to observe how the market moves next.

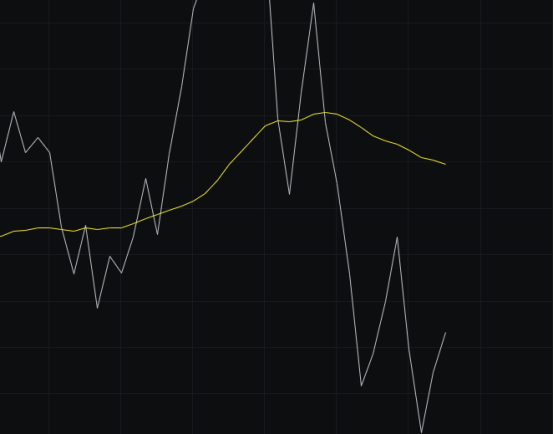

From the OBV perspective, there is a recovery, but the previous outflow was too large, and it has not yet reclaimed the previous volume. Additionally, the slow line is under pressure, so we cannot be bullish here and should maintain a bearish outlook.

In terms of KDJ, after two golden crosses above 20, it is diverging upwards, which is favorable for the bulls, so if shorting, be sure to set a stop loss.

Looking at the MFI and RSI, both indicators have returned to the neutral zone and are moving upwards, which is favorable for the bulls. As for whether they will continue upwards or turn down after reaching the neutral zone, we will need to wait until next week to find out.

From the moving averages perspective, the death cross between the 30 and 120 periods has completed, which is a bearish signal. However, the BBI has started to turn upwards. If today closes bullish, it is likely that the next two days will be sideways consolidation, and then a direction will be chosen next week.

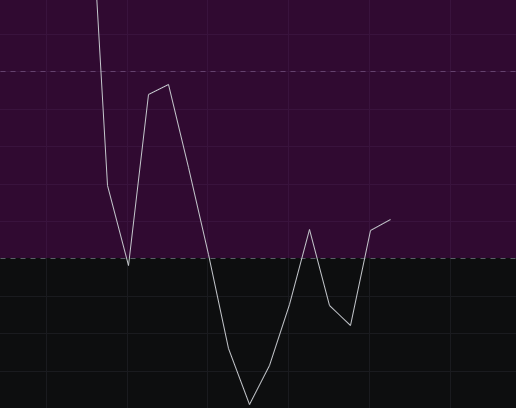

Looking at the Bollinger Bands, the upper band continues to move downwards, but with the bullish candles over the past two days, the lower band has flattened out, indicating that the previous downward channel has been broken. Since we are not in a downward channel, we will transition to a wider range, with the upper band continuing to press down and the lower band starting to rise until a range is established, after which a direction will be chosen. This cycle will take at least a few days to complete, so we will have to wait until next week to determine the direction.

In summary: The downward channel of the Bollinger Bands has been disrupted, and the moving averages are also inconsistent in direction. Therefore, we believe the next two days will primarily be characterized by consolidation, with a range expected between 107500 and 112000. For the bears this week, it would be best if the price could close below 107500, as this would increase confidence in the bearish outlook. If not, we will continue to observe next week. Today's resistance is seen at 112000-114000, with support at 107500-105000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。