Original | Odaily Planet Daily (@OdailyChina)

Polymarket has confirmed that it will launch a token and an airdrop. On October 24, Polymarket's Chief Marketing Officer Matthew Modabber stated in a podcast interview, "There will be a token, and there will be an airdrop. We could have launched the token at any time; we just wanted to do it more thoroughly. We hope it will be a truly practical, lasting, and permanent token."

According to other sources, Polymarket will reopen to U.S. users by the end of November and issue tokens in 2026.

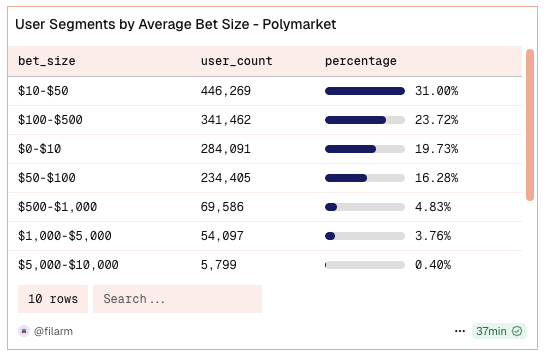

This means that users have a window of 3-4 months left to interact with Polymarket. Although there are rumors that Polymarket has already conducted several rounds of snapshots, it is not too late to start interacting from now. According to Dune data, over 90% of users bet with funds under $100, while whales betting between $5,000 and $10,000 only account for 0.4%. Therefore, although Polymarket appears to have a large user base and strategies and tutorials for "grabbing Polymarket" are widely available, the actual number of people putting in the effort may not be many. Betting over $500 can easily place one in the top 10.

To avoid losing principal during interactions with Polymarket (according to statistics, about 85% of Polymarket accounts are in negative balance), there are currently three main popular strategies for "risk-free volume brushing" on Polymarket. The first is for users to find a prediction event with low liquidity and use two wallets to brush volume back and forth; the second is to trade only on events with a probability of over 95%; the third is to capture arbitrage opportunities in multi-option markets where the "total probability is less than 100%."

However, executing these three strategies requires a significant amount of time and effort. Finding prediction events that meet the strategy criteria takes time, and even after finding suitable events, one still needs to expend effort on mechanical trading. This is why, despite the confirmation of token issuance and sufficient strategies, interactions with Polymarket still do not seem competitive; general players find it difficult to maintain continuous interaction, and these near-risk-free opportunities are gradually being monopolized by professional bots.

Using AI Agents to Execute Polymarket Tail-End Strategies

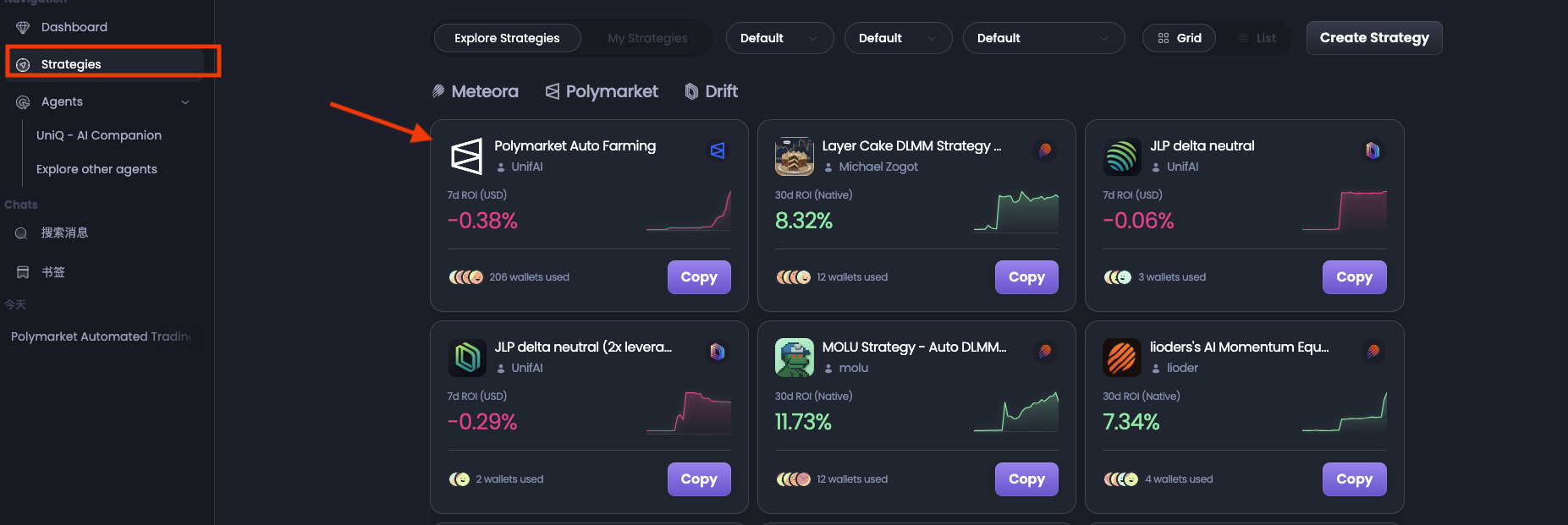

Considering these three Polymarket interaction strategies, the tail-end strategy is more suitable for most users, and there are already AI agents in the market that help users search for events on Polymarket with a probability of over 95% and trade autonomously. The following will provide a detailed explanation using the Polymarket tail-end strategy agent launched by the AI agent infrastructure UnifAI as an example.

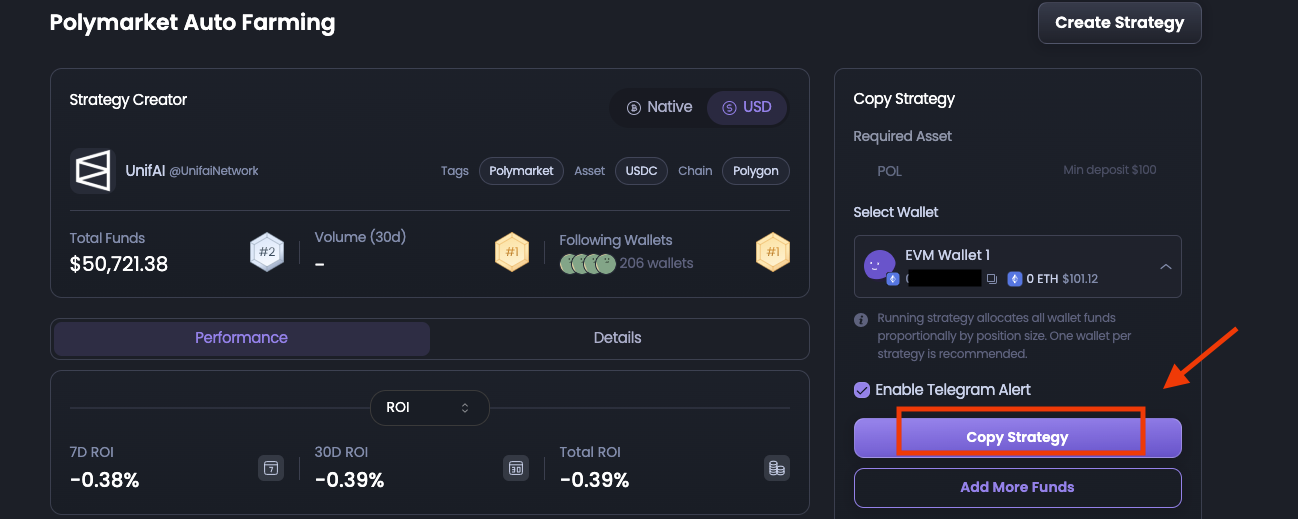

UnifAI is a platform that allows autonomous AI agents to perform on-chain and off-chain tasks within the Web3 ecosystem. The platform has launched various autonomous AI strategy agents, and users can run the required strategies for free with just one click to copy. The Polymarket tail-end strategy agent is one of the strategies recently launched on the platform, and according to platform data, 206 wallets are currently running this strategy.

How to Run the Polymarket Tail-End Strategy Agent

Running this strategy is straightforward. First, log in to the UnifAI official website using your Telegram account, click on "Strategies," and then enter the "Polymarket Auto Farming" strategy agent.

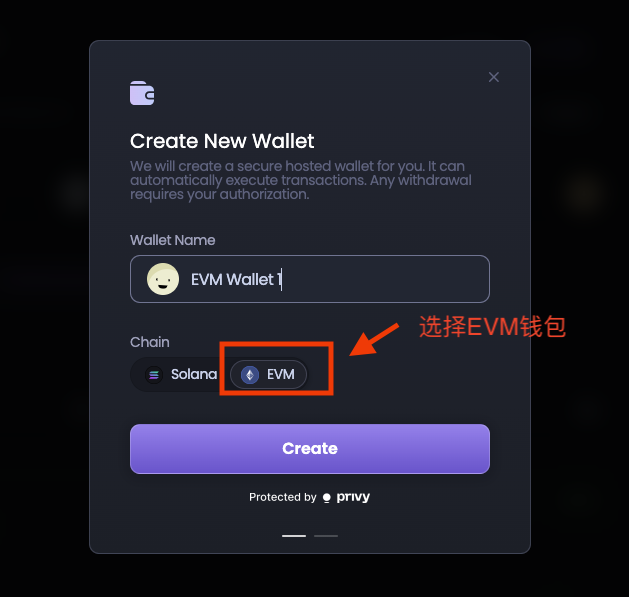

Then, click to create a new wallet in the "Select Wallet" section. Note that since Polymarket operates on the Polygon network, you need to create an EVM wallet. Additionally, the wallet created through UnifAI is a non-custodial wallet, and users can click "Manage Wallet" in the upper right corner of the website to export the private key.

Once the wallet is successfully created, you need to deposit at least 100 USDC and a small amount of POL to cover gas fees. Note that while UnifAI supports deposits via Ethereum, Base, BSC, and Polygon, using the Polygon network is more convenient for running the Polymarket tail-end strategy agent. Users can directly transfer USDC and POL to the address via an exchange using the Polygon network.

After the transfer is completed, click "Copy Strategy," and the agent will automatically run, searching for events in the Polymarket market with a probability greater than 95% and automatically buying in.

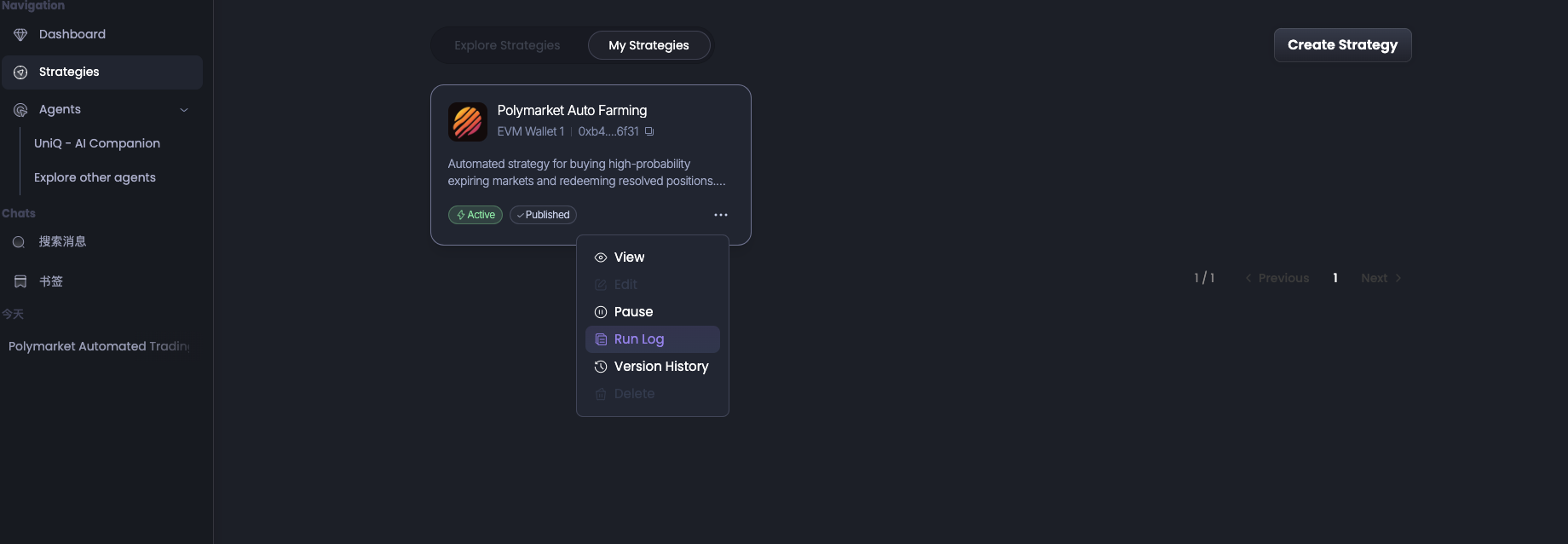

On the "Strategies" page, click "My Strategies" to see the agents currently running. Users can also choose to stop the strategy or click "Run Log" to view the strategy execution log.

Risk Warning

Although the tail-end strategy is generally profitable, it can also encounter black swan events, where an event with a 95% probability suddenly reverses or is manipulated by large players. In such cases, user funds may "go to zero." To mitigate this, UnifAI employs a risk management mechanism, meaning that it will not bet the entire amount on a single event, thus preventing some risks for users.

It is also important to note that UnifAI's Polymarket tail-end strategy agent has only been launched for 2 days, and its operation is not particularly stable. Many users in the community have reported betting errors, and the official response is that "the influx of new users has caused Polymarket to reach its speed limit, and we are working to resolve this." Therefore, as a player, you can currently invest a small amount of funds to participate or look for similar products in the market that operate more stably. Those with technical skills might try writing their own programs.

Can Using AI Agents for Polymarket Interaction Qualify for Airdrops?

The main purpose of using AI agents to execute the Polymarket tail-end strategy is to engage in "risk-free interaction" with Polymarket to qualify for airdrops while saving time and effort. However, if interactions conducted using AI agents do not qualify for airdrops, it would be counterproductive.

Polymarket uses a built-in custodial wallet model, where users log in through wallets, emails, etc., and the platform automatically generates a wallet associated with this login. Users need to deposit funds into this built-in wallet to trade, and they cannot export the private key. Therefore, even if Polymarket conducts airdrop snapshots, it is likely based on the data from the built-in wallets.

However, the AI agent executing the Polymarket tail-end strategy does not create a Polymarket account using the user's wallet. Users can verify this by exporting the UnifAI wallet's private key and logging into Polymarket themselves. This has led the community to speculate that the UnifAI agent uses a "large fund model" and does not operate user wallet funds separately.

Nevertheless, according to UnifAI community managers, the Polymarket tail-end strategy agent directly uses the user's wallet to place bets. The reason users cannot see the interaction status when logging into the Polymarket website is that "any third-party Polymarket account, from Telegram Bots to third-party market makers, directly interacts using the wallet rather than generating a Polymarket built-in wallet based on that address."

It remains uncertain whether the interaction addresses of this model will fall within the scope of Polymarket airdrops. However, if Polymarket ultimately only recognizes addresses with built-in wallets and interaction data as "real users," it would be a significant loss for users employing this strategy. Therefore, airdrop hunters can currently allocate a small amount of funds for AI agents to interact with Polymarket, while the main funds should still focus on manual strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。