Original Author: @BlazingKevin_, the Researcher at Blockbooster

x402 Protocol - Becoming the Pivot for Agent Payments

1.1 Payment Dilemma Faced by AgentFi

In the context of rapid development in artificial intelligence (AI), the large-scale application of Agents has become a foregone conclusion. However, when these Agents attempt to interact with the traditional financial system, they face two insurmountable structural barriers that greatly limit the realization of AgentFi:

- Identity Absence and Sovereignty Issues: Agents do not possess the identity of a legal entity or a natural person, making it impossible to open accounts in traditional banks or payment systems (like Stripe). This means that all economic activities of AI must rely on human intervention, such as complex API key setups, transaction authorizations, and payment type restrictions, resulting in a loss of autonomy.

- Economic Friction of Micropayments: The economic activities of Agents are essentially high-frequency and low-value. For example, each API call or AI service request may only be worth $0.01 or $0.05. In the current payment environment, processing a $0.01 payment may incur fees of $0.30 or more, making this model economically unfeasible.

1.2 Solution of x402: A2A On-Chain Payment Gateway

The design of the x402 protocol aims to systematically address all the aforementioned frictions. It provides an on-chain payment gateway specifically designed for value transfer between Agents (Agent-to-Agent, A2A).

Its core workflow is based on the HTTP 402 "Payment Required" standard, extended to the blockchain:

- Request: When a client (Agent A) requests a service from a server (Agent B), Agent B returns a 402 payment request, explicitly asking for a small fee (e.g., 0.01 USDC).

- Payment: After receiving the 402 request, Agent A autonomously sends 0.01 USDC to Agent B's address via the blockchain.

- Verification and Settlement: The on-chain transaction is confirmed within seconds, and once Agent B verifies the payment, it immediately provides the service to Agent A.

The revolutionary aspect of this process is that it completes the entire payment, clearing, and settlement process within seconds, without any human involvement, and the transaction cost is almost negligible.

Moreover, this "pay-per-use" micropayment model is also attractive to human users, offering a fairer and more efficient value exchange method that frees them from the traditional "registration/subscription" system.

1.3 Core of x402: Architecture Design Pivoted on "Simplicity"

The strength of the x402 protocol lies in its minimalist design philosophy.

It focuses solely on solving one core issue: the "verifiability" of payments between buyers (clients) and sellers (servers).

It must be clarified that x402 is not a brand new, all-encompassing foundational protocol. Its positioning is as a "crypto-native extension tool" for the AP2 standard promoted by giants like Google. The AP2 protocol defines the macro standards for "trusted interoperability" between Agents and API service providers (e.g., using Mandates for authorization and Verifiable Credentials (VCs)), while x402 provides a plug-and-play "payment form" adapted for crypto assets.

This design significantly lowers the adoption threshold: developers or service sellers do not need to understand the complex operational mechanisms of blockchain. They only need to create a wallet and integrate a few lines of code to monetize their services to Agents or human users worldwide.

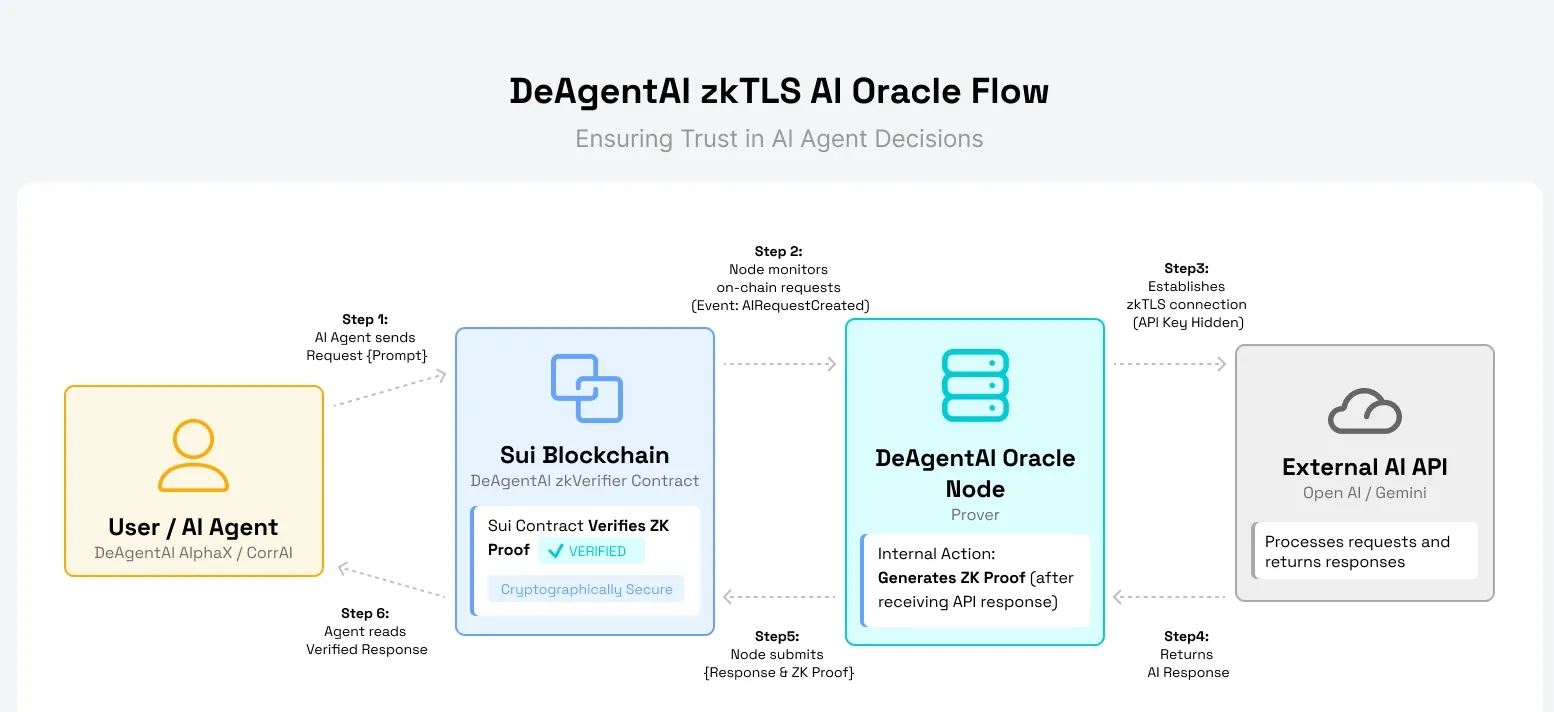

1.4 Realizing "Verifiability": Chain-Agnostic Interaction

The simplicity of x402 is further reflected in its verification mechanism. When the buyer's Agent initiates an HTTP 402 request, the seller (server) does not even need to run a node or access the blockchain to verify whether the transaction has been completed.

The server outsources the verification work to a third-party service known as "Facilitator". This intermediary is responsible for monitoring the on-chain status and notifying the server once the transaction is confirmed. This allows both parties to interact with almost no awareness of the blockchain, further reducing integration difficulty.

1.5 Why "Simplicity" is the Explosive Point?

"Crypto x AI Agent" has long been a hot topic in the market, but it has yet to trigger large-scale market adoption. The fundamental issue lies in the previous phase of the AI Agent narrative (such as DeFi) being too complex.

This narrative attempted to have Agents directly manage users' private keys and autonomously schedule a series of complex DeFi transactions. Faced with the dual dilemma of lacking unified standards and extremely high implementation difficulty, this narrative ultimately struggled to take root.

The emergence of x402 provides a crucial "pivot" for this dilemma.

What was missing in the Crypto x AI Agent narrative was a sufficiently simple and foundational foothold. As an extremely minimalist payment protocol standard, x402 perfectly fulfills this role.

- Because it is simple, it is easy to integrate: Any Web2 or Web3 developer can adopt it without barriers.

- Because it is simple, it possesses the strongest composability: A standardized payment layer can give rise to a vast ecosystem, including but not limited to: diversified intermediary services, efficient on-chain data indexers, and infinite application scenarios ranging from meme coin payments to real-world asset (RWA) services.

Core Role and Workflow of the Facilitator

In the x402 protocol architecture, the intermediary is central to achieving its "simplicity," playing a key role as the "on-chain payment coordinator" and "technical abstraction layer."

Its fundamental value lies in completely encapsulating all the complexities involving blockchain in the payment process. This includes wallet management, private key signing, gas fee estimation, transaction construction, on-chain broadcasting, and status verification.

Thanks to the presence of the intermediary, neither the client nor the server needs to interact directly with the blockchain. They only need to complete a full on-chain value settlement through standard HTTP requests, achieving a smooth and seamless payment experience.

2.1 Architecture and Interaction Process of x402

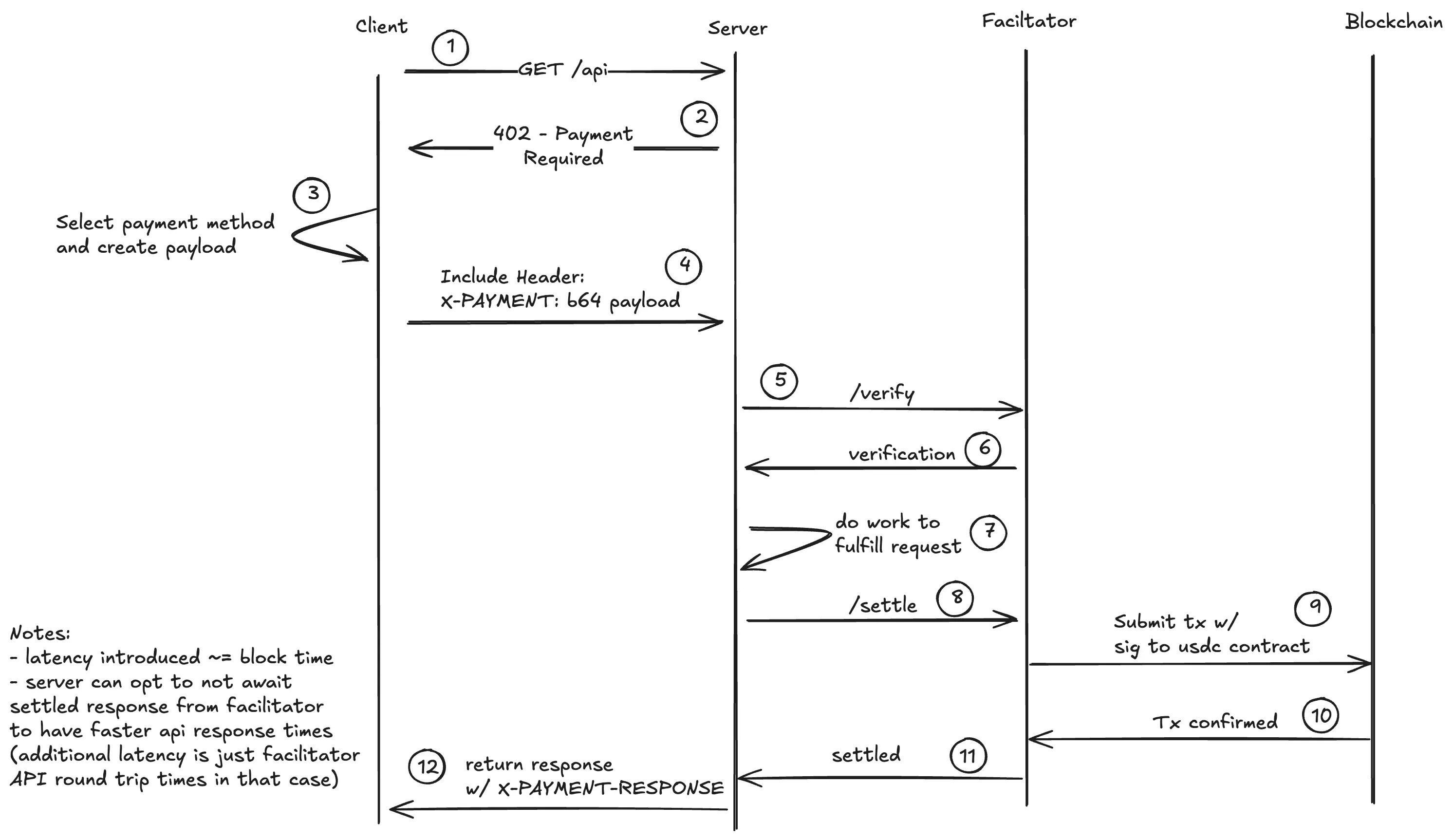

The workflow of x402 consists of four key roles:

- Client: The Agent or user browser initiating the request.

- Server: The website providing the API or content, i.e., the "seller."

- Facilitator: The third-party service handling on-chain verification and settlement.

- Blockchain: The final value settlement layer (e.g., Base chain).

The core interaction process can be broken down into the following key stages:

Stage One: Payment Challenge

- The client initiates a standard service request (GET /api) to the server.

- The server identifies the resource as a paid item and returns a 402 - Payment Required status code, initiating a payment challenge to the client.

Stage Two: Signing the Payment Intent

- After receiving the 402 challenge, the client does not immediately construct or send an on-chain transaction.

- Instead, it locally creates a "payment credential" that complies with the EIP-3009 specification. This is essentially a signed "payment commitment" (similar to a signed check), authorizing a specific party to withdraw a specific amount in the future.

- The client places this credential in the HTTP request header (X-PAYMENT) and requests the server again.

Stage Three: Key Divergence of Verification and Settlement This is where the design of the x402 protocol becomes ingenious, as the process can diverge here:

- Verification: After the server receives this "payment credential," it does not verify it itself. It forwards the credential to the facilitator, initiating a /verify API request. The facilitator is responsible for checking the validity of the signature, account balance, etc., and confirms to the server: "This credential is valid and can be redeemed."

At this point, the server faces a critical choice:

- Path A: Synchronous Settlement The server, upon receiving "verification passed," chooses to wait for the funds to be fully credited. It instructs the facilitator to execute a /settle (settlement) request. The facilitator then broadcasts the credential to the blockchain, waiting for block confirmation. Only when the facilitator ultimately notifies the server "the money has arrived" does the server return the requested data to the client.

- Drawback: The entire process's delay is bound by the blockchain's block time, which can last several seconds, severely impacting user experience.

- Path B: Asynchronous Settlement This is the core mechanism that enables x402 to achieve low-latency experiences. After receiving the facilitator's "verification passed" confirmation, the server no longer waits. It immediately returns the data to the client, while simultaneously instructing the facilitator to complete the subsequent settlement process "asynchronously" in the background.

2.2 Transfer of Trust: The Ingenious Balance of x402

In Path B, the server makes a critical trade-off: it chooses to trust the facilitator's "verification," equating it to a guarantee for future "settlement."

In this way, the server transfers the delay risk of "waiting for blockchain confirmation" to the facilitator. In exchange, the client experiences almost no blockchain delay, with the perceived delay reduced to the round-trip time of two API calls between the server and the facilitator (in milliseconds).

2.3 Underlying Technology: The Key Role of EIP-3009

All of this is made possible by the Ethereum EIP-3009 standard. This standard allows users (or Agents) to sign authorization once, enabling the facilitator to "pull" funds in the future based on this signature, without requiring further intervention from the client. Currently, the USDC contract on the Base chain is the primary asset supporting this functionality, making it the preferred settlement network for the x402 protocol.

Current Landscape of the "Facilitator" Market

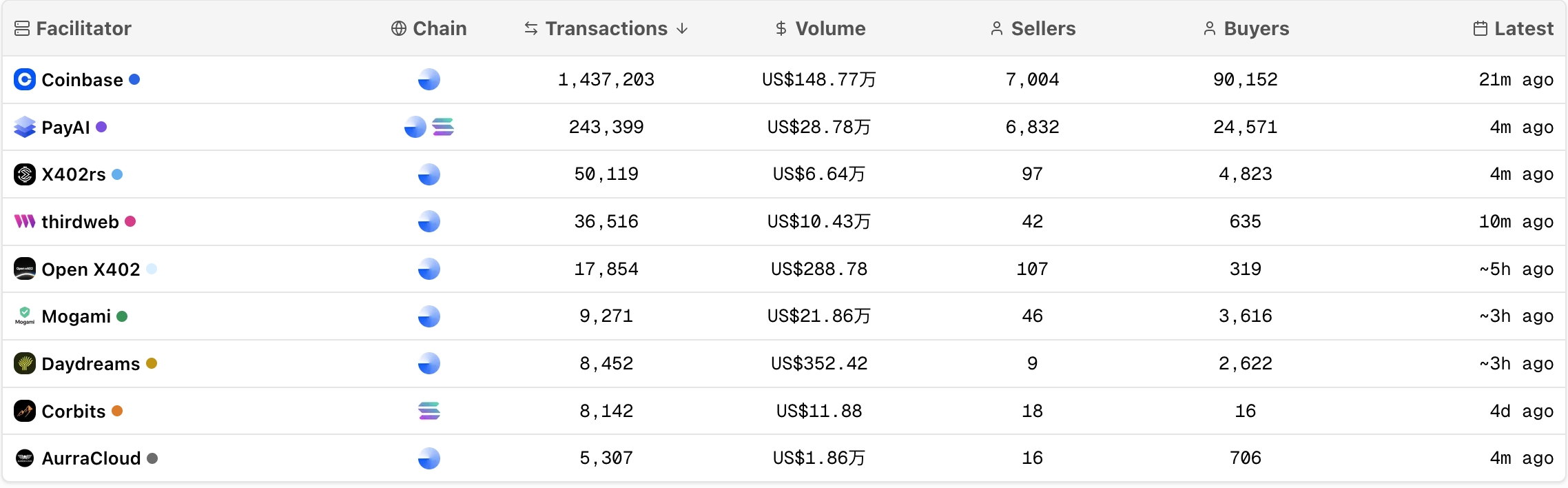

The simplicity of the x402 protocol shifts its core complexity (and value) onto the role of the "Facilitator." Currently, the market has initially formed four main participants, each revealing different trade-offs and dependencies in their strategic positioning and business models.

2.4 Coinbase: Defining Standards with Subsidies

As the creator of the x402 protocol, Coinbase operates the official facilitator service and has dominated the market in its early stages.

- Market Data: Its platform has processed over 1.4 million transactions, with a total transaction volume of approximately $1.48 million.

- Ecosystem Scale: It has attracted 7,000 sellers and over 90,000 buyers, forming the largest user base currently.

- Core Strategy: The Coinbase developer platform currently employs a completely free subsidy policy. This strategy rapidly captures market share and promotes its standards, while also making the early development of the x402 ecosystem highly dependent on Coinbase's continued financial support. Its strategic intent is to deeply bind early adopters of the x402 protocol with the Base chain by subsidizing infrastructure in a typical manner.

2.5 PayAI: Seeking Differentiation in the Ecosystem

PayAI positions itself as one of Coinbase's main competitors, holding about 13% of the market share. It attempts to gain market share through "dislocated competition."

- Strategic Positioning: The project's claimed slogan is "Solana First, Multi-Chain x402 Coordinator." However, a notable reality is that its current trading activity still primarily occurs on the Base chain, and its "Solana First" strategy has yet to be reflected in the data.

- Core Approach: PayAI aims to build an "agent business" ecosystem that goes beyond payments themselves. Its planned product matrix (such as the "Freelance AI" marketplace) shows its intention to bundle scenarios with payments. Whether this model can truly create a self-sustaining closed loop, rather than becoming another dependency on Coinbase's subsidies, remains to be tested by the market.

2.6 thirdweb: The Tool Provider that "Commodifies" Standards

For thirdweb, x402 is not its core business but rather a functional "plugin" that aligns with its strategy.

- Platform Positioning: thirdweb is a full-stack Web3 development platform that offers a wide range of SDKs and APIs.

- Core Strategy: The platform does not focus on competing as an independent track for x402 but rather quickly "commodifies" it, packaging it into its "Payments" product line as a value-added feature for its existing developer base.

- Market Role: This strategy indicates that thirdweb's focus is on acting as a tool service provider. Its resource investment and focus on the x402 track are therefore relatively limited, making it unlikely to become a dominant player in the protocol's ecosystem.

2.7 x402.rs: Open Source and "Trustless" Infrastructure

x402.rs is an independent open-source protocol implementation built on the Rust language, positioned as a neutral technical option independent of the protocol initiators.

- Core Value Proposition: Its main value lies in providing a "fully open and auditable implementation," which sharply contrasts with other facilitators that operate as closed-source, hosted services.

- Product and Positioning: The core product of x402.rs is a self-hosted facilitator. This allows any developer or company to deploy and run their own facilitator service, thereby fully controlling their infrastructure and freeing themselves from third-party dependencies. Its positioning is not as a SaaS platform but as an infrastructure building module, focusing on providing high-performance middleware for backend developers, especially those using the Rust stack.

- Market Significance: Therefore, the official public instance seen on the facilitator leaderboard is merely an example of the project's operation. The true market value of x402.rs lies in its promotion of protocol decentralization and developer autonomy, providing a critical alternative for technical teams wishing to audit, self-host, and freely modify their payment infrastructure outside of Coinbase's hosting.

Analogy of x402's Issuance Mechanism and Market Insights

3.1 Mechanism of x402 Asset Issuance: On-Chain Data and Off-Chain Interpretation Rights

Recent market hotspots spawned by the x402 protocol (such as $PING) exhibit significant structural similarities in their asset issuance (Launchpad) mechanisms to Bitcoin's inscriptions. The core operational logic can be summarized as: using a public chain as an "immutable data ledger," while relying on an off-chain "indexer" to assign specific meanings to this data.

- Operation Logic of Inscriptions: Users send a transaction to the Bitcoin mainnet. The Bitcoin network itself is only responsible for recording this transaction and does not interpret whether it constitutes an "inscription." The Ordinals protocol acts as a third-party indexer, serving as a "state interpreter." It scans all on-chain data and determines which transactions are valid inscriptions according to its custom rules (such as "first come, first served"), thereby constructing the BRC-20 state off-chain.

- Operation Logic of $PING: This model adopts an almost identical architecture. Users send USDC to a specific address on the Base chain. From the perspective of the Base chain and the x402 protocol, this is merely a standard ERC-20 transfer. What truly assigns the "Mint" significance to this transaction is the x402scan indexer. It scans all USDC transfers sent to the specific address and confirms which are "valid Mints" in its off-chain database according to its defined rules (e.g., 1 USDC = 5000 $PING), ultimately distributing tokens through a contract.

3.2 Potential Impact of x402 Narrative on CEX Competitive Landscape

The rise of the x402 protocol provides a strategic opportunity to reshape the on-chain narrative influence for CEX and its ecosystem. This judgment is based on three points:

- Hierarchy and Durability of Narrative: From Application Layer to Protocol Layer: The strategic significance of x402 lies in the fact that it is not merely an application layer hotspot (like inscriptions) but a "protocol layer revival" of the core internet protocol HTTP 402 on the modern blockchain settlement layer. It aims to address the "infrastructure layer issue" of autonomous, real-time settlement in the Agent economy. For CEX, this presents a strategic opportunity: shifting from supporting "applications" to defining "standards" is a key step in evolving from a traffic platform to an infrastructure provider.

- Strategic Gap of Indexers: The Battle for "Data Interpretation Rights": Indexers are the "data interpreters" of the crypto ecosystem. Currently, x402scan operates as a centralized entity that has issued its own token, presenting systemic conflicts of interest and centralization risks. This creates a clear strategic entry point for CEX: to provide a more neutral, open "public product" type indexer. This move aims to build technical trust and ecological moats, with strategic value far exceeding mere capital subsidies.

- Positioning in Long-Term Tracks: The "Settlement Bus" of the Agent Economy: MEME assets (like $PING) merely validate the market heat of x402. Its true long-term value lies in providing the missing "autonomous procurement protocol" for the integration of AI and crypto. In the future machine-to-machine (M2M) economy, Agents will need x402 to autonomously and frequently procure "computing resources" and "data." Therefore, x402's positioning as the "settlement bus" of this high-certainty long-term trend has a very high strategic ceiling.

Future Landscape and Rotation Predictions of the x402 Track

The explosion of the x402 protocol acts as a catalyst, injecting new narratives and capital flows into the long-dormant AI Agent track. Based on the current market structure, we can deduce several key sub-sectors that may experience rotation in the future.

4.1 AI Launchpad

The x402 protocol is currently widely interpreted by the market as a novel "asset issuance primitive," rather than merely a payment tool. This interpretation provides an excellent opportunity for existing AI Agent platforms in the Base ecosystem (such as Virtuals and Clanker) to return to the center stage.

These platforms have accumulated a large amount of user consensus, project resources, and developer foundations during the AI Agent boom a year ago. Currently, they need a new, powerful narrative to reactivate their ecosystems. The "issuance as payment" model brought by the x402 protocol perfectly aligns with the core business logic of these Launchpads. Therefore, it is foreseeable that these "native AI issuance platforms" will become the main force most likely to enter the next stage and leverage their existing advantages to compete for market share.

4.2 Indexers

If x402 follows the development path of inscriptions, the next focus of market competition will inevitably shift from "issuing assets" to "defining the rules of asset issuance"—that is, the battle for the voice of indexers.

Indexers are the sole arbiters of "which payment is a valid Mint." If Launchpads choose not to rely on x402scan but instead build their own indexers and define a new, potentially more attractive issuance mechanism, they will quickly capture the market with their existing brand and user base.

4.3 Facilitators

The role of the facilitator is central to the current narrative, but this positioning has strategic duality:

- For the Crypto-Native Market: The technical barriers of the facilitator role are not high. Any indexer or Agent payment application can (and likely will) choose to run its own facilitator service to control the complete technical stack and value chain. From this perspective, the moat for this role is limited, and its narrative heat may be temporary.

- For the Web2 Adoption Market: The dynamics are completely opposite. When traditional Web2 companies seek to integrate crypto payments, they will never build their own infrastructure but will choose the most trusted, compliant, and leading suppliers in the market. In this field, Coinbase, with its brand, regulatory status, and deep integration with the Base chain, possesses a near-monopolistic structural advantage.

4.4 Public Chain Competition and Integrity of the Ecological Stack

The competition of x402 will ultimately evolve into a competition between public chain ecosystems, with the core of this competition being the depth of technical adaptation.

- Challenges of Contract Adaptation: The low-latency "pull-based" payment of x402 heavily relies on the support of the EIP-3009 standard. Rapidly and securely implementing and embedding this standard on other EVM-compatible chains is no small feat, presenting severe engineering and security challenges.

- "Shell" Protocol and System Engineering: The x402 protocol itself is merely a standard, a "shell." Its true power comes from a complete ecosystem supporting system engineering behind it. Coinbase has been making long-term, systematic arrangements to connect the upstream and downstream of x402, including:

- Protocol Layer: MCP (connectivity), A2A (multi-model collaboration), AP2 (macro standards), EIP-3009 (payment primitives), etc.

- Infrastructure: Native wallet services, trading markets.

- Application Layer: Specific scenarios built on the x402 standard.

About BlockBooster

BlockBooster is an Asian Web3 venture studio supported by OKX Ventures and other top institutions, dedicated to being a trusted partner for outstanding entrepreneurs. We connect Web3 projects with the real world through strategic investments and deep incubation, helping quality entrepreneurial projects grow.

Disclaimer

This article/blog is for reference only, representing the author's personal views and does not reflect the position of BlockBooster. This article does not intend to provide: (i) investment advice or investment recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, with significant price volatility, and they may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific issues, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling this data and charts, but we accept no responsibility for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。