In the wave of integration between DeFi and traditional finance, the RWA (Real World Assets) sector is undergoing a profound paradigm shift: the early experimental phase represented by Security Token Offerings (STO) is giving way to a phase of yield-bearing tokenized products centered around U.S. Treasury bonds; and from 2023 to 2025, a new phase characterized by high-performance public chains, cross-chain liquidity mechanisms, and structured credit products is emerging. Fixed income RWA (especially U.S. Treasury bonds and high-quality credit assets) is at the forefront of this migration. This article focuses on the U.S. market, centering on Ondo Finance, identifying typical cases from the past two years, and deeply analyzing its product logic, technical implementation, risk control mechanisms, and institutional participation pathways; it also compares the different strategies of projects like Maple and Centrifuge. The article aims to provide insights into the industry's development pathways through the interaction of empirical evidence, mechanisms, and trends. The core points are as follows:

- Compliance, transparency, and liquidity are the core elements for the success or failure of fixed income RWA;

- There is room to form differentiated barriers in Token architecture (accumulation vs. rebasing), cross-chain design, and arbitrage mechanisms;

- The key to institutional capital involvement is not merely the yield but the satisfaction with trust, legal protection, and operational efficiency;

- Although U.S. Treasury products have established a foundation of trust, the evolution of RWA paradigms and real structures is ongoing.

1.1 Three-Stage Evolution of RWA

The evolution of RWA is actually a slow evolution under the joint action of blockchain capability stacks, financial market demands, and regulatory environments. A brief review of the three stages:

- First Stage: STO Experimental Period (2015–2020) Before the rise of Ethereum, many early attempts involved "tokenizing" assets such as stocks, bonds, and real estate rights into security tokens (STO). Traditional securities were mapped onto the blockchain through legal contracts. Unfortunately, the dilemma of this stage was that the on-chain liquidity infrastructure was not yet mature, with weak Oracle awareness, a lack of cross-chain mechanisms, and difficulties in matching secondary markets. As a result, many assets ultimately traded in traditional markets, with on-chain representation being merely formal.

- Second Stage: Yield-Bearing Stablecoins / Tokenized Government Bonds (2020–2023) As the DeFi ecosystem matured, stablecoins became the main entry point for capital into the blockchain. With the exposure of credit crises in the crypto industry, more capital sought stable, low-risk returns. U.S. Treasury bonds / government bond assets, viewed as an ideal target due to their credit foundation, were gradually tokenized and incorporated into the asset side of stablecoins or independent yield-bearing tokens. In this stage, the mainstream expression of RWA was no longer direct mapping of stock-type STOs but rather bringing low-risk returns into the on-chain ecosystem through U.S. Treasury reserves in the form of stablecoins or dedicated tokens.

- Third Stage (Current and Future): Structured Credit + High-Performance Chains and Cross-Chain Liquidity By 2023–2025, driven by several factors, RWA began to enter a more complex stage. The scale of U.S. Treasury tokenization rapidly expanded, while new challenges arose regarding how to support credit assets, how to circulate efficiently across multiple chains, how to reduce cross-chain friction, and how to provide infrastructure support with high-performance public chains. In this stage, RWA is not just about asset tokenization but rather a collection of "liquid assets + structured products + composable financial primitives."

This paradigm shift means that blockchain is no longer a simple ledger carrier but may become a mainstream financial infrastructure.

1.2 Current Asset Distribution Pattern of RWA

As of October 2025, according to CoinGecko's "RWA Report 2024" and data from the RWA.xyz platform, the current RWA asset side is concentrated in a few standardized, highly liquid asset types. Here are several key categories:

- Private Credit / Private Debt: This is currently the largest segment in the RWA ecosystem, with a total scale of approximately $17.4 billion, accounting for over 50%. This category includes institutional credit pools, corporate receivables, structured debt products, etc., with on-chain yields typically ranging from 8% to 15%[1].

- Tokenized U.S. Treasury Bonds / Yield-Bearing Stablecoins: Government bonds remain the most trusted and compliant type of RWA asset, with a total scale of approximately $8.3 billion. The core logic in this field is "using government bonds to support on-chain interest rates," with typical representatives including Ondo's OUSG and USDY[2], Franklin Templeton's BENJI fund, BlackRock's BUIDL fund, etc.

- Tokenized Commodities / Gold: Approximately $3.1 billion in scale, mainly represented by gold tokens PAXG and XAUT, serving as non-correlated hedging assets in crypto asset portfolios. Given gold's natural value anchoring and global pricing system, these assets perform robustly during market downturns.

- Tokenized Institutional Alternative Funds / Private Equity Funds: Approximately $2.8 billion in scale, representing institutional funds that are tokenized through SPV structures, such as the JAAA fund managed by Janus Henderson and the BCAP fund managed by Blockchain Capital. These products enhance the transparency and liquidity of private equity funds and serve as an important bridge for traditional asset management institutions to enter DeFi.

- Non-U.S. Government Debt: Approximately $1 billion in scale, mainly involving the tokenization of short-term government bonds or notes from Europe and emerging markets, still in the pilot stage. Related products are often issued by TradFi funds through qualified investor channels.

- Tokenized Traditional Stocks / ETFs: Approximately $680 million in scale, still in the exploratory stage. Companies like Ondo, Securitize, and Backed Finance have launched corresponding tokenized U.S. stock or ETF products, opening a new channel for "equity assets" in on-chain capital markets, but currently limited by compliance, liquidity, and valuation synchronization, resulting in a relatively small scale.

Typical Case of U.S. Fixed Income RWA: Deep Deconstruction of Ondo Finance

In the U.S. Treasury RWA track, Ondo Finance is one of the most representative and thoroughly implemented cases.

2.1 Product Logic: How to Make Government Bonds "Live" on the Chain

First, let's look at how Ondo constructs a tokenized product for government bonds that combines low risk and liquidity.

2.1.1 Asset Allocation and Portfolio Strategy

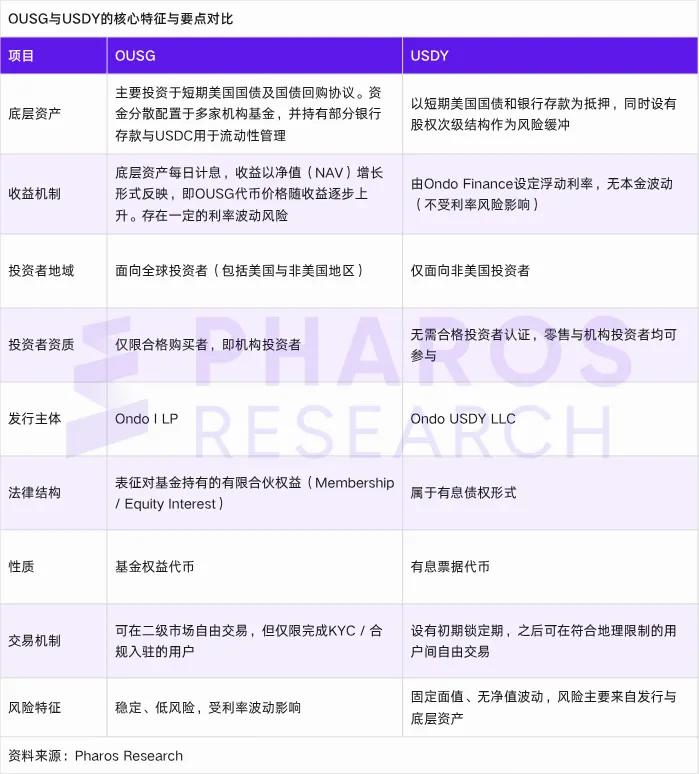

Ondo currently offers tokenized financial products including the tokenized U.S. Treasury fund Short-Term US Government Treasuries ($OUSG) and the yield-bearing stablecoin Ondo US Dollar Yield Token ($USDY).

Unlike USDY, the OUSG portfolio is primarily allocated to multiple institutionally managed government bond/money market funds, such as BlackRock's BUIDL, Franklin's FOBXX, WisdomTree's WTGXX, FundBridge's ULTRA, Fidelity's FYHXX, and some cash/USDC as liquidity buffers. This diversified allocation reduces reliance risk on a single fund/manager. This strategy means that OUSG does not directly hold native government bonds but invests in institutionally managed, government bond-based funds.

The underlying assets of USDY mainly consist of short-term U.S. Treasury bonds and bank deposits, with the Treasury bond portion held through on-chain government bond instruments, while bank deposits are kept in accounts of regulated financial institutions, with an equity subordination structure set as a risk buffer. Unlike OUSG, which indirectly holds government bonds through fund shares, USDY is designed to directly connect to underlying assets in the form of interest-bearing debt, with its yield dynamically adjusted by Ondo Finance based on market interest rates.

2.1.2 Token Architecture Design: Accumulation + Rebasing + Instant Minting and Redemption

In terms of token design, both OUSG and USDY adopt two versions:

- Accumulation OUSG/USDY: The net asset value (NAV) of each token rises with accrued earnings;

- Rebasing rOUSG/rUSDY: The price is fixed at $1.00, but the system mints more tokens daily for holders based on earnings, thus achieving yield distribution.

This dual-version design provides users (especially institutions) with more flexibility, and the official documentation clearly states that the two versions can be exchanged 1:1.

At the same time, these fixed income notes support 24/7 instant minting and redemption, allowing users to instantly swap in or out of OUSG/USDY using USDC or PYUSD. However, instant transactions have a limit on the amount, and exceeding the limit or large redemptions may trigger non-instant processing.

2.1.3 Multi-Chain Deployment + Cross-Chain Bridging Strategy

To enable OUSG to circulate across multiple ecosystems (such as Ethereum, Solana, Polygon, XRPL), Ondo has launched cross-chain deployment and bridging solutions. For example, earlier this year, Ondo collaborated with Ripple to deploy OUSG into XRPL, allowing the use of the RLUSD stablecoin as a settlement asset for minting/redemption operations[3][4]. This cross-chain layout enhances liquidity and expands the user base while providing a low-friction path for capital entry across different chains.

2.1.4 Fee Model and Yield Distribution

Ondo sets the management fee at an annual rate of 0.15% (which is relatively conservative). The distribution of earnings (whether accumulation or rebasing) is based on the net interest of the underlying portfolio minus costs. Minting/redemption itself may incur minimal transaction fees or slippage compensation, but the official claim states that some operations are fee-free (such as certain minting/redemption operations).

In summary, the key to Ondo's product logic is: using a stable, verifiable government bond portfolio + flexible token architecture + cross-chain supply + low fee design to transform the traditionally safest assets into on-chain usable tools.

2.1.5 Current Actual Performance

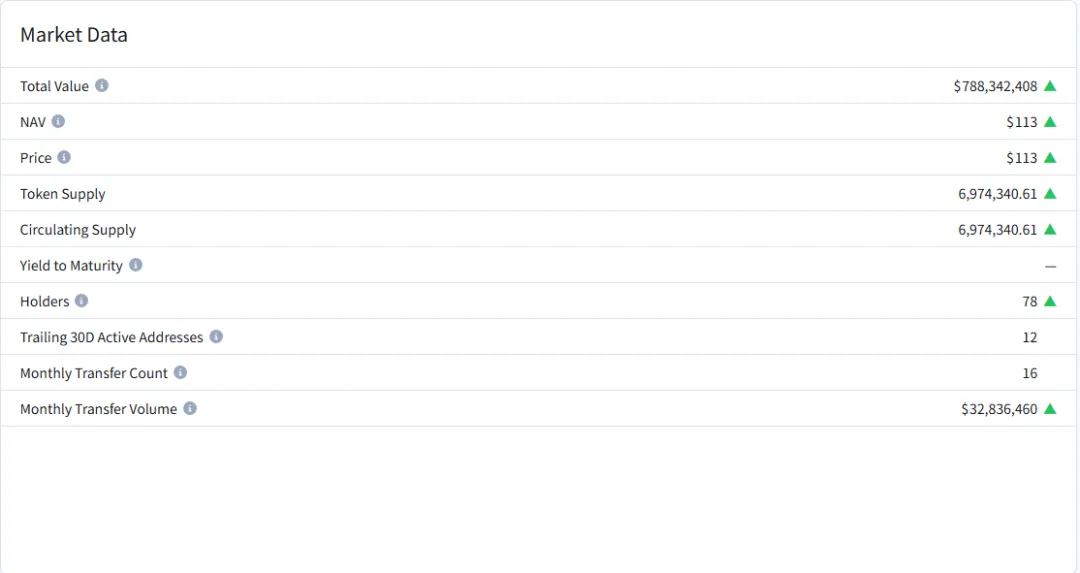

As of October 2025, the total asset value of OUSG is approximately $792 million, with a token net asset value (NAV) of about $113 per token. In the last 30 days, its secondary market monthly transfer volume is around $32.85 million, with a circulating supply of approximately 7,011,494 tokens, only about 79 holders, and around 12 active addresses. From this data, OUSG has already achieved scale effects and a compliant structure. However, at the same time, its secondary market activity is relatively low, with active addresses and the number of holders far below that of typical digital asset products, reflecting that its liquidity is still mainly concentrated among a few large holders or institutions.

In contrast, USDY shows a more significant expansion capability in terms of user coverage and on-chain participation. Its total asset value is approximately $691 million. The token net asset value is about $1.11 per token, with an annual percentage yield (APY) of around 4.00%. More importantly, it has approximately 15,959 holders, around 1,124 monthly active addresses, and a monthly transfer volume of about $22.66 million. These figures clearly indicate that USDY has a broader user base and higher on-chain activity.

2.2 Technical Architecture: On-Chain System and Trusted Interfaces

Product logic is just the foundation; the success of implementation also depends on whether the technology can reliably connect off-chain assets, cross-chain mechanisms, and on-chain contracts.

2.2.1 Contract System and Permission Control

OUSG deploys standard ERC-20 or compatible security token contracts on the main chain (e.g., Ethereum), providing functions such as minting, redemption, price querying, and rebasing. The contract design needs to incorporate permission control (such as administrators, pause, minting whitelist, redemption limit management, etc.) to prevent accidental operations or abuse. To reduce risk, the contract has undergone multiple security audits, including static analysis and fuzz testing. Ondo has indicated in public materials that its contracts have audit endorsements.

2.2.2 Net Asset Value / Valuation Oracle and Transparency Mechanism

To synchronize the on-chain token with the off-chain asset value, a reliable and manipulation-resistant net asset value oracle mechanism is required. Ondo engages third-party fund administrators to access the underlying asset accounts, calculate daily net asset values, asset composition, etc., and transmits this data through off-chain to on-chain interfaces via oracles (mainly Pyth Network and Chainlink).

In terms of transparency, Ondo provides investors with asset composition details, daily reports, audit reports, and disclosures from asset custodians. The RWA.xyz platform clearly displays key indicators such as the asset composition, number of holders, and net asset value of OUSG and USDY.

2.2.3 Cross-Chain Bridging and Arbitrage Synchronization

Market value change trends of government bond RWA products across different public chains

Source: RWA.xyz

To achieve price consistency and convertibility of OUSG and USDY across chains, Ondo's cross-chain design must include a bridging mechanism (lock + mint / unlock + burn) and an arbitrage mechanism. When the price of OUSG on a certain chain deviates from its net asset value, arbitrageurs can perform cross-chain redemptions, transfers, and minting/redemptions to pull back the price difference.

Cross-chain bridges themselves are high-risk areas. Therefore, Ondo has implemented multiple protective measures in practice, including multi-signature control, exit buffers, and asset isolation. The deployment on XRPL is a representative attempt, where OUSG is hosted on XRPL and uses RLUSD stablecoin as a settlement channel for cross-chain minting and redemption. This cross-chain collaboration is a core strategy for Ondo's ecosystem expansion.

2.2.4 Building Composability / Lending Integration

To make OUSG and USDY truly useful in the DeFi ecosystem, Ondo has launched supporting protocols such as Flux, allowing OUSG to be used as collateral for loans to participate in liquidity mining, asset composition strategies, etc. (similar to using OUSG as a foundational asset in DeFi). This composability design allows OUSG to be more than just a "yield-holding tool" but also to participate in more complex financial operations.

Additionally, Ondo announced the launch of its own foundational chain (Ondo Chain) in February 2025 to accommodate large-scale RWA operations.

2.3 Risk Control Mechanism: From Trust Building to Anomaly Response

Even if the product and technology setup is acceptable, if the risk control system is not sound, institutional capital will still find it difficult to enter. Ondo's design in terms of risk is worth a deeper understanding.

2.3.1 Compliance, Legal Structure, and Asset Isolation

Ondo places OUSG under a regulated trust / SPV structure and views its tokens as products compliant with U.S. securities laws, selling them to qualified investors under Reg D rules. By setting investor qualification thresholds, implementing KYC / AML reviews, and an address whitelist system, Ondo achieves compliance access management on-chain. The underlying assets (such as government bonds and fund shares) are held by independent custodial institutions, and relevant contracts and fund agreements clarify asset ownership and the legal rights relationship of investors, ensuring that in the event of technical or operational risks on the platform, investors can still legally assert ownership of the assets and obtain retroactive protection.

In contrast, traditional DeFi protocols primarily rely on smart contracts to execute fund management and yield distribution, often lacking clear legal entities and asset ownership definitions, leaving users with very limited recourse in the event of contract vulnerabilities, liquidation risks, or hacking attacks. This combination of "law + compliance + custody" structure is the biggest difference between Ondo and pure DeFi projects.

2.3.2 Transparency / Audit / Disclosure Mechanism

Ondo entrusts third-party fund administrators to calculate net asset values daily, disclose asset composition details, net asset value reports, etc.; at the same time, it hires annual audit firms to audit custodial assets, cash flows, reporting processes, etc.

On the on-chain level, its contracts allow public viewing of minting/redemption records, token circulation data, holder address structures, etc. Platforms like RWA.xyz also display key indicators of OUSG, such as asset scale, number of holders, and net asset value changes. This "dual on-chain + off-chain" transparency mechanism is the foundation for building trust[5].

Current market data overview of OUSG

Source: RWA.xyz

2.3.3 Redemption / Liquidity Risk Control

To avoid the impact of a bank run, Ondo Finance has introduced a three-layer hybrid redemption design in its on-chain government bond products, which includes "instant redemption limits + buffer cash pools + redemption queuing mechanisms." Daily users can operate instantly within limits, while exceeding limits will enter a non-instant redemption process[6].

Specifically, the buffer cash pool consists of some cash and highly liquid assets to meet daily redemptions and sudden liquidity needs, avoiding forced sales of government bonds during market fluctuations; secondly, combined with the buffer pool is the "instant redemption limit" mechanism. Users are limited to a redeemable amount that can be processed instantly for each day or each redemption. When the redemption request does not exceed this limit, the system can directly meet the exchange demand from the buffer pool or daily liquid funds; if it exceeds the limit, the redemption request enters the "non-instant redemption process," which may require waiting for the pool to reset, the underlying assets to be liquidated, or to be processed through a redemption queue; the redemption queuing mechanism is activated when the redemption volume exceeds the limit, balancing user experience and asset safety through queuing execution and periodic fund replenishment. This layered redemption system balances liquidity and robustness, allowing the product to maintain 24/7 minting and redemption functionality while preventing systemic risks caused by large-scale redemptions.

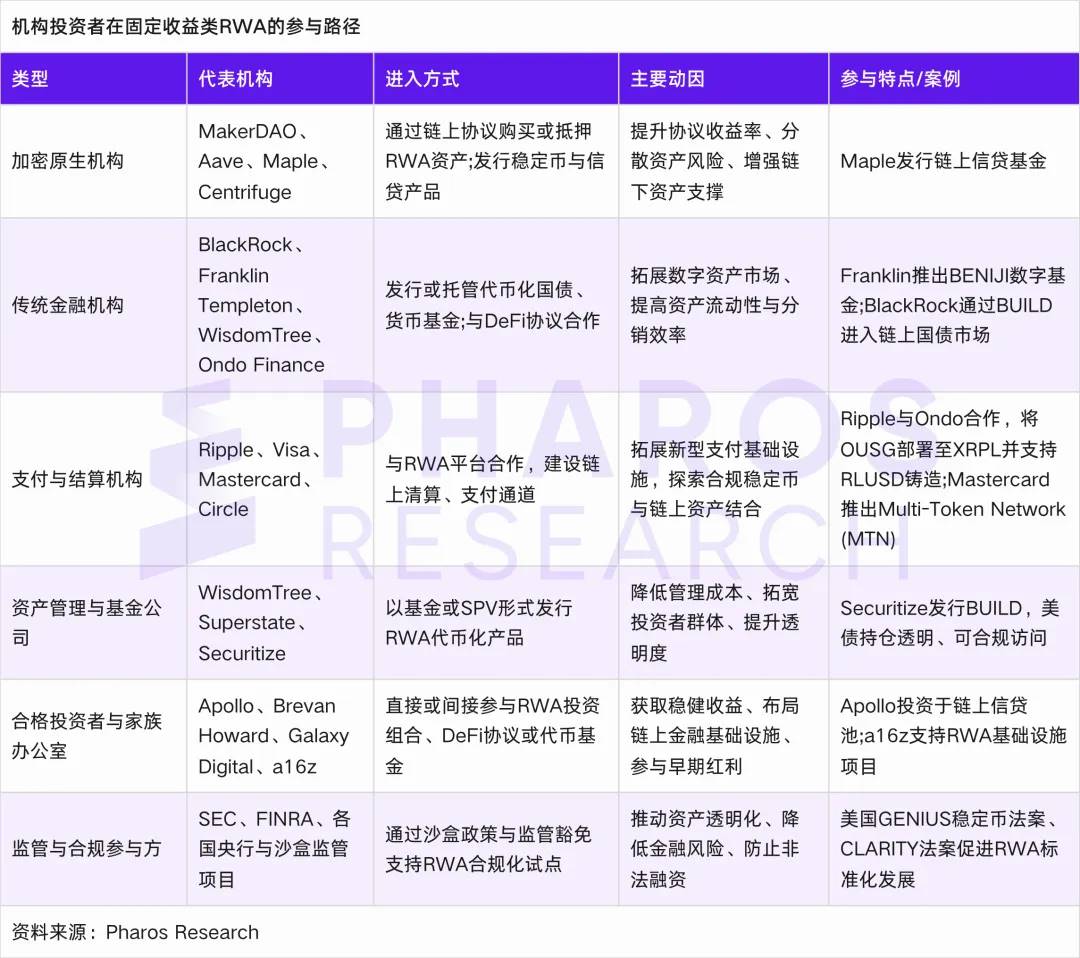

2.4 Institutional Participation Pathways: Who, How, Why

After successfully building the product and technology, the most critical step is to attract institutional capital. The following table organizes the participation pathways for institutional investors in the fixed income RWA sector for readers' reference.

2.4.1 Crypto-Native Institutions / DAOs / Protocol Parties

These users are often the first to test the waters. They hold a large amount of stablecoins but lack secure yield channels. Through OUSG and USDY, users can obtain approximately 4–5% annual compound yield (APY), corresponding to short-term U.S. Treasury yield levels.

DAOs, project parties, and crypto funds are willing to trust on-chain mechanisms, are familiar with contract systems, and are willing to bear the risks of smart contracts, making them Ondo's natural primary user group.

2.4.2 Traditional Finance / Asset Management Companies / Banks

These institutions have very high requirements for legal structure, compliance, asset custody, and operational efficiency. Ondo's pathway is to:

- Reduce legal and trust barriers through an auditable, legal SPV/trust structure + KYC/compliance thresholds + compliant disclosures;

- Provide API/custody integration/batch operation and other professional service interfaces, allowing institutions to enter in ways they are familiar with;

- Fee rates, liquidity, and leverage arbitrage costs must be sufficiently favorable (ensuring capital efficiency).

In April 2025, Ondo established a custody partnership with Copper Markets, which stated that users, including institutions, could custody OUSG and USDY through this institution. Although specific institutional user names have not been publicly disclosed, as long as Ondo successfully attracts a few institutional users, it can create a demonstration effect, lowering the "psychological threshold" for other institutions.

2.4.3 Family Offices / High Net Worth Individuals / Trusts / Foundations

Although these users are not as large as major institutions, they are characterized by strong flexibility, low risk appetite, and a focus on stable returns. They are willing to allocate some capital to OUSG or USDY for secure returns once they gain sufficient trust[7].

For these users, key factors include product usability, transparent reporting, customer support, and legal protection. If Ondo can excel in these areas, it can attract these customers to become long-term holders.

2.4.4 Market Makers / Liquidity Providers / Arbitrageurs / DeFi Protocols

These capital players often serve as the lubricant of the market.

- Market makers and arbitrageurs maintain the price anchoring of OUSG by arbitraging across multiple chains and trading pairs;

- Liquidity providers offer OUSG/USDC pairs (or other pairings) on DEXs to earn transaction fees;

- DeFi protocols incorporate OUSG into collateral/lending/strategy compositions, expanding the use of OUSG.

To attract these ecosystem players, Ondo must ensure sufficient liquidity for OUSG, good contract compatibility, and low cross-chain costs. These participants effectively expand the composability and ecological influence of OUSG.

2.4.5 Achievements and Scale Performance

As of mid-2025, Ondo's OUSG and USDY have been listed among the top three tokenized U.S. Treasury products in multiple reports, with token asset scales in the billion-dollar range. Its deployment on XRPL even leverages Ripple's liquidity commitments to enhance market activity[8].

Ondo has also been integrated into Mastercard's Multi-Token Network (MTN), becoming the first integrated RWA provider to promote the use of tokens in traditional payment/financial networks. These initiatives indicate that Ondo is transitioning from the fringes of DeFi to mainstream financial infrastructure[9].

Comparative and Trend Observations: Maple, Centrifuge, and Future Directions

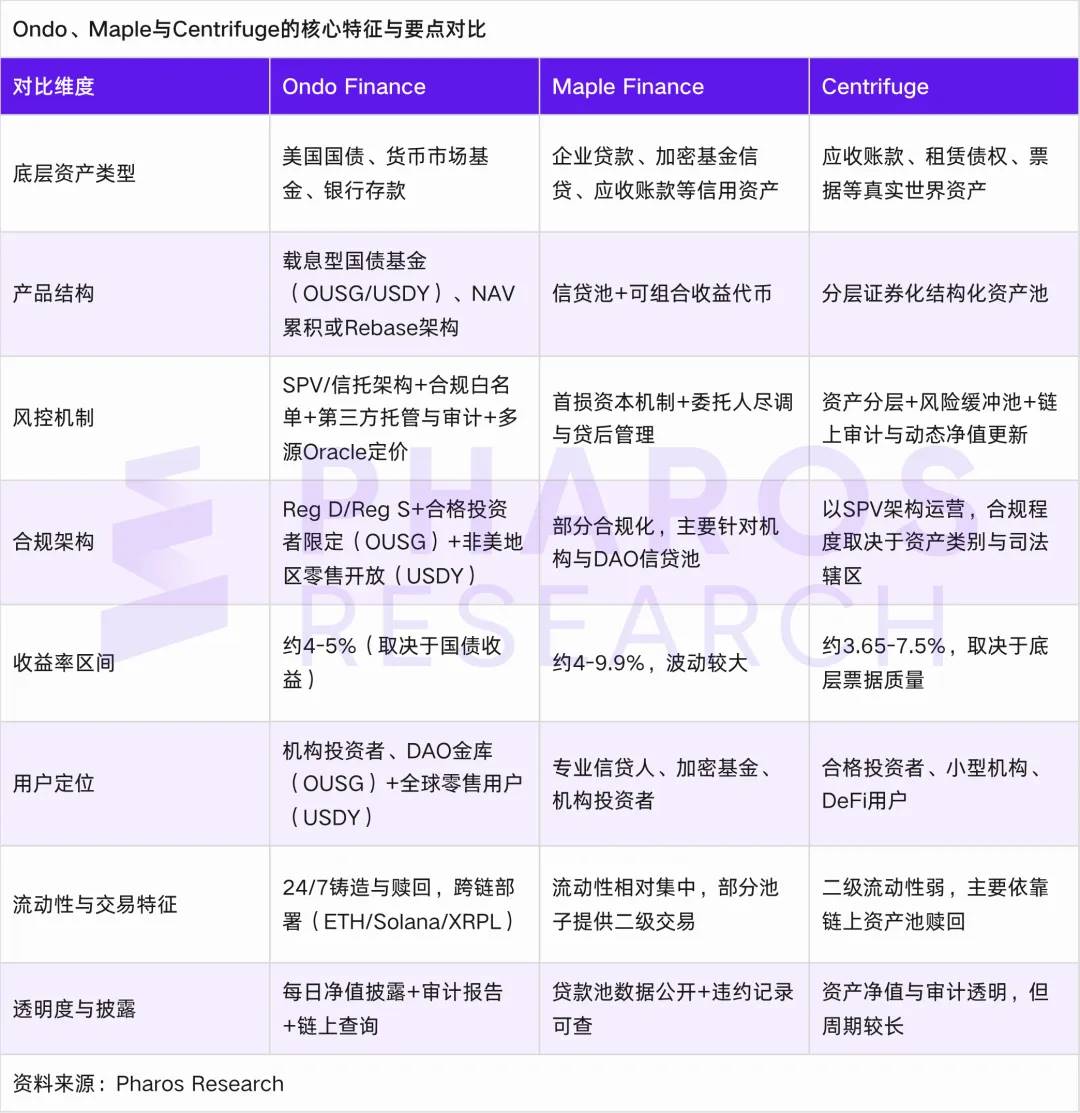

After understanding Ondo's successful path, we broaden our perspective to compare the strategies and risks of credit/structured RWA projects like Maple and Centrifuge, and point out pathways Ondo might learn from and future development trends.

3.1 Credit Buffering and Structuring: What’s Next for Ondo?

The emergence of Ondo Finance marks the entry of fixed-income RWA into a phase of "standardization and institutionalization."

However, for RWA to truly become mainstream financial infrastructure, a single type of government bond asset is insufficient to support market depth and diversity. To further improve credit expansion and yield layering mechanisms, Ondo must draw lessons from other mature RWA projects, with Maple Finance and Centrifuge being the most representative. The former provides insights into on-chain credit lending and risk buffering mechanisms, while the latter showcases pathways for structured securitization and multi-layer yield distribution[12][14].

From Maple's development logic, the core experience Ondo can learn is "institutionalized risk buffering under credit expansion." Maple Finance's business model centers on institutional credit loans, featuring three key roles: borrowers, funders, and liquidity pool representatives (Pool Delegates). Borrowers are often crypto-native institutions, such as market makers or hedge funds, typically obtaining credit loans with insufficient collateral (collateral ratio of 0–50%); funders deposit capital into liquidity pools to earn interest, but the principal can only be redeemed after the loan period ends. Pool representatives act as fund managers, responsible for assessing borrower credit and setting loan terms, and must pledge a certain proportion of capital (usually not less than $100,000 in USDC-MPL LP positions) to provide compensation to funders in the event of default. This design establishes an on-chain logic of "interest binding + risk sharing" for credit guarantees, creating a dynamic balance between loan security and incentive mechanisms.

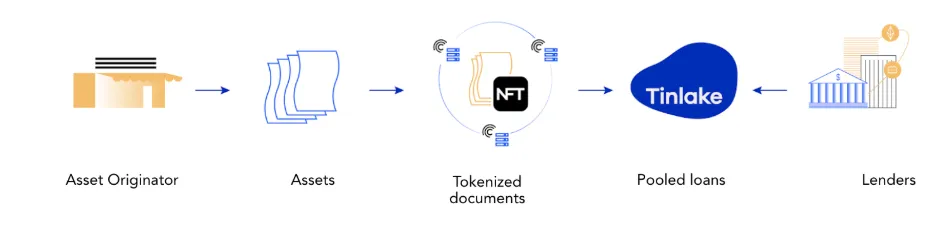

Centrifuge's experience offers Ondo a reference direction for structured and composable asset securitization frameworks. Centrifuge's Tinlake system is based on real assets like receivables, with layered yield tokens (different risk levels) that investors can choose from based on their risk preferences. This layering mechanism enhances the flexibility of RWA products in risk management and allows on-chain capital to participate in asset pools of different risk levels in a modular way[11][13]. If Ondo adopts this model, it could build a structured asset module on top of the low-risk yield layer formed by OUSG and USDY. For example, future products like "OND Yield+" or "OND Structured" could be launched, using OUSG as a safe base and layering credit bonds or high-yield bonds to achieve multi-layer risk-return matching. This would meet the differentiated needs of institutional and retail users while releasing higher yield potential under the premise of maintaining underlying stability[15].

Tinlake asset securitization and tokenization process diagram.

Source: Centrifuge

3.2 Trend Observations and Future Pathways

Based on the above comparisons and case experiences, the author summarizes the potential development paths and trends for fixed-income RWA over the next 2–3 years:

- Tokenization of government bonds enters a mature stage: In the next 1–2 years, U.S. Treasury RWA will continue to expand, likely integrating deeply with stablecoin businesses and institutional cash management, becoming one of the mainstream asset classes.

- Steady progress in credit expansion: Credit assets (high-quality notes, high-rated corporate bonds, microloans, receivables, etc.) will gradually be incorporated into the RWA system, but expansion must be supported by credit buffers, insurance mechanisms, credit ratings & data introduction, and enhanced legal contracts.

- Cross-chain / high-performance chains become infrastructure focal points: As RWA scales grow, demands for performance, cost, and cross-chain efficiency will increase. High-performance L1 / L2 (supporting fast confirmations, state parallelism, lightweight execution) will be the next bud of industry infrastructure.

- Evolution of bridging and cross-chain security mechanisms: Cross-chain bridging is an essential path for RWA expansion, and its security remains a core challenge. Safer multi-signature/exit mechanisms, buffer mechanisms, and cross-chain insurance will become standard configurations.

- Standardized compliance and industry infrastructure construction: RWA standard token specifications (such as security token standards, compliant KYC whitelist interfaces), asset custody/audit/rating/credit reporting/legal service platforms will become necessary public facilities.

- Capital layering + modular architecture: Future platforms are more likely to launch "multi-layer risk / multi-layer yield" modules (safety layer, credit layer, leverage layer, etc.), allowing capital with different risk preferences to find entry points, rather than just a single risk point.

- Regulatory policies and financial infrastructure integration: In the U.S., EU, Hong Kong, and other regions, the regulatory attitude towards RWA will play a decisive role. Policies such as the U.S. stablecoin bill, securities law amendments, and asset custody regulations will directly impact the boundaries of RWA implementation.

Conclusion

The significance of fixed-income RWA goes far beyond simply "moving" a type of traditional asset onto the chain. Ondo Finance's practice demonstrates that only when the financial rationality of product design, the safety and controllability of smart contracts, the transparency and robustness of the risk framework, and the trust logic of institutional investors form a closed loop can on-chain assetization truly possess systemic significance.

However, Ondo's success is just a starting point. As the tokenization of U.S. Treasuries enters maturity, the core competition of RWA will shift from "can it go on-chain" to "after going on-chain, can it build new liquidity structures and capital orders." Credit expansion, structured securitization, cross-chain interoperability, asset composability, and regulatory co-construction will become the main axes of the next stage. Projects that can find a balance between technical efficiency, financial innovation, and institutional trust will have the opportunity to truly define the future of financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。