The ultimate battle for Bitcoin is not in the code, but in the hearts of people.

Written by: Jon Helgi Egilsson, Forbes

Translated by: AididiaoJP, Foresight News

This Friday marks the seventeenth anniversary of Satoshi Nakamoto's release of the Bitcoin white paper.

Today, this revolution seems to have returned to its starting point: Wall Street now holds the keys.

From BlackRock's Bitcoin ETF to JPMorgan's decision to accept Bitcoin and Ethereum as collateral, the very institutions that Bitcoin aimed to bypass have now become its custodians, its largest beneficiaries, and advocates, perhaps also its greatest test.

From Economic Rebellion to Regulatory Acceptance

This irony reveals a deeper truth about how revolutions evolve and why this moment is crucial.

First they ignore you, then they laugh at you, then they fight you, then you win.

This pattern described by Gandhi often repeats in technological revolutions and is now manifesting again. Bankers once scoffed, regulators fought, and now Wall Street embraces what it once dismissed.

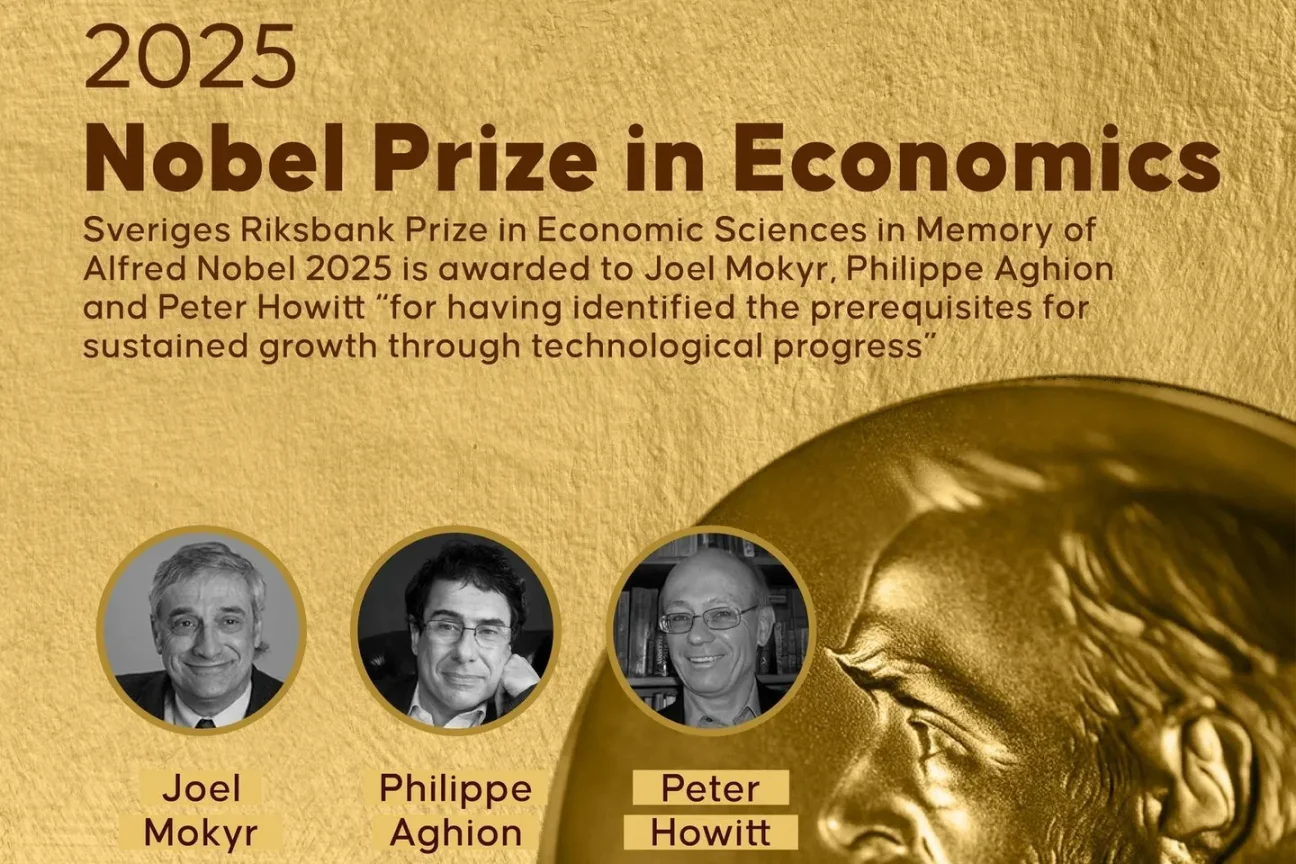

Earlier this month, the Nobel Prize in Economics was awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their complementary work on creative destruction and the culture of growth. Their research explains how progress relies on a society's willingness to allow old institutions, technologies, and habits to be replaced by new, more efficient ones.

Joseph Schumpeter's concept of "creative destruction" is not just about innovation; it is about the courage to break conventions. Mokyr links sustained growth to a culture that celebrates curiosity and experimentation, while Aghion and Howitt demonstrate how innovation advances by continuously replacing the old with the new, disruptive in the short term but essential for long-term progress.

The Creative Evolution of Bitcoin

The story of Bitcoin and cryptocurrencies almost perfectly fits this pattern. It began as a rebellion against financial institutions and is now being absorbed by them. Jamie Dimon once called Bitcoin a "fraud" with "no intrinsic value," yet now leads a bank that accepts it as collateral. The SEC was cracking down on cryptocurrencies last year, but has since undergone a historic shift, embracing it and openly considering cryptocurrency standards as a regulatory bridge to a trillion-dollar market.

As these institutions adapt, they are proving Mokyr's point: progress rarely unfolds directly but rather through resistance, absorption, and ultimately cultural transformation, which is the process of reshaping governance and social institutions.

From Crypto Code to Cypherpunk Culture

ATTILA KISBENEDEK / AFP

Fans pose with a statue of Bitcoin's pseudonymous creator Satoshi Nakamoto. This hooded figure symbolizes the mystery behind Bitcoin's origins and the movement it sparked seventeen years ago. Today, that revolution is no longer taking place in code but in culture. Communities around the world are striving to win hearts, transforming technology into a shared belief. As this year's Nobel laureates remind us, innovation can only reshape institutions when it becomes part of the social culture.

Milestones are real, but the mission is not yet complete. The institutional acceptance of Bitcoin marks progress, but its core commitments, such as self-custody, open networks, and user sovereignty, are still fighting on the cultural front lines. Across the globe, Bitcoin's native builders and communities are shaping that culture from the ground up.

The energy of such gatherings is not merely technical; it is cultural and communal. The struggle is no longer just about code but about protecting individual choice and freedom in a world filled with intermediation, increasing centralization, and surveillance. As Mokyr states, the transformation from technology to culture to institutions is still ongoing. The question now is whether society will complete the mission initiated by Satoshi Nakamoto: not by writing new code, but by choosing the values that will define the next era of currency and freedom.

The Battle for Bitcoin Has Begun

At a Bitcoin-themed event in Los Angeles this month, MIT's Christian Catalini proposed that open networks and interoperability are the foundation of the next payment era. Catalini believes that the future of money depends on shared infrastructure rather than closed gardens, and the struggle for openness is ultimately cultural, not technical. Education and community will determine whether innovation remains free or is captured by vested interests.

A similar pattern emerged in Prague, where Trezor's "Design is Trust" gathering viewed self-custody as a continuation of Europe's long struggle for personal freedom. Speakers drew historical parallels between digital sovereignty and hard-won lessons of self-reliance, reminding participants that freedom is not a product feature; it is a mindset.

In Prague, Czech Republic, on October 21, 2025, speakers at the "Design is Trust" conference focused less on technology and more on the culture that sustains financial freedom. "Czechs have learned not to trust authority," Matěj Žák said, capturing a deeper theme of the event: lasting change begins with culture, as institutions rarely change before society does.

Meanwhile, in Lugano, Switzerland, the "B Plan Forum" brought together policymakers, entrepreneurs, and tech experts around a shared belief that Bitcoin's fundamental principles, such as transparency, openness, and personal choice, must extend beyond financial markets into the ways of social self-governance. As one participant noted, "What started with the B Plan is rapidly becoming the A Plan."

These are not isolated events. A broader movement to win hearts and minds is underway across podcasts, online communities, and social media, reminding us that a revolution cannot succeed unless individuals believe in its value and act accordingly.

These gatherings amount to a cultural engineering, a community-building of rebels. As Mokyr argues, once a technology is invented, its spread relies on culture: the willingness of people to adopt new norms and abandon old comfort zones.

The Bitcoin movement is testing this threshold. It has conquered the balance sheets of global institutions but has yet to conquer the habits of individuals. Unless ordinary people feel both the need and the confidence to hold their own keys, support open-source innovation, and trust public networks, this revolution remains unfinished.

A Revolution in Transformation

NASA flight director applauds the safe return of Apollo 13, photo provided by Heritage Space/Heritage Images via Getty Images.

NASA flight director applauds the safe return of Apollo 13, one of the most dramatic missions in space history. What began as a near-disastrous mission ultimately ended in victory through wisdom, trust, and collaboration. This reminds us that some revolutions succeed through adaptation. Like Apollo 13, the Bitcoin and cryptocurrency revolution is in a state of transformation. Its challenge today is not technical but cultural: will society muster the same resolve to return to fundamental principles and complete the unfinished business?

Seventeen years later, we are no longer debating whether the technology works; we are deciding what kind of society we want it to serve, and the choice is in our hands.

The phrase "Houston, we have a problem" from Apollo 13 has become shorthand for crisis, but the mission it refers to did not fail; it adapted. The astronauts solved their problems through wisdom, trust, and collaboration, turning disaster into discovery.

Similarly, Satoshi's revolution is not in crisis but in transformation. The challenge is not technical; it is cultural. Whether Bitcoin fulfills its founding promise or becomes another layer of financial intermediation will depend on our collective choices. It depends on whether society, like those astronauts, decides to return to fundamental principles and complete the unfinished business.

Independence and the freedom from financial intermediation are not granted by institutions that profit from dependency; they are acts of will, conscious choices by users.

Freedom is not given; it is chosen. It is shaped by our culture, rooted in our values, and sustained by our choices.

The struggle continues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。