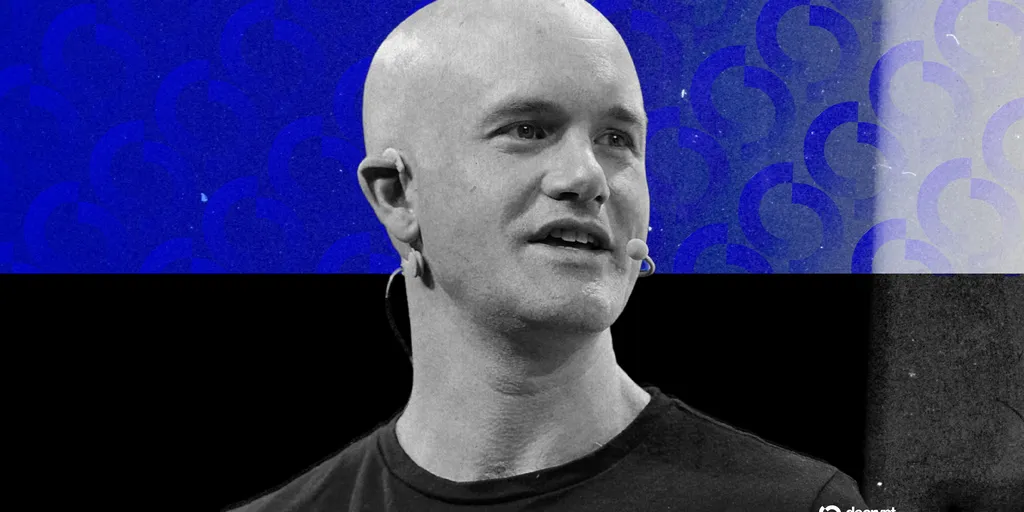

Brian Armstrong’s last-minute crypto shout-out turned a $4,000 prediction market into a punchline. With a few words, the Coinbase CEO made every bet on “Bitcoin,” “Ethereum,” and “Web3” pay out at once.

It was a thin market, where the largest winner took home only $111, according to Poymarket Analytics.

But if Armstrong’s impromptu word salad showed how ridiculous prediction markets can get, New York City mayoral market, with $22 million in open interest, shows how serious they’ve become. Moving the odds there by just 10 percentage points would now cost roughly $1 million in concentrated buying power.

That’s because Polymarket’s open interest reflects real money sitting in a liquidity pool, not just the sum of theoretical wagers waiting to settle. Every trade interacts with an automated pricing curve backed by collateral, meaning odds shift gradually rather than being set by direct matches between traders.

The biggest positions show just how deep that pool runs: whales like "dubdubdub2" and "asfgh" each hold over $2 million backing Zohran Mamdani, according to Polymarket Analytics, while most of the large “No” traders are already sitting on heavy losses and have little room to add capital.

Because of this, any new bet placed “out of the money”, for example, buying Andrew Cuomo at long odds or selling Mamdani near 95%, is quickly absorbed by the market maker’s curve, which adjusts prices based on supply and demand.

To move the odds by 10 percentage points, a trader needs to push through millions of dollars in opposing orders, around $1 million in concentrated buying or selling, before the curve starts to meaningfully shift. The market’s size and structure make small attempts at manipulation almost instantly diluted by existing capital.

Recent polling backs up the market’s view. A Fox News survey shows Mamdani leading Cuomo by 16 points, while an Emerson College poll puts his advantage at 25, evidence that his 95% odds reflect voter sentiment rather than manipulation.

Perhaps there was also a misunderstanding that polls measure what voters say they’ll do, while prediction markets measure how confident traders are that those voters will actually do it, so a candidate polling at 50% doesn’t necessarily have a 50% chance of winning.

Ackman’s criticism missed what traders already knew: if Mamdani’s 95% odds were truly inflated, anyone could have exploited the mispricing.

As CSPTrading.eth put it, right now a bet on Mamdani is just a guaranteed 5% return in 10 days.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。