As the overall cryptocurrency market experiences a correction, Ethereum (ETH) finds itself at a critical moment, both suppressed by the external macro environment and revitalized by internal mechanisms and ecological expansion. This article analyzes three major aspects: market performance, technological/ecological progress, and institutional trends, while exploring the potential risks and future directions it faces.

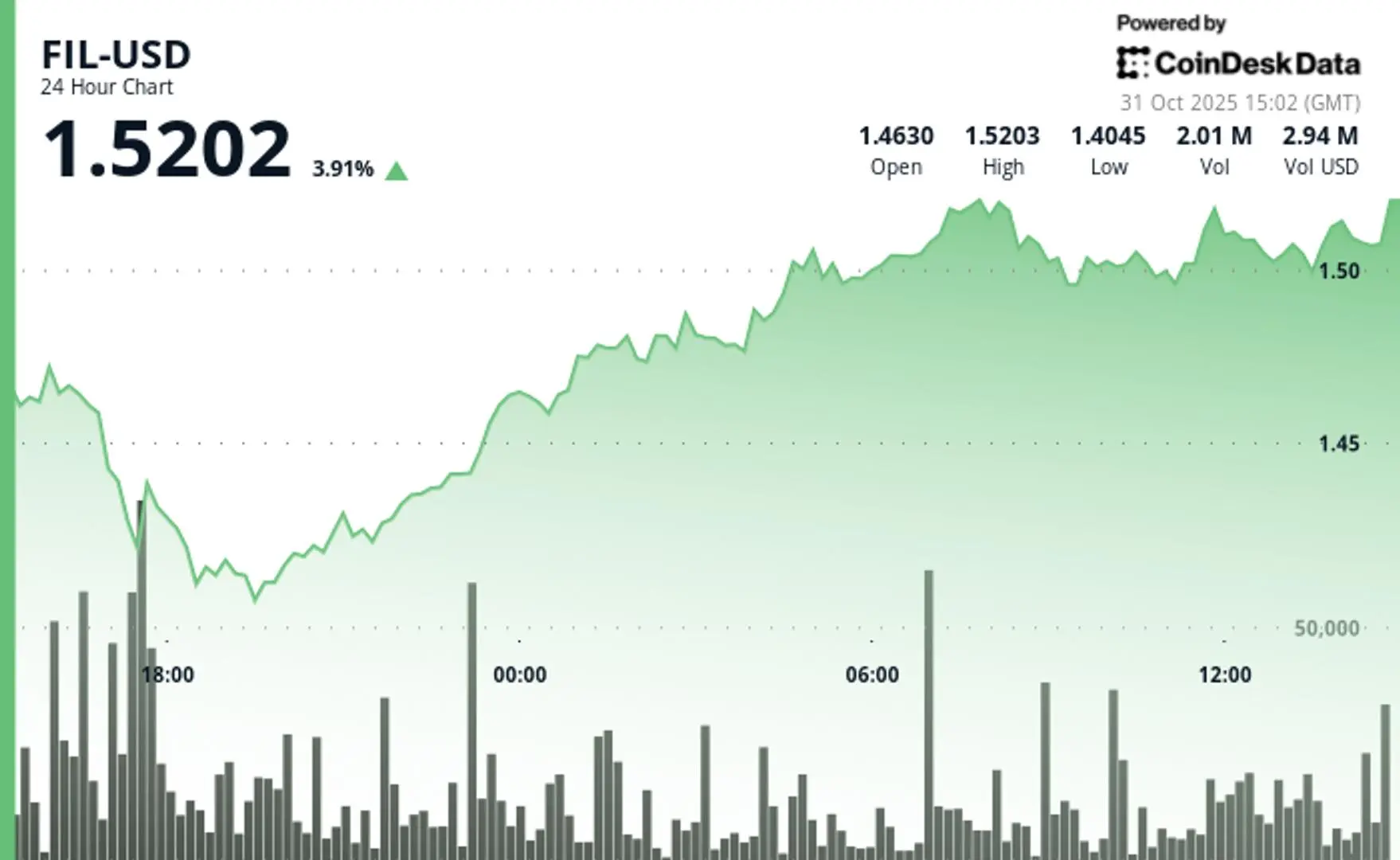

Recently, ETH's price trend has shown significant fluctuations and differentiation. Reports indicate that its price once dropped about 4.9% to around $3,757, marking a recent low. At the same time, it faces larger-scale derivative expiration pressures: on October 31, the total amount of ETH and BTC-related options contracts exceeded $16 billion, which could amplify short-term volatility. However, despite the price pressure, trading volume and activity have shown signs of rebound after the decline. Reports suggest that ETH's trading activity on certain days outperformed the long-term average, with increased participation.

Overall, the current phase can be seen as a transition from "accelerated rise" to "consolidation": prices are under pressure, the market is cautious, but the underlying activity, technical architecture, and capital flow have not regressed.

From a technological and ecological perspective, Ethereum is accelerating towards "institutionalization." On October 29, the Ethereum Foundation launched a portal called "Ethereum for Institutions," specifically designed to provide on-chain pathways, compliance tools, and technical architecture guidance for financial institutions, enterprises, and developers. This portal emphasizes that Ethereum has over 1.1 million validation nodes and a continuous operational history of more than a decade, with several financial institutions already engaged in asset management and on-chain applications within the ecosystem. Additionally, the Foundation particularly pointed out that privacy protection technologies (such as zero-knowledge proofs ZK, trusted execution environments TEE, and fully homomorphic encryption FHE) are becoming essential components for enterprises deploying on-chain assets. Furthermore, data from the derivatives market indicates that by the third quarter of 2025, ETH-related futures/options contracts will reach new highs in trading volume and open interest. This shows that the Ethereum ecosystem is moving from a purely developer experimental space towards "compliant institutions + real assets on-chain."

Ethereum is entering a phase of "institutionalization," "assetization," and "underlying financialization." Firstly, in terms of capital, as mentioned above, the active derivatives market and record-high open interest indicate increased institutional participation. Secondly, in terms of applications, the new portal and clear institutional positioning signify that traditional finance is incorporating Ethereum into its technology stack. Finally, from a pathway perspective, Ethereum is building an "on-chain financial infrastructure" through stablecoins, real-world assets (RWA), and compliant deployments, rather than being limited to DeFi speculation. The simultaneous advancement of these three pathways makes Ethereum's combination of "network effects + developer community + stable asset flow enablement" more competitive compared to its rivals.

However, challenges cannot be overlooked. In terms of the macro environment, the overall cryptocurrency market is currently constrained by interest rate policies, the dollar's performance, and a decline in risk sentiment. Ethereum's decline is partly attributed to this. Secondly, competition from chains like Solana and Avalanche in terms of transaction costs and speed has made Ethereum appear somewhat passive under "upgrade pressure." Despite reports of a "mid-life crisis," the current ecosystem has not fallen into a complete predicament. Thirdly, technical challenges still exist. How to enhance scalability, achieve contract upgrades, and ensure privacy protection while maintaining security and decentralization is a significant issue facing Ethereum.

Observation acceleration period: Given the ongoing uncertainty in the macro environment, ETH may maintain a fluctuating pattern. However, if interest rate expectations improve and capital continues to flow in, there may be a chance for renewed momentum.

Technological advancement synchronization: As the "Ethereum for Institutions" pathway unfolds, it is expected that more institutions will engage in stablecoins, RWA, and compliant on-chain activities. The iteration of privacy and scalability technologies will become the focus of the next phase.

Ecological structure change: Transitioning from "pure trading/speculation" to "underlying financial infrastructure" means that Ethereum's value anchor may shift from mere price increases to network value, asset flow, and application scale.

Ethereum is at a critical transformation period: although prices are under pressure, the structure is stabilizing, and the technological and ecological advancements towards institutionalization are accelerating. If it can seize the pathways of "institutional on-chain + real assets + privacy compliance" amid an improving macro environment, Ethereum may not only provide the second-largest asset for the cryptocurrency market but also become an important bridge for traditional finance to migrate to blockchain. For market participants, this is both an observation period and a pre-layout period: identifying opportunities amid volatility and selecting positions within the structure.

Related articles: Analysis of trends and risks in the cryptocurrency market driven by institutional funds.

Original article: “Ethereum (ETH): Technological Leap and Market Test Under Institutional Wave”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。