Original Title: Why Crypto Can't Build Anything Long-Term

Original Author: rosie

Original Translation: Odaily Planet Daily Golem

Most crypto founders I know are now undergoing their third transformation. This group developed NFT platforms in 2021, shifted to DeFi yields in 2022, and are now pivoting to AI agents in 2023/24, chasing this quarter's hot trend (perhaps prediction markets).

There’s nothing wrong with their transformations; in many ways, their strategies are correct. But the problem is that this pattern itself makes it difficult to build any product that can develop long-term.

18-Month Product Cycle

New concept emerges → Capital floods in → Everyone pivots → Sustained development for 6-9 months → New concept fades away → Pivot again.

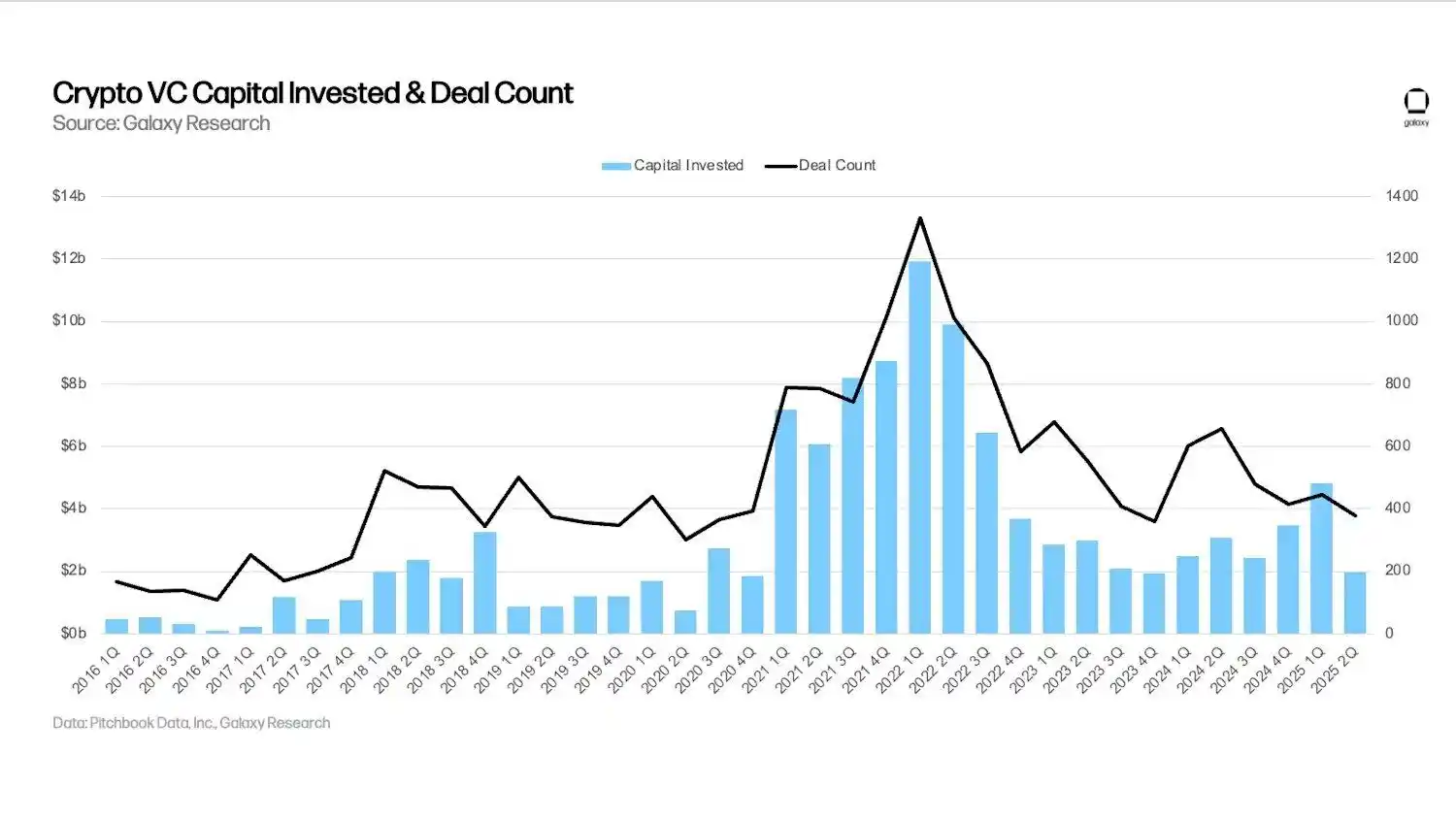

A crypto cycle used to last 3-4 years (during the ICO era), then it shortened to 2 years, and now, if lucky, a crypto cycle lasts a maximum of 18 months. In the second quarter of 2025, crypto venture capital dropped by nearly 60%, leaving crypto founders with insufficient time and funds to develop before the next narrative forces them to pivot again.

It is nearly impossible to build anything meaningful within 18 months; real infrastructure requires at least 3-5 years, and achieving true product-market fit takes years, not just a few quarters of iteration.

But if crypto founders continue to rely on last year's narrative, they are wasting money, investors will abandon them, and users will drift away. Some investors may even force crypto founders to cater to current trends, while their teams begin to evaluate investments in projects that secure funding based on this quarter's hot narrative.

Sunk Cost Fallacy as a Survival Mechanism

Traditional business advice is to avoid the sunk cost fallacy. If a project isn’t working, pivot immediately. But the crypto space has completely fallen into this trap, using the sunk cost fallacy as a survival mechanism. Now, no one sticks around long enough to validate whether what they are doing is effective; instead, they pivot at the first sign of resistance, pivot when user growth is slow, and pivot when funding is difficult.

Every crypto founder faces this trade-off:

- Continue developing the existing product, which may succeed in 2-3 years. If lucky, you might secure another round of funding.

- Shift to a hot narrative: secure immediate funding, show paper gains, and exit before anyone realizes it’s not working.

The second option wins most of the time.

Projects Are Always "About to Be Completed"

Few crypto projects can truly complete what’s on their roadmap. Most projects are always in a "about to be completed" state. They are always just one feature away from achieving product-market fit. They can never achieve it because halfway through, market winds shift, and completing your DeFi protocol becomes meaningless overnight as everyone talks about AI agents.

The market punishes completed projects. A completed product has known limitations, while a "about to be completed" product still holds infinite narrative potential.

Capital Chases Attention, Not Completion

In the crypto space, if you have a new narrative, you can raise $50 million even without a product; if the narrative is established and the product is available, you might struggle to raise even $5 million; if it’s an old narrative with a product and real users, you might not be able to raise any funds at all.

VCs don’t invest in products; they invest in attention. Attention flows to new narratives, not to completed old narratives. Most teams are now solely focused on "narrative maximization," optimizing purely for which story can attract funding, completely indifferent to what they are actually doing. Completing projects limits them, while abandoning projects allows them to keep their options open.

Team Retention

If you are a crypto founder, after a new narrative emerges, your best developers may receive double salaries to join hot new projects, and your marketing director may be poached by a company that just raised $100 million. You can’t compete because you abandoned the hot narrative six months ago to focus on truly completing the project you started.

No one wants to participate in dull, stable projects. They want chaos, excess funding, and projects that might collapse but could yield tenfold returns.

User Attention Span

Crypto users sometimes use a product simply because it’s new, because everyone is talking about it, or because there might be an airdrop. Once the narrative shifts, they leave, and no one cares whether the product has improved or whether it has added the features they requested.

In fact, we cannot build sustainable products for unsustainable users. Some crypto founders pivot so often that they forget their original goals.

Decentralized social networks → NFT markets → DeFi aggregators → Gaming infrastructure → AI agents → Prediction markets… Pivoting is no longer a strategic issue; it has become the core of the entire business model.

Infrastructure Paradox

In the crypto space, those things that can exist long-term were mostly established before cryptocurrencies gained attention. Bitcoin was born when it was ignored, without VCs or ICOs. Ethereum emerged before the ICO boom, before anyone foresaw the future of smart contracts.

Most things born during hype cycles will fade away with the end of the cycle, while things born before the cycle are more likely to succeed. But the fact is that very few people will develop before a narrative begins due to a lack of funding, attention, and exit liquidity.

Why Is This Situation Hard to Change?

Token-based incentive mechanisms create liquidity exit opportunities. As long as founders and investors can exit before a product matures, they will do so.

The speed of information and sentiment dissemination far exceeds the speed of construction. By the time a project is completed, everyone knows the outcome. The entire value proposition of the crypto industry is rapidly evolving; asking crypto to develop slowly is like asking it to become something it was never meant to be.

This means that if you spend three years building a product, others can copy your idea and launch a product in three months with worse code and better marketing strategies. Then they win.

Cryptocurrencies struggle to build any long-term products because they are structurally opposed to long-term thinking.

You can be a principled founder, refusing to pivot, remaining true to your original vision, and developing over years rather than months. But you are likely to go bankrupt, be forgotten, and ultimately be replaced by those who pivoted three times while you were releasing your first version.

The market does not reward completion; it rewards constant innovation. Perhaps the true innovation in the crypto industry lies not in the technology itself, but in how to achieve the greatest value with the least investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。