Who Will Take Over the Altcoins?

Written by | Liam, Deep Tide TechFlow

If there were a contest for the world's most enthusiastic cryptocurrency traders, South Koreans would certainly be on the list.

South Korea has long been one of the most fervent countries for cryptocurrency globally, even coining a term: "Kimchi Premium," where South Korean traders once paid up to 10% more for Bitcoin than the global price.

However, by 2025, the tide has turned.

The trading volume on South Korea's largest crypto exchange, Upbit, has plummeted by 80% compared to the same period last year, and the activity of the Bitcoin-Korean Won trading pair is far less than in previous years; instead, the South Korean stock market is booming, with the KOSPI index soaring over 70% this year, continuously setting historical highs.

On Kakao Talk and Naver forums, retail investors who once discussed altcoins daily are now talking about "AI semiconductor concept stocks."

The ghost stories of the crypto world have arrived, and even South Koreans are trading cryptocurrencies less frequently.

Trading Volume Halved, South Koreans Are No Longer Trading Cryptocurrencies

In recent years, South Korea has been a battleground for the global crypto market.

For exchanges and project teams, this place has high-net-worth quality clients; to put it simply, South Koreans have often been the main force in taking over altcoins.

Media and films are filled with stories of South Koreans trading cryptocurrencies overnight, getting rich, and then facing liquidation.

So, when someone tells you that retail investors in this "crypto trading nation" are now trading cryptocurrencies less frequently, you might find it absurd.

But data does not lie.

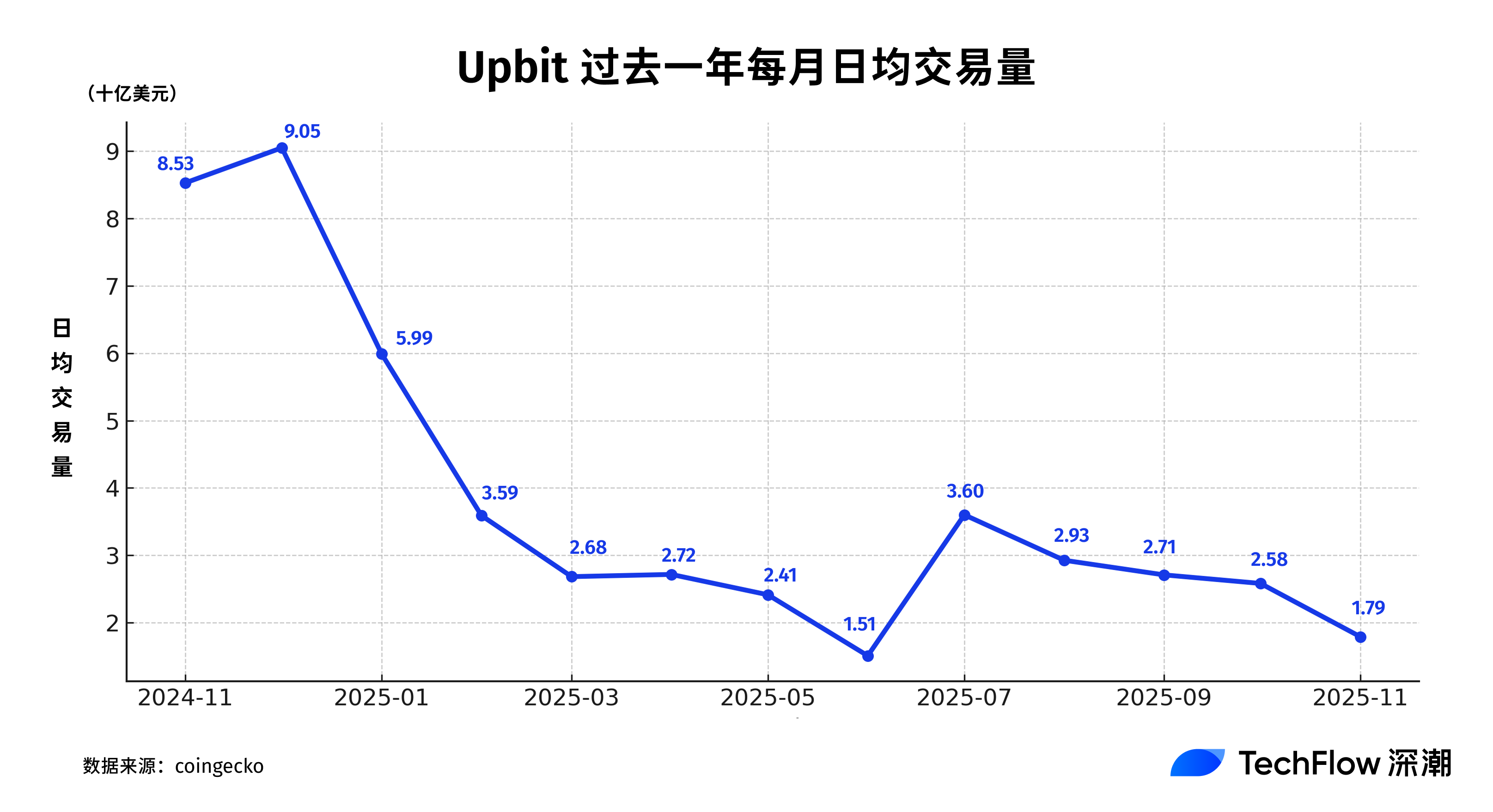

The trading volume of South Korea's largest exchange, Upbit, has collapsed.

In November 2025, Upbit's average daily trading volume was only $1.78 billion, a staggering drop of 80% from $9 billion in December 2024, and it has been declining for four consecutive months.

Upbit's historical peak occurred on December 3, 2024, the night of South Korea's martial law, with a trading volume of $27.45 billion, ten times the usual amount.

But that night of madness became the peak, and the market quickly cooled down, with trading volume collapsing dramatically.

More notably, the volatility of trading volume has also significantly decreased.

During the frenzy at the end of 2024, daily trading volume often fluctuated wildly between $5 billion and $27 billion; however, entering 2025, most of the time, trading volume has stabilized in the range of $2 billion to $4 billion, with a significantly reduced fluctuation range.

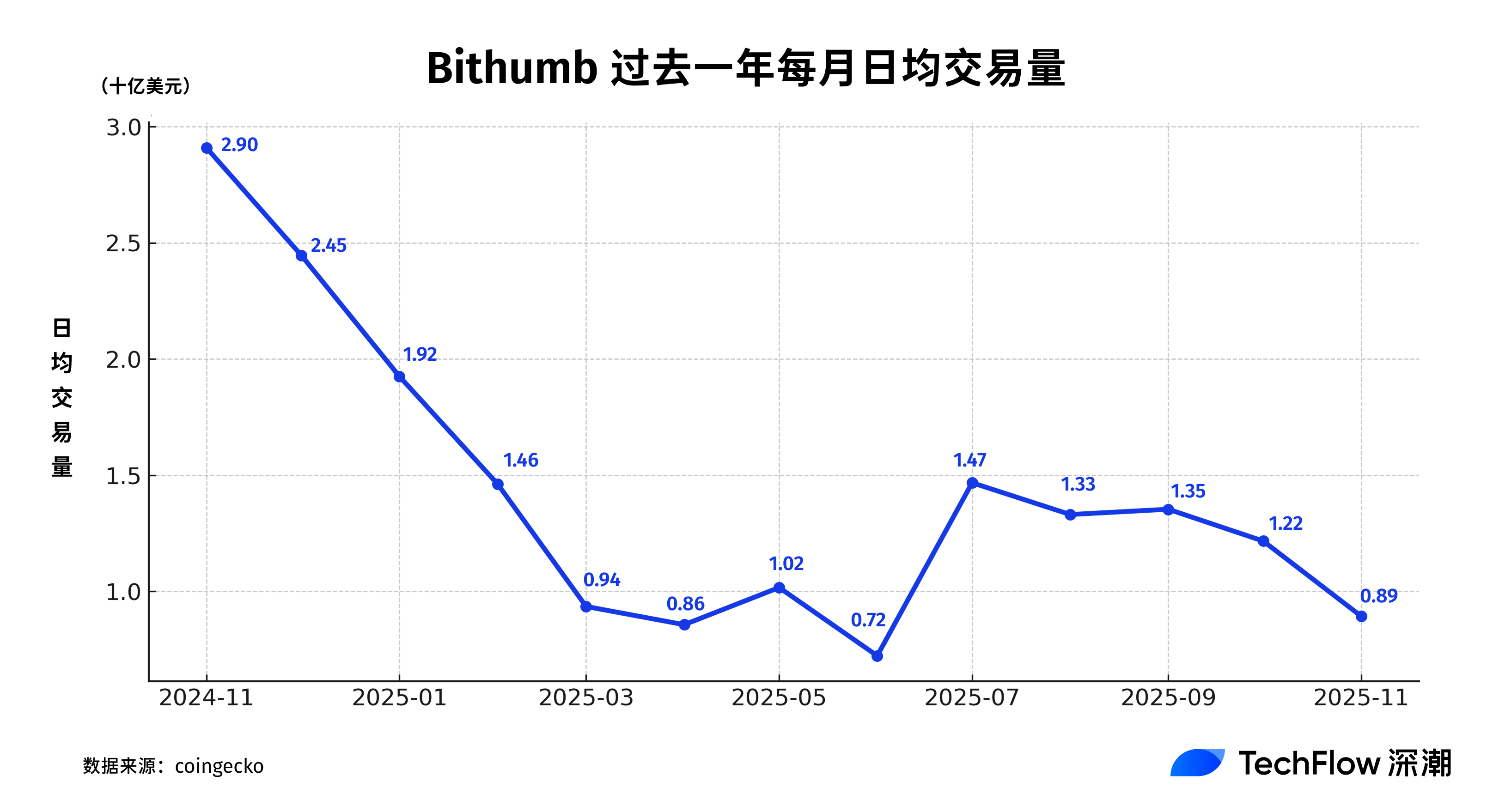

The fate of South Korea's second-largest exchange, Bithumb, is similar.

At the end of 2024 (December), Bithumb's average daily trading volume was about $2.45 billion, but by November 2025, it had dropped to around $890 million, an overall decline of about 69%, with liquidity loss nearing two-thirds.

The two largest local exchanges in South Korea (Upbit and Bithumb) have both fallen into "volume recession" during the same period, which not only indicates a cooling of trading but also a comprehensive retreat of retail investor sentiment in South Korea.

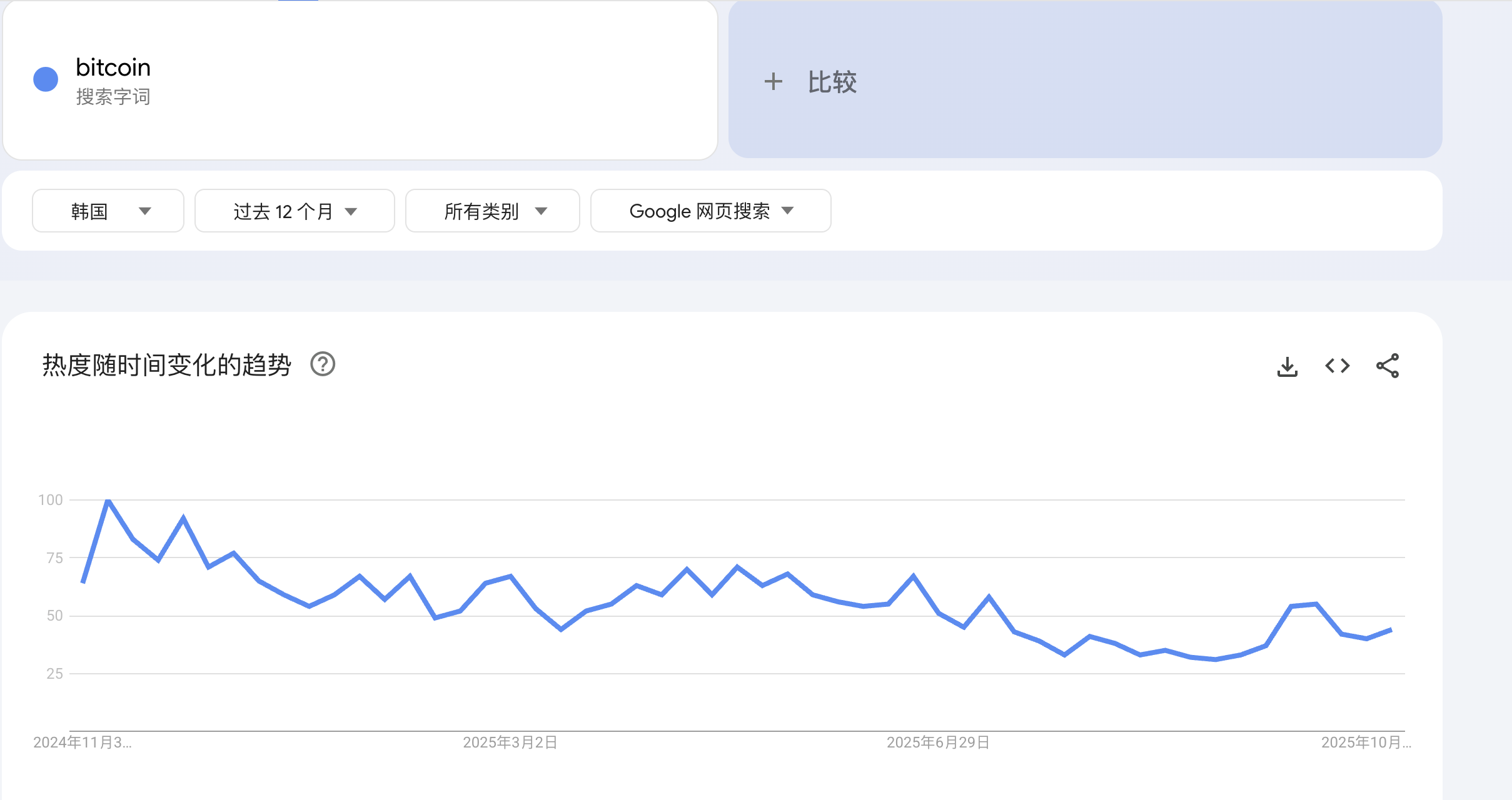

Search data confirms this; in South Korea's Google search trends, the latest search index for Bitcoin is 44, down 66% from the peak of 100 at the end of 2024.

Korean Stock Market Frenzy

So, where has the money of South Koreans gone? The answer is: the stock market.

This year's South Korean stock market can be described as a reincarnation of the 2017 Bitcoin bull market, an epic frenzy.

The benchmark KOSPI index in South Korea set 17 intraday historical highs in October alone, breaking through the 4200-point mark, with a cumulative increase of nearly 21% in just October, marking the best single month since 2001.

From the beginning of the year to now, the KOSPI index has surged over 72%, leading all asset classes.

In October, the average daily trading volume of KOSPI reached 16.6 trillion won (about $11.5 billion), with a single-day peak of 18.9 trillion won, a 44% increase from September, causing brokerage apps to lag.

This is just the index; individual stocks are even crazier.

Samsung Electronics has risen 100% since the beginning of the year; storage giant SK Hynix's stock price has increased 70% this quarter and skyrocketed 240% since the beginning of the year, with the two companies averaging a daily trading volume of 4.59 trillion won, accounting for 28% of the entire market.

The market's heat is so high that even the exchanges can't ignore it. On Monday evening, South Korean exchanges announced that they had issued an "investment caution" notice for SK Hynix stocks, citing the rapid rise of the stock, which caused SK Hynix's stock price to plummet on Tuesday.

AI Has Become a "National Faith"

Once, the South Korean stock market was stagnant, with little growth for over a decade, and local media frequently sang its demise, claiming "the South Korean stock market has no future," which led many South Korean investors to trade cryptocurrencies or invest in U.S. stocks. Why has the South Korean stock market turned around in 2025?

The recent surge in the South Korean stock market seems to be due to "retail investors going crazy," but the underlying logic is exceptionally clear:

Global AI Wave + Policy Push + Domestic Capital Return.

Everyone knows that the spark for this round of market activity comes from AI.

ChatGPT ignited the second season of the global tech bubble, and South Korea happens to sit in the "ammunition depot" of the industrial chain.

South Korea is a leading country in global memory chips, with SK Hynix and Samsung Electronics almost monopolizing the high-bandwidth memory (HBM) market, which is the most critical raw material for training AI large models.

This means that whenever NVIDIA and AMD's GPU shipments increase, the profit curve of South Korean companies will rise in tandem.

At the end of October, SK Hynix released its financial report, showing third-quarter revenue of $17.1 billion and operating profit of $8 billion, a year-on-year increase of 62%, both hitting historical highs.

More crucially, SK Hynix has locked in customer demand for all DRAM and NAND production capacity through 2026, leading to a supply shortage.

Thus, South Koreans have realized:

AI is America's narrative, but the money is being made in South Korea.

If NVIDIA is the soul of the U.S. stock market, South Korean retail investors have found their faith in SK Hynix.

From the crypto world to the stock market, they are still chasing that "tenfold dream," but buying Samsung or SK also allows them to wear the crown of "patriot."

Additionally, do not overlook a key background: the South Korean government is actively trying to save the stock market.

For a long time, South Korean stocks have faced what is known as the "Korea Discount."

Family conglomerates' monopolies, chaotic corporate governance, and low shareholder returns have led to South Korean companies being generally undervalued, even Samsung Electronics has long been valued below global peers, and SK Hynix's PE remains only 14 after a 240% rise.

After Yoon Suk-yeol's government took office, it launched a reform plan known as the "Korean version of the shareholder value revolution":

Encouraging companies to increase dividends and buy back stocks;

Cracking down on cross-shareholding among conglomerates;

Lowering capital gains tax and encouraging pension funds and retail investors to increase local allocations.

This reform has been referred to by the media as "a national action to free South Korea from the discount."

As a result, overseas capital has begun to flow back, and local institutions and retail investors are also "returning home to buy stocks."

Of course, another reality is that there are few places for money to go.

The South Korean real estate market has cooled during the high-interest rate cycle, U.S. stock valuations are high, and the crypto world can only passively take over.

Investors need a new gambling table, and the stock market just happens to provide a legal investment venue.

Data from the Bank of Korea shows that more than 5 million new securities accounts were opened by local retail investors in the first half of this year, and the download volume of brokerage apps surged.

The speed of this capital inflow into KOSPI is faster than the rush of retail investors into the crypto world in 2021.

At the same time, South Korean pension and insurance funds are also increasing their positions in local tech stocks.

From the government to institutions to retail investors, everyone is rushing into the stock market; you could even say this is a "national-level bull market."

Speculation Never Sleeps

Unlike the crypto world, which relies on "emotion" to drive prices, this time, the "bull" in the South Korean stock market at least has some performance support.

Finally, one must admit:

This stock market bull run is essentially a nationwide "emotional resonance."

South Koreans have not changed; they have just switched gambling tables. They not only gamble but also leverage.

According to Bloomberg, South Korean retail investors are significantly increasing their leverage, causing the balance of margin loans to double within five years, and they are flooding into high-leverage and inverse ETFs.

According to data from Gelonghui, in 2025, retail investor leverage accounts for 28.7% of total holdings, an increase of 9% from last year; the holdings of 3x leveraged products rose from 5.1% to 12.8%, with the leverage usage rate among young people aged 25-35 at 41.2%.

This generation of retail investors comes with a "go all in" gene.

However, when South Korean retail investors collectively rush to the stock market, the question arises:

"If South Koreans are no longer trading cryptocurrencies, who will take over the altcoins?"

In recent years, the South Korean market has often been the last bastion for altcoins.

From Dogecoin to PEPE, from LUNA to XRP, almost every round of crazy bull markets has seen the presence of South Korean retail investors.

They represent the "ultimate emotional indicator" of the global crypto market; as long as South Koreans are still buying, the bubble has not peaked.

But now, with the trading volumes of Upbit and Bithumb both plummeting, the crypto world has lost its last believers and, consequently, its biggest fuel.

Altcoins have no one to take over.

Perhaps we will have to wait until the heat of this global AI stock market fades or until the crypto world can tell a sufficiently compelling story again.

At that time, the sleeping gamblers will be awakened and return to the blockchain to continue betting.

After all, the gamblers are still there; they have just changed casinos.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。