The broader crypto economy experienced a steep plunge late Nov. 17, with its market capitalization dropping to $3.15 trillion amid a global markets rout. This rout was fueled by growing fears of an artificial intelligence (AI) bubble burst, intensified after Sundar Pichai, the head of Google’s parent firm Alphabet, conceded there was some “irrationality” in the current AI boom.

In an interview with the BBC, Pichai warned that if the AI bubble were to burst, “no company is going to be immune,” a warning that seemingly triggered a sell-off in tech stocks. Concerns over the growth of the U.S. economy are also cited by some observers as being central to the market downturn.

Read more: Bitcoin Dips Under $90K, but Bulls Are Still Unfazed

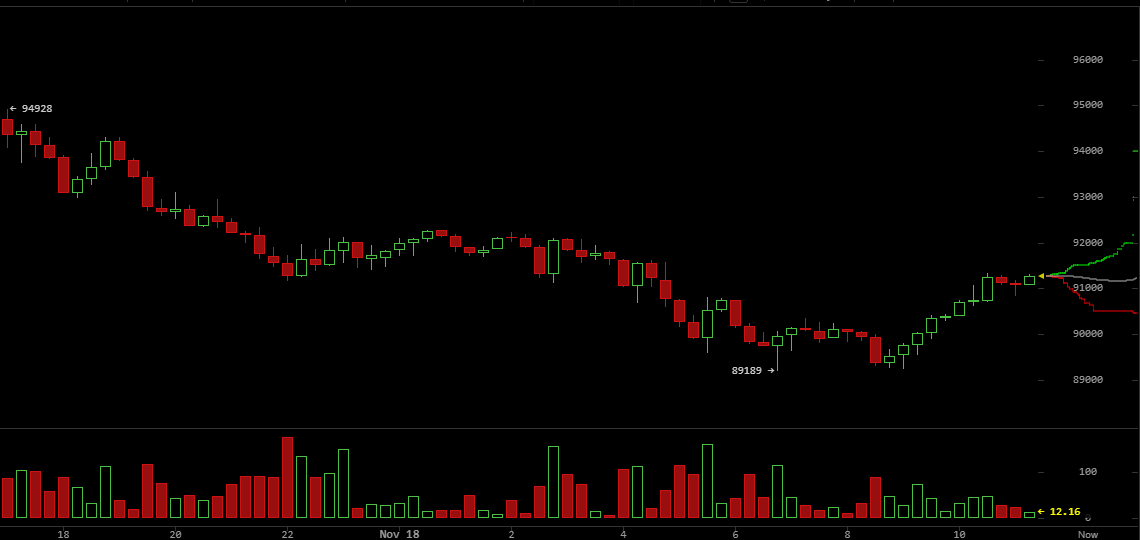

Amid the wider market turmoil, bitcoin ( BTC) plunged to $89,226, essentially wiping out the gains it made since the start of 2025. This sharp correction saw BTC’s market capitalization slip to $1.8 trillion. The swift decline decimated leveraged positions: over $560 million in leveraged BTC positions were obliterated in 24 hours. Overall, the crypto market sell-off liquidated just over $1 billion in long and short positions, affecting more than 185,000 traders.

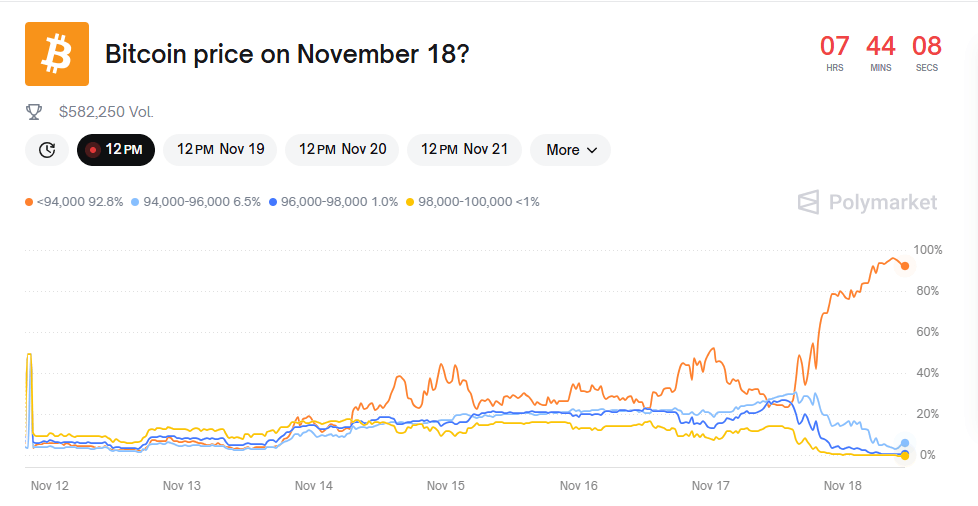

With experts and prediction market bettors increasingly less optimistic about BTC reclaiming $125,000 this year, economist Tracy Shuchart, a senior economist at Ninjatrader, argued the decline was inevitable.

Writing on X on Nov. 18, Shuchart contended that the macro story that sustained BTC at $126,000 had “collapsed in just a few weeks,” leaving the top cryptocurrency without a narrative to sustain its price.

Shuchart identified two key structural factors driving the sustained selling pressure. First, the spot BTC exchange-traded funds (ETFs), initially celebrated for attracting institutional money, have simultaneously created institutional-scale sell liquidity that never existed before. Shuchart points to huge ETF outflows, which she attributes to “professional portfolio managers rebalancing away from an asset whose fundamental thesis just evaporated.”

Second, she noted that long-term holders, who bought BTC between $40,000 and $80,000, are offloading their holdings to realize profits and reposition.

“They offloaded 815,000 Bitcoin in 30 days. These holders aren’t selling because they think Bitcoin is worthless. They’re selling because they see volatility ahead and they’re sitting on 50 to 150 percent profits. Smart money doesn’t ride drawdowns when they can step aside and rebuy lower with the same capital,” Shuchart explained.

The economist argued that the price breaking below the $100,000 support level triggered a massive cascading liquidation sweep through derivatives markets, accelerating the decline. While open interest plunged from $94 billion to $68 billion, Shuchart believes excess leverage likely remains in the system.

Therefore, BTC will likely continue to fall until the remaining leverage is completely cleared and the price reaches levels where long-term holders stop distributing and start accumulating again.

“The real question isn’t why did this happen. The real question is what price level actually clears the market and brings in genuine buyers rather than leveraged speculators. That’s still being discovered,” she concluded.

- What triggered the global rout? Fears of an AI bubble burst and U.S. economic concerns fueled the Nov. 17 sell‑off.

- How did crypto markets react worldwide? Market cap fell to $3.15T, with bitcoin plunging under $90K and $1B in positions liquidated.

- What structural factors drove BTC’s decline? ETF outflows and profit‑taking by long‑term holders added institutional‑scale sell pressure.

- What’s next for global investors? BTC may keep falling until leverage clears and genuine buyers return to accumulate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。