Original|Odaily Planet Daily (@OdailyChina)

Author|CryptoLeo (@LeoAndCrypto)

Devout SOL guardians have recently received some comfort due to a new proposal put forth by the Solana community, named SIMD-0411 (translated as double suppression of the inflation rate, which can be understood as not reaching deflation but the inflation rate is decreasing). This proposal was initiated by Solana community contributors Lostin and helius Dev Ichigo and is currently in the governance discussion phase, with voting expected to commence soon.

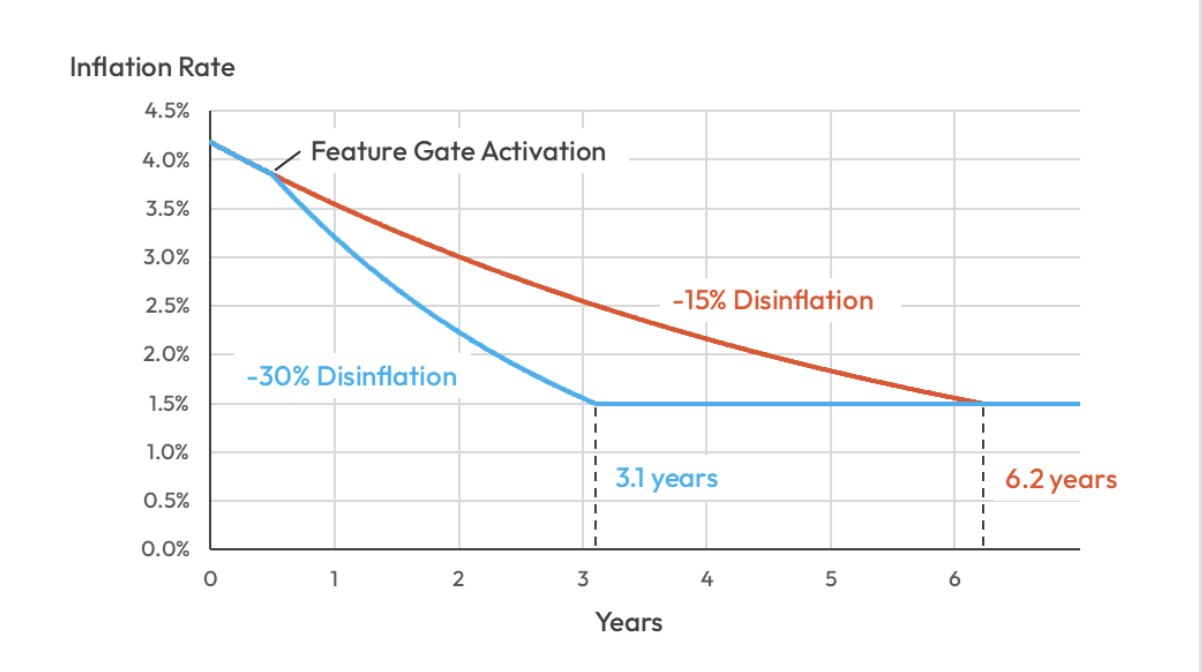

The proposal suggests doubling the SOL inflation deceleration rate from -15% to -30%. After parameter adjustments, the SOL inflation rate will decrease from the current 4.18% to 1.5%, moving the timeline from early 2032 to early 2029. This means that reaching the target inflation rate of 1.5% will only take 3.1 years. Under this parameter, the SOL issuance will decrease by 22.3 million coins over the next 6 years (according to the existing mechanism, the SOL supply will be 721.5 million coins in 6 years, while under the SIMD-0411 mechanism, it will be 699.2 million coins). Based on the current price of SOL at $140, this amounts to approximately $3.12 billion.

Differences Between SOL SIMD-0228 and SIMD-0411

Let’s first review the SOL token inflation plan, which was originally designed with an initial inflation rate of 8% and an inflation deceleration rate of 15%, gradually decreasing to a final inflation rate of 1.5%, currently at 4.18%.

SIMD-0411 is not the first proposal to improve the SOL inflation mechanism. Earlier this year, early SOL investors such as Multicoin Capital released a proposal named SIMD-0228, which also aimed to modify the Solana inflation model by adjusting the SOL issuance rate to a dynamic and variable mode. The proposal set a target staking rate of 50% to enhance network security and decentralization. If more than 50% of SOL is staked, the inflation rate decreases by reducing rewards to suppress further staking; if less than 50% of SOL is staked, the inflation rate increases, raising rewards to encourage staking. Based on the Solana network situation at that time, the final inflation rate would be set at 0.87%.

However, due to the complexity of the proposal and strong opposition from the community, it ultimately did not succeed. The opposition from most community members stemmed from the conflict of interest between large and small validator nodes:

Large validator nodes supported the SIMD-0228 proposal, as a quick reduction in inflation would lead to an increase in token prices, yielding greater returns;

Small validator nodes were concerned that reduced staking rewards would significantly decrease their income, and some DeFi projects worried about liquidity issues. If small validator nodes exited, Solana's power would concentrate in the hands of a few large validator nodes, affecting the network's decentralization.

In this context, SIMD-0411 can be seen as a simplified and safer version of SIMD-0228. Based on this, the proposal of SIMD-0411 is more targeted, doubling the speed of inflation reduction while maintaining the already agreed-upon final inflation rate of 1.5%. It achieves this by adjusting a single parameter rather than redesigning the entire inflation system like SIMD-0228. It provides a minimal, predictable, and low-risk way to strengthen the inflation design of the SOL token without increasing protocol complexity. Simpler and easier to govern.

What Does the Community Think?

Regarding SIMD-0411, opinions are mixed:

Positive Views: Institutions Optimistic, Encouraging Innovation and DeFi Activity

The SOL treasury company DeFi Dev Corp (DFDV) has also expressed support for SIMD-0411, with DFDV analyzing:

In addition to the reduction of 22.3 million SOL, SIMD-0411 applies a single, easy-to-understand parameter adjustment, avoiding any complex or dynamic monetary logic, enhancing predictability. Furthermore, SIMD-0411 includes a 6-month activation grace period for network participants to prepare;

Regarding staking rewards, DFDV stated, high staking rewards are reasonable in the early stages of blockchain network development, helping to attract developers, accelerate decentralization, and stimulate token demand, but Solana has already passed that stage. For comparison:

Solana's protocol revenue grew from $29 million in 2023 to $1.42 billion in 2024, reaching approximately $1.38 billion so far in 2025: an increase of nearly 50 times in one year. By 2025, Solana's protocol revenue will be more than double that of Ethereum. Solana reached $1 billion in about 4 years (while Ethereum took 6 years).

Solana's DEX trading volume grew from $12 billion in 2022 to $55 billion in 2023, and is expected to reach $694 billion in 2024, with an anticipated $1.45 trillion in 2025. Solana's processing volume this year is approximately 1.6 times that of Ethereum's DEX trading volume.

From 2023 to 2025, Solana processed about 6.86 billion transactions, while Ethereum only processed 1.27 billion, a difference of up to 50 times. Solana's annual transaction count grew from 12.3 billion in 2023 to 25.9 billion in 2024, reaching 30.5 billion so far this year, while Ethereum's annual transaction volume has remained below 500 million. Solana has achieved scalability (while Ethereum has not).

Solana has consistently outperformed Ethereum in almost all key metrics, including network revenue, transaction data, DEX trading volume, and new wallets;

Currently, high inflation is also dragging down the performance of the SOL token price, which urgently needs to be addressed;

Institutional investors, DAT, and ETF issuers prefer to issue assets with predictable, long-term economic benefits and structurally low inflation;

Lower staking yields will also lead to more SOL flowing into DeFi products, such as lending, LP, stablecoins, etc.;

Reducing reliance on token inflation encourages network validators to innovate.

Concerns: A Series of Issues Arising from Reduced Staking Rewards

According to Pine Analytics, the nominal staking yield of SOL will steadily decline after SIMD-0411 is passed, approximately:

The first year: about 5.04%;

The second year: about 3.48%;

The third year: about 2.42%.

Additionally, according to 0xSpade analysis, after SIMD-0411 is passed, 10 validator nodes will transition from profit/breakeven to unprofitable in the first year, 27 in the second year, and 47 in the third year.

In response, DFDV also stated:

A lower inflation rate will make the economic viability of validator nodes more challenging, reducing staking participation, lowering economic security, and causing short-term volatility;

As yields decrease, some validator nodes may incur losses or even shut down;

The uncertainty of a sudden adjustment to Solana's inflation plan may lead to market volatility;

The yields of ETFs, staking products, and DAT will decrease;

Intervening in the token mechanism may set a bad precedent, and not all networks can follow this mechanism; most networks' dynamics and token designs should remain unchanged.

DAT, ETF, and with reduced inflation, is SOL about to take off?

Although the SOL token price has not performed well this year, there have been significant substantive advancements: first, the DAT treasury; while the SOL treasury may not be as "grand" as BTC and ETH, it is still continuously buying; second, the SOL ETF. SOSOValue data shows: SOL spot ETF had a net inflow of $128 million in the week (Eastern Time from November 17 to November 21). As of the time of writing, the total net asset value of the SOL spot ETF is $719 million, with an ETF net asset ratio (market cap compared to Bitcoin's total market cap) reaching 1.01%, and the historical cumulative net inflow has reached $510 million.

Strategic SOL Reserve data shows that the SOL treasury company and ETF hold a total of 25.581 million SOL, valued at approximately $3.55 billion. Amid other crypto assets being abandoned and continuously bleeding, SOL has welcomed a more solid backing, with a well-funded institutional buying support already formed. Related reading: “SOL Guardians, Don't Panic, Major Funds Are Here to Support You

In the eyes of us SOL guardians: "Better a short pain than a long pain; after all, we will eventually reach the 1.5% inflation rate. I am optimistic about SIMD-0411. Of course, the reduction in staking yields may affect ETF data, and concerns are reasonable, but in the long run, the 'new transparent and predictable inflation mechanism' will attract more retail and institutional investors, far outweighing the risks brought by 'reduced staking yields leading to some exits.' Moreover, the volatility caused by potential short-term selling pressure is likely to lead to 'continuous new highs' in the future."

I hope SIMD-0411 passes the voting phase quickly and does not end in failure like SIMD-0228.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。