Author: Nancy, PANews

On November 25, overseas media Unchained published an in-depth investigative report revealing that the star public chain Berachain signed privacy agreements with VCs, secretly granting its leading investor Nova Digital a risk-free exit privilege. Amidst a weak market and ecosystem, this news immediately caused an uproar in the Berachain community. However, Berachain's official response denied the claims, stating that Nova remains one of the largest holders of BERA tokens.

Exposed: Leading Investor Nova Enjoys Exclusive Refund Rights, Berachain Denies Discrimination

In this round of the crypto cycle, the golden age of crypto VCs is gradually fading, with shrinking returns, diminished influence, and even a wave of resistance against VC tokens, leaving investment firms in a difficult position of struggling to make profits and raise funds. Surprisingly, crypto VCs have also staged a performance of capital preservation.

According to Unchained, Berachain was originally an NFT project but completed at least $140 million in financing within a few years, growing into one of the popular public chains. In the last round of financing, Berachain was co-led by Framework Ventures and Nova Digital, a subsidiary of Brevan Howard, at a valuation of $1.5 billion. An anonymous former employee revealed that Brevan promised to "endorse" the project but required preferential treatment in the B round terms.

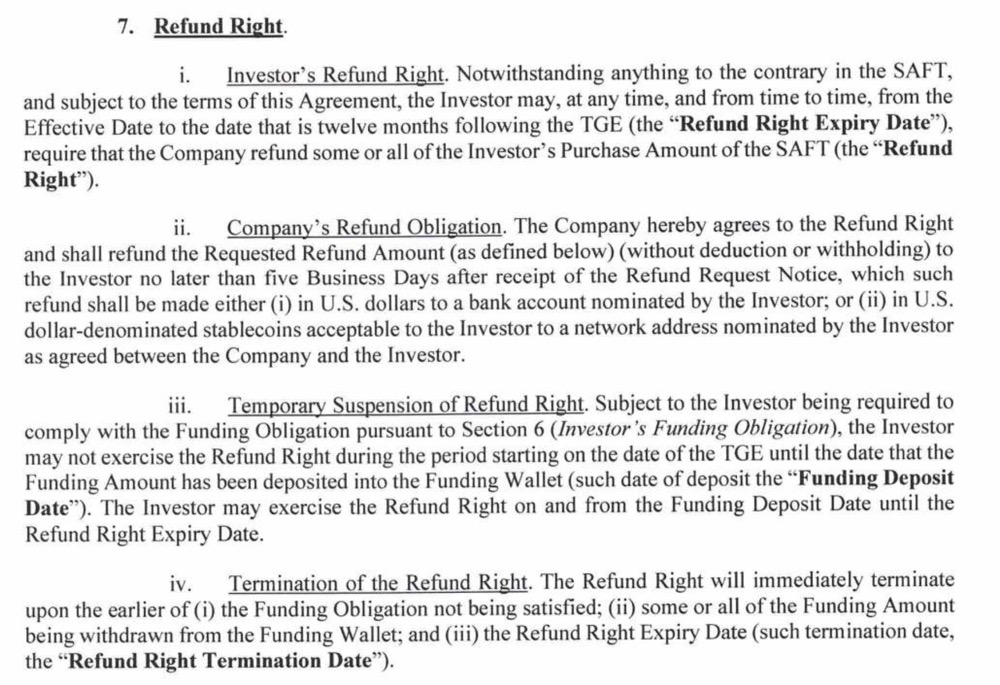

Documents obtained by Unchained show that Nova purchased $25 million worth of BERA tokens at a price of $3 during the B round and received a highly controversial "refund right": the ability to request a full refund of the investment within one year after Berachain's TGE on February 6, 2025 (i.e., until February 6, 2026). The condition for exercising this right is that Nova must deposit $5 million within 30 days after the TGE. Currently, the trading price of BERA is approximately $1.04, meaning that if Nova fulfills the margin requirement and exercises the refund right, it will recover the principal in full while incurring significant losses, with the losses borne by Berachain. This investment clause, which guarantees profit without loss, has sparked significant controversy.

It is understood that Nova Digital was acquired by the large hedge fund Brevan Howard in 2023 from Dragonfly Capital and raised $9 million through its digital asset division BH Digital for liquidity token strategies. Nova Digital has also become a branch of Brevan Howard's digital asset division BH Digital, with Kevin Hu from Dragonfly serving as CIO and reporting directly to BH Digital CEO Gautam Sharma.

In August 2025, Brevan announced the divestment of Nova Digital, led by Kevin Hu, with insiders citing internal losses and differences in investment strategies as the main reasons. Kevin Hu was also accused of participating in Berachain's seed round investment. Notably, Kevin's direct supervisor, BH Digital CEO Sharma, also left at the same time. Brevan plans to fill Sharma's position but will not fill Kevin's position.

Currently, neither Brevan nor Nova has responded to this.

More critically, the report pointed out that other B round investors did not receive refund rights, with two anonymous investors stating they were never informed of such special terms. This move is seen as potentially violating the "material disclosure" obligations in SEC Reg D and could trigger MFN (most favored nation) clauses in some investors' contracts. According to the current price of BERA, several B round investors are in a state of severe losses, with one of the leading investors, Framework Ventures, facing a paper loss of over $50 million, holding 21,145,476 BERA at a cost of approximately $72.4 million, with an average purchase price of $3.42.

In response to the report, Berachain co-founder Smokey the Bera urgently publicly stated that the relevant narrative is "incomplete and inaccurate." He clarified the details of the investment agreement, stating that Brevan Howard, through its Abu Dhabi office's Nova fund, co-led Berachain's B round financing a year ago, with investment terms consistent with other investors. Nova's compliance team required additional terms to mitigate risks of TGE failure and failure to list, leading to the signing of an additional commercial agreement, including a commitment to provide liquidity after the network launch. These terms were not intended to facilitate the transaction or to evade potential declines in token prices after TGE, as such practices have precedents (leading investors typically have preferential rights, buyback rights, exit protection clauses, etc.). On the contrary, Nova remains one of Berachain's largest token holders, a liquidity provider, holding locked BERA tokens obtained in the B round financing as well as liquid BERA tokens purchased on the open market, continuously supporting Berachain and increasing holdings amid market fluctuations.

Facing Multiple Ecological Challenges, DAT Strategy Struggles to Halt Token Price Decline

Despite its luxurious financing background, Berachain's current ecological performance is not ideal.

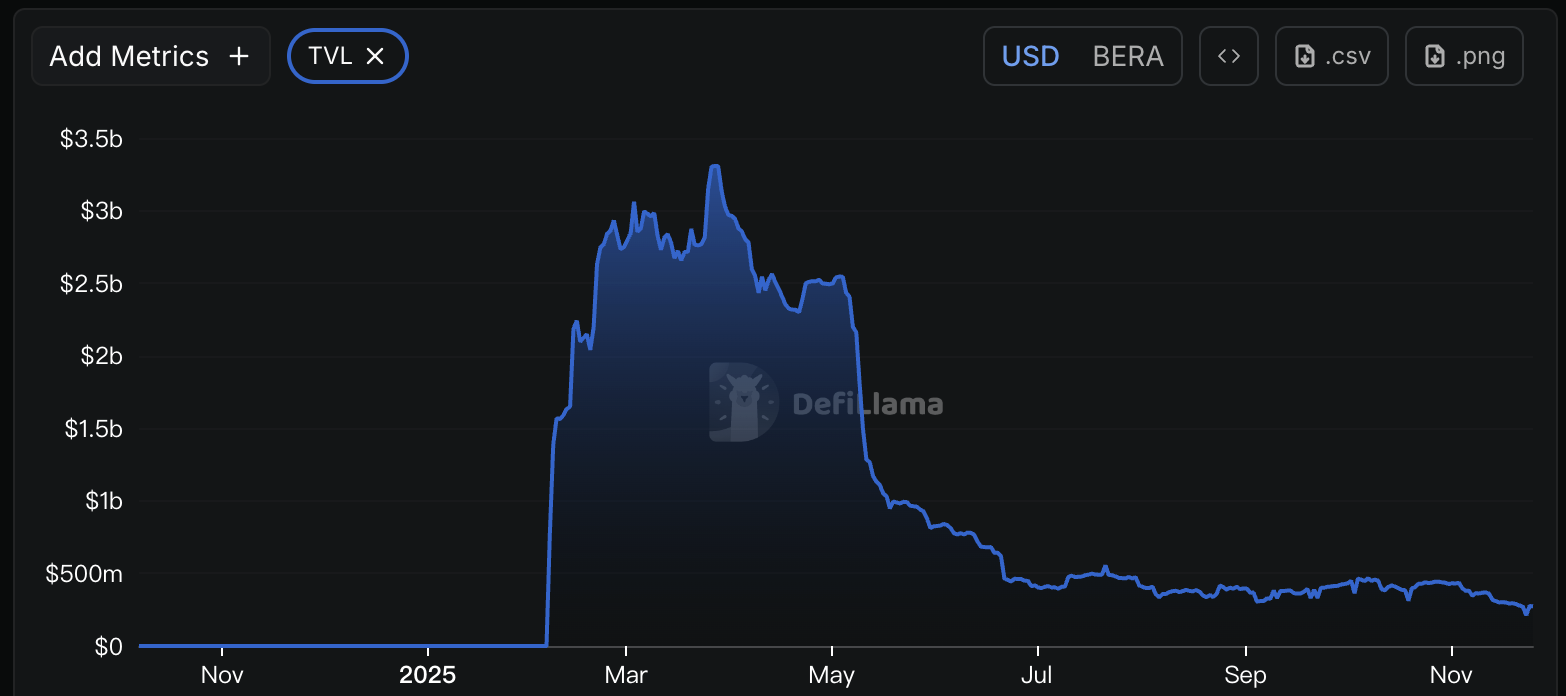

According to DeFiLlama data, as of November 25, 2025, Berachain's TVL has dropped to approximately $270 million, only 8.1% of this year's historical peak of $3.3 billion in May, a decline of over 90%. In terms of TVL contribution, the liquid staking protocol Infrared Finance dominates the ecosystem, with a TVL of about $230 million, accounting for 86.5% of the total, while the TVL of other protocols mostly remains in the tens of millions or even lower. This indicates that Berachain's ecosystem is singular and lacks diversified product support.

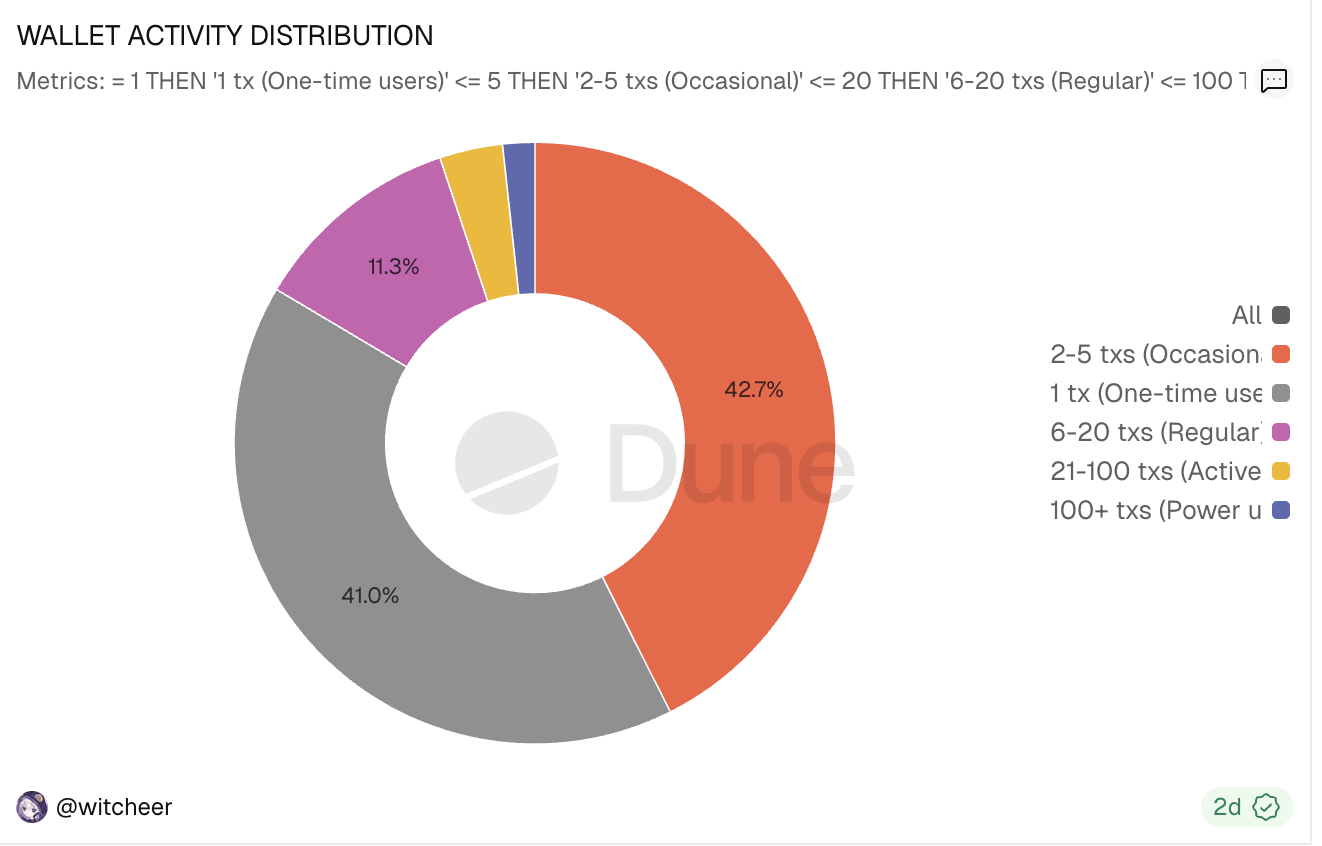

At the same time, Berachain's user activity has also seen a significant decline since its launch, lacking sustained trading momentum. Dune data shows that as of November 23, Berachain had approximately 3.24 million unique wallet addresses, with daily active wallet addresses maintaining in the tens of thousands, having experienced a notable decline but recently showing signs of recovery. From the distribution of transaction counts, addresses with fewer than 5 transactions account for as much as 83.7%, while those with over 100 transactions only account for 1.6%, indicating that most users are low-frequency participants. Additionally, its cumulative transaction count has approached nearly 289 million, with transaction volume peaking at about 2 million transactions per day at the launch in February, but gradually fluctuating downwards, especially dropping to around 200,000 transactions in September, with recent signs of recovery.

From a revenue perspective, DeFiLlama data shows that since September this year, Berachain's cumulative revenue has only been about $37,000, with revenue of just $987 in the past 24 hours, indicating limited value capture capability. Meanwhile, Artemis data shows that Berachain is among the top ten chains with the highest capital outflows in the past six months, with total outflows of approximately $1.8 billion.

The price of the BERA token has also been on a continuous decline. CoinGecko data shows that the BERA price has dropped 93% from its historical high and has fallen 44.7% in the past 30 days. Notably, Smokey stated in an interview that if he could do it all over again and the team could start from scratch, they might not sell so many tokens to venture capital firms. In fact, most of the supply was sold during the seed round in early 2022. At that time, the team thought it might be an interesting thing, but they did not expect it to develop to such a large scale now. Therefore, he personally believes that the market criticism is justified. In fact, over time, Berachain has been working to buy back those seed round and subsequent A round tokens, striving to reduce the dilution pressure on the community.

To boost market confidence, Berachain has also taken recent actions. For example, Berachain has partnered with Infrared, TermMax, and others to introduce fixed-rate lending; Berachain has integrated StableFlow to upgrade its ecological payment capabilities, etc. In October of this year, the US-listed company Greenlane Holdings announced a $110 million PIPE (private investment in public equity) financing to launch the B ERA treasury strategy, which includes about $50 million in cash and approximately $60 million worth of BERA tokens, with investors including Polychain, Blockchain.com, Kraken, North Rock Digital, CitizenX, and others. Although this financing itself is substantial, the stock price did not show significant increases, which is certainly related to the overall cooling of the DAT sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。