Last weekend, the price of Bitcoin briefly approached $91,000, and the total market capitalization of the entire cryptocurrency market temporarily surpassed Microsoft, reaching $3.2 trillion. Market sentiment was instantly ignited, and FOMO (Fear of Missing Out) spread. However, this was not an independent victory for the crypto world, but rather a profound confirmation of its external dependencies. This frenzy, orchestrated by expectations of interest rate cuts from the Federal Reserve, along with the liquidation data of over 120,000 traders, reveals a stark reality: as the fate of cryptocurrencies is increasingly influenced by the tides of macroeconomics, their idealistic narrative of "decentralization" is being ruthlessly rewritten by the reality of global liquidity.

A "Slaughter" Driven by Expectations

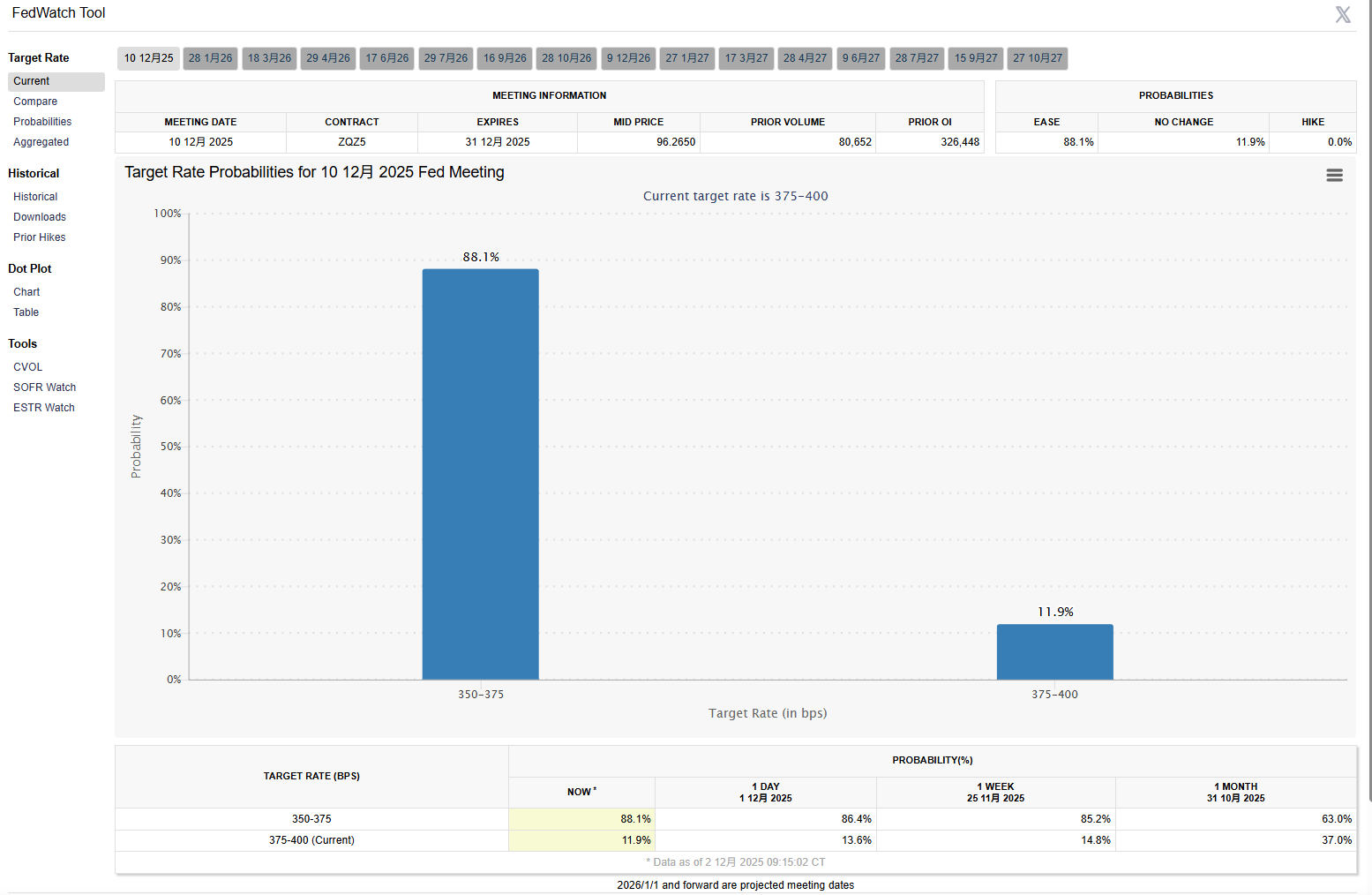

The trigger for this event did not come from technological breakthroughs or applications within the crypto industry, but from a piece of news from the traditional financial world: the probability of the Federal Reserve cutting interest rates in September suddenly soared. This signal acted like a command, instantly activating dormant capital. The price of Bitcoin surged from around $80,000 to briefly touch the $91,000 mark. However, the steep rise in the candlestick chart came at the cost of over 120,000 accounts being forcibly liquidated. Short sellers were precisely hunted down, while leveraged long positions that chased the price were left teetering in the subsequent volatility. This was not a win-win feast, but a brutal hunt driven by macro expectations, with high-leverage traders as the sacrificial lambs. The core conflict emerged: the price discovery mechanism in the crypto market is shifting from an endogenous logic based on project fundamentals and on-chain data to external speculation based on central bank monetary policy expectations. Bitcoin is no longer merely "digital gold"; it resembles a highly sensitive macroeconomic sensor, or a high-beta risk asset.

Players at the Table: Who is Manipulating This Game?

In this game dominated by liquidity expectations, the motives and interests of different roles are clearly visible.

The Federal Reserve: The Invisible Hand of God. Although the Federal Reserve has never directly commented on cryptocurrencies, every movement in its interest rate toolbox becomes the core driving force of the market. Expectations of interest rate cuts mean lower funding costs and the release of liquidity, causing capital to naturally flow into the highest-risk, most elastic asset classes, with the crypto market at the forefront. Every hawkish or dovish statement from Federal Reserve officials invisibly sets the boundaries for price fluctuations in this "decentralized" market.

Political Agents: Weaponizing Cryptocurrencies. Against the backdrop of the 2024 U.S. presidential election, the status of cryptocurrencies has become delicate. Members of the Trump family have publicly stated that "interest rate cuts will inject new vitality into cryptocurrencies," which is not only a call to the market but also a political stance. This move attempts to bind the prosperity of the crypto market to a specific political agenda, vying for the votes of tens of millions of crypto users. The rise and fall of cryptocurrencies are gradually becoming props for politicians to showcase their economic influence.

Institutional "Smart Money": The Weavers and Reapers of Narrative. Institutional investors, represented by figures like Michael Saylor, have long positioned Bitcoin as a macro hedge tool. They continuously reinforce the narrative that "Bitcoin counters currency devaluation" and accumulate during market downturns. When signals of a shift in Federal Reserve policy emerge, they are the biggest beneficiaries. They not only enjoy the dividends of rising asset prices, but their investment logic is also "validated" by the market, attracting more mainstream capital to enter. They are the narrative builders and ultimate profit harvesters in this game.

Retail Leveraged Traders: Fuel and Cost. The liquidation data of over 120,000 individuals is the most authentic footnote to this frenzy. Driven by FOMO, a large number of retail traders chase short-term profits through high-leverage contracts. They constitute an important part of market liquidity and provide fuel for price volatility. However, in a game dominated by institutions and macro forces, they are information-lagged and financially fragile, ultimately becoming the targets of liquidation. Their liquidations provide liquidity for market reversals and create better entry points for "smart money."

Transmission Path: From Interest Rate Decisions to Market Frenzy

How are the Federal Reserve's policy expectations precisely transmitted to Bitcoin prices? The mechanism is far more complex than "printing money leads to price increases." First is the change in opportunity cost. When interest rates on fiat currencies decline, the opportunity cost of holding non-interest-bearing assets like Bitcoin also decreases, making holding Bitcoin more attractive. Second is the increase in risk appetite. Interest rate cuts are typically seen as a signal of economic weakness, but they also indicate that the central bank will support the market. This encourages capital to flow from low-yield safe-haven assets to high-risk, high-return areas, with cryptocurrencies at the end of this risk curve, thus reacting most violently. Finally, and most crucially, is the amplifying effect of leverage. Expectations of interest rate cuts generate a large number of leveraged long positions. When prices begin to rise, these positions trigger short sellers' stop-losses and liquidations, creating a "short squeeze" that further drives up prices. This self-reinforcing cycle driven by leverage is the fundamental reason why the crypto market can experience violent fluctuations in a short period. Each price movement is unrelated to the crypto technology itself but is an overreaction of financial leverage to macro signals.

The $3.2 Trillion Myth: Independence or Co-optation?

The total market capitalization of the crypto market surpassing Microsoft has been hailed by many as a "milestone" in the industry's move towards mainstream acceptance. However, the other side of this milestone may signify the end of the crypto world's "declaration of independence." When a market's size becomes sufficiently large, it can no longer exist independently of the global macroeconomic system but will passively become a part of it. The approval of Bitcoin ETFs has already opened a compliant entry for traditional financial capital. Now, the Federal Reserve's monetary policy has become the market's master valve. The crypto market is evolving from an alternative system built by geeks, cypherpunks, and early believers into a high-risk option on Wall Street's asset allocation table. Its former revolutionary narrative—against inflation, decentralization, and permissionless—seems pale in the face of price candlesticks closely following the Federal Reserve's interest rate decisions. When the market's joys and sorrows are entirely tied to the decisions of a centralized institution, the notion of "decentralized finance" becomes a paradox. This is not a victory for cryptocurrencies, but rather a co-optation of their success by the traditional financial system.

Industry Insights: When Cryptocurrencies Become the Canary in the Macroeconomic Coal Mine

This event provides clear insights for all participants in the crypto industry. In the future, the key variables determining the bull and bear cycles of the crypto market will increasingly come from the macro level. The importance of CPI data, non-farm payroll reports, and Federal Reserve meeting minutes may rival that of Bitcoin's halving cycles or Ethereum's technological upgrades. The narrative of Bitcoin as an "inflation hedge" is weakening, replaced by its positioning as a "global liquidity barometer." It is no longer a safe haven but the most sensitive sail in a storm. For investors, this means that macroeconomic analysis must be integrated into their core decision-making framework. The era of relying solely on on-chain data or technical analysis may be over; understanding the logic of global capital flows has become more important than ever. The crypto industry once attempted to establish a parallel financial universe, but it now seems more likely to become a high-volatility projection of the old world in the digital realm. In this new phase, firmly captured by macro forces, finding one's position is more challenging and more crucial than ever.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。