Lighter 标准账户得到的并非免费交易,而是更慢的交易。这种延迟被更快的参与者转化成了利润来源。

撰文:@PerpetualCow

编译:AididiaoJP,Foresight News

商场上有句真理:如果某个产品是免费的,那么你就是产品本身。

Lighter DEX 正在向散户交易者宣传「零手续费」。听起来美好得不像真的,事实也确实如此。

但 Lighter 没有用醒目的大字标出的是这些「免费」交易背后的延迟结构。

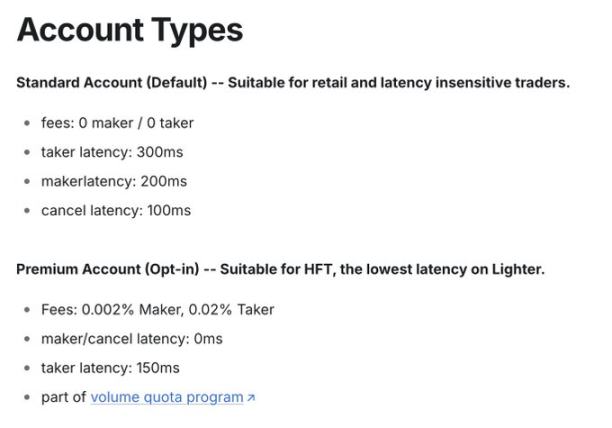

Lighter 提供两种账户类型:一旦你了解延迟的运作方式,就会发现 0% 手续费其实是平台上最贵的一档费用。

那 200–300 毫秒的延迟,正是他们商业模式的全部。

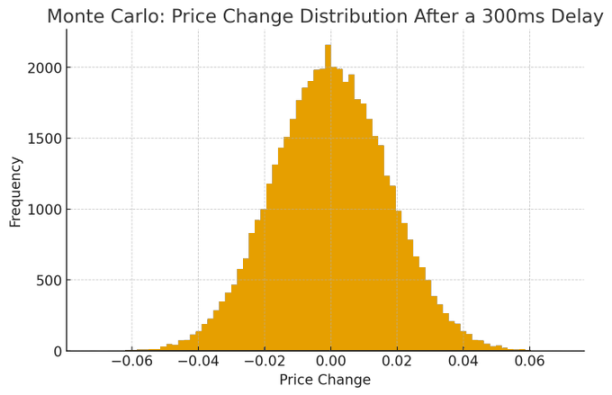

300 毫秒到底意味着什么?

人眨一次眼平均需要 100–150 毫秒。就在你眨两次眼的瞬间,更快的交易者已经捕捉到价格波动、调整仓位,并与你进行了反向交易。

加密市场波动剧烈,在典型的波动率水平(年化 50–80%)下,价格每秒大约变动 0.5 到 1 个基点。

也就是说,在 300 毫秒内,仅市场的随机波动就会导致价格平均移动 0.15–0.30 个基点。

「免费」的真正代价

如果我们把它量化:

关于逆向选择成本的学术研究(Glosten & Milgrom、Kyle『s Lambda 等)指出,知情交易者的优势通常是价格随机波动幅度的 2–5 倍。

如果 300 毫秒内的随机滑点约为 0.2 个基点,那么逆向选择还会额外增加 0.4–1.0 个基点。

对活跃交易者和做市商来说,实际成本大致如下:

- 标准账户实际成本:每笔交易 6–12 个基点(0.06%–0.12%)

- 高级账户实际成本:每笔交易 0.2–2 个基点(0.002%–0.02%)

「免费」账户的成本比付费账户高出 5–10 倍。

零手续费只是个营销数字,真正的成本隐藏在延迟里。

高级账户其实更划算,毫无疑问

在任何情况下,标准账户(0% 手续费)都不是更优的选择。

无论是对小散户、大户、剥头皮交易者、波段交易者,甚至是被动投资者,都不是。对做市商尤其不是,对任何人都不是。

「我只是个小散户,用不上高级架构。」

错了。

小散户更承受不起滑点。如果你用 1000 美元交易,每笔损失 10 个基点,就等于每次亏掉 1 美元。交易 50 次,你账户的 5% 就悄无声息地消失了。

「我交易不频繁,延迟对我没影响。」

也错了。

如果你交易不频繁,那高级账户的费用本来就微不足道。

但即使在寥寥几次交易中,你得到的成交价也依然更差。既然避免这种损失的成本几乎为零,为什么要接受任何不利呢?

直接升级到高级账户吧。

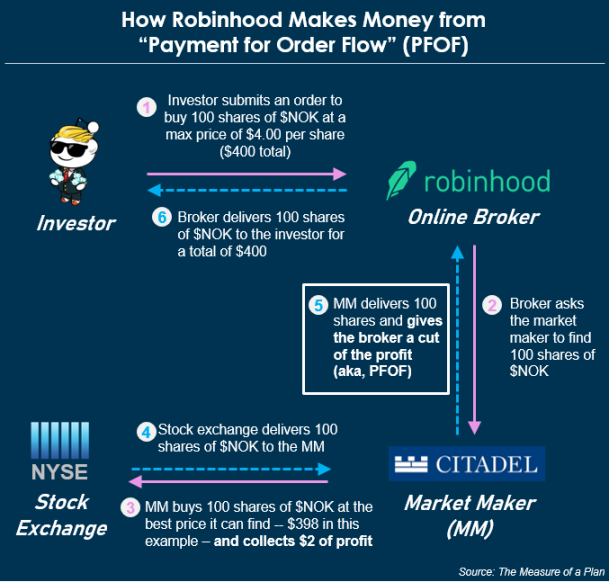

这种模式早有先例

传统金融市场早就见识过这种手法,叫做订单流付费。

@RobinhoodApp 曾以「免费交易」吸引散户,然后将订单路由给做市商,让他们通过与散户的非知情订单反向交易来获利,从而普及了这一模式。

Lighter 的模式在结构上与此相似。标准账户得到的并非免费交易,而是更慢的交易。这种延迟被更快的参与者转化成了利润。

交易所不需要向你收手续费,因为你其实是在用执行质量来付费。

Lighter 做得对和不对的地方

Lighter 并未隐瞒延迟数据,毕竟它写在文档里。

但透明不等于清晰。

在标题里突出「0% 手续费」,却把「300 毫秒延迟」藏在细则中,这是一种策略,它追求的是注册转化率,而不是用户的理解。

大多数散户并不理解延迟的含义,也不知道什么是逆向选择,自然无法算出等效的实际费用。

而 Lighter 清楚这一点。

高级账户在任何方面都比「零手续费」的标准账户更划算,这一点无需争论。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。