Bitcoin and Ether ETFs Extend Winning Streak with Strong Midweek Inflows

Wednesday, Dec. 10, brought an unmistakable sense of momentum to the crypto exchange-traded fund (ETF) market. Fresh capital poured in for a second straight day, lifting sentiment and reinforcing the view that institutional appetite is quietly rebuilding. It wasn’t a market boom yet, but it was a steady, confident stride forward.

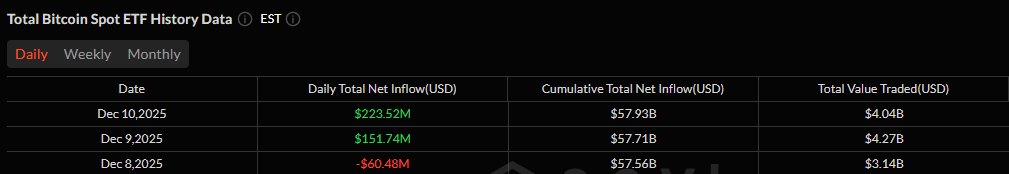

Bitcoin ETFs led the charge with $223.52 million in inflows, concentrated entirely in two funds. Blackrock’s IBIT dominated the day, absorbing $192.95 million, a clear reversal from earlier outflows this week. Fidelity’s FBTC supplied the remaining $30.58 million, giving BTC funds back-to-back strong sessions. With $4.04 billion traded, net assets held firm at $122.43 billion, signaling stability even as flows concentrated among just a few issuers.

Two days of consecutive inflows for BTC ETFs worth almost $400 million.

Ether ETFs followed suit, recording a third consecutive green day with $57.58 million in inflows. Blackrock’s ETHA once again carried the bulk with $56.45 million, supported by a smaller $7.91 million inflow into Grayscale’s Ether Mini Trust. Fidelity’s FETH saw a $6.78 million outflow, but that single departure was far too small to derail the positive trend. Total value traded reached $2.24 billion, and net assets held steady at $21.43 billion.

Solana ETFs added a modest but steady $4.85 million, driven by Bitwise’s BSOL with $3.68 million. Additional flows of $454K into Vaneck’s VSOL, $411K into Fidelity’s FSOL, and $303K into Grayscale’s GSOL rounded out the category. Activity remained healthy, with $26.46 million traded and net assets unchanged at $949.18 million.

Read more: All-Green Day: Bitcoin, Ether, Solana, XRP ETFs Rally with Strong Inflows

XRP ETFs closed the day with an additional $10.20 million in inflows, $7 million into Bitwise’s fund, and $3.20 million into Grayscale’s GXRP. Trading volumes reached $24.53 million, and assets held firm at $939.46 million.

Across all major sectors, Wednesday’s session delivered another steady push of inflows, marking growing investor confidence and the continuation of a broader midweek surge. Momentum held, capital moved, and the ETF market ended uniformly green once again.

FAQ📈

- What drove Wednesday’s ETF momentum?

Bitcoin and ether ETFs attracted steady institutional inflows for a second straight day. - Which ETFs led the inflows?

Blackrock’s IBIT dominated BTC flows, while ETHA led the ether category. - Did solana and XRP join the trend?

Yes, both SOL and XRP ETFs posted additional positive inflows. - What does this mean for market sentiment?

Consistent multi-day inflows signal quietly rebuilding investor confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。