Original | Odaily Planet Daily (@OdailyChina)

In the early hours of December 16, stablecoin giant Circle officially announced that it has completed the signing of an agreement to acquire the core talent and technology of the initial development team of the cross-chain protocol Axelar Network, Interop Labs, to advance Circle's cross-chain infrastructure strategy and help Circle achieve seamless and scalable interoperability in its core products such as Arc and CCTP.

This is yet another typical case of industry giants merging with high-quality teams, seemingly a win-win situation. However, the crux of the issue lies in the fact that Circle explicitly mentioned in the acquisition announcement that this transaction only involves the Interop Labs team and its proprietary intellectual property, while Axelar Network, the Axelar Foundation, and the AXL token will continue to operate independently under community governance. The original project's other contributing team, Common Prefix, will take over the relevant activities of Interop Labs.

In summary, Circle has taken away the original development team of Axelar Network but has clearly discarded the Axelar Network project itself and its token AXL.

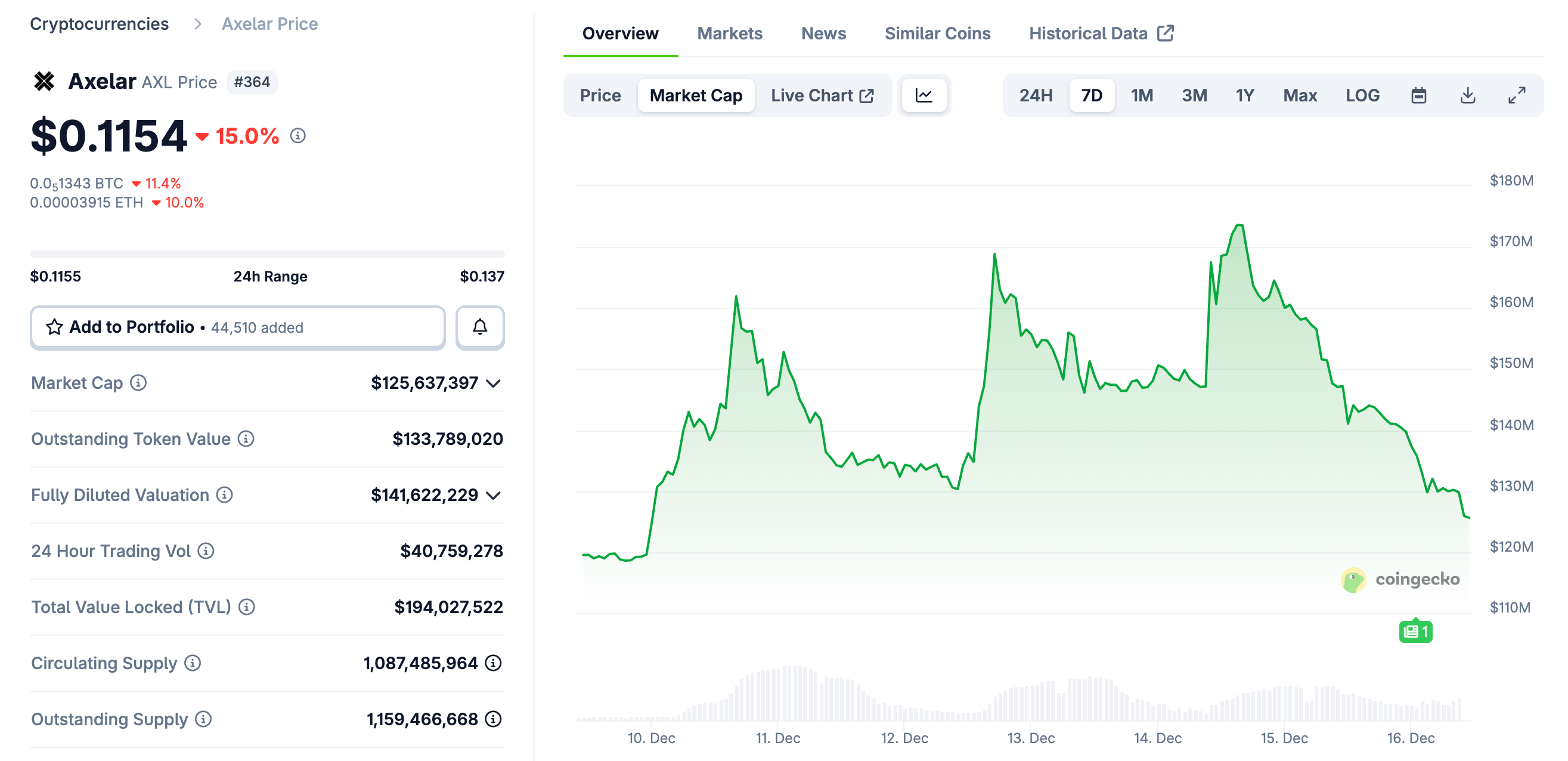

As a result of this sudden news, AXL plummeted sharply, trading at around $0.115 as of 10:00 AM today, a 15% drop in 24 hours.

At the same time, the unique situation of the acquisition case, which is "wanting people but not the token," has sparked much discussion within the community. Supporters of this acquisition model and opponents are arguing back and forth.

Opposing Viewpoint: A Deceptive RUG, Circle's Recklessness, Only Token Holders Are Hurt…

The backbone of the opposing side consists of some VCs, which is understandable — "I invested real money in the project's token rights, received the tokens, and now you take away the team that does the work. What use is this token to me?"

Simon Dedic, founder of Moonrock Capital, commented: “Another acquisition, another RUG. Circle acquires Axelar but explicitly excludes the foundation and the AXL token, this is simply criminal behavior. Even if it doesn't violate the law, it goes against ethics. If you are a founder looking to issue a token: treat it like equity, or just get lost.”

Mike Dudas, co-founder of The Block and founder of 6MV, commented: “For everyone who thinks this is a token vs equity issue, I can tell you clearly, this is entirely Circle causing trouble. There are rumors that Circle's VP of corporate development once told one of Axelar's co-founders, 'I don't care about your investors,' and without paying any consideration to the investors, 'bought' the CEO and IP right under their noses, and these IP and team are crucial for the launch of Arc.”

Lombard Finance founder posted the AXL trend and predicted: “The core team of Axelar has been bought by Circle, and AXL may now be worthless. The token has been issued for over three years, and the team's rights have long been realized. But this result feels very uncomfortable: the team and/or investors profit from selling tokens, while token holders can only hope for a distant dream.”

Zach Rynes, a prominent figure in the ChainLink community, stated: “This once again exposes the conflict of interest between tokens and equity that plagues the crypto industry. The development team behind the protocol has successfully been acquired, while the token holders who funded that team gain nothing. The so-called independent operation under community governance is no different from the development team abandoning users in pursuit of a better future. If we want to attract real capital, this is the primary issue the industry urgently needs to address.”

Nicholas Wenzel, head of the SOAR ecosystem, stated: “The Axelar token is heading towards zero, thanks to everyone’s participation. This is yet another acquisition where token holders gain nothing, while equity holders profit significantly.”

Supporting Viewpoint: Normal Market Behavior, Tokens Are Already at the Bottom of the Capital Structure

While the opposing side focuses more on the unfair treatment of token holders, the supporting side emphasizes the market rules of financing and mergers.

Jeff Dorman, Chief Investment Officer of Arca, believes Circle's actions are justified and elaborated on the capital structure of corporate financing and the inherent disadvantage of tokens.

Companies finance through different levels of capital structure, and these levels have a clear priority order, with some levels naturally ahead of others — secured debt > unsecured senior debt > subordinated debt > preferred stock > common stock > tokens.

There are countless historical cases showing that the interests of one type of investor are realized at the expense of another type of investor.

- In bankruptcy liquidation, creditors win at the expense of equity investors;

- In leveraged buyouts (LBO), equity holders often profit at the expense of creditors;

- In low-price acquisitions (take-under), creditors usually have priority over equity holders;

- In strategic acquisitions, both creditors and equity holders can benefit (but not always);

- And tokens often sit at the very bottom of the capital structure…

This does not mean that tokens have no value, nor does it mean that tokens necessarily need some sort of "protection mechanism," but the market needs to recognize a reality: when a company acquires another company of low value, and the tokens issued by that company are also nearly worthless, token holders will not magically receive a "dividend." In such cases, the returns on equity are often realized at the expense of tokens.

Avichal Garg, co-founder of Electric Capital, also commented: “This is normal. If all future value is created by the team, no company will be willing to pay returns to investors.”

Core Conflict: What Exactly Are Tokens?

Surrounding the acquisition controversy between Axelar and Circle, both sides of the debate seem to have their points.

The anger of the opposition is real: Token holders took on risks when the project was at its most difficult and needed liquidity and narrative support, only to be completely excluded at the critical moment of value realization. As a result, the core team and intellectual property have realized their value, while the tokens have been left in the vacuum narrative of "community governance." The market has given the most direct vote with prices, which indeed frustrates all who believe in the value of tokens.

The judgment of the supporters is also reasonably grounded in reality: From a strictly capital structure perspective, tokens are neither debt nor equity, and naturally do not have priority in the context of mergers and liquidations. Circle has not violated existing business rules; it has simply chosen the assets most valuable to itself.

The real core of the conflict does not lie in whether Circle is ethical, but in a long-avoided question in the industry: What exactly are tokens in the legal and economic structure?

When the prospects are bright, tokens are implicitly regarded as "quasi-equity," endowed with the imagination of claiming a share of future success; but in real scenarios such as mergers, bankruptcies, and liquidations, they are quickly reverted to their original form as "rights-less certificates." This narrative of equity-like treatment and structural positioning at the bottom is the root cause of the recurring conflicts.

The Axelar acquisition case may not be the last of its kind, but hopefully, it can serve as an opportunity for the industry to further reflect on the positioning and significance of tokens — tokens do not inherently possess rights; only institutionalized and structured rights will be recognized at critical moments, and the specific forms of realization still need all practitioners to explore and practice together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。