Master Discusses Hot Topics:

Today, I’ll make a blind guess first; surely a bunch of KOLs will jump out and repeat: Japan's interest rate hike and CPI have already been digested by the market, and the bad news turning into good news. When you hear this, you should be alert because it often means the next step is to start harvesting.

Let’s talk about Japan's interest rate hike at noon; this time it’s a real hike. Moreover, it was passed unanimously with a 9:0 vote, a one-sided decision. The Bank of Japan has already stated clearly: as long as the economy and prices follow the forecast, there will be further hikes.

Previously, the market was expecting a terminal rate of 1.25%, but inflation is still rising. The actual borrowing rates remain relatively low, which means this rope hasn’t been tightened yet. The official stance and expectations are basically aligned, but consensus doesn’t mean it lacks lethality; it just means the knife will cut slowly.

Now looking at the U.S. data, the unemployment rate is 4.6%, higher than expected. CPI is 2.7%, lower than expected. These two indicators together indeed form a rate-cut friendly combination, which is what the Federal Reserve cares about the most.

That's right, the probability of a rate cut in January is increasing, and the number of cuts throughout the year may also rise; some have even started to benchmark against the second half of 2019. But it’s important to clarify one thing: macro is a mid-term logic. The market is a short-term washout; don’t use a story from six months later to catch the current knife.

The recent price movements have already explained everything. There was a violent surge before the U.S. market opened, giving you the illusion that this time is different. When U.S. stocks rise, retail investors immediately get excited. What happened? Within one to three hours after the market opened, it flipped and crashed, even hitting new lows.

Whatever goes up is brought down in equal measure, with precision as if it were quantitative trading. This kind of movement is blatant market control; using conventional defenses to trade long and short is basically giving money away. Only those who short at highs and hold on through gritted teeth can survive in such a market.

The rhythm of U.S. stocks is also repeatedly proving itself: up before the market, down during the market; down before the market, then a rebound during the market. It sounds like a joke, but it has happened consecutively.

Now that Japan's interest rate hike has landed, and with a liquidity vacuum before Christmas, lack of confidence is a consensus. Any rebound today is essentially an opportunity to reduce beta and exit; selling pressure will only pile up later.

Back to the market, Bitcoin yesterday could still touch the key resistance at the 4-hour level. Today, it dropped without even touching it; the bulls are almost out of breath.

Don’t rush to bottom fish; things like Japan's interest rate hike never give you a quick resolution on the same day; the aftereffects build up slowly. Today might not deliver a big blow, but the following days of gradual decline will wear you down even more.

Now is not the time for a trend to start; it’s a test of the bottom. The early morning surge created FOMO, technical analysts confirmed, emotional traders jumped in, and in the end, they were slapped back to reality by tax selling and liquidity vacuum. This is not a failed rebound; it’s a rebound that was doomed to fail from the start.

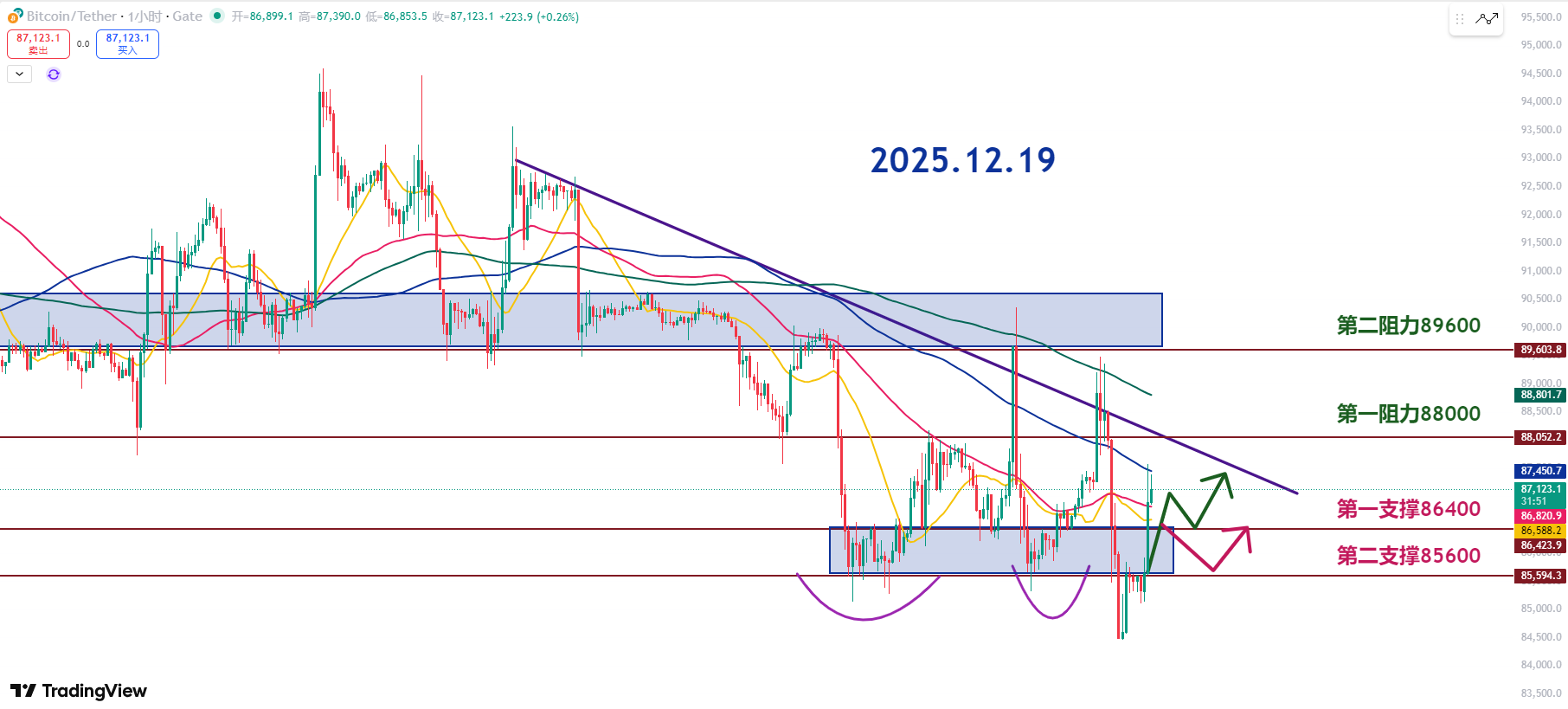

At the 4-hour level, it’s still oscillating downwards; the highs are lower, and the lows are also lower. The 87K line is the battleground for bulls and bears. If it can’t break 90K, it remains weak.

Support has been trampled repeatedly and is starting to weaken. If 83.7K is lost, it will directly drop to the daily range. Recently, every time you think it’s about to break through, the market will turn around and slap you hard in the face.

Ethereum has only risen in those three months this year; the rest of the time it has been beaten down. Holding onto so-called bull market assets, you haven’t made a penny in over four years; if you were an institution, would you continue to stubbornly hold on? Without liquidity, next year will be even harder! Short-term support can refer to 2405 and 2225, with resistance at 3170 and 3400.

Master Looks at Trends:

The current price of Bitcoin is around 867K, which is essentially a technical rebound. With Japan's interest rate hike confirmed, short-term uncertainties have disappeared. The market has taken a breath, but don’t rush to see this as a trend reversal; at most, it’s a dead cat bounce.

From a structural perspective, the range from 85.6K to 86.4K is a double bottom, so this is the lifeline for short-term bulls and bears. Although it was briefly broken during the day, it quickly bounced back, indicating that there is indeed capital buying at this level. But just because someone is buying doesn’t mean it will go up; it just means they don’t want it to break down now.

After a big bullish candle appears, the worst thing to do is to chase it blindly. History has repeatedly told you that every time after such a bullish candle, there will be a pullback to test sentiment. If there’s a pullback next, the range of 85.6K to 86.4K cannot be effectively broken down; otherwise, the newly formed rebound structure will be invalidated.

The upper resistance is very clear; the 120MA and 200MA are lined up as short-term hard resistance. It’s not something that can just be passed; the RSI is at 58, which is not low at all, and further adjustments are completely reasonable.

The first support below remains at 86.4K, and the second support hasn’t changed. This range is the core area for short-term speculation, where you can calculate the risk-reward ratio and must recognize stop-loss levels.

As long as it’s not a large volume long bearish candle that directly breaks down, short-term, it’s still possible to consider trying to go long in batches; if it decisively breaks down, don’t stubbornly hold on.

Today’s first and second resistance levels remain unchanged; before the market reaches 88K, it must first face the pressure from the 120MA. If there’s no accompanying trading volume, touching 88K will likely still be pushed back down. Only a breakout with volume can talk about a pullback confirmation; otherwise, everything is a false breakout.

The current state is very clear; the downtrend line hasn’t been truly broken yet; it’s just trying to turn. Whether it can succeed, the only standard is volume; without volume, all breakouts are just tricks to lure you into taking the bait.

Combining the recent market movements and the analysis above, you should have noticed that the big bullish candle goes up and then immediately retraces; this script has been repeatedly played out. So before the trend truly reverses, don’t think about catching the bottom; being steady is better than anything else.

12.19 Master’s Band Trading Setup:

Long Entry Reference: Buy in the range of 85600-86400, Target: 88000

Short Entry Reference: Sell in the range of 87800-88400, Target: 86400-85600

If you genuinely want to learn something from a blogger, you need to keep following them, rather than making rash conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "always catch the top and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

The content of this article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you want to know more about real-time investment strategies, liquidation, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can add Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official public account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。