Original Author: Matt

Original Translation: Chopper, Foresight News

Today, even cryptocurrency applications are gradually becoming standardized infrastructure, serving Web2 and traditional financial institutions with user-friendly front-end interfaces.

With each round of the cryptocurrency cycle, a new theory about "how value accumulates in the crypto ecosystem" emerges, and these theories are reasonable at the time.

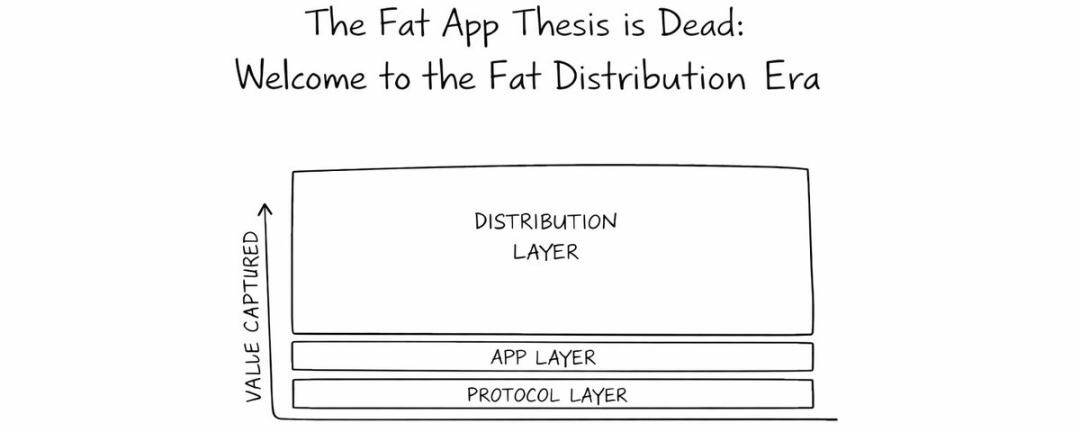

- In 2016, Joel Monegro proposed the "Fat Protocol Theory" which states that value aggregates towards underlying public chains like Ethereum through shared data, tokens, and network effects.

- In 2022, Westie proposed the "Fat Application Theory" which suggests that as layer two networks significantly reduce transaction costs, applications like Uniswap, Aave, and OpenSea earn fees that even exceed those of the public chains they belong to by building liquidity and user experience barriers.

As of today in 2025, the industry has officially entered a new phase: cryptocurrency applications themselves have become interchangeable standardized products.

The reason for this shift is simple: the crypto industry has invested excessive resources in infrastructure and technology optimization. We have been obsessively researching complex automated market maker (AMM) algorithms, innovative clearing mechanisms, customized consensus protocols, and zero-knowledge proof cost optimizations, but we have now fallen into diminishing marginal returns. The technical improvements in applications are no longer perceptible to end users.

Users do not care about a 1 basis point reduction in oracle data costs, a 10 basis point increase in lending rates, or improved pricing accuracy of decentralized exchange liquidity pools; what they truly care about is using the familiar and trusted interface they already know.

This trend is becoming increasingly evident: applications like Polymarket, Kalshi, Hyperliquid, Aave, Morpho, and Fluid are investing more time and resources into B-end collaborations. They are no longer struggling to attract new users to adapt to cumbersome on-chain operations but are transforming into backend services, embedding themselves into other product ecosystems.

Convincing 25 million new users to download a browser extension, manage private keys, prepare gas fees, transfer assets across chains, and adapt to complex on-chain processes; or getting platforms like Robinhood to add a "yield" feature that directly channels user deposits into your lending market. Clearly, the latter is much easier to achieve.

Integration and collaboration will ultimately prevail, distribution channels will win out, and front-end interfaces will dominate; while crypto applications will merely become simple traffic pipelines.

The case of Coinbase perfectly illustrates this point: users can use their Bitcoin (cbBTC) on the platform as collateral to borrow USDC, and this transaction flow is directed to the Morpho lending market on the Base chain. Although Aave and Fluid on the Base chain offer significantly better rates for borrowing stablecoins against cbBTC collateral, Morpho still holds market dominance. The reason is simple: Coinbase users are willing to pay an extra cost for "visible convenience."

However, not all applications will become invisible infrastructure. Some applications will still adhere to the B2C (business-to-consumer) track and will not make B2B2C (business-to-business-to-consumer) their primary profit model. But they must undergo a complete transformation: adjusting core priorities, restructuring profit logic, building new competitive barriers, optimizing marketing strategies and development strategies, while reinterpreting the core path for users entering the crypto space.

This does not mean that infrastructure-type applications can no longer create value; rather, it indicates that those who truly control user traffic on front-end platforms will capture a larger share of value.

In the future, competitive barriers will no longer be built around liquidity or crypto-native user experiences, but will focus on distribution capabilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。