Written by: Eric, Foresight News

When the market environment is poor, it often magnifies and ultimately exposes existing problems within some favorable situations. Recently, Aave and ENS have revealed some internal issues, all of which point to the core of DAO.

After so many years, everyone has finally realized that although DAOs have decentralized, they have not escaped the management problems faced by centralized organizations.

What Happened?

I believe many have seen various analyses regarding the recent internal conflicts at Aave and ENS. For those who are not familiar, I will briefly recap the events.

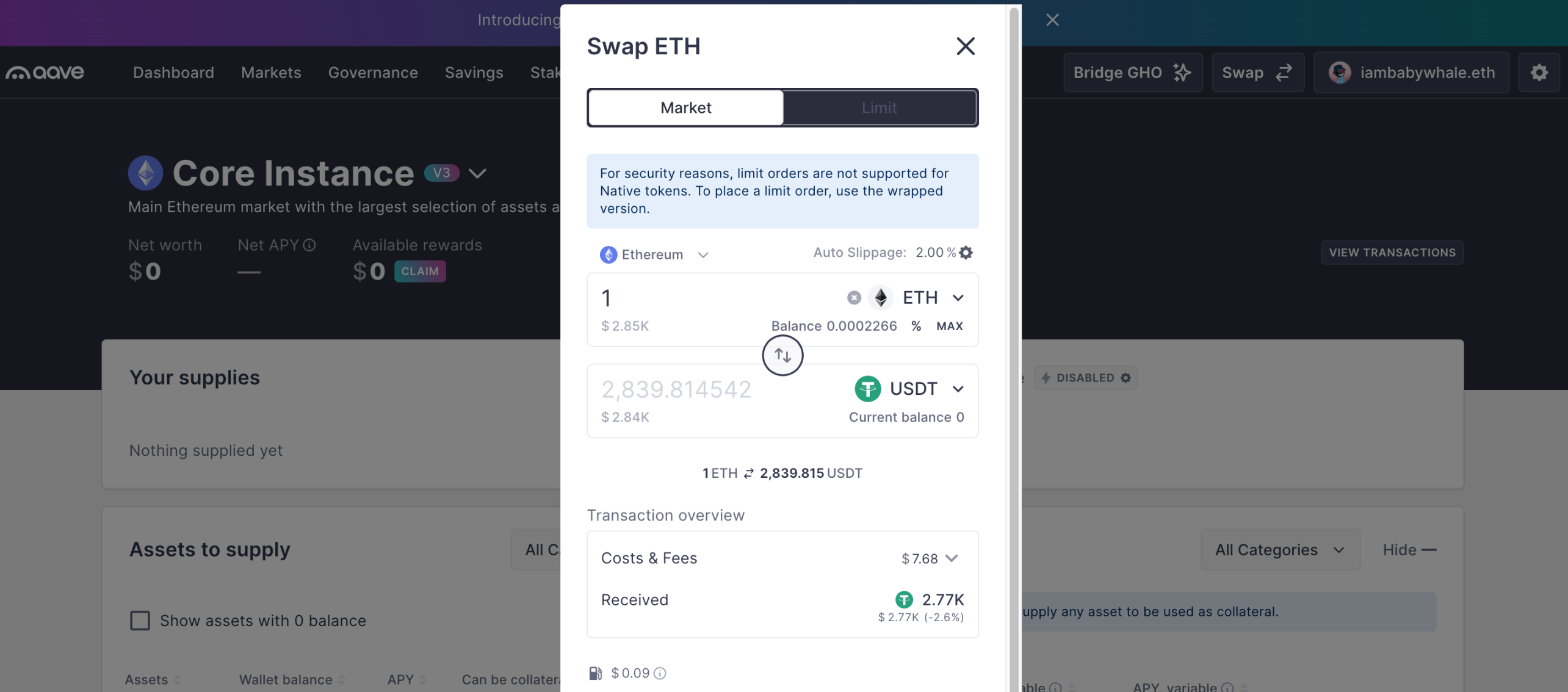

First, regarding Aave, the issue at hand is actually a conflict between Aave Labs and Aave DAO. Aave Labs previously replaced the front-end integrated ParaSwap with CoW Swap, and the resulting fees shifted from flowing to the DAO to addresses controlled by Aave Labs.

As a result, Aave DAO accused Aave Labs of privatizing the protocol's revenue. Aave Labs, on the other hand, argued that transaction fees belong to the front-end and product layer's revenue, unrelated to the Aave protocol, and that operating the front-end incurs costs, so taking the revenue is justifiable.

In Aave's structure, Aave DAO controls the protocol, such as contract upgrades and treasury management, and any proposals related to protocol-level development and upgrades must be voted on by the DAO before implementation. Aave Labs is considered the core development team of Aave and is also responsible for product, marketing, and other project development efforts.

In simple terms, Aave Labs developed the Aave protocol, and after issuing the token, transferred ownership of the protocol to the DAO. If Aave Labs needs funding for tasks such as development, operations, or marketing, it must apply for funding from the DAO, and if the DAO does not agree, Aave Labs cannot access the funds.

From Aave Labs' perspective, they believe the DAO has not "found its place." Without the efforts and strategic foresight of some members of the Aave Labs team, there might not be an Aave today. Implicitly, they suggest that the ability to vote with AAVE today is because they created Aave, so the DAO should not overestimate its importance.

From Aave DAO's perspective, Aave Labs may have had a god-like view in the early stages, but subsequent developments, including Lens and even the v4 version, have consumed a significant amount of treasury funds without corresponding returns. Some have pointed out that Aave Labs has repeatedly attempted to use the DAO to achieve its own goals but was exposed.

Clearly, this is a dispute between the founding contributors and the existing management system, representing external conflicts for the DAO, while ENS faces internal conflicts.

Last month, ENS founder Nick Johnson wrote a poignant statement on the forum, suggesting that the ENS DAO is currently filled with political struggles, with capable individuals gradually leaving, and the leadership of the DAO falling into the hands of inexperienced individuals whose interests do not align with the protocol.

The impetus for this statement was likely a proposal submitted by ENS DAO secretary Limes, suggesting the termination of the operations of three working groups—meta-governance, ecosystem, and public goods—at the end of the sixth term, which is December 31 of this year. The reasons include that proposals have turned into a "you support me, I support you" game, with no one caring about what should actually be done; and the lack of entry standards has led to the phenomenon of "bad money driving out good." Limes believes that improving the process will not resolve this structural ailment, and shutting down is the only way out.

The Current DAO is a Regression

So far, the most successful DAO we can see is the Bitcoin community, and Ethereum might barely qualify as one. Why is it that most DAO governance is inefficient and fraught with problems? As someone who has always opposed purely democratic voting forms of DAO, I would like to offer some viewpoints for your consideration.

First, I believe the fundamental premise for establishing a DAO is actually a significant misjudgment.

The emergence of blockchain or cryptocurrencies was initially to resist centralization, based on the belief that when power is concentrated in the hands of a few, decision-making cannot be fair. Whether it is because decentralized governance is seen as a standard feature of Web3 projects or because centralization is believed to lead to opacity and corruption, it all points to one argument: "centralization" is the root cause of all problems.

From the results, the issues that arise in traditional organizational forms are equally prevalent in DAOs, often with greater destructive power. Therefore, if DAOs are introduced simply because centralization is seen as "backward," it reflects a failure to grasp the core of the problem.

As someone with a background in management studies, my greatest realization is that management science does not even have the concepts of centralization and decentralization; its core consists of four words: "planning, organizing, leading, controlling." I do not deny the value of decentralization, but the emergence of the term DAO, in my view, reflects ignorance of management science and a lack of respect for history.

Management science has developed to this day without ever suggesting that there is any inherent good or bad between centralization and decentralization; it merely studies how to be most effective. For a specific problem, if a centralized solution is better, then centralize; if decentralization is better, then decentralize. The evolution of organizational forms is essentially a process of natural selection, and the currently common organizational form, which is considered better in the Web3 industry, the DAO, may very well be an obsolete model. As for why it is "revived," it may simply be the wishful thinking of the OGs.

Management science is fundamentally an insight into human nature, and DAOs have not changed the greatest variable in management—people. Attempting to use a seemingly democratic decision-making method ultimately amplifies the darker sides of human nature.

In June of this year, Yuga Labs CEO Greg Solano proposed dissolving the ApeCoin DAO and transferring all assets and responsibilities to the newly created entity ApeCo. The CEO stated that the purpose of this move is to focus resources on ApeChain, Bored Ape Yacht Club, and Otherside. The proposal has been voted through, and I find this matter impressive because ApeCoin DAO often has some very outrageous proposals.

Readers interested can check Snapshot for themselves; proposals such as developing new games, launching an independent NFT marketplace, and developing meme tools—each of which seems thankless—have all been approved. Closing the DAO and consolidating power within the core team is a move that may spark controversy, but it is the best option in the current situation.

The disputes and dilemmas at Aave and ENS are also common in traditional companies, where veteran employees clash with new systems, and the internal focus on avoiding mistakes leads to a loss of innovation capability. Companies still have some filtering and elimination mechanisms, while DAOs, as open organizations, are almost certain to encounter the problem of "bad money driving out good," and there are no correction mechanisms to balance these issues. For capable individuals, they can easily earn a decent salary at a company or start their own business; why would they engage in potentially fruitless and unprofitable endeavors for countless unknown investors?

Currently, we can see that large projects with long survival times and high market recognition have not reached their current state due to DAO decisions; the vast majority are still directed by the core team or investors, with the DAO merely serving as a formality for voting.

It must be acknowledged that this is the only correct choice before a project matures. The capabilities and insights of the core team are superior to those of most simple token holders, and they understand all aspects of the project better. They may be the ones who know best what should be done in the early stages of the project. There are countless examples of pure democracy leading to absurd outcomes, such as many citizens only beginning to Google what "Brexit" meant after the UK left the EU, or Ukraine electing a comedian as president.

"The decision of a company should rest with one person" has become a consensus. It is not that a dictatorship will not lead to misjudgments, but that such a system can pivot quickly when mistakes occur. If every decision must be fully discussed and respect everyone's wishes, the likely outcome is endless disputes and decisions that can never be executed. The king of DeFi, AC, once mentioned in an article that someone had questioned some of his decisions and decided to execute them differently, only to realize in the end why AC made what seemed like unreasonable decisions from the start.

The second issue is that the positioning of DAOs within the ecosystem is very vague.

In my view, DAOs are a very distorted existence; they seem to possess only voting power, while the ownership of protocol code, brand, and technology does not belong to the DAO. Overall, as token holders, you and I can only participate in the protocol to a certain extent but do not own it.

The logic that tokens issued by public chains are ecological currencies is not problematic, but what about DApp tokens? Existing global regulatory frameworks only state that tokens are a new form of asset or are not classified as securities, but there has never been a clear definition of what kind of asset they should be.

This form of asset that possesses governance rights but not ownership becomes very delicate when problems arise. For example, if a DAO-approved expenditure ultimately encounters issues such as corruption or unclear fund allocation, who should be held accountable? For token holders, should they hold the voting token holders accountable, the executors, or the protocol developers? It seems that everyone on this line bears some responsibility, but specific accountability appears to lack a basis.

The current corporate system, with its designs of legal persons, shareholders, and executives, is partly to ensure that there are clear parties responsible when disputes arise. The DAO governance mechanism is very vague regarding accountability; in the aforementioned ENS incident, when some proposals in the DAO serve private interests or are merely mutual support, it is impossible to find any accountable party because every process conforms to governance procedures, and every voter may be considered an "accomplice."

I do not deny the DAO itself; I just believe that we clearly have a wealth of management science knowledge and countless past cases that could make decentralized governance more efficient and reasonable. However, the vast majority of projects seem to adopt a purely "absolute democracy" voting system to manage organizations with market values in the hundreds of millions, which disregards scientific principles and resembles a regression rather than progress.

Having said all this, if we are to discuss specific improvement plans, it may need to be "tailored to each DAO." In the case of Aave, it is necessary to find a way to balance the relationship between Aave Labs and the DAO, while in the case of ENS, the more important issue is how to streamline the DAO, retain talented individuals, and how to implement punitive policies balanced with incentives to keep the "right people."

Interestingly, I do not believe these clever founders are unaware of the problems with DAOs; perhaps they are just unwilling to accept that they can do what their predecessors could not. Ultimately, they must acknowledge that history has chosen the corporate system for a reason. But this is not necessarily a bad thing; for the Web3 industry, only by experiencing these mistakes can we learn what the right approach is.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。