Trading does not guarantee periodic victories; a poor decision can ruin an entire career in an instant.

Written by: thiccy

Translated by: Chopper, Foresight News

2025 is another year of extreme volatility, but many have suffered losses in trading.

This article is not for those who have been losing for a long time, but for those who were originally profitable and capable, yet have given back a significant amount of earnings this quarter.

One of the most painful things in life is watching months or even years of effort go to waste in an instant.

In Greek mythology, Sisyphus was punished by the gods to an eternal punishment: he must constantly push a boulder up a hill, and whenever he reaches the top, the boulder rolls back down, forcing him to start all over again. The cruelty of this punishment is unique, striking at the core of human experience.

Trading is similar. Unlike most professions, trading does not guarantee periodic victories; a poor decision can ruin an entire career in an instant. This characteristic has pushed many into the abyss.

When the "boulder" rolls down, people typically have two reactions.

One type of person increases their bets, trying to quickly recover their losses. They trade more aggressively, inadvertently falling into the trap of the "Martingale strategy": doubling down after a loss, hoping that one win will cover all losses. This method can sometimes work, and therein lies its deadly danger: it reinforces a habit that will ultimately lead to losses.

The other type of person becomes exhausted and completely exits the market. These individuals often have good financial conditions and a comfortable life, so risk no longer has asymmetry for them. They comfort themselves by claiming that the market has no profit potential or that they are no longer suited for trading. They choose to permanently exit the market, effectively ending their trading careers.

Both reactions are understandable, but they are too extreme and fail to address the essence of the problem. The real core issue is: there are flaws in your risk management system. Most people overestimate their risk management abilities.

Risk management itself is not an unsolvable problem; the mathematical logic behind it is already clear. The real difficulty lies not in "knowing what to do," but in "persistently executing even in the face of emotions, arrogance, pressure, and fatigue." Keeping actions aligned with intentions is one of the hardest things for humans to achieve. The market will always ruthlessly expose this cognitive bias that is disconnected from reality.

So, how do you get out of the predicament after a loss?

First, you must accept the fact that you are not unlucky and have not been treated unfairly. This loss was caused by flaws in your trading process and is unavoidable. If you do not accurately identify and fix this problem, history will repeat itself.

Second, you need to fully accept your current net worth and not anchor to past historical highs. The impulse to "make the money back" is one of the most dangerous obsessions in the market. Temporarily step away from the trading screen and be grateful for what you have already achieved. You are still alive and still in the market; that is enough. Your current goal is not to break even, but simply to make a profit.

View this loss as tuition paid to the market; it has exposed a fatal flaw. This lesson is one you will have to learn eventually, and fortunately, you learned it before the stakes got higher. If subsequent actions are taken correctly, looking back at this moment in the future, you will feel grateful. Character is forged in adversity.

Identify the specific reasons for the failure. For most people, losses are often caused by factors such as "over-leveraging," "not setting stop-losses," or "not executing after stop-losses are triggered." Establishing strict rules around risk and stop-losses can help avoid the vast majority of catastrophic losses.

Constantly remind yourself: the only way to prevent the boulder from rolling down again is to adhere to these rules. They are the only barrier between you and the pain and self-loathing you are currently experiencing. Without rules, you will have nothing.

Give yourself ample time to mourn the loss. Yelling, venting, or even breaking something can help release emotions rather than letting them build up inside.

Most importantly, transform the pain into action. Trauma must be converted into structured rules and processes; otherwise, it will repeat itself.

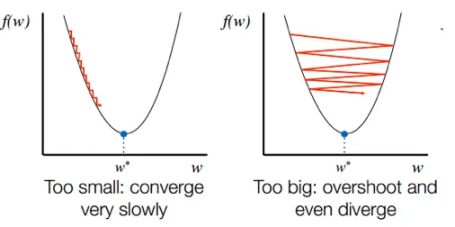

This cognitive approach to dealing with trauma applies not only to trading losses but also to all losses in life. The two common reactions mentioned earlier are too extreme because they often create more new problems while trying to solve one. If you cannot recover from losses in a nuanced and precise way, you will forever oscillate around the optimal solution, like a gradient descent algorithm with too large a step size, never converging to the correct result.

After Napoleon's defeat, he immediately set about rebuilding infrastructure to prepare for the next battle. A defeat is fatal because it destroys your ability to fight again. The primary task after a defeat is to ensure that the weak point is no longer exploited by the opponent and to quickly restore to optimal condition.

You do not need to seek redemption or revenge; you do not need to wallow in self-pity or burn with anger. You must operate like a precision machine: fix the flaws, rebuild the system, and ensure that this mistake never happens again. Every failure you endure will become a moat in your trading system, and this moat must be experienced by others to be learned.

It is such failures that shape a person. Be grateful for their arrival, for they come to teach you important lessons, not without meaning. Allow yourself to feel the pain, but more importantly, transform this suffering into motivation to ensure it never happens again.

These things are difficult because once you find the right direction, the compounding growth of wealth will become inevitable. Finally, I wish you good luck.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。