Under the combined influence of global macro uncertainty and the cryptocurrency technology cycle, the crypto market in 2025 experienced a profound shift from sentiment-driven dynamics to structural reshaping. The market gradually bid farewell to short-term speculative logic, turning towards a reassessment of security, liquidity, and long-term value. The core competitiveness of leading trading platforms also shifted from short-term traffic to security, liquidity, and long-term service capabilities. Recently, Huobi HTX officially released the "2026 Year Start Report," systematically reviewing its business performance, ecological development, and future strategies for 2025.

To read the full report, please visit: https://square.htx.com/zh/htx-2025-recap-2026-outlook-defining-the-next-growth-cycle-through-long-termism/

The report shows that in 2025, Huobi HTX achieved steady growth in key indicators such as user scale, trading volume, and compliance progress. By the end of the year, the platform's global cumulative registered user count exceeded 55 million, with 6 million new users added throughout the year; the annual cumulative trading volume reached approximately $3.3 trillion, a year-on-year increase of 39%, achieving a net inflow of $608 million. The platform maintained a record of zero security incidents throughout the year and was included in Forbes' list of "The Most Trusted Crypto Exchanges in 2025."

Steady Growth in Spot Trading, Intelligent Tools Become the New Engine

In a volatile market, Huobi HTX's spot business showed a stable growth trend. In 2025, the platform's cumulative spot trading volume exceeded 1.9 trillion USDT, a year-on-year increase of nearly 30%.

The report points out that intelligent trading tools are reshaping user trading methods. The trading volume of spot trading bots increased by 97% year-on-year, with the scale of capital accumulation doubling. Among them, the trading volume of stablecoin-related grid trading increased by 352%, while the trading volume of mainstream coin grid trading grew by 122%. By reducing operational frequency through automated strategies, spot trading bots have gradually become an important tool for users to cope with volatile markets.

New Asset Strategy Shifts to "Initial Value," Strengthening Forward-Looking Layout Capabilities

In terms of new asset listings, Huobi HTX launched a total of 166 new cryptocurrencies in 2025, with the overall strategy shifting from chasing short-term sentiment to making preemptive judgments on narrative sources and asset lifecycles.

The report shows that the platform has repeatedly achieved initial listing effects in tracks such as Meme, AI, and crypto financial infrastructure, including assets like TRUMP, PIPPIN, and M, which saw several-fold increases after their debut on Huobi HTX. At the same time, in the narratives of stablecoins and compliant finance, Huobi HTX was the first to list assets such as USD1, WLFI, and U, continuously strengthening its first-mover advantage in cutting-edge tracks. Through stricter screening mechanisms and a continuous listing rhythm, Huobi HTX is gradually building a differentiated advantage as a "first-value platform."

Contract Trading Scale Continues to Expand, Products and Liquidity Synchronized Optimization

In the derivatives sector, Huobi HTX's cumulative contract trading volume reached $1.4 trillion for the year, a year-on-year increase of approximately 50%, with trading volume showing a month-on-month growth trend; by introducing multiple top-tier market makers and optimizing trading structures, the depth and stability of core contract trading pairs like BTC and ETH have continuously improved. Over the year, more than 120 contract function optimizations were completed, covering high-frequency usage scenarios such as order logic, funding rate display, and risk control mechanisms.

On the product level, the contract grid was upgraded to version 2.0, with monthly active users exceeding 30,000; the copy trading system was upgraded to version 4.0, introducing intelligent copy trading and capital isolation mechanisms, further lowering the participation threshold for contract trading. Additionally, the joint margin model supports multi-asset collaboration, with related trading volume accounting for over 60% of the overall contracts, significantly improving capital utilization efficiency.

First C2C Selection Station, Leading Upgrades in OTC Trading Services

Huobi HTX's OTC trading business continued to expand in 2025, continuously playing the role of a platform-level financial infrastructure. Throughout the year, OTC trading served a cumulative 3.93 million users, facilitating a trading volume of approximately $360 billion, supporting 74 fiat currencies and over 600 payment methods, covering 231 countries and regions.

Among them, the C2C selection station, as one of the most iconic innovations of the year, led the upgrade of industry OTC trading services. This section maintains a record of zero freezes since its launch through a strict merchant admission mechanism, a full-process risk control system, and a "100% full compensation" guarantee mechanism, setting a new industry standard for safety and trading efficiency. Through a zero-fee policy and an intelligent matching system, Huobi's selection station has reshaped the trust mechanism of C2C trading while ensuring compliance and user experience, becoming an important model for upgrading industry service paradigms.

Multi-Level Capital Management and Brand Influence Resonance, Continuously Releasing Platform Ecological Vitality

Focusing on different risk preferences and capital usage scenarios, Huobi HTX continued to improve its matrix of capital management products such as coin earning, leverage, and margin exchange (formerly lending) in 2025, gradually building a multi-level capital solution covering stable appreciation and efficient trading. Data shows that Huobi's coin earning service served over 600,000 users throughout the year, covering over 300 digital assets; in terms of leverage and margin exchange, simultaneous optimizations were made in asset richness, capital utilization efficiency, and risk control capabilities, becoming an important support for the platform's professional trading ecosystem.

As the product system continues to mature, Huobi HTX enhances user participation and promotes trading activity through high-frequency, structured asset activities, forming a positive cycle. In 2025, the platform held over 300 asset-related activities centered around popular assets, core trading scenarios, and strategic gameplay, attracting over a million users to participate. Among them, activities like Launchpool and Peak Competitions not only enhanced liquidity and trading depth but also significantly increased user stickiness and community activity, becoming a link connecting assets, users, and the platform. With the continuous growth of business scale and ecological activity, Huobi HTX has achieved breakthroughs in industry influence and brand credibility. In 2025, Huobi HTX was strongly selected for Forbes' list of "The Most Trusted Crypto Exchanges in the World" and achieved a leap in global comprehensive rankings on multiple mainstream data platforms; global advisor Sun Yuchen graced the cover of Forbes and won multiple industry awards; its global investment department, HTX Ventures, also received several annual investment institution awards for its forward-looking layout in Web3 and primary markets. According to CoinDesk's research report, as of November, Huobi HTX's market share grew by 2.06% in 2025, ranking first among global mainstream centralized exchanges.

Through the synergistic resonance of capital management products, asset activities, and brand influence, Huobi HTX is building a comprehensive crypto asset platform that combines trading efficiency, user participation, and a long-term trust foundation, accumulating momentum for sustainable growth in future cycles.

Continuous Advancement in Security and Compliance, Solidifying Long-Term Trust Foundation

Security and compliance have always been the most important baseline capabilities for Huobi HTX. The report shows that Huobi HTX continued to strengthen its security and compliance capabilities in 2025. The platform publishes Merkle tree reserve proofs monthly, with the main asset reserve ratio consistently maintained above 100%. Among them, the reserve scale of USDT grew by approximately 150% throughout the year, significantly enhancing user asset accumulation and trust.

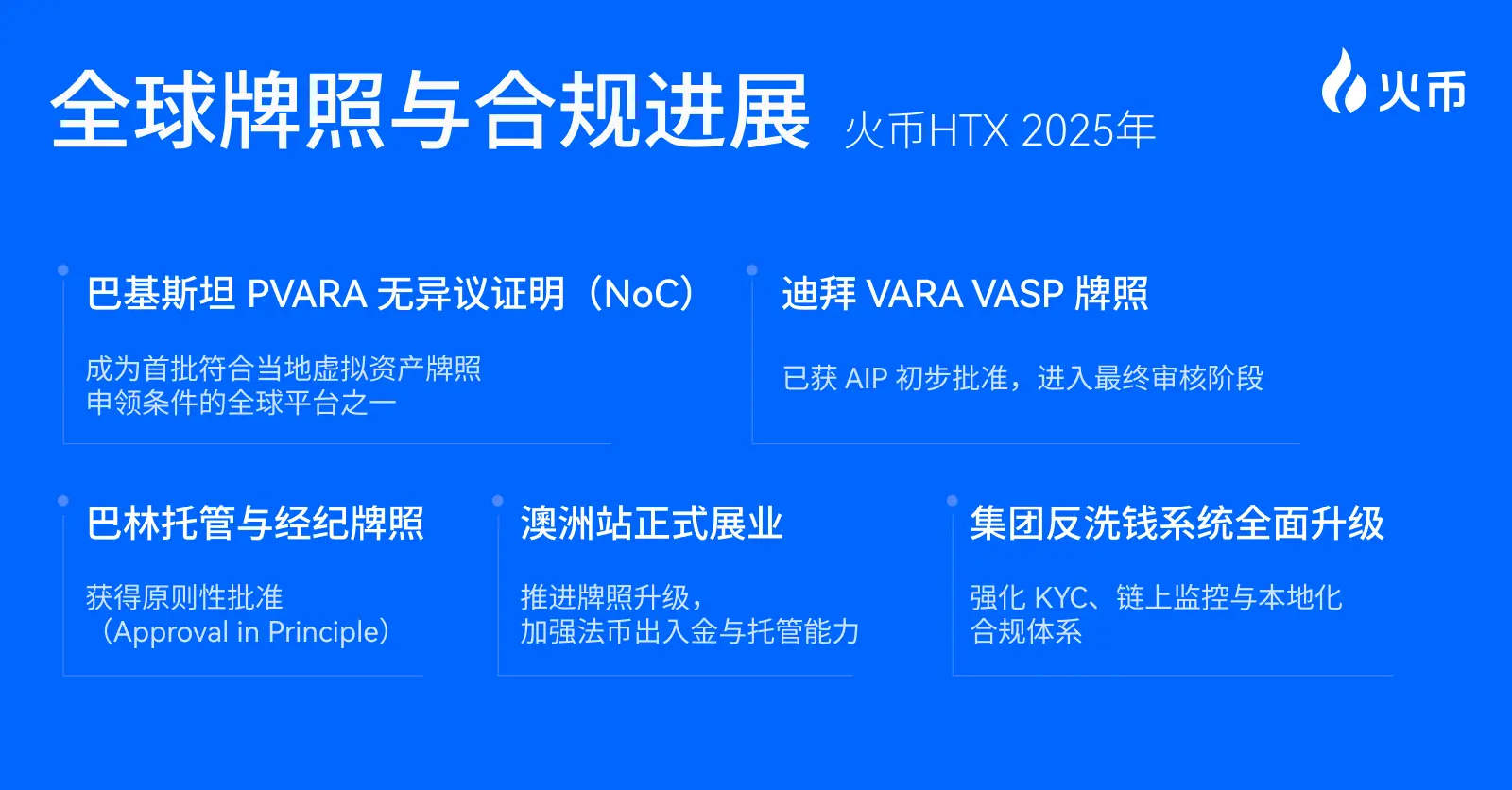

In terms of compliance, Huobi HTX steadily advances its multi-regional licensing layout, officially becoming one of the first two global digital asset platforms that meet the application conditions for virtual asset licenses in Pakistan, and is promoting licensing and regulatory cooperation in key markets such as the Middle East and Australia, continuously upgrading its anti-money laundering and anti-crypto crime system construction, strengthening the compliance foundation for global operations.

Outlook for 2026: Focusing on Core Trading Scenarios, Continuing to Evolve Steadily

Standing at the starting point of a new cycle, Huobi HTX stated in the report that in 2026, it will continue to deepen product specialization and user experience around the three core trading scenarios of spot, contracts, and C2C; while expanding capital management efficiency, strengthening security and compliance construction, and promoting long-term ecological prosperity through HTX DAO, research, and investment systems.

As emphasized by Huobi HTX in the report—true growth comes from respecting time. In the rapidly changing crypto world, Huobi HTX is moving towards the next stage belonging to long-termists at a more stable pace.

About Huobi HTX

Founded in 2013, Huobi HTX has developed over 12 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem, covering digital asset trading, financial derivatives, research, investment, incubation, and other businesses.

As a leading global Web3 portal, Huobi HTX adheres to a development strategy of global expansion, ecological prosperity, wealth effect, and security compliance, providing comprehensive, safe, and reliable value and services for virtual currency enthusiasts worldwide.

For more information about Huobi HTX, please visit https://www.htx.com/ or HTX Square, and follow X, Telegram, and Discord. For further inquiries, please contact glo-media@htx-inc.com.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。