Many users first encounter Web3 due to incentives, airdrops, or short-term hype. However, those who truly stay often do not do so for these reasons. As the market gradually cools down, more and more users begin to make a simple choice: to only use products that "do not need explanation."

By 2026, the Web3 consumer market has undergone a significant transformation. Users no longer care about the underlying chains or complex mechanisms but return to familiar criteria. Is the game fun? Is the social interaction sticky? Do digital assets naturally integrate into life? When products cannot exist independently of subsidies, users will quickly leave.

Under this filtering mechanism, a batch of applications has quietly completed differentiation. They no longer rely on market sentiment but establish a presence through continuous use. This article reviews the six Web3 consumer-grade applications with the most long-term retention capabilities before 2026, attempting to depict a Web3 consumer landscape that is closer to users' real choices.

TL;DR Quick Summary

- Retention beats hype. By 2026, the truly successful Web3 consumer-grade applications no longer rely on subsidies or hype but can bring users back repeatedly.

- The best products do not look like crypto. As blockchain gradually retreats behind the scenes, games, social interactions, and digital assets can integrate into user experiences more naturally.

- Games remain the primary entry point. Immutable and Ronin have demonstrated repeatable and sustainable user behavior at a real consumer scale.

- Social and NFTs enter a stable period. Farcaster, Magic Eden, and OpenSea maintain ongoing relevance by emphasizing usage habits and ease of use.

- Usage data outweighs narrative. This ranking is based on observable real activity rather than token prices or ideologies.

How We Evaluate Real Consumer Adoption

This ranking focuses on real consumer usage rather than project narratives or market volume.

Equally important are the metrics deliberately excluded from this list. Token price performance, short-term incentive programs, grand roadmaps lacking usage validation, and projects that are only infrastructural but lack consumer traction are not included in the evaluation.

By filtering out speculative noise, this evaluation framework highlights those products that primarily operate as consumer-grade platforms, with blockchain technology quietly playing a supporting role. The final presentation is a Web3 consumer leadership landscape based on real usage weight, rather than a reflection of market sentiment or short-term hype.

#1 Immutable

Conclusion: The only Web3 gaming platform that "operates like a publisher," rather than "like a blockchain."

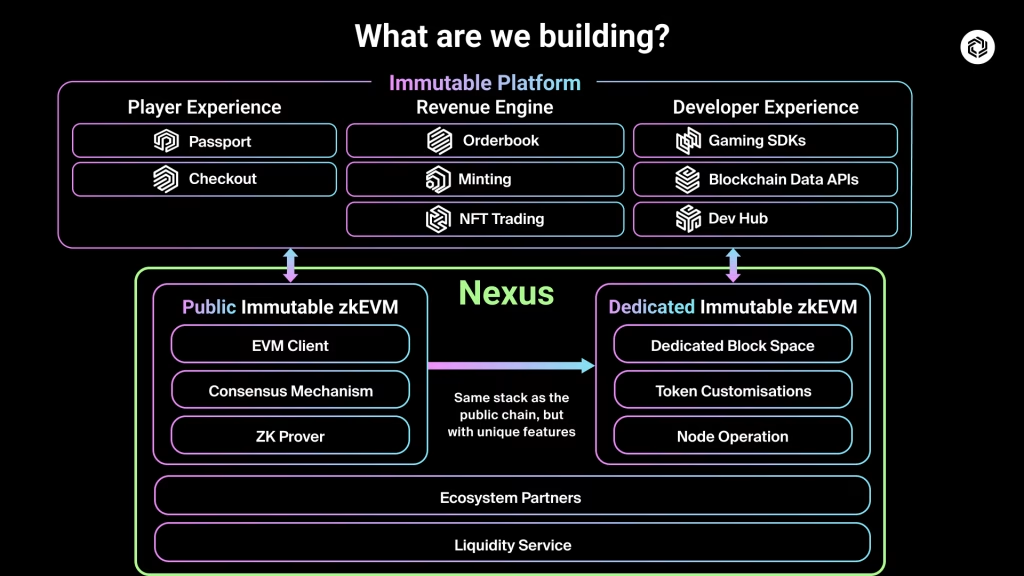

Immutable (IMX) ranks first because it has transcended the positioning of a single public chain and built a full-stack distribution layer for Web3 games. Its focus is not on showcasing the crypto infrastructure itself but on helping studios launch games that are familiar and easy to use for mainstream players.

Image source: Immutable Docs

Image source: Immutable Docs

Its core principle is very clear:

Players do not need to understand crypto to enjoy the game.

Immutable does not rely on incentives to drive usage but actively eliminates friction through product design, with key elements including:

- Wallet abstraction, significantly simplifying the onboarding process for new users

- A unified game and asset marketplace, balancing discovery and trading

- Studio-level development tools that support mature game production processes

From the player's perspective, the overall experience is gradually approaching traditional gaming forms, with digital asset ownership becoming a optional feature rather than a prerequisite for existence.

This strategy has shown strong resilience. Even as overall GameFi participation has declined, activity on Immutable zkEVM remains stable, reflecting sustained usage rather than short-term volume behavior. Meanwhile, mature games continue to migrate to its ecosystem, and market activity grows in sync with real gaming behavior.

Image source: @coingeener

Image source: @coingeener

Looking towards 2026, Immutable's core advantage lies in the high concentration of quality game studios and its consistent refusal to use "crypto" itself as a product selling point. Developers focus on selling games, players focus on playing games, and ownership is just one of the features, not the title.

Representative projects include:

Might and Magic: Fates

Legends of Illumia

The key factors that may affect its ranking in 2026 lie in execution: user retention performance beyond flagship games, the proportion of in-game consumption on-chain, and the ability to continuously attract traditional game studios will determine whether Immutable can maintain its leading position.

#2 Ronin

Conclusion: One of the few consumer-grade game chains that has fully gone through a round of mass market cycles.

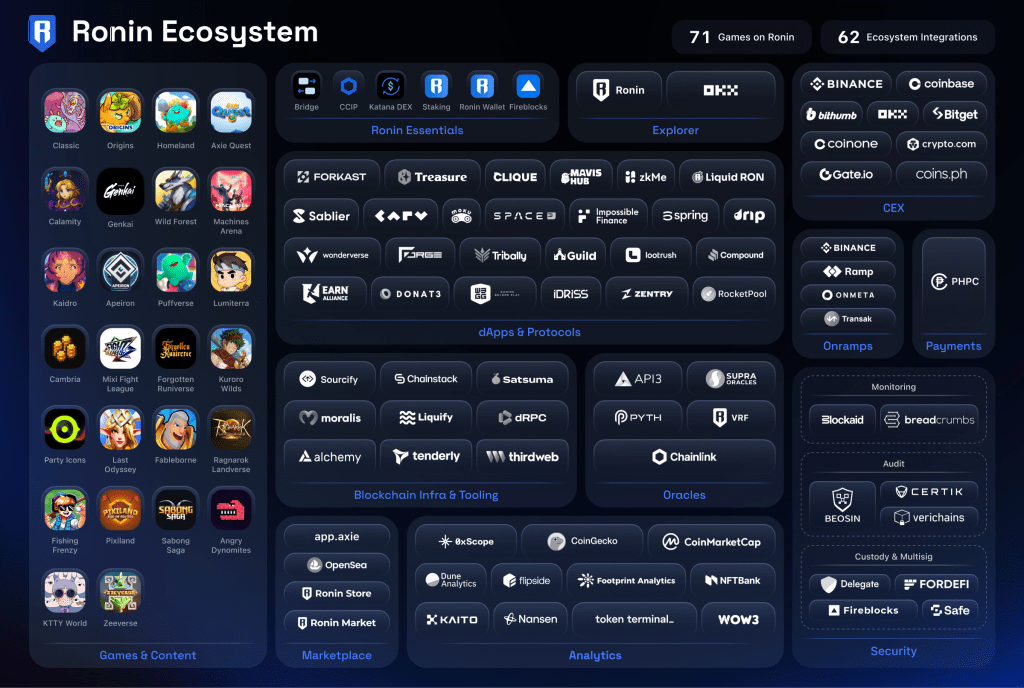

Ronin (RON) ranks second because it is one of the few blockchains that has validated repeat consumer-grade usage at scale, rather than relying on incentive-driven temporary attention.

Ronin was initially built around a single hit game but has since proven its ability to move beyond "single product dependency." Entering 2025, its number of active wallets is accelerating, driven not only by the retention of early users but also by the continuous introduction of new games into the ecosystem. More importantly, this growth has not been based on continuously increasing rewards.

Representative products include:

- Axie Infinity

Ronin's core design principle is clarity and focus.

It is primarily designed for players, not for crypto-native users.

This philosophy is reflected in multiple aspects:

- Simplified onboarding and wallet processes

- High-speed, low-cost transactions optimized for gaming experience

- Clear gaming network positioning, rather than a general-purpose public chain

For many users, especially in regions dominated by mobile, Ronin feels more like a gaming platform than a blockchain.

Image source: Roninchain Blog

Image source: Roninchain Blog

Ronin's relevance in 2026 comes from the facts that have already occurred, rather than future promises. It has gone through three phases: boom, contraction, and stability, which is a test that most consumer-grade blockchains have yet to complete.

The key factors that may affect its future ranking still lie in execution: whether it can continue to achieve ecosystem diversification, successfully attract more new game studios, and maintain differentiated advantages in the context of increasing competition in modular gaming technology stacks will determine whether Ronin can continue to exist as a long-term consumer-grade leader.

#3 Farcaster

Conclusion: The most durable example of a Web3 social product to date.

Image source: ThirdWeb

Image source: ThirdWeb

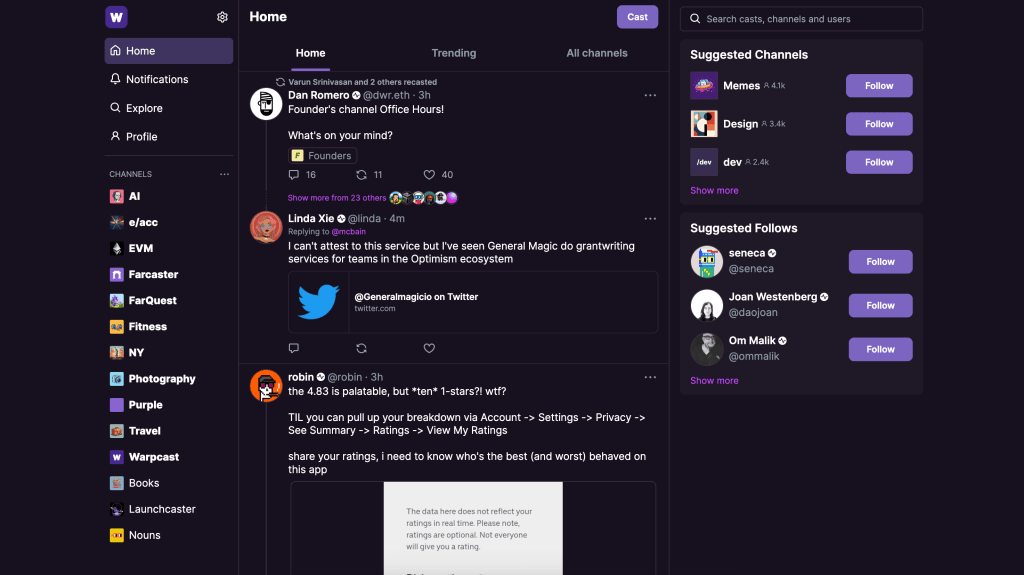

Social interaction has always been the most challenging track in Web3, and for this reason, Farcaster's continued existence is significant. Although overall activity has declined from its peak in 2024, Farcaster still maintains a reference-worthy level of daily engagement compared to other decentralized social platforms.

Farcaster's success comes from a rare restraint.

It views social interaction itself as a product, rather than a speculative tool.

Its core advantages mainly lie in:

- A social cognition model close to mainstream platforms, with low learning costs

- An active developer ecosystem that continuously experiments with new content and interaction forms

- Limited reliance on financial incentives, avoiding being dominated by short-term behavior

Unlike many projects eager to push monetization, Farcaster chooses to let usage habits and community culture grow naturally. This strategy has allowed it to retain a stable daily active user base even after the SocialFi narrative has receded.

Image source: Moralis

Image source: Moralis

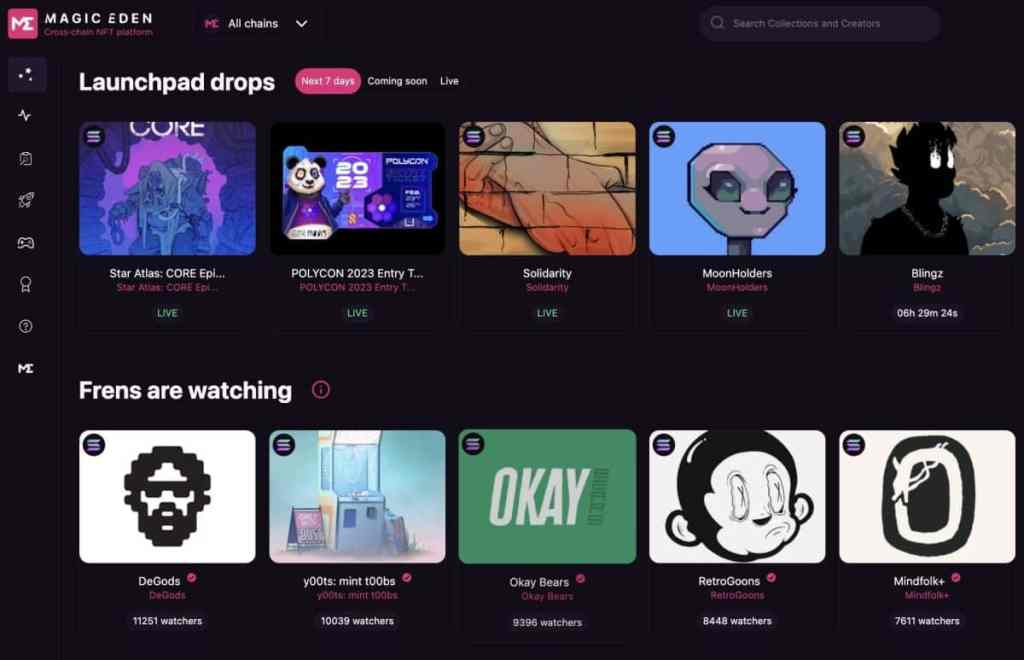

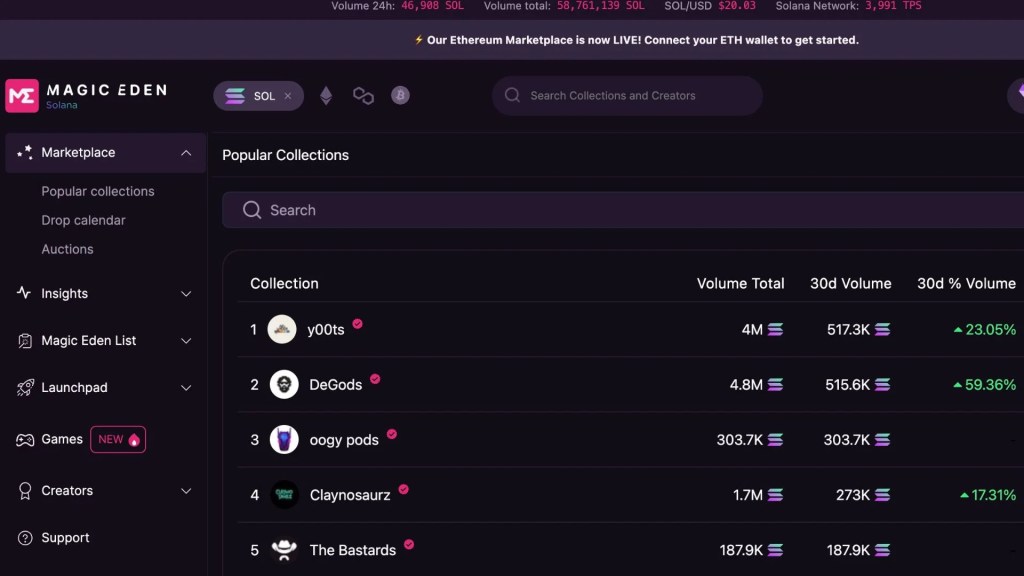

#4 Magic Eden

Conclusion: A consumer-grade NFT marketplace that follows users rather than chasing narratives.

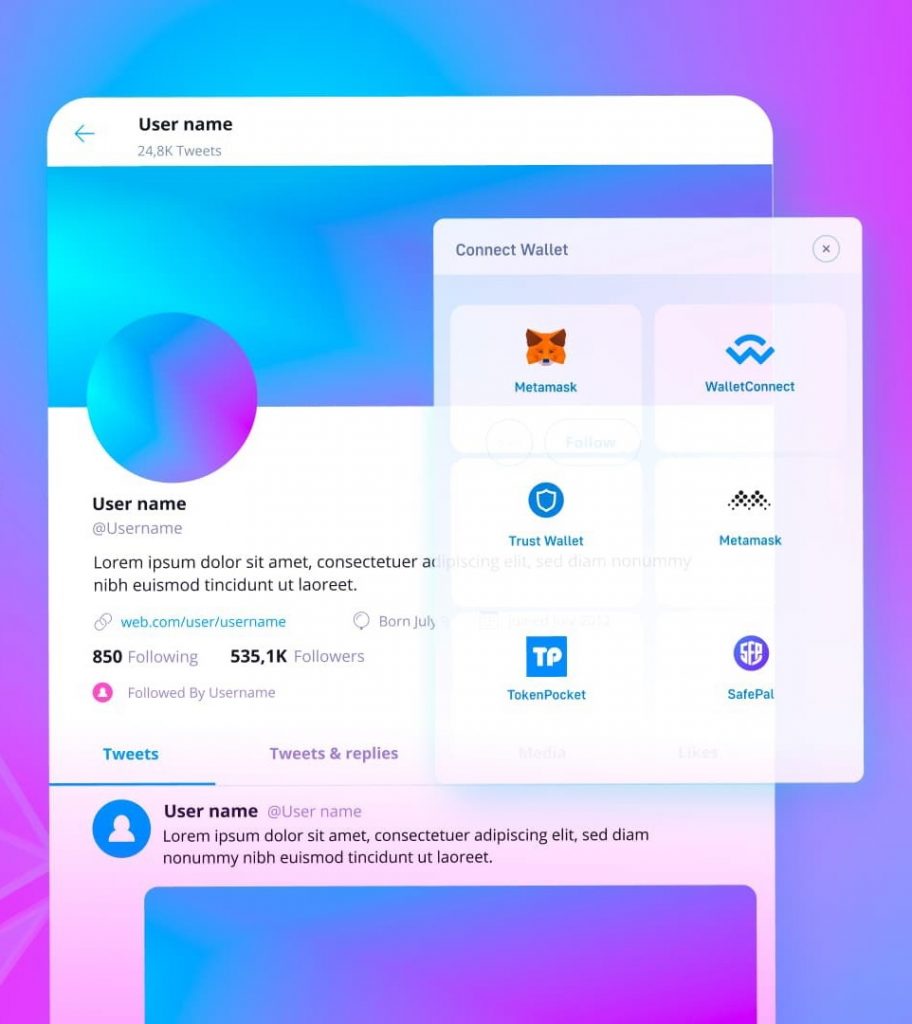

Although the speculative hype around NFTs has clearly cooled down, digital collectibles as a consumer behavior have not disappeared. Magic Eden (ME) is positioned to closely align with this ongoing user behavior.

Image source: NFT Evening

Image source: NFT Evening

Magic Eden's brand-building path differs from many professional trading-oriented platforms. It prioritizes accessibility and ease of use rather than serving high-frequency traders. Its early leadership in the Solana NFT ecosystem, combined with subsequent expansion into Bitcoin-native digital assets, has successfully attracted a broad audience primarily composed of retail users, avoiding over-reliance on a single Ethereum cycle.

Its guiding logic is very pragmatic:

Go where the users are, rather than chasing short-term volume peaks.

This strategy is reflected in multiple aspects:

- User-friendly interface design centered around discovery

- Maintaining a strong presence in ecosystems where retail users are active

- Restrained handling of professional trading features to avoid raising the entry barrier for newcomers

In the increasingly fragmented NFT market, Magic Eden's core advantage lies in its continuous service to collectors and ordinary users. Even as speculative behavior recedes, these users still maintain stable trading and participation.

Image source: NFT.com

Image source: NFT.com

Variables that may affect its ranking in 2026 include changes in the dominant NFT ecosystem or a new round of competition centered on consumer experience. But for now, Magic Eden remains one of the most recognizable and user-friendly NFT platforms in the minds of ordinary users.

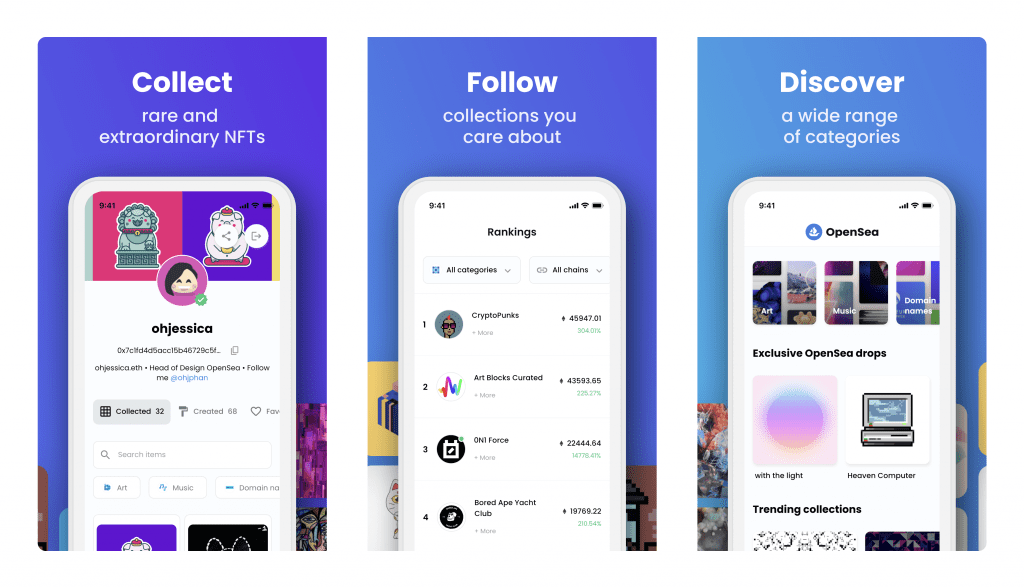

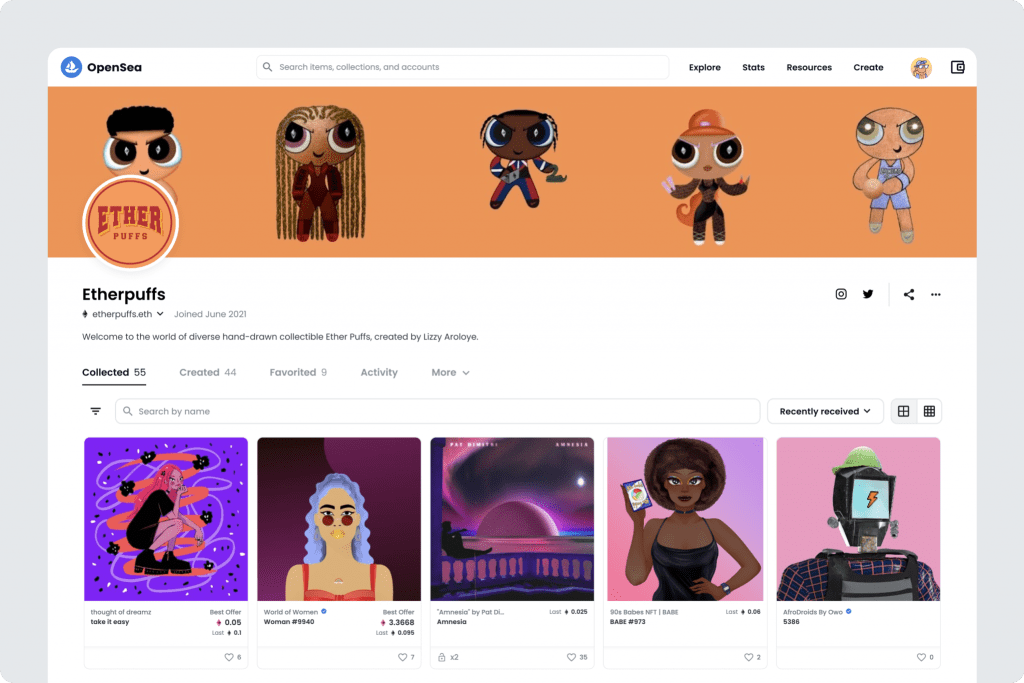

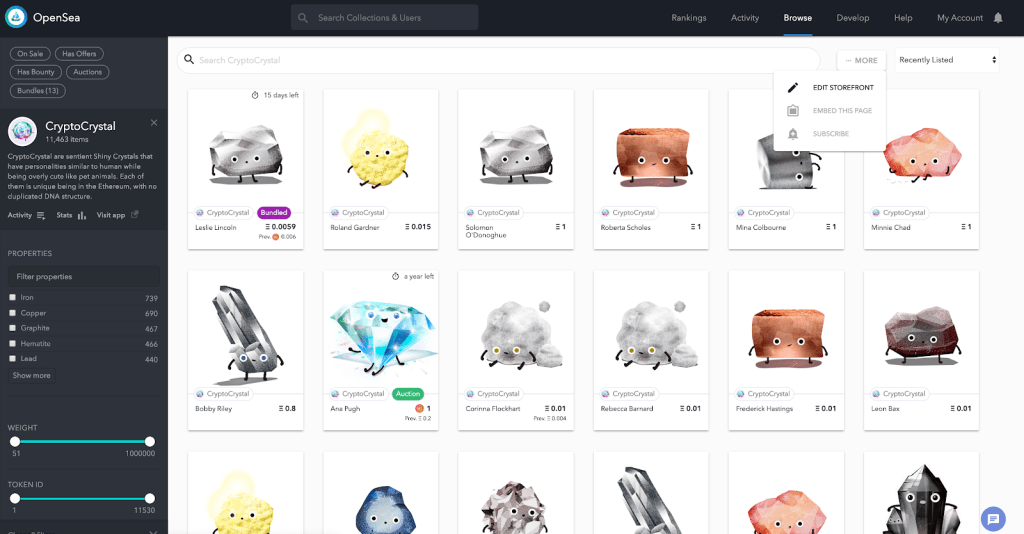

#5 OpenSea

Conclusion: Still the "default entry point" for NFT markets in the minds of mainstream users.

Image source: OpenSea Blog

Image source: OpenSea Blog

OpenSea no longer holds an absolute dominant position in all NFT trading segments, but in the minds of the general public, it remains the most recognizable NFT market brand.

Image source: OpenSea Blog

Image source: OpenSea Blog

For users who are encountering NFTs for the first time or returning to the NFT world, OpenSea is often still the first discovery entry that comes to mind. Its wide coverage of asset types, compatibility with multi-chain ecosystems, and relatively intuitive product interface keep its usage threshold low for non-professional trading users.

OpenSea's core value in 2026 comes from the familiarity itself.

In consumer-grade applications, brand memory remains an indispensable factor in the adoption process.

Currently, OpenSea still plays multiple roles:

- A discovery layer for digital collectibles

- A transitional bridge connecting Web2 users with the NFT world

- A reference coordinate for mainstream users participating in the NFT market

Although professional traders are gradually shifting to more vertical and high-frequency platforms, for most ordinary users, ease of use and trust still take precedence over minor fee advantages.

Image source: OpenSea Blog

Image source: OpenSea Blog

Factors that may affect its future ranking include further fragmentation of NFT discovery platforms or the continued expansion of professional trading-oriented platforms. However, in the foreseeable future, even with increasing competition, OpenSea remains an indispensable user anchor in the NFT consumer ecosystem.

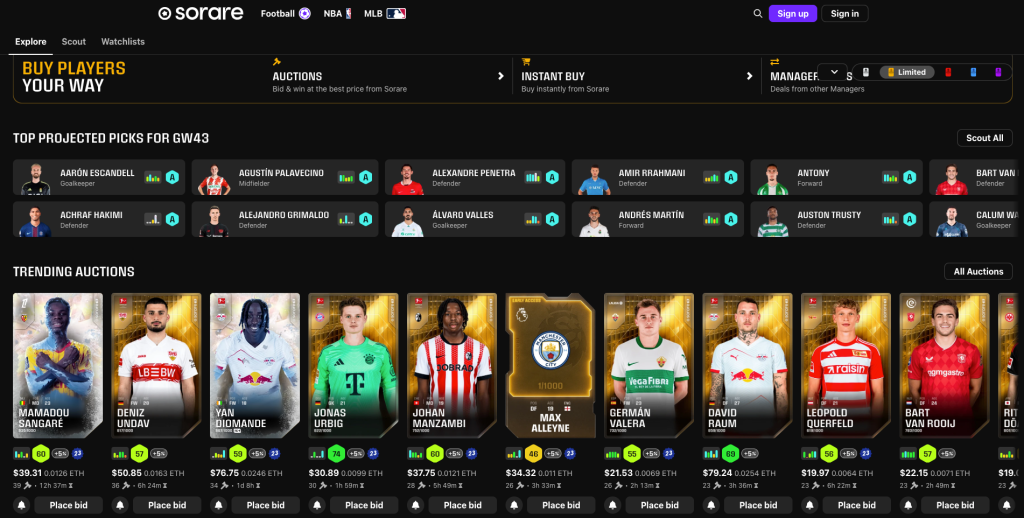

#6 Sorare

Conclusion: Fantasy sports remain one of the most sustainable consumer-grade usage loops in Web3.

Sorare's ability to rank in the top six is primarily due to its close integration of NFTs with a user behavior that has long been validated globally—sports fan culture.

Rather than guiding users toward asset speculation, Sorare focuses on naturally embedding digital ownership within fantasy sports leagues and seasonal competitions. User engagement is mainly driven by real-world sports schedules, creating a natural retention loop relatively independent of crypto market cycles.

Its product logic is very clear:

Competition is core; ownership is just a support.

This model is effective because:

- Users will continuously return based on seasons, teams, and player performances

- NFTs play the role of game components rather than financial assets

- Even for non-crypto users, the overall participation experience remains familiar

This structure makes Sorare more resilient compared to many Web3 consumer-grade applications. It does not rely on continuous incentives to maintain product relevance.

Image source: Sorare.com

Image source: Sorare.com

Variables that may affect its position in 2026 include the pace of expansion into more sports, changes in copyright and licensing environments, and competitive pressure from other fantasy sports products. For now, Sorare remains one of the clearest examples of how Web3 technology can naturally integrate into daily consumer habits.

Notable Projects: Important but Not Yet Consumer-Grade Leaders

Some well-known projects still hold significant importance in the Web3 ecosystem, but "importance" does not equate to "consumer-grade leadership." The following projects have influence in their respective fields but have not yet met the standards for Top Six in terms of real user retention, usage stability, or scalability validation.

These rankings reveal the real choices of Web3 consumers in 2026

The strongest Web3 consumer-grade products in 2026 often share a common characteristic: they do not look like crypto products.

When players forget the chain they are using, the game can truly succeed; when interaction itself takes precedence over financialization, social platforms can exist long-term; when digital collectibles naturally integrate into familiar usage scenarios, their value can persist. The importance of infrastructure lies only in whether it can smoothly "disappear" behind the experience.

As the industry matures, the importance of retention is surpassing coverage, and execution is surpassing grand visions. Consumer-grade leadership will continue to evolve, but signals based on real usage behavior are clearly more valuable than cyclical narratives.

In 2026, the consumer-grade winners of Web3 will not be the loudest protocols, but those products that users repeatedly return to without thinking about their technological origins.

Frequently Asked Questions (FAQ) about GameFi, SocialFi, and NFTs

1. What kind of Web3 applications qualify as consumer-grade products in 2026?

Products that can continuously attract users to return, have a clear value proposition and familiar user experience, and do not rely on long-term incentives to maintain activity.

2. Why are games still the main entry point for Web3 consumer adoption?

Games inherently possess mechanisms for repeated participation while allowing digital ownership to remain "optional" rather than core, thus lowering the entry barrier for users.

3. Why were token prices and TVL not included in the evaluation?

These metrics reflect speculative behavior more than real user usage or the long-term durability of the product.

4. Does Web3 social still have real significance?

Yes, but selectively. Platforms like Farcaster continue to exist by prioritizing interaction experiences over incentive mechanisms.

5. Do NFTs still hold relevance after the speculation has receded?

They still exist. When digital collectibles prioritize discovery and usage over trading, their consumer attributes remain valid.

6. Why are some well-known projects only listed as "notable"?

Influence alone is not enough. Daily usage scale, user retention performance, and sustained execution capability are the key criteria for entering the Top Six.

7. Where can I follow the official X accounts of these Web3 consumer-grade projects?

The six projects mentioned in this article—Immutable, Ronin, Farcaster, Magic Eden, OpenSea, and Sorare—are all active on the X platform. To avoid falling into counterfeit or scam accounts, it is recommended to always access their official X accounts through the links provided on each project's official website.

Further Reading

- XT Double Festival Carnival Officially Launched, $2,000,000 Rewards Fully Distributed

- X Legends Contract Championship Ranking Strategy: How to Efficiently Accumulate Trading Volume to Compete for a $5,000,000 Prize Pool

- Top 5 Layer 1 Blockchains to Watch in 2026: The Mainline Evolution from DeFi to RWA

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform, now boasting over 12 million registered users, with operations covering more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports over 1,300 quality coins and 1,300+ trading pairs, offering diverse trading services such as spot trading, margin trading, and futures trading, along with a secure and reliable RWA (Real World Assets) trading market. We adhere to the philosophy of "Exploring Crypto, Trusting Trading," committed to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。