Changes in Bitcoin On-Chain Data for the Second Week of 2026 — Continuing as a Tech Stock Sidekick

In the past week, the conclusions drawn from on-chain data indicated that at that time, $BTC was neither in a state of rapid decline typical of a bear market nor in a mode of rapid increase characteristic of a bull market. Instead, it was in a fluctuating trend under macroeconomic and political games, and only a substantial change would alter this situation. So, did any substantial changes occur this week?

Unfortunately, no. Therefore, this week continued to maintain a slight oscillating trend. What constitutes a substantial change? It depends on the main players in the current game; the primary narratives for 2026 should be threefold.

U.S. monetary policy.

U.S. midterm elections.

Geopolitical conflicts related to the U.S.

Although some geopolitical conflicts occurred in the past week, and the U.S. was even prepared to take action against Iran, it was evident that the market's impact was minimal. This level of geopolitical conflict primarily affects U.S. inflation, which in turn influences U.S. monetary policy. Even the situation in Venezuela did not significantly alter the landscape of the U.S. stock market.

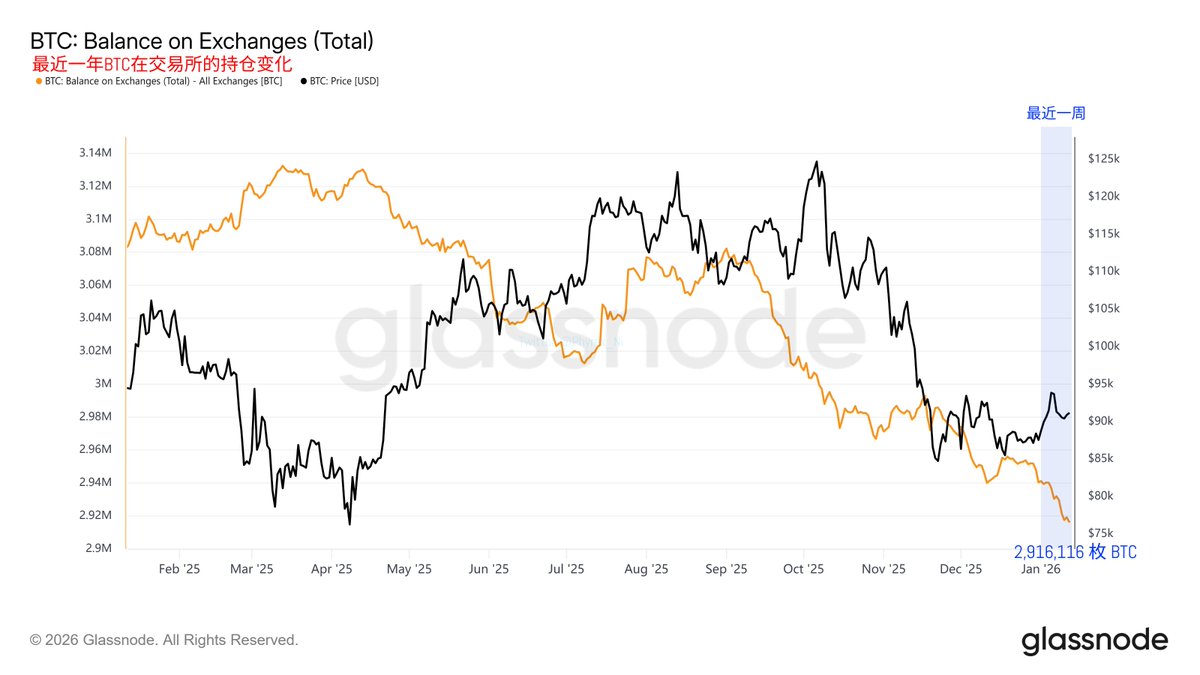

Recent Year BTC Inventory in Exchanges

Returning to on-chain data, the inventory of Bitcoin in exchanges continued to decrease over the past week. This principle has been explained many times; although a decrease does not equate to a price surge, the reduction in inventory indicates that most holders remain optimistic about the future of $BTC, with a higher buying willingness compared to selling willingness, thus exerting little pressure on the market. This represents that investor sentiment has not entered a state of panic; rather, there are signs of bottom-fishing.

Comparing the data from Bitcoin spot ETFs over the past week reveals that a total of 7,445 $BTC was sold, indicating a net selling state. Therefore, this reduction in exchange inventory did not transfer to spot ETFs.

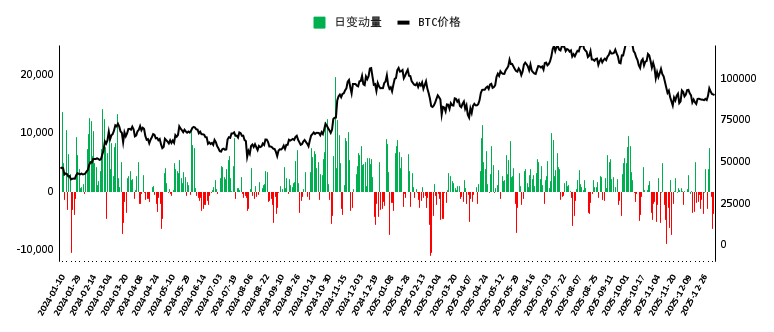

Net Flow of BTC Spot ETFs in History

Moreover, from the overall net flow data of spot ETFs, although there was a day of significant net inflow at the beginning of last week due to the Venezuela situation, it turned into a net outflow starting last Tuesday, with the outflow amount increasing. Even the investors from BlackRock, who had the largest inflow due to Venezuela, saw two-thirds of their investments flow out in the past week. The data for $ETH is similarly unimpressive.

The ETF data clearly shows that traditional investors' interest in cryptocurrencies has not significantly changed. We often say, "The spring river water warms, the duck knows first," but as a barometer, cryptocurrency ETFs remain in a state of limbo, consistently experiencing net outflows. Although the amounts are small and unlikely to affect spot prices, it is evident that there are currently no clear positive signals for cryptocurrencies.

Traditional investors are mostly engaging in speculative behaviors of chasing highs and cutting losses.

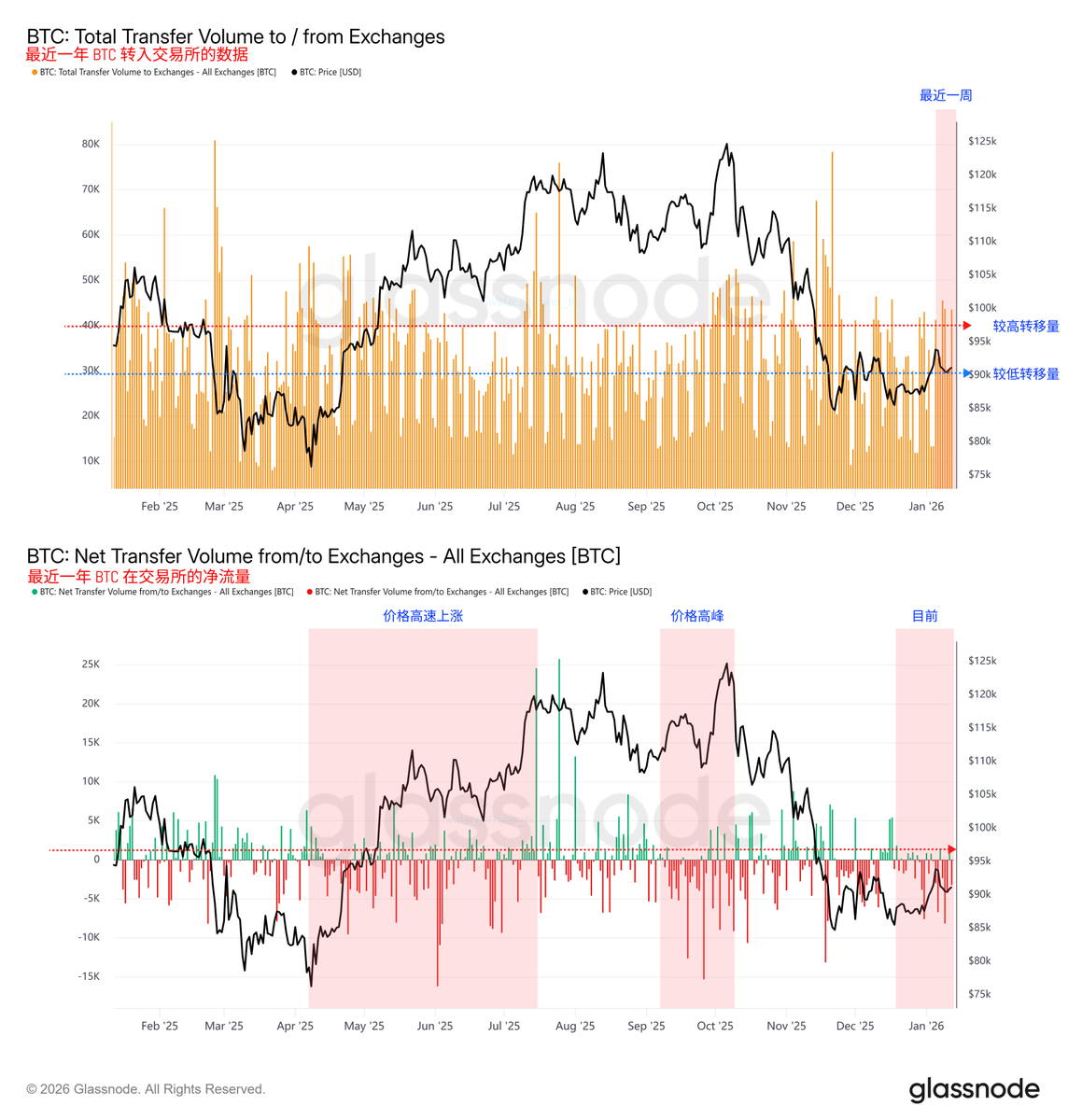

However, looking at the data for $BTC transferred to exchanges, although there has been a net outflow, indicating that the outflow volume exceeds the inflow volume, the data for the past week shows an increase in transfers to exchanges, especially over the weekend, which indicated significant transfers into exchanges, likely in anticipation of U.S. action against Iran.

BTC Transferred to Exchanges Over the Past Year and Net Flow

Yet, the peak of transfers into exchanges did not show significant increases; there were just a few days of strong inflows. However, from the net flow data, it is clear that most of the inflows were offset by outflows, resulting in a low impact on prices. This also indicates that while some investors are feeling tense, the majority still believe that around $90,000 is a buyable price.

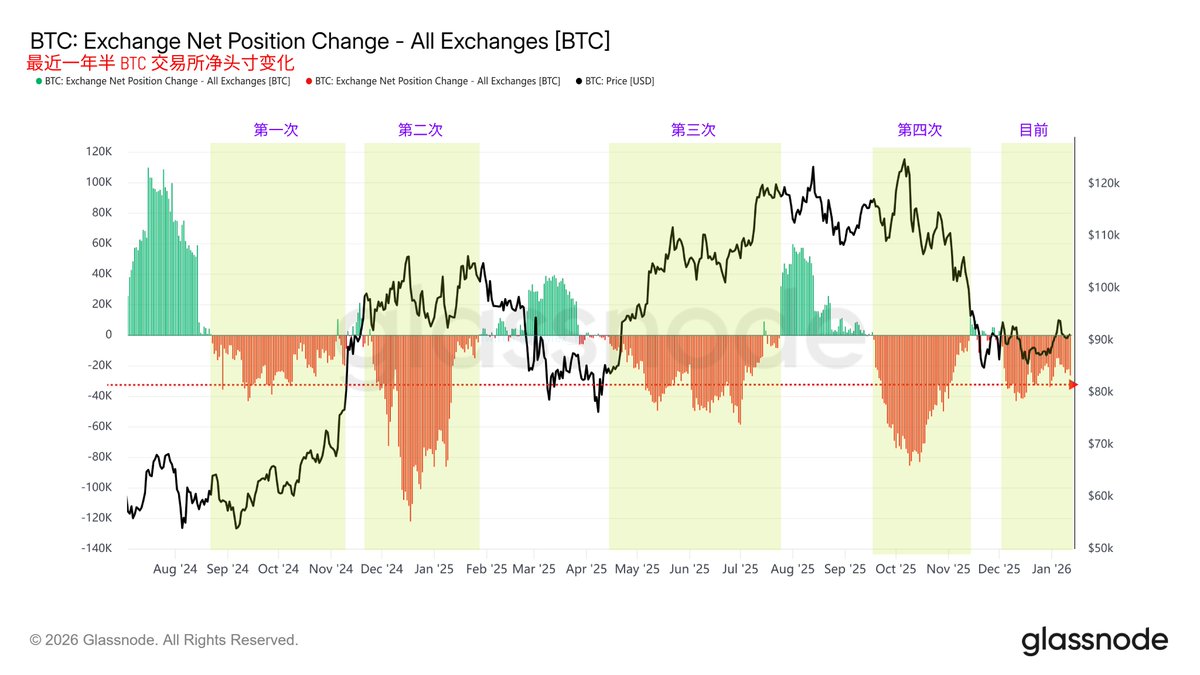

30-Day Average Inventory Data for Exchanges Over the Past Year and a Half

The conclusion I provided last week regarding why it is not a bull market is partly due to the 30-day average outflow being too low, not reaching the FOMO levels seen during the previous three significant outflows. The 30-day average slightly increased over the past week, although it did not reach FOMO levels, it still indicates that entering 2026, at least at this stage, there are signs of increased risk appetite among investors.

However, the overall market changes are still more influenced by macroeconomic, political, and economic factors. For instance, Trump's tariffs also affect inflation, and the previously mentioned geopolitical conflicts also impact inflation. In the purely political realm, it depends on Trump's actions. For example, the latest credit card limit aims to increase the purchasing power of American users. If a 10% limit is established, it will stimulate users' willingness to purchase.

Then there is the threat to Powell, which is not a good thing as it increases market uncertainty. Investors are concerned that the independence of the Federal Reserve is being challenged, leading to a situation where the president has unchecked power, which may also create some resistance. Overall, all of this is based on U.S. monetary policy.

Thus, the final conclusion is that Bitcoin still maintains a certain correlation with tech stocks, and cryptocurrencies still lack an independent narrative. Traditional investors remain in a wait-and-see state regarding cryptocurrencies, and the buying volume from within the crypto circle is still not strong.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。