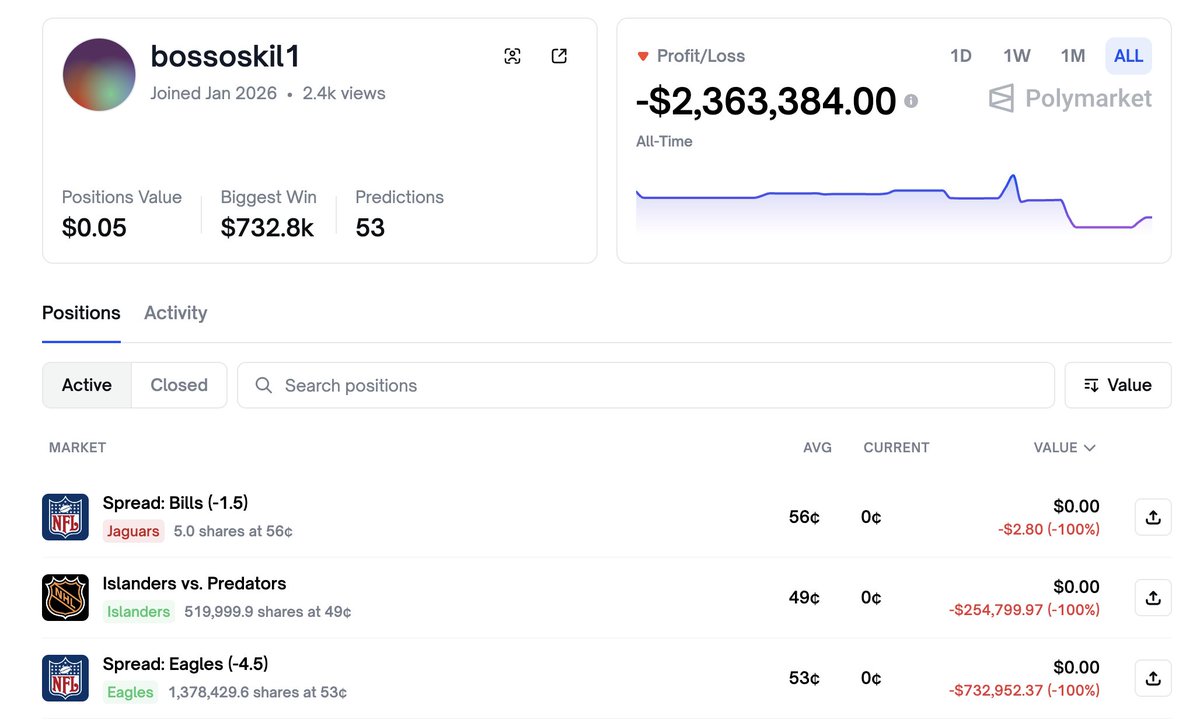

A Polymarket trader lost $2.36M in just 8 days.

He made 53 predictions in the past 8 days:

25 winning trades

28 losing trades

Win rate: 47.2%

👉How He Traded

Focused on sports markets (NFL, NBA, NHL, NCAA)

Frequently traded spread markets

Bought positions mostly at 40–60¢

Very large bet sizes, often $200K to over $1M per trade

Positions were held to settlement, with no hedging or scaling

In simple terms, these were high-conviction, all-or-nothing bets.

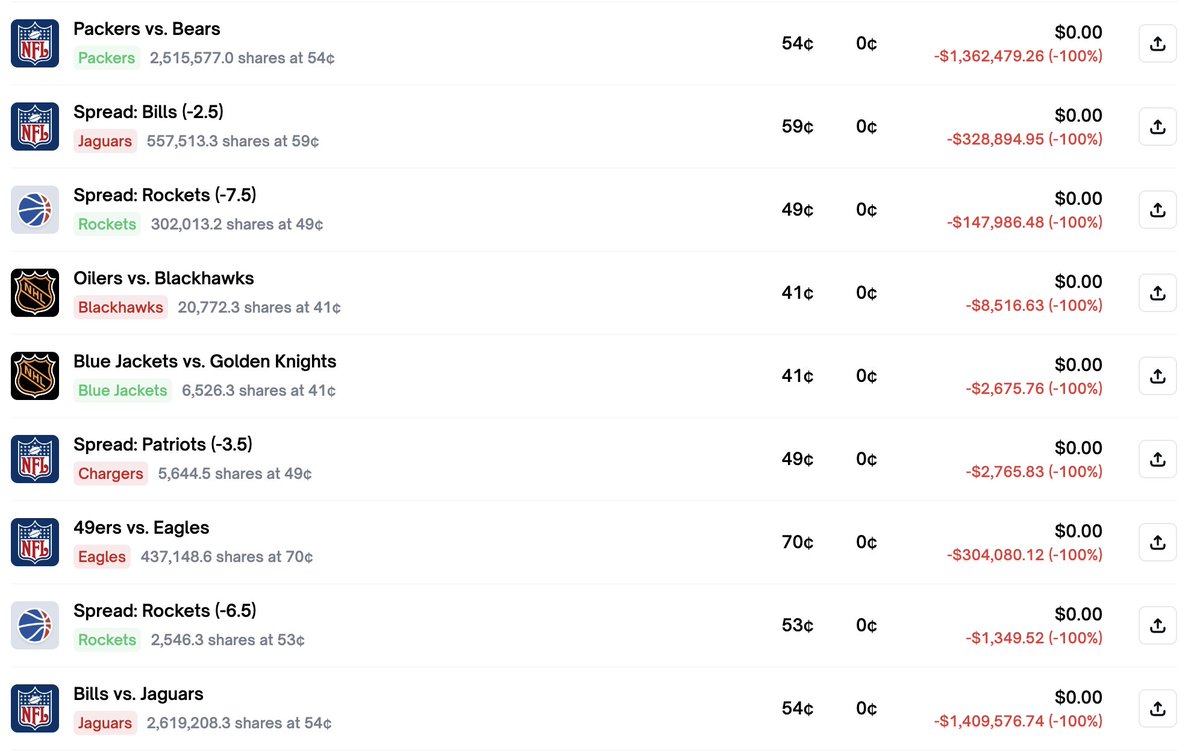

👉Why He Lost

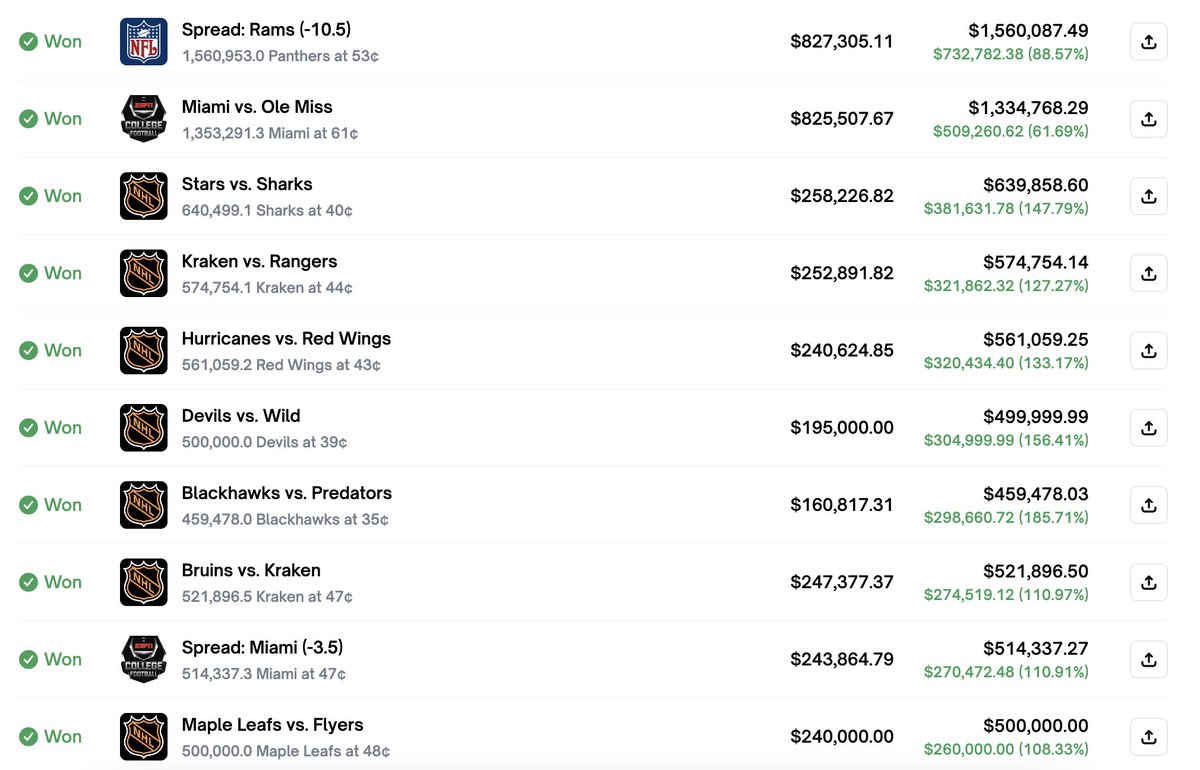

Winning trades usually returned +60% to +150%.

Losing trades settled at $0 (-100%).

Just two or three losing bets were enough to wipe out all prior profits.

With this risk structure, a 47.2% win rate was not sustainable.

👉Key Lesson

In prediction markets, being right is not enough.

Spread markets are high-variance, and without strict position limits,

a few wrong outcomes can destroy an entire account.

👉Takeaway

This trader wasn’t consistently wrong.

He simply allowed single outcomes to define his survival.

In prediction markets, risk management matters more than conviction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。