Author: Delphi Digital

Compiled by: Jiahua, ChainCatcher

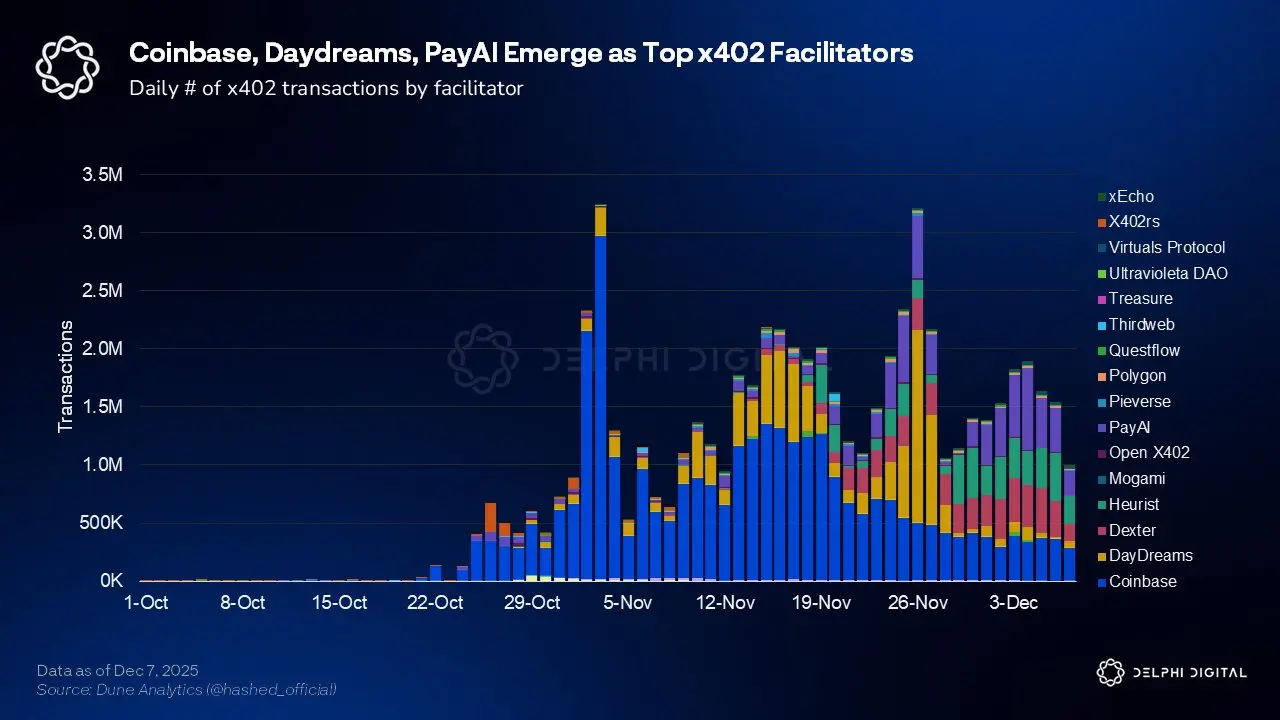

1. AI Agents Start Autonomous Trading

The x402 protocol allows any API to access restrictions through encrypted payments. When an agent needs a service, it pays instantly with stablecoins. No shopping cart, no subscription required. ERC-8004 increases trust by creating a reputation registry for agents (containing performance history and staked collateral). Combined, these create an autonomous agent economy. Users can delegate travel planning. Their agents will subcontract tasks to flight search agents, pay data fees via x402, and book tickets on-chain, all without human intervention.

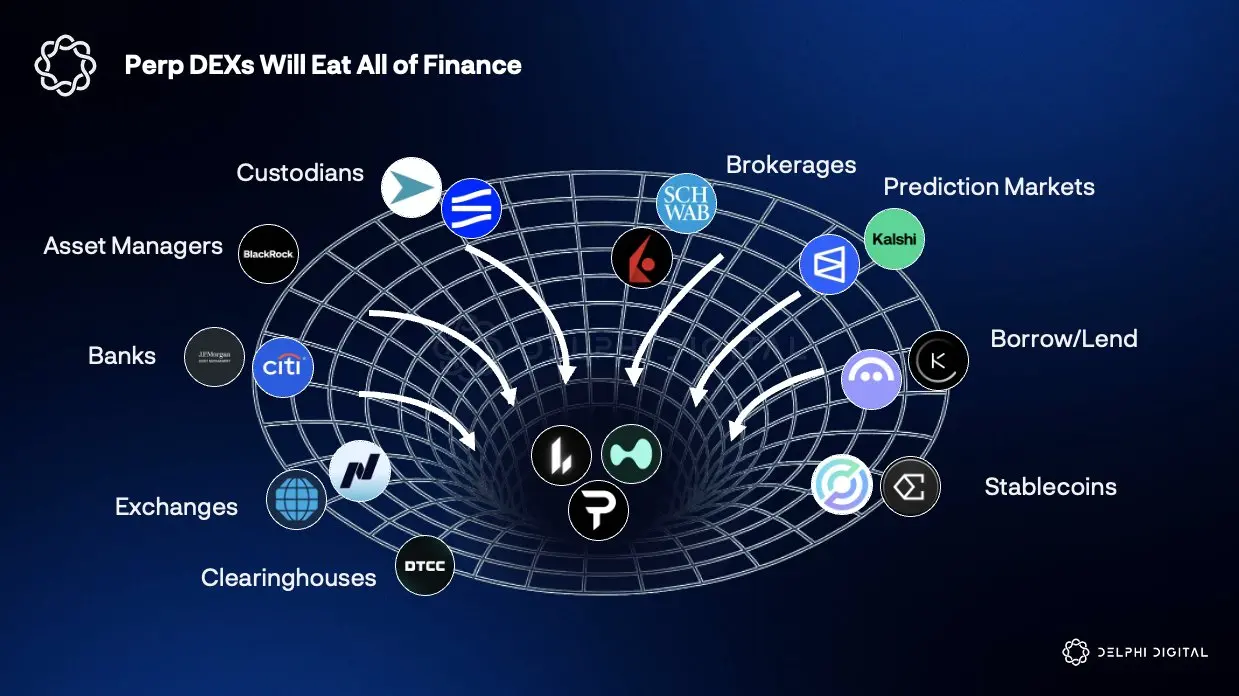

2. Perpetual Contract DEX Devours Traditional Finance

Traditional finance is expensive due to fragmentation. Trades occur on exchanges, settlements through clearinghouses, and custody via banks. Blockchain compresses all of this into a smart contract. Now Hyperliquid is building native lending. Perpetual contract DEXs could simultaneously become brokers, exchanges, custodians, banks, and clearinghouses. Competitors like @AsterDEX, @Lighterxyz, and @paradex are racing to catch up.

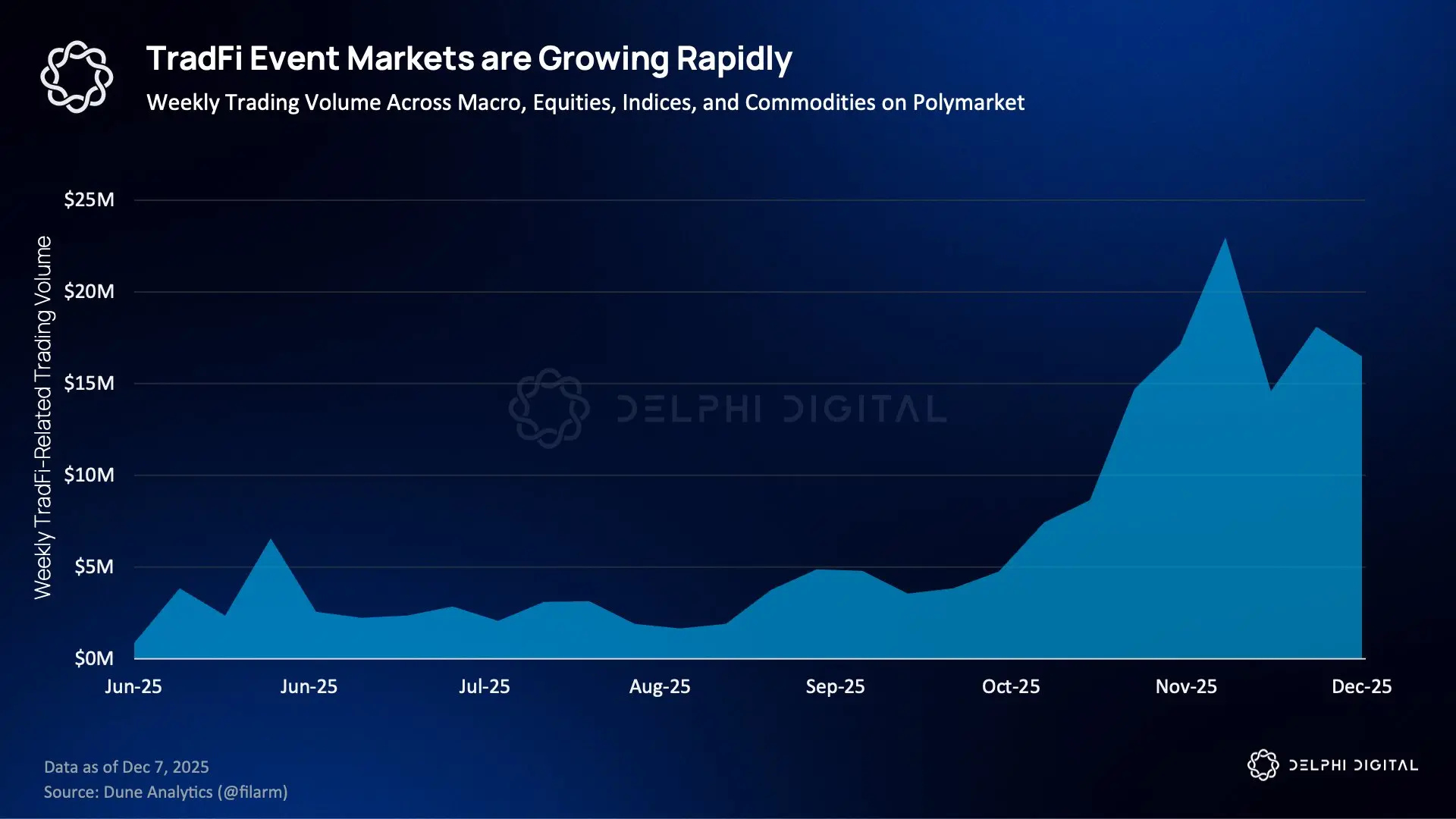

3. Prediction Markets Upgrade to Traditional Financial Infrastructure

Thomas Peterffy, Chairman of Interactive Brokers, views prediction markets as a real-time information layer for portfolios. Early demand on IBKR focused on weather contracts for energy, logistics, and insurance risks. A new category opens in 2026: stock event markets for earnings beats and guidance ranges, macro data like CPI and Federal Reserve decisions, and cross-asset relative value markets. Traders holding tokenized AAPL can hedge earnings risk with simple binary contracts without dealing with options. Prediction markets will become top-tier derivatives.

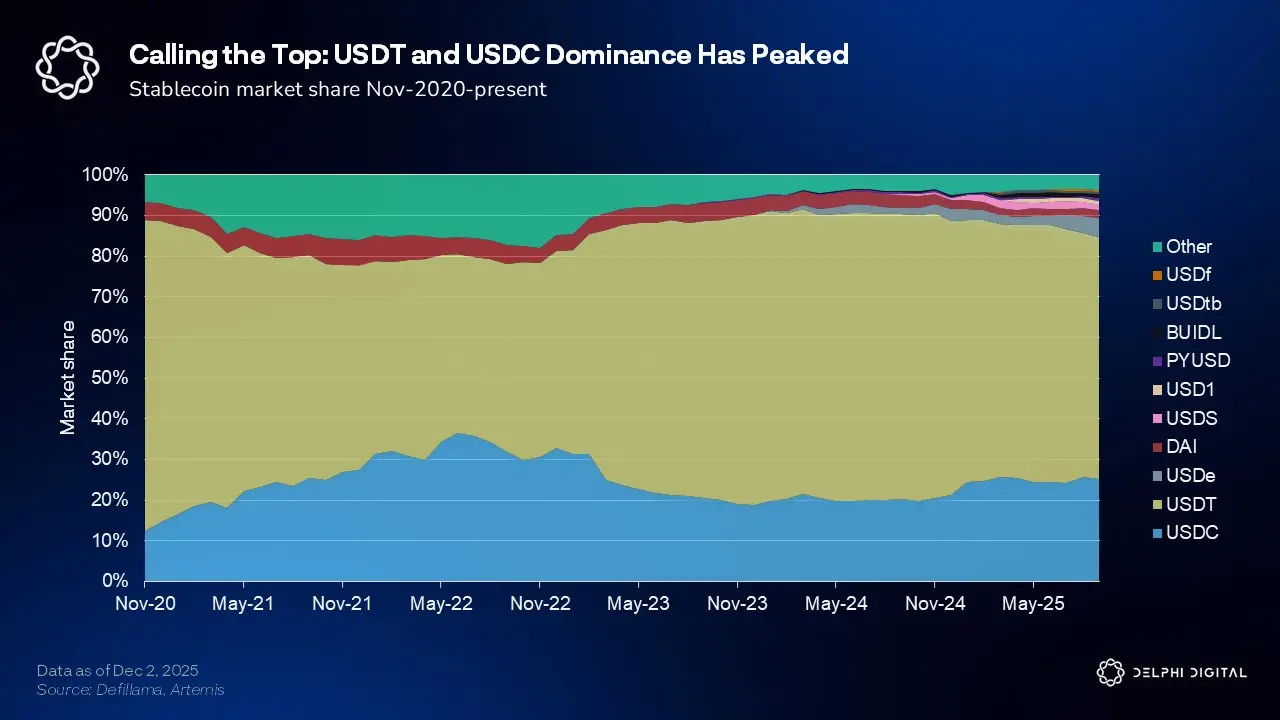

4. Ecosystem Reclaims Stablecoin Revenue from Issuers

Coinbase earned over $900 million in USDC reserve revenue last year just by controlling distribution. Chains like Solana, BSC, Arbitrum, Aptos, and Avalanche earn about $800 million annually in fees, while over $30 billion in USDC and USDT circulates on their networks. The loss of stablecoin usage to platforms is costing issuers more than they earn themselves.

Now the situation is changing. Hyperliquid has initiated a bidding process for USDH and has secured half of the reserve revenue for its assistance fund. Ethena's "stablecoin as a service" model is currently being adopted by Sui, MegaETH, and Jupiter. The passive accumulation of revenue for existing businesses is being reclaimed by platforms generating demand.

5. DeFi Conquers Under-Collateralized Lending

DeFi lending protocols have billions in TVL, but almost all require over-collateralization. The key to unlocking this is zkTLS. Users can prove their bank balance exceeds a certain amount without revealing account numbers, transaction history, or identity. @3janexyz leverages verified Web2 financial data to provide instant under-collateralized USDC credit lines. The algorithm monitors borrowers in real-time and dynamically adjusts interest rates. The same framework can use performance history as a credit score for underwriting AI agents. @maplefinance, @centrifuge, and @USDai_Official are tackling related issues. 2026 will be the year under-collateralized lending transitions from experimentation to infrastructure.

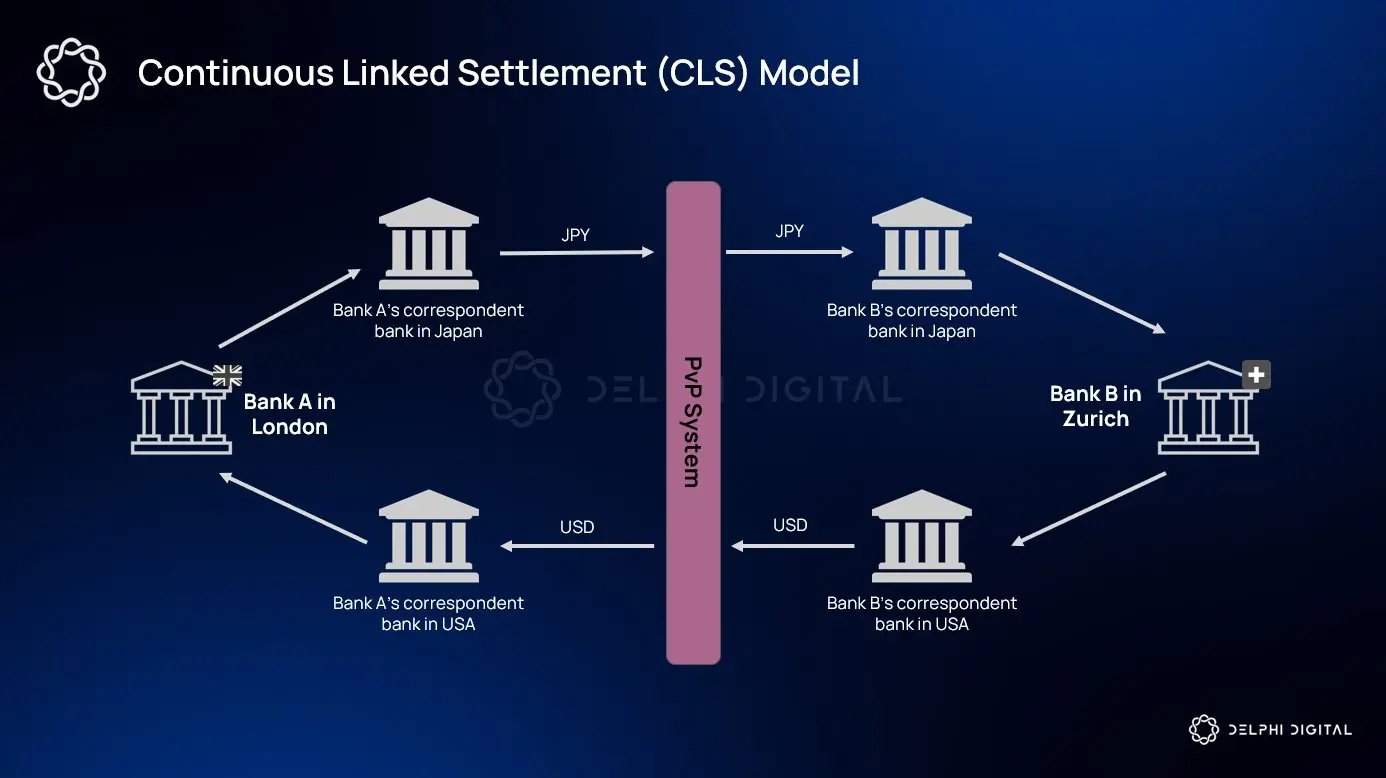

6. On-Chain Forex Finds Product-Market Fit

USD stablecoins account for 99.7% of total supply, but this may have peaked. Traditional forex is a multi-trillion dollar market filled with intermediaries, fragmented settlement channels, and high fees. On-chain forex eliminates multiple intermediary hops by allowing all currencies to exist as tokenized assets on a shared execution layer, compressing the trading process. Product-market fit may emerge in emerging market currency pairs, where traditional forex channels are the most expensive and least efficient. In these underserved corridors, the value proposition of cryptocurrencies is clearest.

7. Gold and Bitcoin to Attract Safe-Haven Flows

After we marked gold as one of the charts to watch, its price surged by 60%. Despite record prices, central banks purchased over 600 tons. China has been one of the most active buyers. The macro environment supports its continued strength. Global central banks are cutting interest rates. Fiscal deficits will persist until 2027. Global M2 is breaking through highs. The Federal Reserve is ending quantitative tightening. Gold typically leads Bitcoin by three to four months. As currency devaluation becomes a mainstream issue heading into the mid-2026 elections, both assets will attract safe-haven flows.

8. Exchanges Become "Universal Applications"

Coinbase, Robinhood, Binance, and Kraken are no longer just building exchanges. They are building universal applications. Coinbase has Base as its operating system, Base App as its interface, USDC for guaranteed income, and Deribit for derivatives. Robinhood's Gold membership grew by 77% year-over-year and serves as a retention engine. Binance is already operating at the scale of a super app, with over 270 million users and $250 billion in payment volume. When distribution becomes cheap, value will accrue to those who own the users. 2026 will be the year winners start to pull ahead.

9. Privacy Infrastructure Catches Up with Demand

The EU has passed the Chat Control Act. Cash transaction limits are capped at €10,000. The European Central Bank plans to launch a digital euro with a holding limit of €3,000. Privacy infrastructure is catching up. @payy_link is launching privacy crypto cards. @SeismicSys provides protocol-level encryption for fintech companies. @KeetaNetwork implements on-chain KYC without disclosing personal data. @CantonNetwork offers privacy infrastructure support for large financial institutions. Without privacy channels, stablecoins will hit a ceiling on adoption.

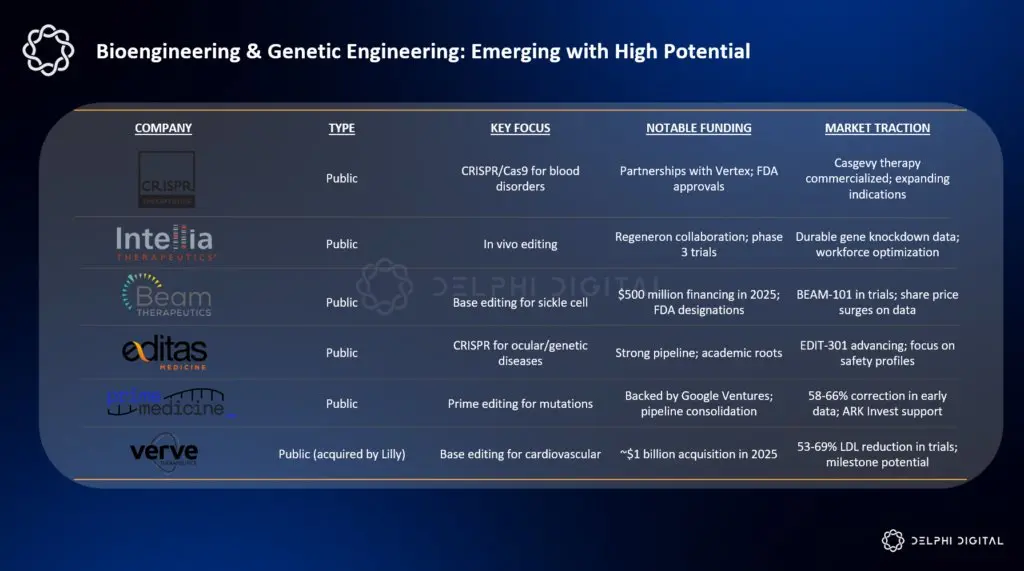

10. Altcoin Returns Remain Divergent

The broad market rally of past cycles will not return. Over $3 billion in token unlocks is imminent. Competition from AI, robotics, and biotechnology is intensifying. ETF fund flows are concentrated in Bitcoin and a few large caps. Funds will gather around structural demand: tokens with ETF fund flows, protocols with real revenue and buybacks, and applications with genuine product-market fit. Winners will concentrate among teams that can build defensive moats in categories with real economic activity.

Conclusion

Cryptocurrency is entering the next phase. Institutionalization has arrived. Prediction markets, on-chain credit, agent economies, and stablecoins as infrastructure represent a true paradigm shift. Cryptocurrency is becoming the infrastructure layer of global finance. Teams that understand this will define the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。