Polymarket’s metals contracts offer a rare window into crowd expectations, translating macro narratives into clean probabilities rather than headlines. Four active contracts track whether gold and silver futures will reach or exceed specific price levels by set deadlines, relying strictly on official settlement prices.

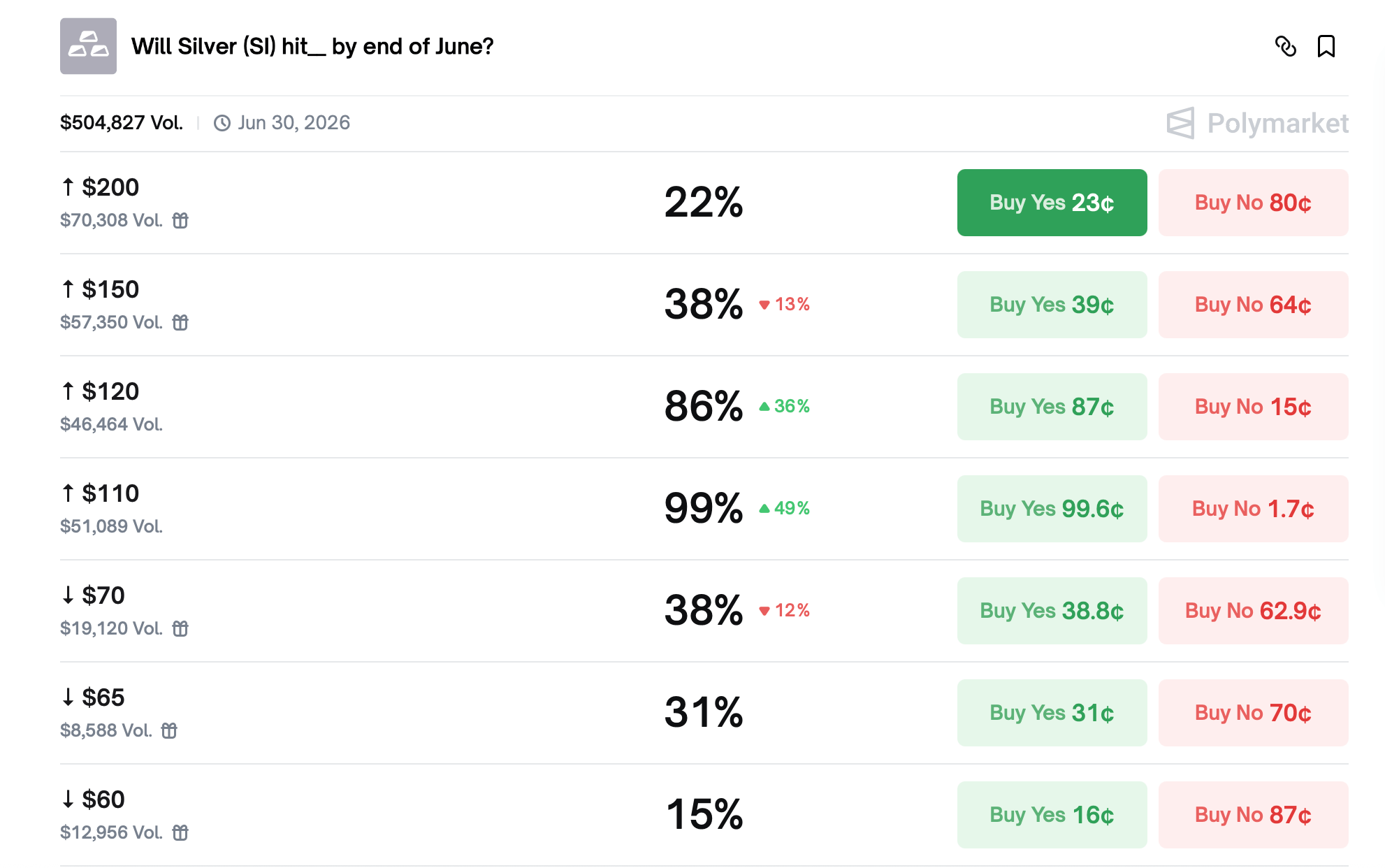

Two contracts focus on silver, both tied to CME silver futures. The first contract looks out to the final trading day of June 2026, structured as a ladder ranging from $35 to an eye-popping $200. Traders assign near certainty—roughly 99.6%—to silver reaching $110, while confidence thins quickly above that mark, sliding to about 86% at $120, 39% at $150, and roughly 20% at $200.

Source: Polymarket on Jan. 26, 2026.

That distribution says a lot. The market consensus is not debating whether silver stays elevated; it is debating how far the rally realistically goes. The crowd appears comfortable with continued strength but draws a clear line between plausible upside and speculative excess.

The second silver contract on Polymarket narrows the timeframe to the end of January 2026. Here, probabilities compress even further. Lower price thresholds carry strong “yes” pricing, while higher targets fade rapidly, many falling below 1%. The takeaway: traders expect silver to stay firm, but they are not paying up for fireworks in the near term.

Gold contracts tell a similar story, just at loftier price levels. One contract asks whether CME gold futures will hit certain thresholds before the end of January 2026. Odds cluster heavily around a single mid-range level priced near certainty, while most higher targets hover near zero probability, reflecting skepticism toward a sudden breakout within weeks.

Trading interest in that January gold market sits around $1.35 million, signaling active participation without the frenzy seen in meme-driven contracts. In other words, this is a market driven by macro conviction, not vibes.

The longer-dated gold contract extends through June 2026 and paints a broader arc. Traders overwhelmingly expect gold to reach $5,000, pricing that outcome as nearly certain. Beyond $5,500, probabilities drop off sharply. The $6,000 level sits in what traders treat as a coin-flip zone, while expectations collapse quickly above $6,500.

Also read: Blackrock Pushes Deeper Into Bitcoin, Filing ETF Built for Both Exposure and Income

Taken together, these four contracts sketch a consistent picture. Participants on Polymarket are broadly bullish on precious metals but disciplined about tail risks. Strength is expected; parabolic moves are not being chased.

It is also notable that all four contracts rely exclusively on official settlement prices from the CME. That design strips out intraday noise and forces traders to anchor expectations to verifiable outcomes rather than momentary spikes.

With gold already north of $5,000 and silver well above $110, these markets suggest the crowd believes the heavy lifting may already be done. The remaining debate is not direction, but magnitude.

In short, prediction markets are signaling confidence without euphoria—a bullish posture, trimmed with restraint, and priced accordingly.

- What price levels do Polymarket traders expect for silver by June 2026?

The market assigns near certainty to silver reaching $110, with sharply lower odds above $120. - Do traders expect a near-term breakout in silver by January 2026?

No, probabilities imply silver remains elevated but within a relatively tight range. - How confident are traders in $5,000 gold?

The June 2026 gold contract prices $5,000 as a near-certain outcome. - Are extreme gold targets like $6,500 widely expected?

No, probabilities fall quickly beyond $6,000, showing skepticism toward outsized upside.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。