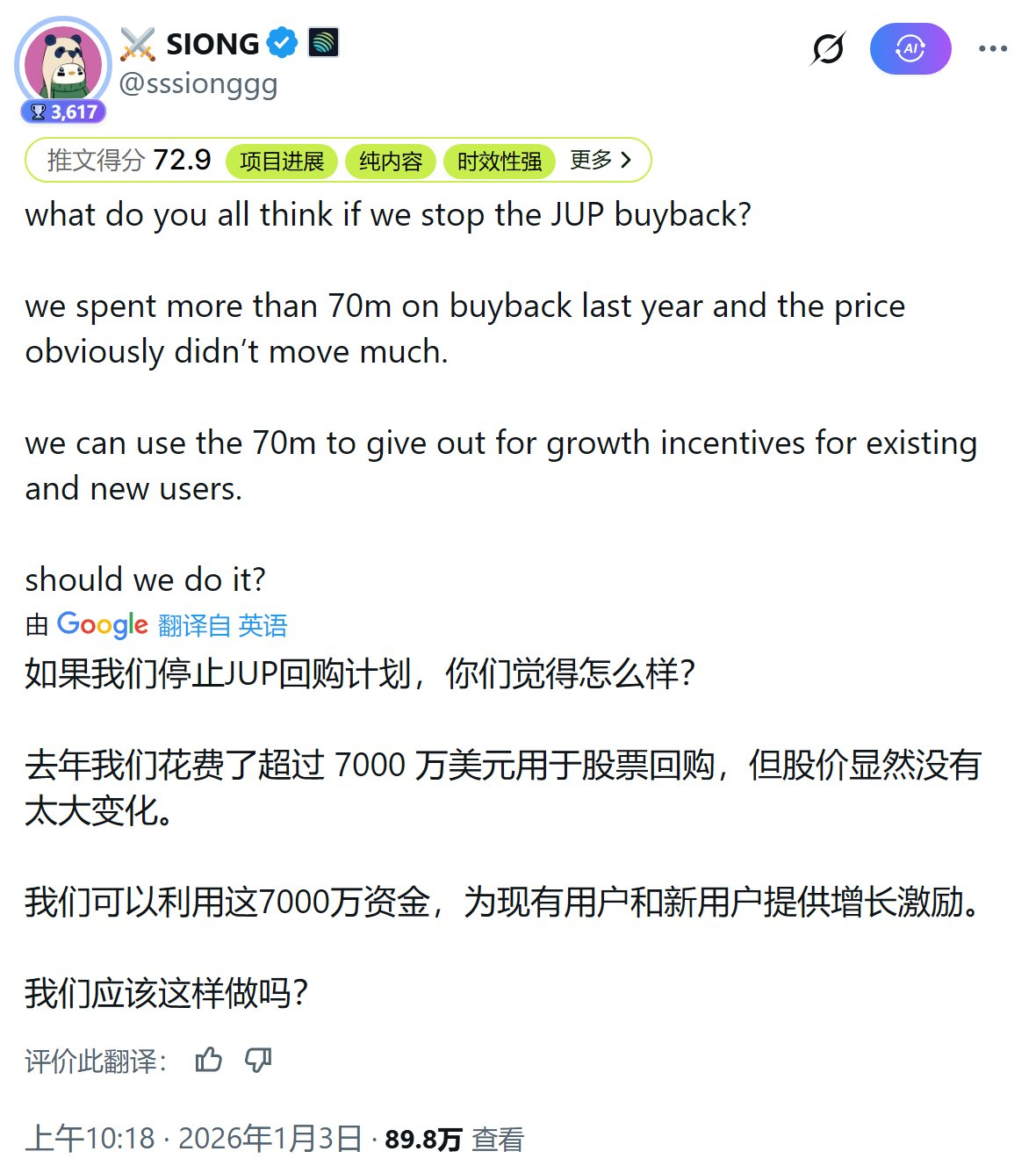

At the beginning of January, JUP** Market Value Launch Record: Two Projects, Three Dimensions, A Game of Buybacks** co-founded a tweet that sparked discussions in the market about token buybacks.

Since January 2025, project parties have started to buy back #JUP, but it has still failed to stop the price from continuously declining.

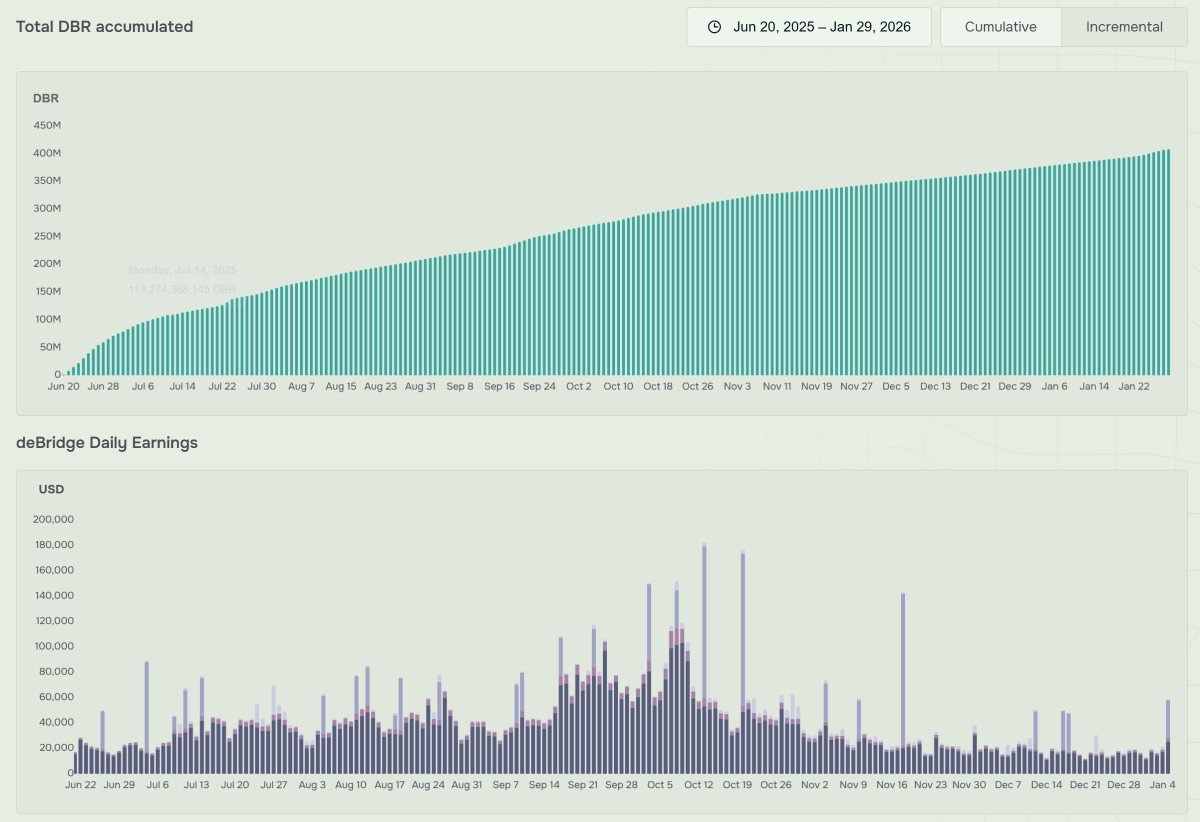

In contrast, the buyback of #DBR has shown immediate effects, starting in June 2025.

On one hand, the price of DBR has risen after the buyback.

On the other hand, it is very evident that a watershed has formed; before the buyback, DBR was weaker than JUP, while after the buyback, DBR became stronger than JUP.

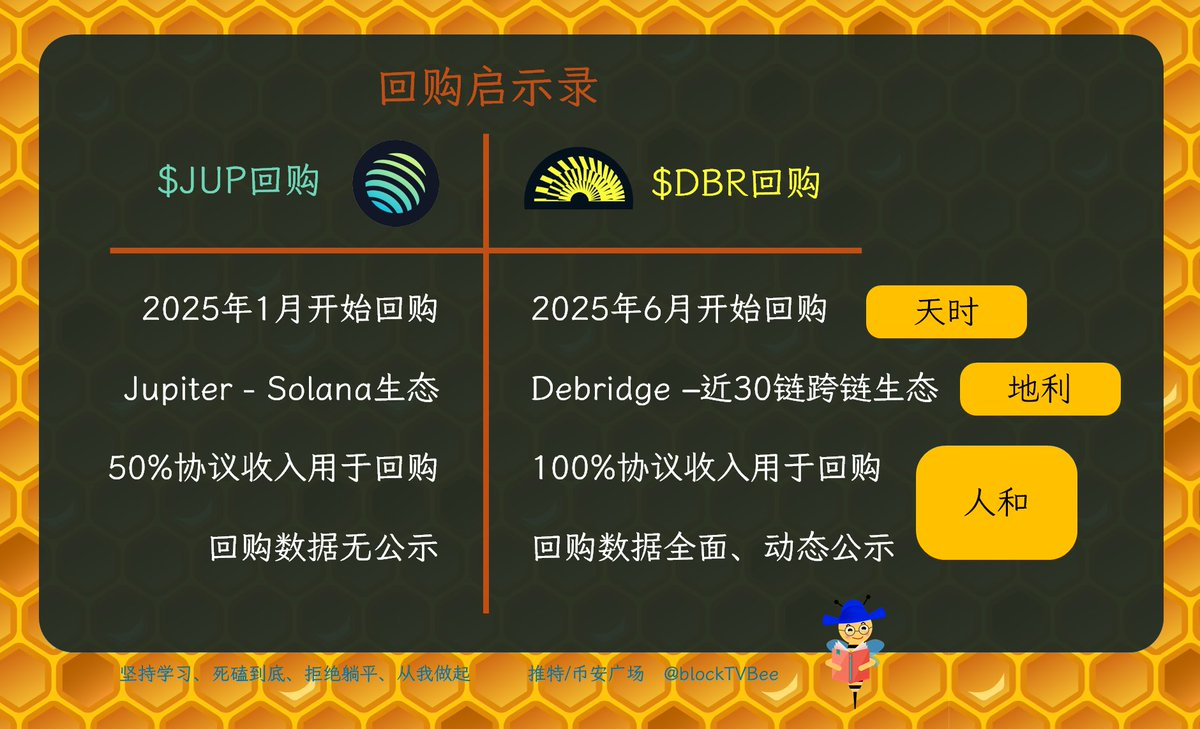

Brother Bee compares and analyzes the game of token buybacks from three dimensions.

┈┈➤ Timing

╰┈✦ The buyback of JUP started in January 2025

This clearly coincided with the beginning of a bull market in the four-year cycle of cryptocurrency. However, the reversal came with Trump.

The tariffs initiated by Trump in 2025 greatly disrupted the macro environment, triggering a trade war on one hand.

On the other hand, the tariffs led to the Federal Reserve's expectations of inflation, resulting in no interest rate cuts from January to August 2025, and continued balance sheet reduction from January to November. The degree of liquidity tightening was not high, but it still had a certain negative impact on the speculative market. The vast majority of Altcoins showed a downward trend in 2025.

╰┈✦ The buyback of DBR started in June 2025

The timing of the DBR buyback began after the tariffs imposed by Trump and after the trade war parties showed signs of easing. The U.S. and China began efforts towards reconciliation in May.

Meanwhile, BTC bottomed out in April 2025 and started to rise.

┈┈➤ Geographical Advantage

╰┈✦ Jupiter is the leading DEX in the Solana ecosystem

Jupiter is the leading DEX in the Solana ecosystem, which is both its advantage and its limitation.

We know that from November 2025 to Q1 2026, the Solana ecosystem experienced three waves of hype: AI + MEME, AI Agent, and Celebrity MEME. However, after TRUMP launched his coin, the overall enthusiasm for the Solana ecosystem has declined.

╰┈✦ Debridge is a cross-chain ecosystem

Debridge is a cross-chain ecosystem. For example, during the period of MEME hype on the BSC chain, Solana experienced a net outflow of funds, while the BSC chain saw a net inflow of funds, with Solana's funds flowing to the BSC chain through Debridge.

Therefore, the Debridge ecosystem will not be locked to any single public chain, and the ecosystem and protocol revenue of Debridge will be relatively more stable.

Regardless of which ecosystem is popular, funds will flow across chains through Debridge.

┈┈➤ Different Buyback Ratios for JUP and DBR

Jupiter uses 50% of its protocol revenue to buy back JUP, while Debridge uses 100% of its protocol revenue to buy back DBR.

Thus, DBR receives more value support.

┈┈➤ Different Buyback Announcements for JUP and DBR

Debridge dynamically announces protocol revenue and buyback status on its foundation website. The daily protocol revenue and the amount of DBR increased by the foundation are clearly visible!

You can directly visit the foundation website debridge.foundation to view the above image, or go to the Debridge official website and click on the "DBR" in the navigation bar to access that site.

The project team has very simply linked the foundation site to "DBR"!

100% buyback + comprehensive dynamic announcements have won more hearts for DBR.

┈┈➤ Final Thoughts

First of all, when we talk about buybacks, we should not discuss the right or wrong of so-called "market value management."

Next, comparing the buybacks of JUP and DBR:

First, JUP itself is a very excellent project, but its buyback timing is unfortunate, while DBR's buyback timing has comprehensively considered the cryptocurrency cycle and macro conditions.

Second, JUP's buyback is limited by the rise and fall of the Solana ecosystem; its buyback coincided with a period of low enthusiasm for Solana, while DBR's buyback, due to its broad cross-chain ecosystem, has shown relatively more stable effects.

Third, JUP's buyback effort is not thorough enough, while DBR uses 100% of its protocol revenue for buybacks, along with comprehensive and dynamic announcements, which can better win people's hearts.

Remember that thecryptoskanda once discussed buybacks, believing that their effects are generally average. Brother Bee, on the other hand, thinks that buybacks can be a good remedy for token prices.

However, a 100% buyback is a strong medicine, and this strong medicine also requires more catalysts.

The timing of the buyback, the stability of the ecosystem itself, how deeply the buyback resonates with people, and even the combination with more strategies will allow the buyback to better exert its influence on token prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。