Written by: KarenZ, Foresight News

The cryptocurrency industry is never short of black swan events such as hacking attacks and lost private keys, but the scene that unfolded on the evening of February 6, 2026, at Bithumb, South Korea's second-largest cryptocurrency exchange, is enough to be etched into the annals of the most absurd blunders in crypto history, earning the title of "the ceiling of exchange confusion."

On the evening of February 6, Bithumb made a fatal operational error during the distribution of event rewards, mistakenly sending a total of approximately 620,000 bitcoins to 695 users. Based on the then price of $66,000, the total value reached a staggering $40.92 billion—an amount sufficient to render this leading exchange instantly insolvent. Fortunately, as of now, the platform has recovered 99.7% of the mistakenly sent BTC, temporarily curbing a full-blown crisis.

This "epic" fatal operational error was by no means an accidental occurrence. From the moment the mistake happened, through market turbulence, to the urgent aftermath, every link starkly exposed the shortcomings in Bithumb's internal management and risk control.

A Frightening 35 Minutes

According to two announcements released by Bithumb (the first at 00:23 and updated at 04:30) and a report from the Korean News Agency on February 7, the timeline of this error is clear and astonishing.

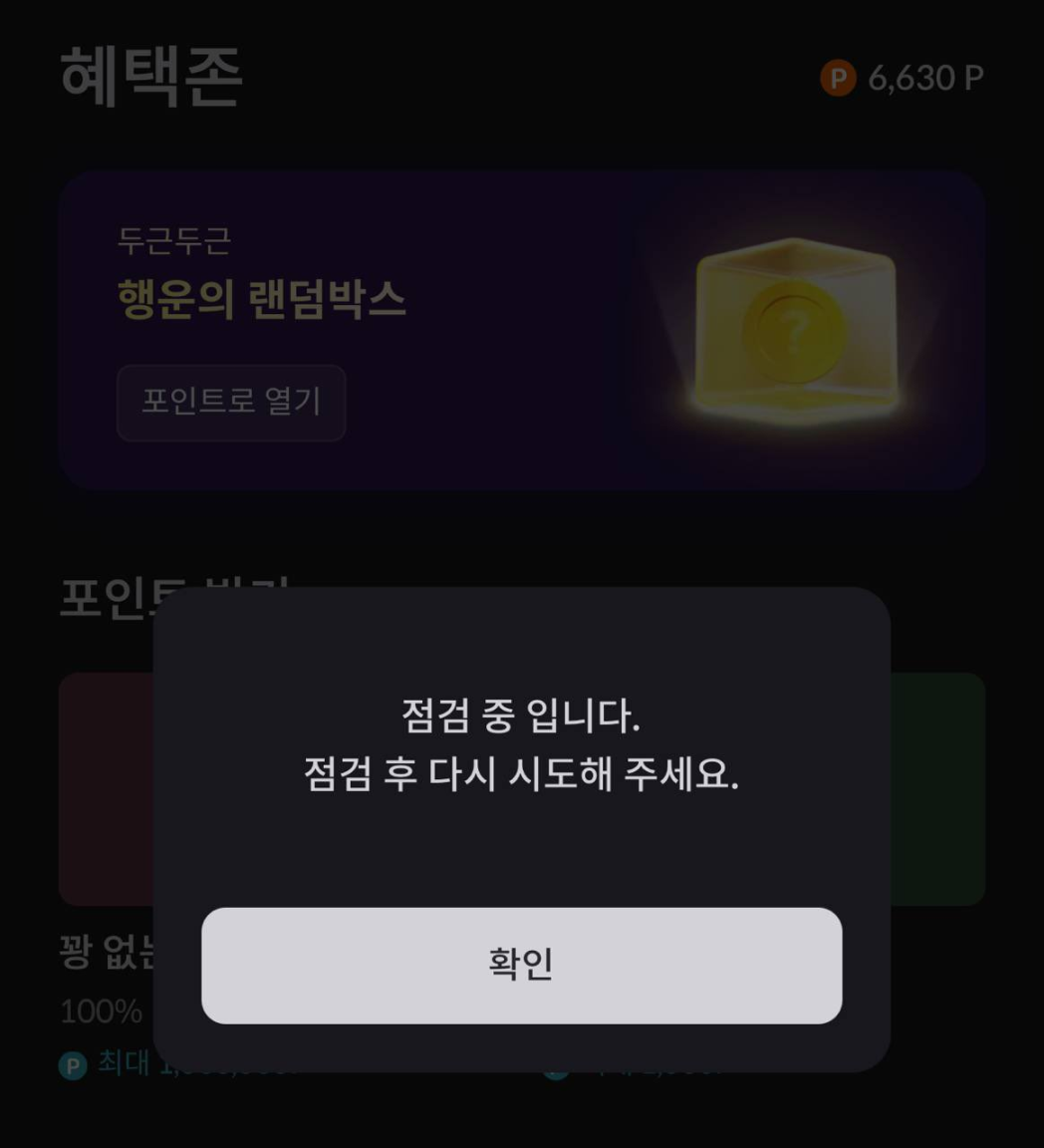

Imagine this: Bithumb's operations team is hosting a "Random Treasure Box" event, planning to distribute rewards of 2,000 to 50,000 Korean won (equivalent to $1.37 to $34.16) to 695 participating users. However, the employee responsible for the operation mistakenly switched the unit from "Korean won" to "bitcoin" when entering the reward amounts.

The originally planned reward of 620,000 Korean won ultimately turned into 620,000 BTC, with only 249 users actually opening the treasure box and receiving the mistakenly sent rewards.

Treasure box event page (Source: Definalist)

Screenshot of receiving 2,000 BTC (Source: Definalist)

The timeline of events shows a hurried and passive response:

- 19:00 KST, February 6: Rewards officially distributed;

- 19:20: Bithumb internally discovers the issue of the mistaken distribution, at which point some users have already begun to sell off their "windfall";

- 19:35: The exchange urgently initiates a trading and withdrawal freeze;

- 19:40: All relevant user accounts are locked, taking a total of 35 minutes.

The market chain reaction triggered by the mistaken distribution was immediate. Some users who received the mistakenly sent BTC chose to sell immediately, causing the price of BTC in the BTC/KRW trading pair on Bithumb to drop by 10% compared to other markets around 19:30, reaching a low of $55,410.

Fortunately, Bithumb's official announcement stated that the market price returned to normal within 5 minutes, and its "domino liquidation prevention system" operated normally, preventing any on-chain chain liquidations due to price anomalies.

At the same time, as of the announcement update, Bithumb had recovered a total of 618,212 BTC through its internal abnormal trading control system, accounting for 99.7% of the mistakenly sent BTC. For the 1,788 BTC that had been sold by users, 93% of the corresponding assets (Korean won and other virtual currencies) had also been recovered. The remaining unrecovered portion is approximately 125 BTC, and no BTC has been found to have been transferred to other exchanges or personal wallets.

The Blunder Behind the Blunder

Bithumb repeatedly emphasized in its announcement that this incident was unrelated to external hacking attacks or system security vulnerabilities, but was merely an operational error, and that user asset security was not affected. The exchange's trading and deposit/withdrawal services have since returned to normal.

However, such an explanation clearly cannot quell market skepticism—how could such a large number of BTC be mistakenly distributed without passing through the exchange's multiple review mechanisms? Is this a result of individual employee negligence, or a systemic flaw in internal management?

It is important to note that 620,000 BTC is not a small number; it accounts for approximately 2.95% of the total BTC supply, and at the then market price of $66,000, the total value reached $41 billion. The fact that such a large sum was distributed without any multiple verification steps is indicative of the chaos in its internal management.

The occurrence of such low-level errors is never just a single employee's issue; it is a concentrated manifestation of the lack of an internal management system, incomplete processes, and weak risk awareness within the enterprise.

The Reserve Controversy

If the low-level error is Bithumb's "management blemish," then the reserve controversy triggered by this incident could potentially undermine market trust. As the incident unfolded, a core question was widely raised in the market: How much BTC does Bithumb actually have in reserve? How could it mistakenly distribute BTC far exceeding its publicly stated reserve?

Bithumb's latest financial report (Q3 2025) shows that Bithumb maintains an over-reserve in bitcoin and other listed crypto assets, with a bitcoin reserve ratio (the ratio of actual bitcoins held to the book assets of users on the platform) of 100.46%. However, the specific holding quantity has been kept confidential. According to the Korean News Agency, as of the end of Q3 2025, Bithumb held 42,619 bitcoins.

In contrast, according to the latest data from CryptoQuant, as of February 7, 2026, Bithumb's bitcoin reserve was 42,304 BTC. By comparison, Binance's bitcoin reserve is 658,855 BTC, and Upbit's bitcoin reserve is 179,523 BTC.

So where did the 620,000 BTC, which far exceeds the reserves, come from?

In response to market skepticism, Bithumb stated in its official announcement that the number of tokens held in its wallet is 100% consistent with the number displayed to users through strict accounting management, and emphasized that it undergoes asset audits by external accounting firms every quarter and publicly discloses the audit results. The unrecovered and sold BTC will be supplemented through the company's own assets to ensure that user assets are not affected.

Regulatory Intervention + Decreased Trust

This mistaken distribution incident not only triggered market panic and reserve controversy but also attracted the attention of South Korean financial regulators. The Korean News Agency reported that South Korean financial authorities have clearly stated that they will conduct on-site inspections of Bithumb, focusing on investigating the circumstances of the incident, the recovery of the mistakenly distributed BTC, and whether any illegal activities occurred.

For Bithumb, regulatory intervention is undoubtedly adding insult to injury. More severely, the collapse of user trust. The core competitiveness of a cryptocurrency exchange lies in users' trust in the security of their assets. The series of failures characterized by "unit input errors, complete review failures, mysterious reserves, and passive emergency responses" has directly depleted the long-accumulated trust of users, and the platform's reputation and market share face irreversible decline.

Conclusion

The mistaken distribution of 620,000 BTC appears to be an absurd low-level human error, but in reality, it is a concentrated explosion of internal management loopholes, lack of transparency in reserves, and weak risk awareness within the cryptocurrency exchange.

Bithumb's lesson is straightforward and harsh: under the rapid expansion of the industry, if the most basic process control, asset verification, and risk warning are abandoned, even the largest exchanges can collapse in an instant due to a "slip of the finger." However, since the FTX collapse, exchanges like Binance, Bybit, and Bitget have begun to implement regular proof of reserves (PoR) disclosures.

For ordinary users, this serves as a hard reminder: cryptocurrency assets are inherently high-risk, and the priority in choosing a platform should always be "transparency, compliance, security, and solid risk control" far above "high returns and high activity subsidies."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。