"Speaking of it is quite sad, it's true that not everyone likes me." Our pain often comes from falling into the vortex of "self-confirmation", seeking to please others or seeking validation from others to prove our own worth. Under the influence of excessive psychology, the "hammer person effect" is formed, holding a hammer and seeing everything as a nail.

Guo Degang described it in his book "Just Right": If a scientist is told that rocket fuel cannot be made from liquid hydrogen, diesel is more cost-effective, and it's best to use coal balls, if the expert explains a single word, he has lost. When someone says the market will fall, before the words have even landed, someone has already given up on going long, letting a group of monkeys guess the market trend, can the monkey that guesses correctly 10 times in a row give advice for the 11th time?

Market review:

The U.S. July JOLTS job openings fell more than expected to the lowest level in over two years, and the August Conference Board Consumer Confidence Index significantly declined, with the market's bet on a November rate hike dropping to 42%. U.S. stocks rose for three consecutive days, with the Dow rising nearly 300 points, the Nasdaq rising over 2%, Tesla rising nearly 8%, Nvidia rising over 4% to a new high, and the approval of a physical Bitcoin ETF boosting Coinbase by 15%.

U.S. bond yields plunged across the board by more than 10 basis points, with the 2-year U.S. bond yield plummeting 16 basis points from its daily high. The U.S. dollar index fell below 104. The yen fell below 147 to hit a nine-and-a-half-month low before rebounding. Bitcoin rose by 7%, hovering around $28,000.

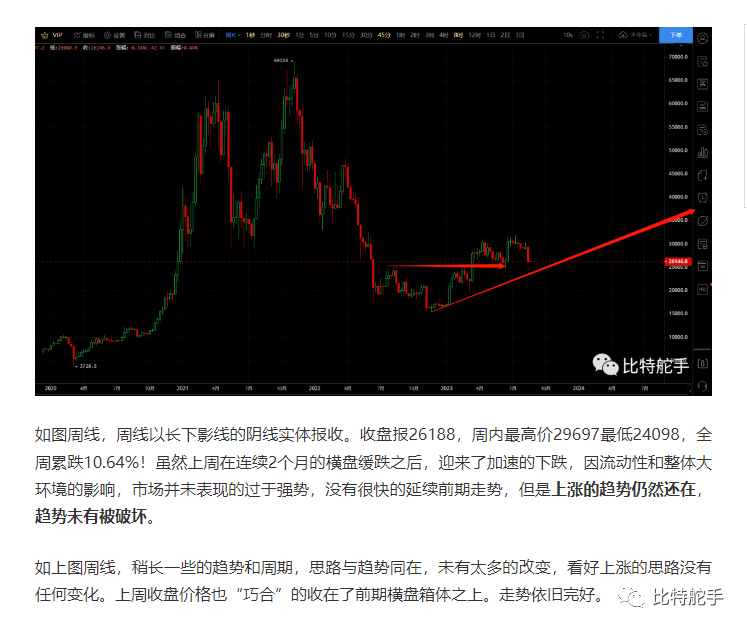

As shown in the Bitcoin weekly chart, stimulated by data, the price accelerated its decline, which is extremely favorable for speculators waiting to buy with an empty position. The previous wave from 24,800 to 31,800 was perfectly profit-taking. A reversal signal appeared intraday, and the helmsman directly indicated the price reversal, with insufficient liquidity and a slow market volatility, the price once again experienced nearly 10 weeks of slow decline. Such two waves of market movements used to be completed within a day or two, but now it takes half a month or even a month…

Friends who have been following the helmsman should be very clear that we went long on any price below 26,000 and bullish above 31,500, and then turned bearish below 29,000, 28,000, and around 27,700. When we first reached 27,700, we also attempted to go long intraday, but ultimately regretfully exited at a loss, as was real-time alerted in previous articles. Stimulated by intraday data, the market trend exceeded expectations. The market is always right, and any prediction is probabilistic analysis and judgment. Therefore, we need to rationally view analysis and judgment, be humble yet confident, and have awe without lacking courage! The intraday price accelerated its decline to nearly 24,000. It then quickly rebounded nearly 3,000 points to reach 27,000, fluctuated around 26,000 for several trading days, and in the last two trading days of the month, the price quickly surged back to around 28,000 last night. We repeatedly indicated intraday that any price below 28,000 can be bought long in spot. Did you buy? Due to the low volatility and long holding time of the contract, and the concern about being liquidated, no real-time strategy was given, but still several friends are holding long positions near 24,500 and around 1,470 for Ethereum, and often seek the helmsman to recharge their faith.

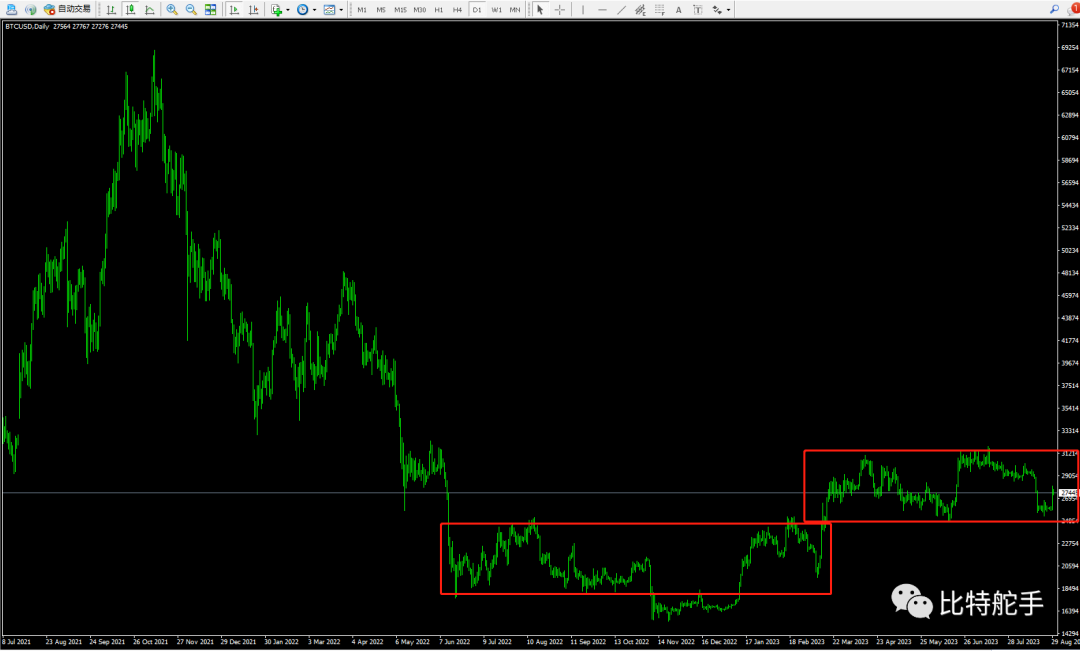

The above chart shows the Bitcoin daily chart. This is how the price is, and this is how the market is, moving from one trading range to another. This is probably the rhythm of a bear market.

The above chart shows the Bitcoin monthly chart, with a red line marked for everyone to easily see the price trend!

The price started to rise from December last year, and entered a high-level oscillation range from April this year. The range repeatedly confirmed the effectiveness of the previous breakthrough support, and this month once again tested the support level.

As shown in the chart, the price has closed above the red line for the past five months, and until yesterday of this month, the price has been below the red line, approaching the end of the month, the main force couldn't hold back. It quickly surged by 2,000 points, and the price once again stood above the red line. The market indicated that the price is still dominated by bulls, and the small intraday pullback is just an interlude.

Market outlook:

This month will soon come to a perfect close with only two trading days left. In the next two trading days, the helmsman believes that there will only be two possible trends intraday: oscillation or a big surge!

In simple terms, there will be no downtrend intraday in the next two trading days, and the price will most likely only oscillate or surge.

Therefore, in terms of strategy, it is not recommended to go short intraday, as a decline or oscillation may last for 12 or 20 hours, but a big surge may only take a few minutes, so follow the trend!

The strategy and view of buying spot long at any price below 28,000 have not changed at all. Even at the current price of 27,444, it is still below 28,000. Buying spot at the current price is still appropriate! We have given opportunities at 24,000, 25,000, 26,000, especially 26,000 for almost a week, don't tell me there is no opportunity, we need to respect the market, but we cannot lack courage and determination!

Due to the low intraday volatility of the contract and the long holding time, the risk is too high, and real-time alerts will be given intraday if there is an opportunity!

The following is a screenshot of the content of the previous article, welcome to review! You can read the articles from the recent period together, and you will find that the mindset has never changed, regardless of whether the price has exceeded some expectations, our judgment of the trend is extremely firm, and our confidence is unwavering!

If there are any changes in the intraday price, the helmsman will give real-time alerts!

All analysis and judgments are probabilistic predictions, the market is risky, and speculation needs to be cautious!

All analysis and judgments are probabilistic predictions, the market is risky, and speculation needs to be cautious!

All analysis and judgments are probabilistic predictions, the market is risky, and speculation needs to be cautious!

2023.8.30

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。