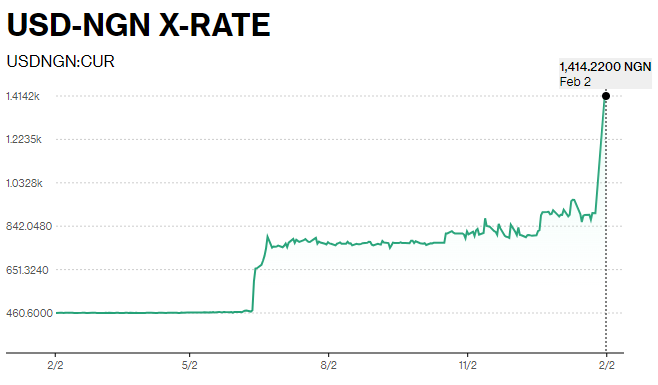

Nigeria's currency has lost 2/3rds of its value relative to USD over the past year.

Anyone holding domestic cash/deposits had their savings greatly devalued, and everyone who is paid in the local currency who can't negotiate a tripling of their income has less purchasing power.

There are 160+ currencies in the world, with each one being a centralized ledger. Many of them lose value rapidly, with this being the most recent example, affecting 200+ million people.

Since the currencies are all localized monopolies, people historically had little choice other than to denominate contracts and savings in them, and keep getting rug-pulled.

The wealthy often have more avenues to get foreign bank/brokerage accounts to hold value elsewhere, while the less wealthy often have fewer ways to get out of the repeated rug-pulling with whatever modest savings they have.

Technologies like bitcoin for the long term and stablecoins for the intermediate term give me people more options. They take what was once mostly accessible to the wealthy (more solid value outside of the control of the local centralized rug-pulling ledger), reduce the overhead of it, and make it more available to everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。