Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Thursday, April 4, 2024, and I am Yibo! We are not predicting trades, but actually observing market fluctuations (narrowing, spreading), structure (market batch structure), emotions (external market such as US stocks, USD, etc.). As a trader, you (through trading) affect prices, and prices also affect you (emotions and behavior).

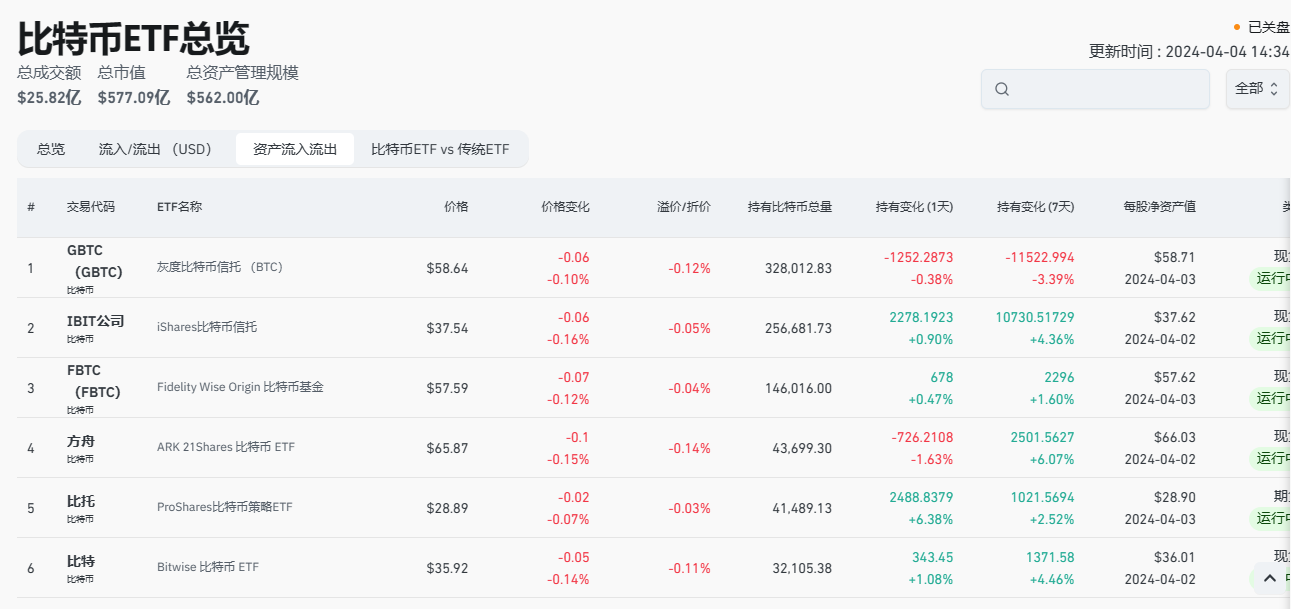

It's less than 20 days away from the halving of Bitcoin. The decline or oscillation before the halving is an opportunity to get on board. The second half of the bull market will occur after the halving. In the second half, Bitcoin funds will overflow into other sectors. The traditional altcoin season will occur after the Fed rate cut. Hold onto high-quality assets in hand, the decline is temporary, and the rise is the main theme of the bull market. The Fed rate cut in the second quarter is a high probability event. The Swiss National Bank has already cut interest rates, and the European Central Bank has also indicated that it will cut interest rates as soon as possible. Through the essence, everything follows the law of large cycles. It's still early to say the bull market is ending, at least until the end of the Fed rate cut cycle, there is no need to worry too much. The recent decline can be seen as the result of US data suppressing expectations of a Fed rate cut. However, with the halving and the expectation of a rate cut, Bitcoin will experience a halving period, with supply halving and increased demand (continuous ETF buying). It's hard to imagine a significant drop in Bitcoin. The market will quickly resume its upward trend. To make substantial profits in a bull market, it's important to acquire chips at low prices and not sell them easily. Once sold, the subsequent investment logic and behavior will be distorted. Losses in a bull market are often caused by unnecessary mistakes. The bull market cycle is not easy to come by, and missing it means waiting for the next cycle.

The trend of Bitcoin yesterday was consistent with my live broadcast analysis. After three attempts to test the 64500 support level, it rebounded, forming a temporary bottom. The market then rose to the 66900 level but was resisted and fell back. Currently, the price is running around 65700. On the four-hour chart, it is suppressed by the MA14 moving average and the MACD shows a shrinking bearish volume with signs of a golden cross. In the short term, the market is in a stage of oscillation and repair. The rebound was resisted and there is still a demand for a pullback in the short term. As long as it holds above 65000, this wave of decline will temporarily end. Looking at the daily chart, the strength of the rebound is not strong, with upper shadow lines, indicating a potential need for a pullback. If this wave falls below the 64500 support, it will test the support in the 60,000-61,000 range again. This adjustment period is relatively long. As long as it does not break 60,000, continue to operate with a bearish bias. However, be cautious of a false breakthrough followed by a rapid rise. The current strategy remains to buy on dips, with resistance at 66700-67500 and support at 65000-64500.

Ethereum rose in the early morning yesterday to test 3370 before falling to 3252, and is currently hovering around 3300, showing a fluctuating trend as the market framework shifts from strong to weak. This kind of closing in an upward trend is a reversal signal. The daily chart shows a very obvious bottom-churning process, with the price kneeling and finding support near the lower Bollinger Band. Currently, the Bollinger Bands are flat, forming a wide-ranging oscillation zone. After repeated attempts to test the bottom, the price will eventually rise to near the previous high or even break through, in line with the rhythm of rise-adjustment-rise. Unless there is a strong decline breaking through the previous low, the current bottom is likely a process of absorbing chips before another high. If the second high does not break the previous high, a larger adjustment may occur, followed by a one-way upward trend. If the second high directly breaks through the previous high, it is a signal of a strong return.

In this market, it ultimately comes down to ability. If your ability is insufficient, the market will eventually take back what it has given you. Therefore, when your wealth exceeds your ability, you need to control the drawdown, even though this control is futile. Because that kind of profitable arrogance and arrogance will ultimately destroy a person's rationality. However, in the capital market, we don't have to worry about the situation where our wealth is lower than our ability, because this kind of imbalance will eventually be corrected by time. If it is not corrected, there is only one reason, which is that your ability is insufficient. If you are still in a state of confusion, don't understand the technology, can't read the market, don't know when to enter, don't know when to stop loss, don't know when to take profit, randomly add positions, get trapped at the bottom, can't hold onto profits, and can't seize the opportunity when the market comes. These are common problems among retail investors. But it's okay, come to me, and I will guide you with the correct trading mindset. A thousand words are not as good as one profitable trade. Instead of frequent operations, it's better to be precise, making each trade valuable. What you need to do is find me, and what we need to do is prove that our words are not empty. 24-hour real-time guidance for trading. Market volatility is fast. Due to the impact of review timeliness, real-time layout based on actual trading is the main focus for the subsequent market trends. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。