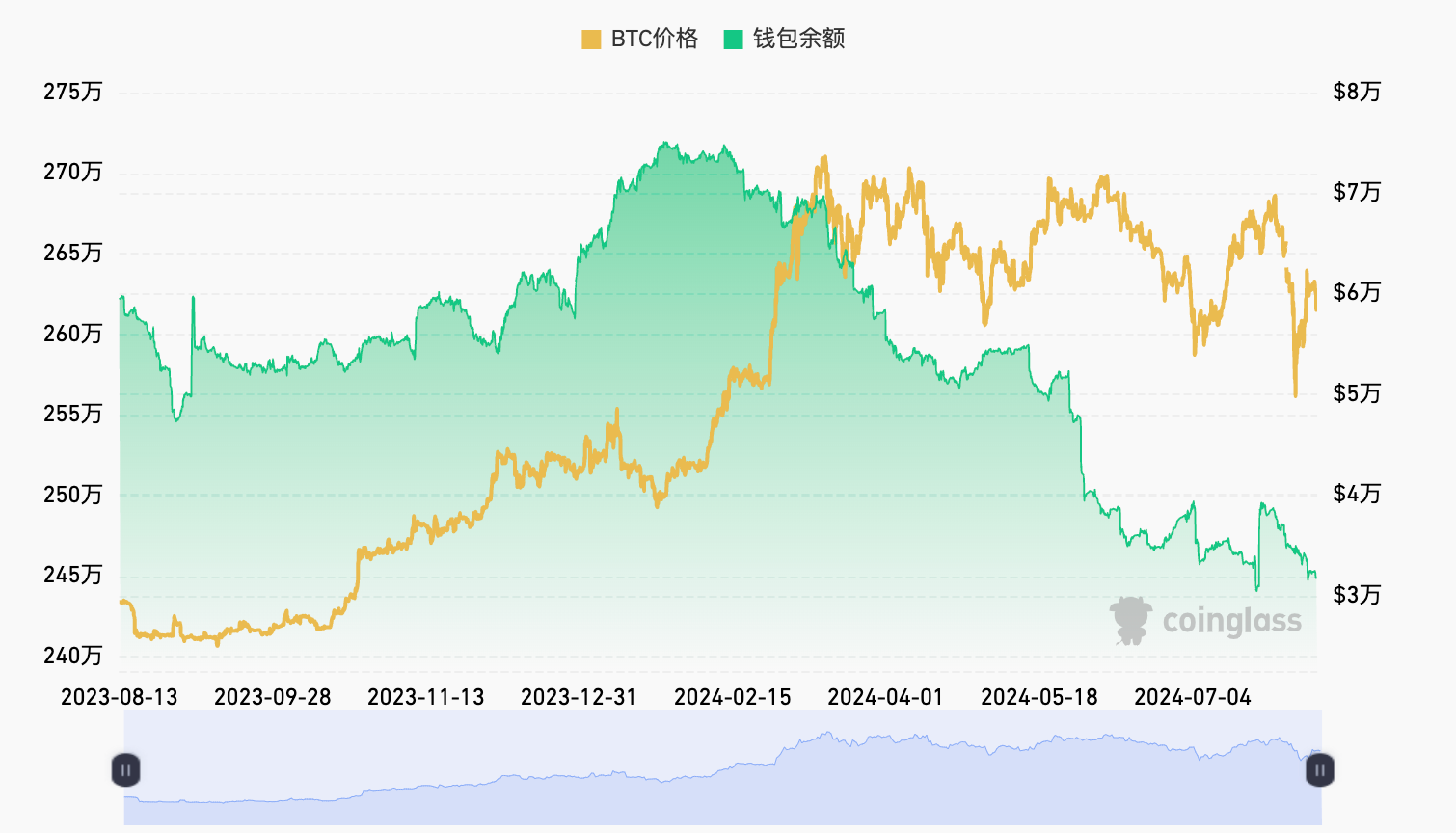

Data Analysis: In the past month (starting from July 11, 2024), 99,308 BTC were transferred out from CEX, worth $5.96 billion. Data shows that CEX currently holds 2,679,880 BTC (worth approximately $161 billion), reaching a new low since November 19, 2018.

Interpreting this data, we can see that nearly 100,000 BTC, worth about $6 billion, were transferred out from CEX in the past month, reflecting significant changes in investor behavior in the cryptocurrency market. A large amount of BTC being withdrawn from exchanges may indicate a decreased interest in short-term trading among investors, who are now seeking longer-term and more secure holding methods, such as self-custody or cold storage.

The current amount of BTC held by CEX dropping to a new low since November 19, 2018, further confirms the shift in investor confidence. This change may have various impacts on the market.

Firstly, the reduction in BTC supply in the market may provide support for its price, as the decreased circulation may increase scarcity in the market, thereby driving up prices. Secondly, the preference for self-custody among investors may lead to more funds flowing into DeFi and other non-custodial solutions, further driving the decentralization trend in the cryptocurrency market. This may continue to influence the market, promoting a more mature and stable cryptocurrency market.

Of course, any market change comes with uncertainty, and while history can be a reference, it may not always follow a pattern. As I have previously analyzed, a large portion of the flow has now gone to ETFs, essentially trading in the secondary market, with approximately 1 million BTC. When combined with BTC within the crypto space, the total quantity inside the market has not actually decreased, and may have even increased.

Additionally, let's discuss "How to Use Staggered Entry and Buy Low, Sell High Strategies to Deal with BTC's Wide Fluctuations".

I. The Value and Practice of Staggered Entry:

In the cryptocurrency market, price fluctuations exhibit strong and difficult-to-predict characteristics. Investing all funds at once may entail significant risks, while staggered entry can significantly reduce risks and increase the probability of capturing favorable entry opportunities.

Effective risk reduction: If the price of BTC sharply declines in the short term, investing all at once may lead to substantial losses. However, staggered entry allows for gradually building positions at different price levels, achieving cost averaging and greatly reducing the risk of significant losses caused by buying at a single price point.

Seizing more opportunities: Accurately determining the market bottom is challenging. Staggered entry allows for gradual buying during price declines. Even if the initial entry point is not the lowest, subsequent batches can accumulate more chips at lower prices.

So, how should staggered entry be implemented? First, determine the total investment funds. For example, if it's $100,000, divide it into several equal parts. For instance, divide it into 5 parts, each worth $20,000. When the BTC price drops from $60,000 to $57,000, buy the first part. If the price continues to drop to $54,150, buy the second part, and so on. However, it's important to adjust the buying intervals and proportions flexibly based on market conditions and your risk tolerance.

It's important to note that the prices mentioned above and below are for illustration purposes only and not actual strategy references.

II. The Principle and Key Points of Buy Low, Sell High:

Buy low, sell high is the core of achieving profits in wide fluctuation markets. Its essence lies in selling at relatively high levels and buying at relatively low levels.

Controlling market fluctuations: Wide fluctuations mean that prices fluctuate significantly within a specific range, rather than showing a one-sided upward or downward trend, oscillating between high and low prices.

Clear high and low points: Combining technical analysis and market experience, for example, using Bollinger Bands, when the price touches the upper band, it may be a suitable selling opportunity, while touching the lower band may be an ideal buying opportunity. Also, closely monitor trading volume and fund flows. During a price increase, if the trading volume initially increases and then decreases, it may indicate insufficient upward momentum, serving as a selling signal. In actual operations, it's important not to be too greedy. Capturing relatively high and low points is sufficient. Manage positions well, retain a certain base position after selling to guard against price reversals, and maintain composure and patience, not being swayed by emotions.

III. Comprehensive Application Example of Staggered Entry and Buy Low, Sell High:

Assuming the BTC price is at $60,000 and the market is expected to exhibit wide fluctuations, with a lower range of $49,000 and an upper range of $73,777. You plan to invest $80,000, dividing it into 4 equal parts, each worth $20,000. When the price drops to $54,000, buy the first part; when it drops to $49,000, buy the second part. If the price rebounds to $59,000, sell a portion of the position, for example, 20%. When the price rises to $65,000, sell another 30% of the position. Then, wait for a price pullback. If it falls back to $57,000, buy a certain proportion of the position. It's important to emphasize that this is an example for illustration purposes and not an actual strategy.

Furthermore, the cryptocurrency market is highly uncertain and risky. Staggered entry and buy low, sell high strategies are not absolutely effective, as the market may experience unexpected and drastic fluctuations, leading to strategy failure. Before trading, it's essential to conduct risk assessment and manage funds properly to avoid significant losses due to incorrect decisions. Continuous learning and experience accumulation, improving technical analysis skills and market judgment, are necessary to achieve more ideal returns in a wide fluctuation market environment. In summary, staggered entry and buy low, sell high are effective strategies for dealing with BTC's wide fluctuations, but caution must be exercised in their application, tailoring trading plans to individual circumstances and specific market conditions. The cryptocurrency market experiences exceptionally violent fluctuations, with high risks. The above content is for reference only, and careful consideration is necessary when making decisions.

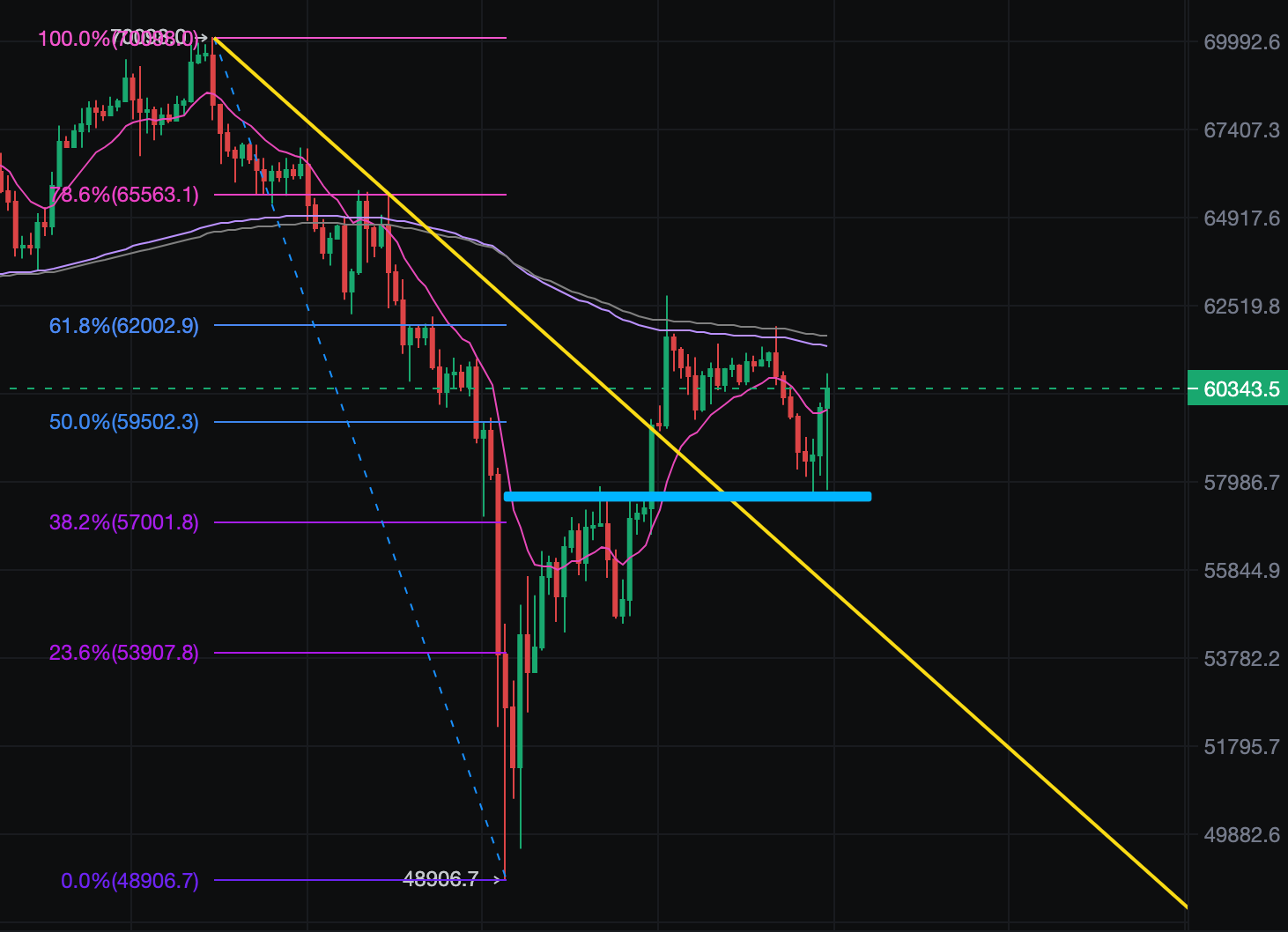

The above is an example. Now, let's look at practical operations. In this round, I operated in this manner as well. I suggested shorting at 70,000/65,600, and many people also profited from this downturn. Previously, I personally made staggered long positions at 54,250/52,860/50,580, gradually increasing the position, essentially using a pyramid-style position building. This also helped capture the low point of this market trend.

Regarding the lowest point of $49,000, whether it was my prediction of $48,000 in mid to late June, or the $50,000 I mentioned in early Monday discussions with friends, or the analysis mentioning the annual MA365 line at $49,080, they were all relatively close. The midpoint I set at $48,500 did not execute.

When the price rebounded last Friday, I closed long positions near $59,500/$62,150 and entered short positions in staggered fashion. The short position at $62,000+ was a position I repeatedly mentioned in analysis and discussions with everyone.

Today, the price dropped to around $57,600, validating the rationality of our operations. If you operate in this manner, first reduce the actual leverage ratio. I usually operate with a real leverage of 3 times. Additionally, position arrangement is important. If you adopt a martingale strategy or what I often refer to as a pyramid-style staggered position building, you need to control your capital and gradually increase positions. You can refer to this.

In a wide fluctuation market, if you define the range well, we have a relatively high probability of winning, and we can have a high probability of making a profit.

Let's also briefly analyze today's market: Overall, the weekend maintained a oscillating trend. Pressure was encountered near $62,000, around the Fibonacci 61.8% level, and the current short-term support is around $57,000 and the previous retracement point near $54,500. Staggered entry can be considered. To continue shorting, resistance can be found near $62,030 and $63,450.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。