Since the Federal Reserve cut interest rates by 50 basis points in September, Bitcoin has risen by 14%, while Ethereum has only increased by 12%. The weak institutional demand for Ethereum has caused the ETH/BTC ratio to drop to its lowest level since April 2021. Bitcoin has benefited from inflows into exchange-traded funds (ETFs), while Ethereum has underperformed compared to other mainstream cryptocurrencies. Additionally, Chu Yuechen believes that Ethereum will struggle to consistently outperform Bitcoin until there is a significant shift in institutional demand.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference on 10.22

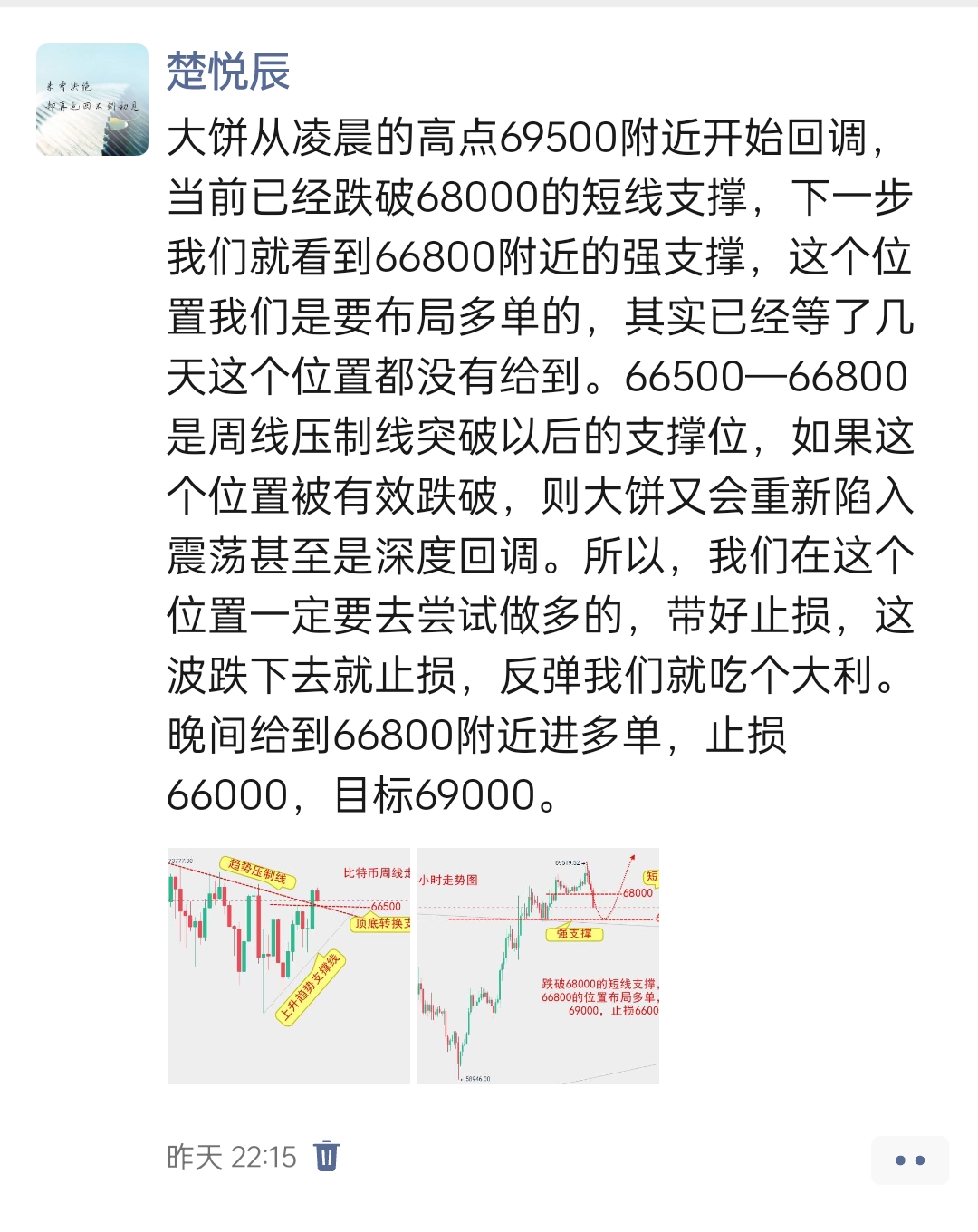

We have repeatedly mentioned going long around 66800 for Bitcoin. Last night and this morning, there were two opportunities to enter, and as of now, the rebound has been quite good, approaching 68000. This position can at least yield over 1000 points, and those who followed have benefited. Friends who want to follow in real-time, send me a private message; there are too many people to attend to everyone, so I will arrange based on the messages received.

Returning to today’s market, we have mentioned multiple times the importance of the 66500—66800 range for Bitcoin from both daily and weekly trend perspectives. This is a significant support level for the trend resistance line, so I won’t elaborate further; it is already marked on the daily chart. If anyone still doesn’t understand, we can discuss it privately.

On the short-term hourly chart, we can see that the short-term pressure is around 68000. If today’s daily close is above 68000, then the market may quickly push towards 70000. If not, it will likely oscillate at lower levels for a while. In any case, we are optimistic about breaking this year’s high of 73777 in the medium to long term.

For intraday short-term contract trading, we suggest entering long positions in the 66500—66800 range, with a stop loss at 66000 and a target of 68000. The medium to long-term target is initially set at 70000.

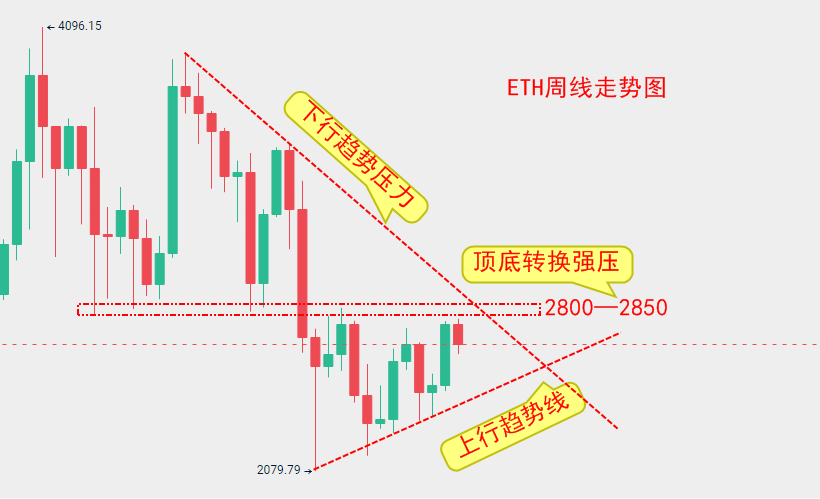

For ETH, we have also mentioned multiple times that the key trend to watch is the strong resistance at 2800—2850. This area is a technical turning point and a psychological level for traders, making it very challenging for ETH to break through this resistance. Therefore, while we are optimistic about Bitcoin continuing to push for new highs, we do not expect ETH to perform significantly better. If Bitcoin sets a new historical high, it will also likely drive ETH higher, but not by much, so please keep this in mind.

For intraday short-term contracts today, we will focus on the short-term pressure at 2680—2700. If it can break through, it will aim for the 2800 level; if not, it will continue to oscillate. When the price reaches the 2600—2580 range, we will enter long positions, with a stop loss at 2550 and a target of 2680—2700.

Specific Operation Suggestions (Based on Actual Market Prices)

Enter long positions in the 66500—66800 range for Bitcoin, with a stop loss at 66000 and a target of 68000. The medium to long-term target is initially set at 70000.

Enter long positions in the 2600—2580 range for ETH, with a stop loss at 2550 and a target of 2680—2700.

Before the market moves, any analysis can be correct and has its reasons, but no position is absolutely accurate and all carry risks. Therefore, the premise for gains must be proper risk control. The market changes in real-time, and the strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are borne by the investor.

Many individual investors find it difficult to enter the trading door, often simply due to the lack of a guide. The questions you ponder may be easily resolved with a single prompt from an experienced person. Daily real-time market analysis, along with guidance in experience exchange groups, and evening practical guidance in muted groups, are available for real-time assistance. Evening live broadcasts will explain real-time market conditions.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。