This week, the net inflow of Bitcoin ETFs reached $997.7 million, marking positive growth for the third consecutive week. In addition to Bitcoin returning to $65,000 on Tuesday, the inflow for the week has been positive.

Moreover, last week, the demand for U.S. spot Bitcoin ETFs hit a six-month high, with a net inflow of approximately $4.4 billion over the past 30 days. Currently, since January, the net inflow for Bitcoin ETFs has reached $22 billion.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for 10.28

Over the weekend, Bitcoin maintained a narrow range of fluctuation between $67,000 and $68,000. On Saturday night, I provided a market order for $67,000, resulting in a profit of 1,000 points.

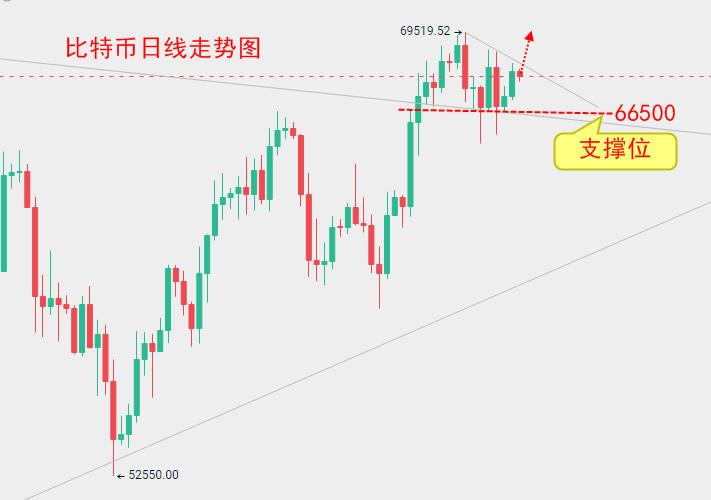

Last week, Bitcoin primarily experienced high-level fluctuations, facing resistance at $69,000 and two downward spikes below $66,000. The daily closing price has consistently remained above $66,500, indicating that bullish support is still relatively strong.

We have always stated that the overall trend is upward, but it won't be a continuous rise; fluctuations and pullbacks are inevitable, and this remains the case.

As we mentioned before, the two downward spikes did not lead to a significant drop, so we continue to anticipate an upward movement. Therefore, on Saturday, I provided a market order for $67,000, and I still hold this view, optimistic about breaking through $70,000. Thus, we continue to choose long positions, entering near $67,800, with a stop loss at $67,000 and a target of $69,000 to $69,500.

ETH follows the trend of Bitcoin but is relatively weaker, which means that if Bitcoin pulls back, ETH will pull back even more. Therefore, for contract trading, it is advisable to refer to Bitcoin and trade in the same direction. The current price of ETH is around $2,480, and we will also take long positions, with a stop loss at $2,440 and a target of $2,560.

Contract trading emphasizes adaptability. We are neither bullish nor bearish; in fact, the trend does not significantly impact short-term contract positions as long as you do not hold onto losing trades. The trend is not important for you.

If you want to engage in medium to long-term trading, you need to pay attention to the trend, find good entry points, and be able to withstand volatility. You must also hold yourself to strict standards; if you realize that your trend judgment is incorrect, you should decisively exit to avoid deeper losses.

Specific Trading Suggestions (Based on Actual Market Prices)

Long position for Bitcoin near the current price of $67,800, with a stop loss at $67,000 and a take profit at $69,000 to $69,500.

Long position for ETH near the current price of $2,480, with a stop loss at $2,440 and a take profit at $2,560.

Market conditions change in real-time, and there may be delays in article publication. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are your own responsibility.

Many individual investors find themselves unable to enter the trading door, often simply due to the lack of a guide. The questions you ponder may be easily resolved with a single suggestion from an experienced person. Daily real-time market analysis, along with experience-sharing groups and practical trading groups, welcome you to receive real-time guidance. Irregular evening live broadcasts explaining real-time market conditions.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。