Zhou Yanling: 10.29 U.S. Election Stimulates Continuous Surge in Cryptocurrency Prices, Can the Uptrend Continue? Latest Analysis Here

As the U.S. election approaches, Bitcoin has surged above $70,000 this week. The election results are widely seen as a key catalyst for this rise in Bitcoin, along with the ongoing situation in the Middle East also having an impact. Meanwhile, data shows that approximately $3.1 billion in net inflows have been attracted by U.S. Bitcoin spot ETFs this month. With about a week left until the U.S. election, investor optimism towards cryptocurrencies is clearly continuing to strengthen. In the previous months, Bitcoin's price had been confined within a range of $55,000 to $70,000. However, with U.S. stocks hitting new highs this month, the election on November 5, and the Federal Reserve's interest rate decision on November 7 approaching, Yanling personally expects Bitcoin's price to continue to break new ground. However, the operational risks in this market are also significant, and everyone should act within their means, avoiding blind following of trends, and remember to implement risk control measures.

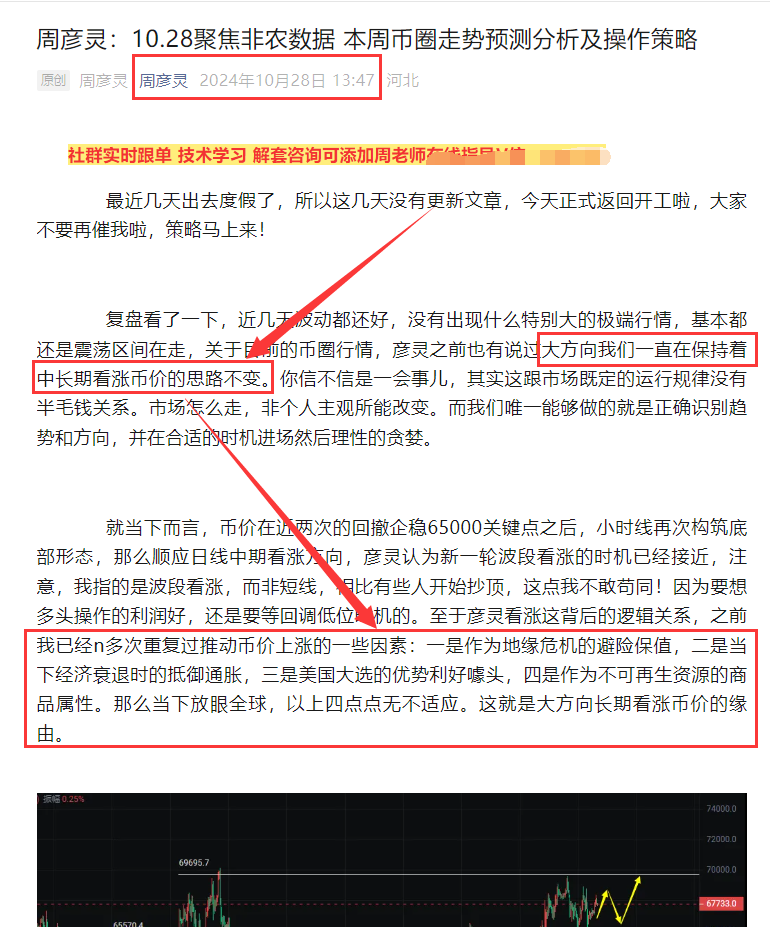

Today's operation is undoubtedly to maintain a bullish outlook as yesterday. Currently, the price is still temporarily maintaining a high position in the daily trend, and the strong trend in the larger time frame has not changed. In the daily trend, the K-line has started to gradually rise above the short-term moving averages, and the price is slowly breaking out of the previous range of pressure, indicating that there is still room for continued upward movement in the daily trend. In the 4-hour time frame, the short-term moving averages are beginning to diverge upwards, and the price has almost no room for a pullback near the previous pressure zone. Today, we can continue to pay attention to whether there is room for a second surge. Let's observe the adjustment and repair situation in the smaller time frame. For support, pay attention to 69,600; as long as it stabilizes above this level, any pullback is an opportunity to enter long positions again. The upper pressure levels to watch are 72,000 and 73,800 for strength and weakness.

10.29 Bitcoin Trading Strategy:

Long at 70,500-71,000, stop loss below 70,000, target around 72,000, continue to look for a breakout towards around 72,800.

Short at 72,700-72,200, stop loss above 73,200, target 71,500-71,000.

10.29 Ethereum Trading Strategy:

Long at 2,570-2,600, stop loss below 2,540, target 2,650-2,680-2,720.

Short at 2,720-2,680, stop loss above 2,760, target 2,630-2,590.

[The above analysis and strategies are for reference only. Risks are to be borne by the reader. The article's review and publication may have delays, and the strategies may not be timely. Specific operations should follow Yanling's real-time strategies.]

This content is exclusively shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for over ten years, currently mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV, and other cryptocurrency contracts/spot operations. For more real-time community guidance, consultation on position recovery, and learning trading skills, you can follow the teacher's public account: Zhou Yanling to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。