Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the King’s articles and videos, and I hope the brothers who have been following the King will return.

**Click the link to watch the video: **https://www.bilibili.com/video/BV1oiDhYjEAo/

In the article published on November 4th, I proposed a short-selling strategy during the rebound, setting 6.93/2500 as the entry point for shorting. The price of Bitcoin rebounded to around 6.92 at its highest, then dipped to 6.7, successfully achieving over 2000 points in profit from the short position, with accurate strategic judgment. Currently, there is a short-term rebound; let’s see how to operate next, please read on.

The U.S. election has a significant impact on the price trend of Bitcoin, mainly in the following aspects:

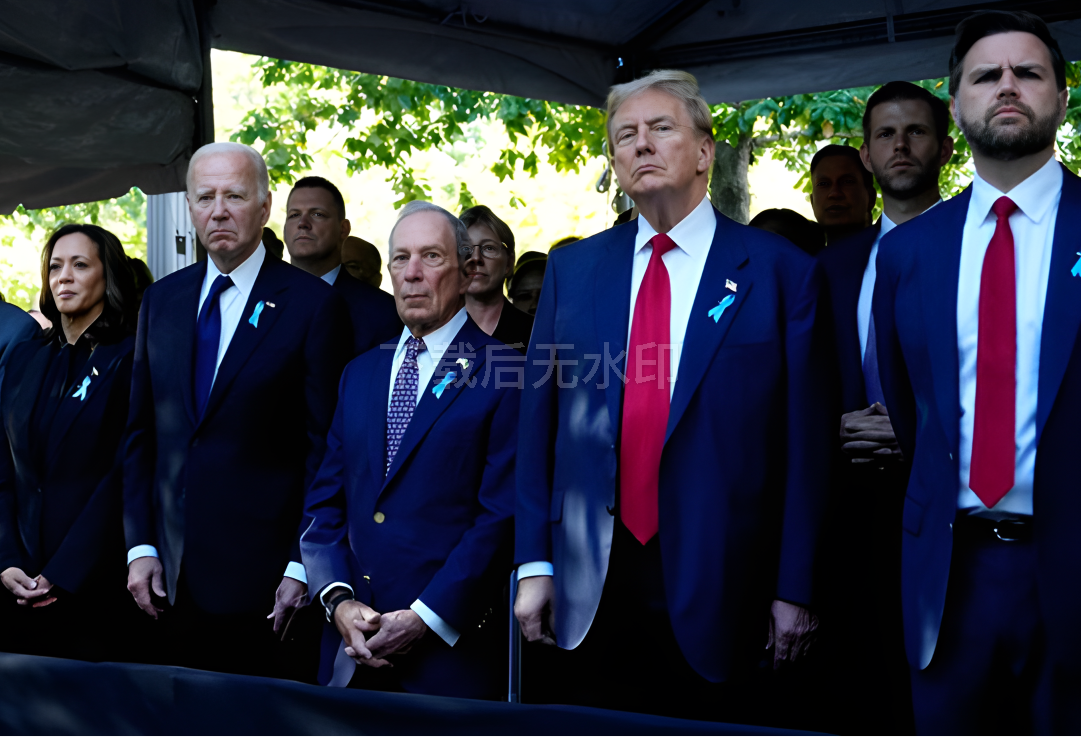

Policy Aspect: If Trump is elected, he wants to make the U.S. the capital of Bitcoin and establish related advisory committees and Bitcoin reserves, which may lead to relaxed regulations and likely an increase in Bitcoin prices. If Harris is elected, she will create a cryptocurrency regulatory framework, which is more cautious, and Bitcoin prices may experience significant fluctuations in the short term.

Market Sentiment Aspect: If people believe a certain candidate is good for Bitcoin, the market will be optimistic, and Bitcoin prices are likely to rise. If the election results are unclear, investors will be cautious, leading to increased volatility in Bitcoin prices.

Macroeconomic Aspect: The new president's fiscal and monetary policies will change the economic and monetary situation in the U.S. For example, Trump’s tax cuts may lead people to believe inflation is coming, prompting them to view Bitcoin as a hedge against inflation, which could drive up Bitcoin prices. Additionally, the election results will also affect the dollar's trend; generally, the dollar and Bitcoin prices move inversely, so changes in the dollar's trend will also affect Bitcoin prices.

The daily chart of Bitcoin shows that yesterday its price fell as previously analyzed, dropping to the daily MA30 moving average, then halted its decline and began to rebound. Now we need to see if its price can return above the daily MA5 and MA10 moving averages, as the prices above these two moving averages are a pressure point for a short-term rebound.

Looking at the 4-hour chart, last night the price of Bitcoin fell below the 4-hour MA120 moving average, which corresponds to a price of 6.86. After breaking below, the price fell even faster, reaching 6.7. Now, the price has rebounded back up to around 6.86, and we need to see if it can surpass 6.86 again. Furthermore, the overall strength or weakness of the Bitcoin market is crucially determined by the 1-hour MA256 moving average, which corresponds to a price of 6.93.

BTC Operation Strategy: When the price is around 6.92, a light short position can be taken. If it rebounds to 6.96, add to the position and continue shorting. Our target is around 6.8; if the price breaks below this level, reduce the position appropriately, but continue to hold, looking further towards the 6.7 line.

This is the strategy for Bitcoin today. If any friends are stuck in positions, feel free to reach out to the Coin Victory Group, and I will help you resolve the issues.

From the daily chart of Ethereum, yesterday's market trend was quite similar to the analysis in the article. The price adjusted back to test the 2380 - 2350 range, which serves as a support level for it. Currently, the overall market is still relatively weak, oscillating and adjusting. How do we determine the resistance level? We can first look at the 4-hour MA5 and MA10 moving averages. If the price does not break through these two moving averages and cannot stabilize above them, we will continue to look for short positions.

ETH Operation Strategy: When the price is around 2450, a light short position can be taken. If the price rebounds and reaches 2480, add to the short position. First, target 2400; if the price breaks below this target and continues downward, reduce the position but continue to hold, looking further towards the 2380 line.

Attention! The short-term market has stopped falling and started to rebound. During intraday trading, pay attention to the strength of the pullback. If the price continuously rebounds and stabilizes above 6.95, we can no longer simply consider the market as a one-sided decline.

This article is independently written by the Coin Victory Group. Friends in need of current price strategies and solutions can find the Coin Victory Group online. Recently, the market has been mainly characterized by oscillation, accompanied by intermittent spikes, so when making trades, remember to control your take-profit and stop-loss levels. In the future, when facing significant market data, the Coin Victory Group will also organize live broadcasts across the internet. Those who wish to watch can find the Coin Victory Group online and contact me for the link.

Mainly focused on spot and contract trading, BTC/ETH/ETC/LTC/EOS/BSV/ATOM/XRP/BCH/LINK/TRX/DOT, specializing in styles, mobile locking strategies centered around high and low support and resistance for short-term fluctuations, medium to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, and monthly head predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。