The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome all coin friends to follow and like, and reject any market smokescreens.

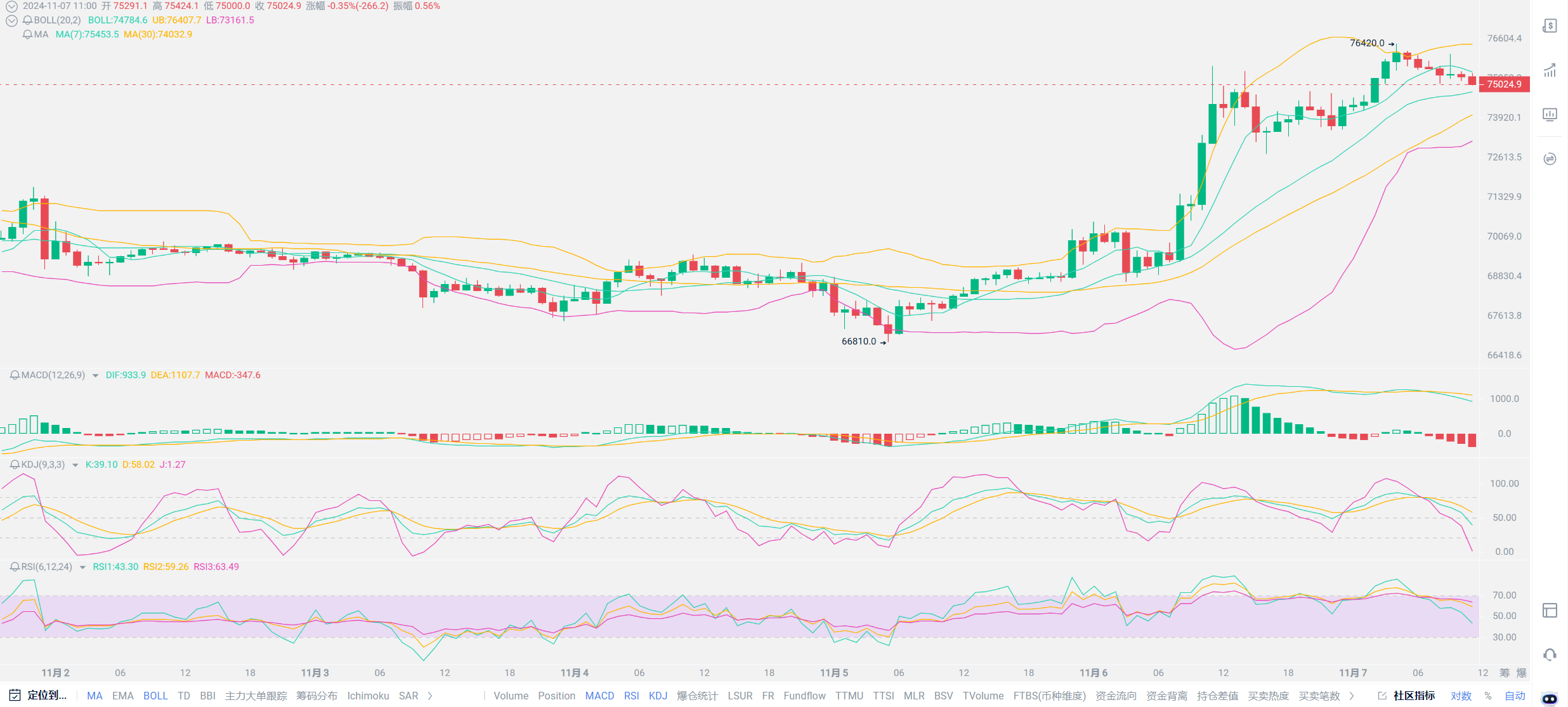

It is truly a blessing that depends on misfortune. I perfectly helped everyone catch a wave at the bottom. Congratulations to all users who chose to believe in Lao Cui around 70,000; salute to you all. After exiting yesterday, Lao Cui had a headache all night, sweating profusely. Indeed, those with weak bodies should not earn too much. Heaven has eyes, and I hope everyone can understand that when the market comes, Lao Cui can only consider the feelings of the users in hand, thus neglecting all the fans. I hope for your understanding. I did prepare to share a follow-up trend with everyone yesterday, but unfortunately, I started feeling unwell in the morning and couldn't hold on in the afternoon, completely exiting with all profits. Lao Cui rested all night, and fortunately, my health has returned to normal now. From the market perspective, the entire election caused Bitcoin to surge from 69,000 to over 6,000 points in one day, with an overall profit of around 4,000 points. The evening's rise is closely related to the performance of the US stock market, benefiting from it and rising further. Ethereum also followed the rise today, but it came too late, and Bitcoin's profits are still higher. After the market moves, surely no one will say Lao Cui is a backseat driver, right? It has finally been quiet for a while, and last night was the best sleep I've had this year.

Now, when we talk about Ethereum above 3,000 and Bitcoin at 80,000, will anyone still think Lao Cui is trying to attract your attention? After nearly half a year of criticism, this wave has proven to Lao Cui that there is indeed something to it. Enough small talk; for those who think I am a backseat driver, please review Lao Cui's articles since March this year. Let's directly enter the follow-up trend analysis. Many friends feel that we are currently at historical highs, making it difficult to decide to chase long positions, while shorting also faces a situation where there is no way to act. At this stage, shorting is no different from entering the Nationalist Party in '49. Lao Cui still maintains the previous view that I will never support my fans to short, even if it means taking a loss from 69,000 to 66,000. It took nearly six days to drop from 72,000 to around 66,000, but the bullish momentum only took half a day to rise over 7,000 points. Surely, no one still thinks the bears have the upper hand now?

After completing a wave of trends, there will always be users who think this bull market is over. When will we short? This only indicates that everyone still does not realize what Trump and interest rate cuts will bring to the crypto world. Lao Cui reminds everyone that we are witnessing history, both in the crypto world and in political structures. Trump's rise to power is not just about the presidency; the US military was the first force to support Trump, followed by the House of Representatives and the Senate, all taken over by Trump's team. Historically, the last time this happened was with Roosevelt. Currently, Trump enjoys an emperor-like treatment; as long as he wants to do something, he can do it at any time. An unrestrained president is enough to attract investment. Especially since Trump is a businessman, profit is always the priority. Bitcoin's listing, Ethereum's listing, and the largest trading platform in the US have directly earned nearly a trillion in half a year. These revenues are facts laid out before us, and the political strategy for the crypto world will not merely stay at the slogan stage. As for many foreign trade users, Lao Cui can only say, it's time to change careers; the policies Trump implemented will not change in the next four years and will only become stricter.

Many friends are surprisingly skeptical about interest rate cuts, thinking that after Trump takes office, interest rate cuts may stop or even be delayed. Do not complicate finance, and do not indulge in conspiracy theories. Many things are basically predictable results, and there is no need to interpret them with complex formulas. Including the current market trend, it could almost be determined at the beginning of the year, yet many fans still paid attention for half a year, and this wave of profits was still missed. Do not think that the crypto world will always create idols; remember, I believe there are many young fans whose historical witness may last longer than Lao Cui's. This round of rising momentum is very likely to be the last round of explosive growth in the entire crypto world; future growth in the crypto world may not see such historical levels again. Encountering a president from the world's number one economy who supports the growth of the crypto world is a timely opportunity. The timing of interest rate cuts is just right, which also belongs to the right timing. Being able to go public is entirely about the right people, and the technological innovations are all declaring the unity of the crypto world. After Trump takes office, strategies regarding the legalization of the crypto world will be introduced, which is a geographical advantage. Even if no corresponding measures are introduced, it is impossible to suppress it. Everyone should be clear that the early crypto world was completely suppressed by all countries, but now it is beginning to become legal and compliant, which is the biggest good news. The right timing, geographical advantages, and the right people all appear in one market; this peak is completely unimaginable.

In the short term, you can try to short during pullbacks, but you must not hold positions overnight. At this stage, waking up to find Bitcoin reaching 80,000, even 100,000 or more, is something Lao Cui considers very normal. Especially this year, there may still be two interest rate cuts within the year. Trump will definitely support interest rate cuts, and based on previous non-farm payroll data and employment data, these two interest rate cuts can basically be considered a done deal. You can also refer to Goldman Sachs' predictions. This wave of growth is not only about Bitcoin; the entire US tech stocks, especially those led by Musk, are still performing well. At this stage, entering the US stock market is not very meaningful; everyone can return their focus to the crypto market. The amount of funds flowing into the crypto world will definitely return to peak levels. As for investments in small coins, Lao Cui still reminds everyone to be cautious even with Ethereum investments at this stage. The founding team and Grayscale's actions, especially the large volume of exits at high positions, aim to maximize profits, and one must align with Bitcoin. Investments in small coins may very well reach historical highs after this round is completed, but they will not create more value; do not buy at high positions.

Small coins may have peaks, but Bitcoin will not have peaks. You can see this from the current market value; in the last bull market, Bitcoin reached a high of 70,000, and the entire crypto market exceeded 300 billion. This round, Bitcoin reaching around 76,000 has not yet recreated the previous glory, so everyone needs to be vigilant. If the capital is insufficient, you can increase your position to trade Bitcoin; even adding 20 times leverage is worthwhile, but 100 times leverage is not advisable. Lao Cui still does not support everyone taking such risks, especially beginners. This wave of growth will definitely attract many new investors into the market; remember that leverage carries risks, and everyone must consider risks before thinking about profits. As for the downward trend, it still exists this year, especially at the end of November, when the topic of not cutting interest rates in December will definitely be hyped, and this kind of rhetoric will affect the crypto world. If the US stock market remains strong, it may bring a pullback of 3,000 to 5,000 points to the crypto world, but this pullback depth will only appear after the interest rate cuts, when the capital cannot keep up, which is when the depth of the pullback will arrive.

Finally, everyone should pay attention to the inflow of funds into Bitcoin. Currently, Bitcoin has set a record for the highest inflow in recent years, directly leading to a net increase in the 30-day fund movement. The inflow of spot and contract funds in 24 hours reached over 150 billion, compared to nearly 20 trillion in daily circulation of the US stock market, which is completely insignificant. I want to emphasize that Bitcoin and Ethereum have already been listed, and whether they can reach this height in the future is a question worth considering. Although Lao Cui has doubts about the liquidity of this volume, I still have confidence in reaching 500 billion in a day. The growth this year is predictable, mainly due to the interest rate cuts in this round and the cuts in December. As for the depth of the decline, it will definitely come, but it is not a concern at this stage. The thought of today's article is bullish. The key time nodes to pay attention to are from mid-month to before the December interest rate cuts. After the two rounds of interest rate cuts, attention should be paid to the risks of short positions. At this stage, whether it is institutional investors or retail investors, no one dares to short easily. Once the impact of interest rate cuts fully arrives, shorting will lead to a dead end, and the number of people taking over in the later stages will increase. Shorting should be done cautiously. Even if you see bears coming, everyone should try to give up and wait for the bottom position to go long. In summary, the profits from going long will definitely be greater than those from going short, and the risks of shorting will also be greater than those of going long. As for entry points, if you are unsure, you can directly ask Lao Cui, and I will definitely reply. Of course, users who are stuck in short positions can also consult Lao Cui. After this round of pullback, we can discuss entry positions again.

Original article created by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。