When the U.S. election results clearly indicate that Trump will return to the White House, the crypto market began to rise as expected, reflecting optimism about the potential relief the Trump administration might bring to the industry. It is undeniable that Trump will be more supportive of the crypto industry than the current President Biden.

However, there remains uncertainty regarding his level of involvement in promoting industry development and whether relevant legislation can be passed amid a busy legislative agenda. All candidates for leadership positions in the Securities and Exchange Commission, Commodity Futures Trading Commission, and the Treasury Department may hold favorable views towards the industry, similar to Trump, but it is unclear how much of a priority this issue will be.

The Trump administration may prioritize deregulation for most industries. However, the crypto industry may be the only sector that runs counter to this trend, as industry members are eager for regulatory clarity. The priority these regulatory agencies place on the crypto industry will determine the duration of this process, but progress in reducing some of the current lawsuits from the SEC may be quicker. However, it is more likely that these agencies will at least provide some form of favorable regulatory guidance, even if not a specific rule.

Chu Yuechen: 11.11 Bitcoin ETH Market Analysis and Trading Reference

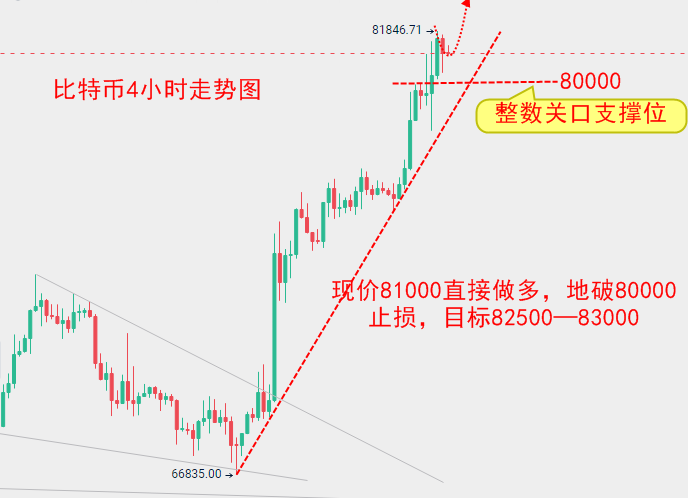

Bitcoin rose over the weekend and continued to hit new highs this morning, currently peaking around 81,800, with some pullback, fluctuating around 81,000. Often, after a historical high, many people look for a pullback to short, or when the market rises and consolidates, some want to short. I think this is incorrect; we should respect the power of the trend.

Also, do not fear heights; the higher it goes, many people are afraid to go long. There’s not much to say about Bitcoin's market; just find a good entry point to go long.

As for the pullback, I believe it will still occur, and we need to patiently wait for opportunities. Due to the favorable news of Trump’s return, Bitcoin's performance should be good in the short term. The positive events following Trump's return will continue to unfold, and analyzing the charts has lost its significance. Here, we should focus on the cycle; if Q4 achieves 100k+, then we can consider taking some profits and wait to buy back after a pullback.

ETH, driven by Bitcoin, also saw a rise over the weekend, peaking at 3,252, with the current price pulling back to around 3,140. In terms of both spot and contracts, ETH is not as stable as Bitcoin, so when trading, prioritize Bitcoin. If you are used to trading ETH, just refer to Bitcoin.

From a trend perspective, it is possible for Bitcoin to rise to 85,000—90,000, or even 100k+. There’s no need to speculate; we will trade as the market moves. There’s no need to hold onto a single position indefinitely, as the market cannot move in a straight line; it will definitely have ups and downs.

For intraday operations, the current price of Bitcoin is around 81,000 for long positions, with a stop loss at 80,000 and take profit at 82,500—83,000.

Specific Operation Suggestions (Based on Actual Market Price)

Current price of Bitcoin around 81,000 for long positions, stop loss at 80,000, take profit at 82,500—83,000.

Market conditions change in real-time, and there may be delays in article publication. Strategy points are for reference only and should not be used as entry criteria. Investment carries risks, and profits and losses are self-responsible. Daily real-time market analysis, along with experience exchange groups and practical discussion groups, welcome to get real-time guidance. Irregular live broadcasts explaining real-time market conditions in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。