Analyst Chen Shu: November 12 Bitcoin and Ethereum Market Strategy *1, Going Long with Great Success, the Market Remains Strong and Has Not Yet Topped in the Short Term!

The analysis provided on November 11 suggested a long position, entering at 8.1/3150. Yesterday, Bitcoin surged by 10%, with long positions peaking at 8.95/3400, securing a profit of 8500/250 points. In recent articles, only long strategies have been provided, and the strong bullish outlook has finally led to a significant rise. Currently, for short-term operations, we will continue to maintain strength at high levels. Please see the following analysis for guidance.

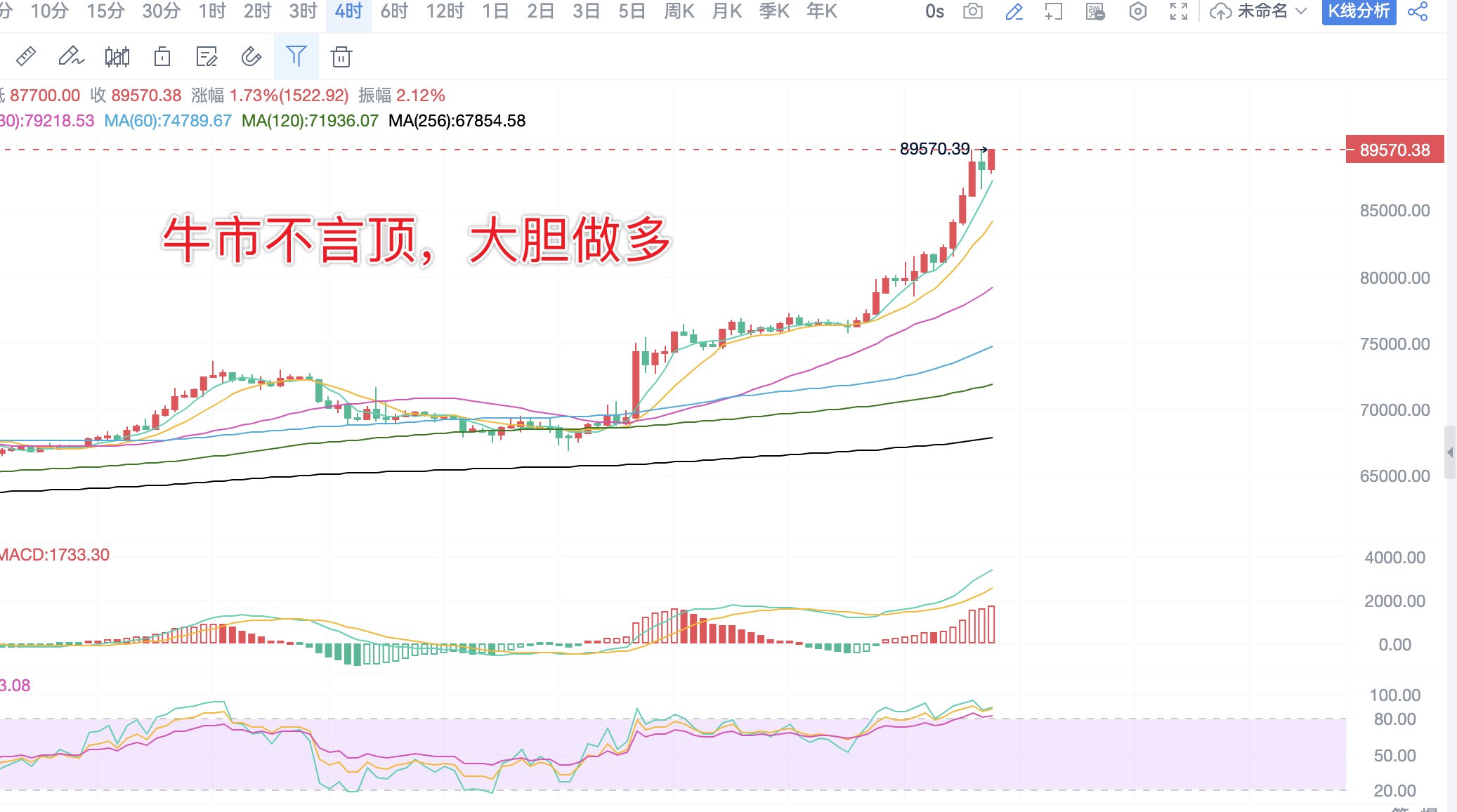

From the daily chart of Bitcoin, yesterday's daily close saw a 10% increase, marking one of the largest single-day gains. The price once approached $90,000. Although the daily chart is overbought, there is currently no sign of a top in the short term. Therefore, the strategy should remain focused on going long, abandoning any thoughts of shorting. Support can be observed at the 4-hour MA5/10 moving average. As long as the 4-hour MA5/10 moving average is not broken, any pullback is merely a signal to go long. For those considering shorting, it would be wise to wait until the 4-hour MA5/10 moving average is breached before entering a short position. Setting a stop loss on long positions is also reasonable. The strong FOMO sentiment is not a reference for predicting a top.

From the daily chart of Ethereum, after previously testing the MA256 moving average (3060) support, it has moved upward again. While Bitcoin surged yesterday, Ethereum has not yet had an opportunity to catch up. However, during Bitcoin's rise, we can still expect Ethereum to have a 200-300 point catch-up opportunity. For short-term trading, focus on the MA5/10 moving averages. As long as there is a pullback to the 4-hour MA5/10 moving averages, it is a good time to buy and go long!

Afternoon Trading Strategy (Written at: 14:40):

BTC: Light long position near 8.82, add to long at 8.73, target 1-1.5K points; yesterday's long position near 8.1 can be traded back and forth.

ETH: Light long position near 3320, add to long at 3270, target 3450/3600; yesterday's long position near 3150 can be held while reducing part of the position around 3500.

Note: Go long! Go long! Go long! Until we break 80,000, everyone should go long. The top is not something you or I can predict. Going long, even with a stop loss, is more cost-effective than going short. For Bitcoin, waiting for a few hundred points pullback is enough to go long directly. There is no crash, and you don't need to wait for a large pullback; small pullbacks are your rare opportunities. For Ethereum, look for entry at the 4-hour MA5/10 moving averages (the cost-effectiveness of going long on Ethereum is currently much higher than that of Bitcoin).

The daily analysis strategy has a very high win rate! Analysis is not easy, so I hope everyone can give a free follow, save, like, and comment. Thank you all, and feel free to leave comments below; I will reply to each one!

For real-time market strategy discussions and inquiries about market issues, you can follow me, the top-ranked personal KOL in the original (Coin World), providing free guidance and answering trading questions. Everyone is welcome to communicate and exchange ideas!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。