Since November 12, when BTC surged strongly to $90,000, it reached a historical high of 93,266 points in the early hours of the 14th, ending a one-sided upward squeeze. Last night, around ten o'clock, it attempted to break the new high again but failed and retraced, with the current price at $87,300.

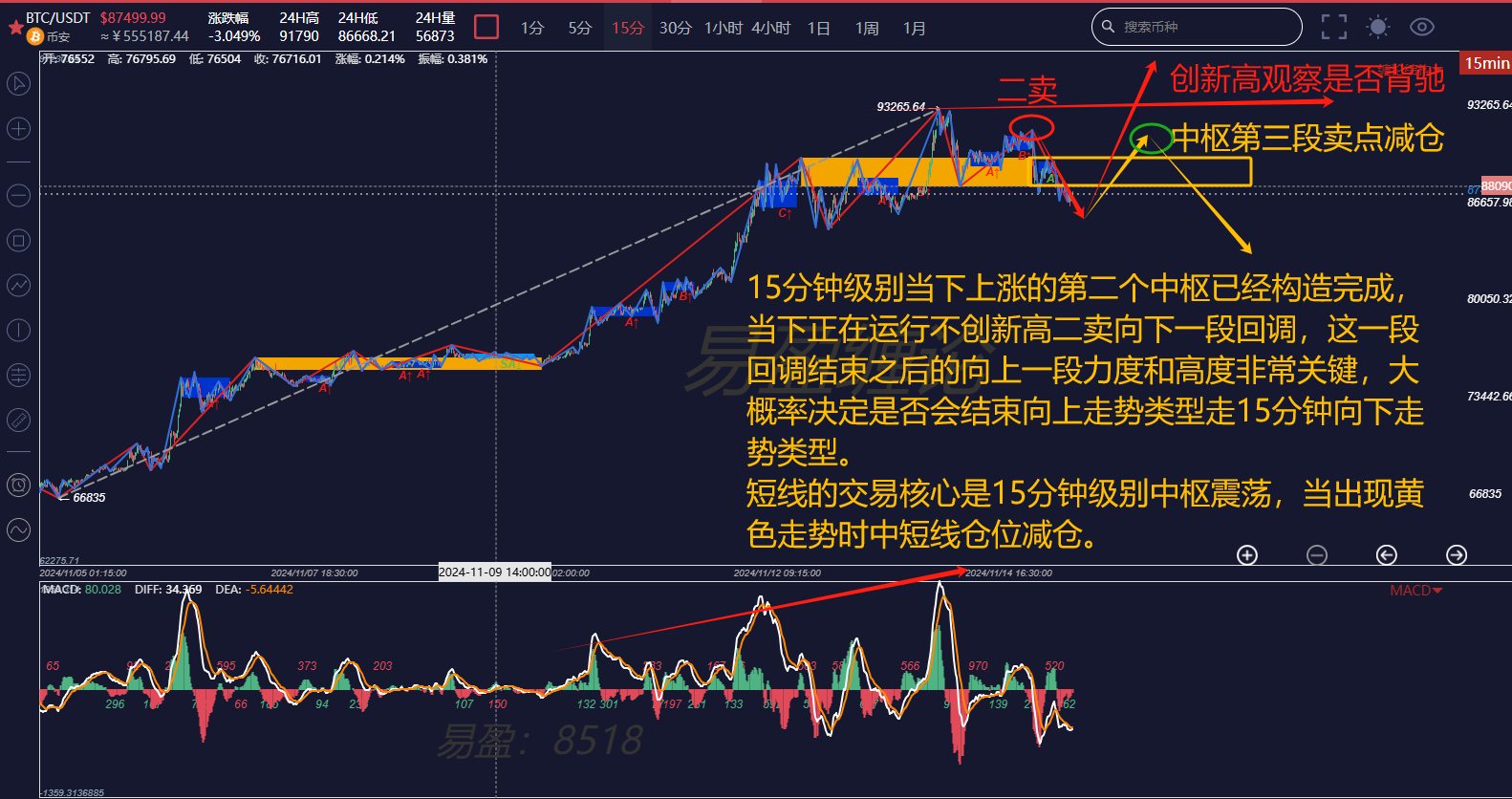

After the bullish rally that started from the low point of $66,835 on November 5, the market has been aggressively pushing up, until last night when it was the first time in 15 minutes that a new high was not made, indicating a second sell signal. The emergence of the second sell signal suggests that the bulls are showing some fatigue. Does this mean that Bitcoin has already peaked in the short term?

The continuous high-level fluctuations between $85,000 and $92,000 for several days indicate that both bulls and bears have differing opinions on the price in this range. There has been intense fighting between the two sides, and eventually, one side will prevail and leave this range. Whether it will break upwards or downwards will need to be classified and deduced based on the structure.

From the larger 4-hour level, it is still running after a third buy signal upwards, and it is a volume-increasing upward trend, meaning that there has not yet been a sell signal at the larger level; the sell signals that have appeared are at the 30-minute level or below.

Currently, the clearest structure for the short to medium term is at the 15-minute level, which has already gone through two yellow central upward trends. The chart provides two types of trend classifications, both of which indicate that there is a certain expectation of a short-term pullback. As for whether it will choose to break the new high trend in red with divergence and then reverse, or the yellow two-time non-new high second sell reversal, we can only follow the strength of the upward rebound over the next two days. Once a sell signal appears again, it is advisable to reduce positions in the short term, leaving some positions to cope with the short-term downward trend.

In summary: From a larger perspective, the current trend is still relatively healthy, with no sell signals appearing, and it is likely to continue extending upwards. However, in the short term, due to the large increase, there is a divergence between bulls and bears, and a 15-minute sell signal has emerged, which may trigger a pullback. In a bull market, there are often sharp declines; to open up upward space, there will definitely be multiple instances of downward spikes to clean out leverage.

The above analysis is for reference only and does not constitute any investment advice!

Friends, if you are interested in the theory of trading, want to obtain free learning materials, watch public live broadcasts, participate in offline training camps, improve your trading skills, build your trading system to achieve stable profit goals, and use trading techniques to escape peaks and buy bottoms in a timely manner, you can scan the QR code to follow the public account and privately chat to get and add this WeChat account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。