Looking at the daily level, Bitcoin (大饼) saw its first bearish close, and with the CPI favorable for bulls, Bitcoin once again reached a new high near 93,500. After testing the high point again yesterday, it closed bearish once more. The expected pullback has basically occurred, and the current resistance level can be referenced at the current high (88,500-89,000). The support level is tentatively set at 87,000-86,000. Ethereum's (以太) performance aligns with expectations, having strongly rebounded to around 3,450 before closing bearish for the first time, followed by a series of bearish closes indicating a pullback. Currently, it has dipped to the 3,000 mark, with resistance at 3,100-3,150 and support at 3,050-3,000. If it continues to break down, we will look at 2,877!

At the 4-hour level, Bitcoin is showing a gradual pullback, with highs and lows continuously moving down. The important support below is around 86,000; if it continues to break down, it will approach the significant 80,000 mark. Otherwise, it will form a box structure and primarily consolidate. Ethereum's pullback trend is more evident, with important support to watch at the 3,000 mark. If it breaks down, it will retreat to the important support level of 2,877, while the upper resistance to watch is at 3,150!

The short strategy near the pressure level laid out yesterday for Bitcoin unfortunately did not get executed, but the overall trend was expected accurately. Ethereum, however, was executed perfectly and exceeded profit expectations. For subsequent operations, it is still recommended to focus on shorting at high levels to look for a pullback!

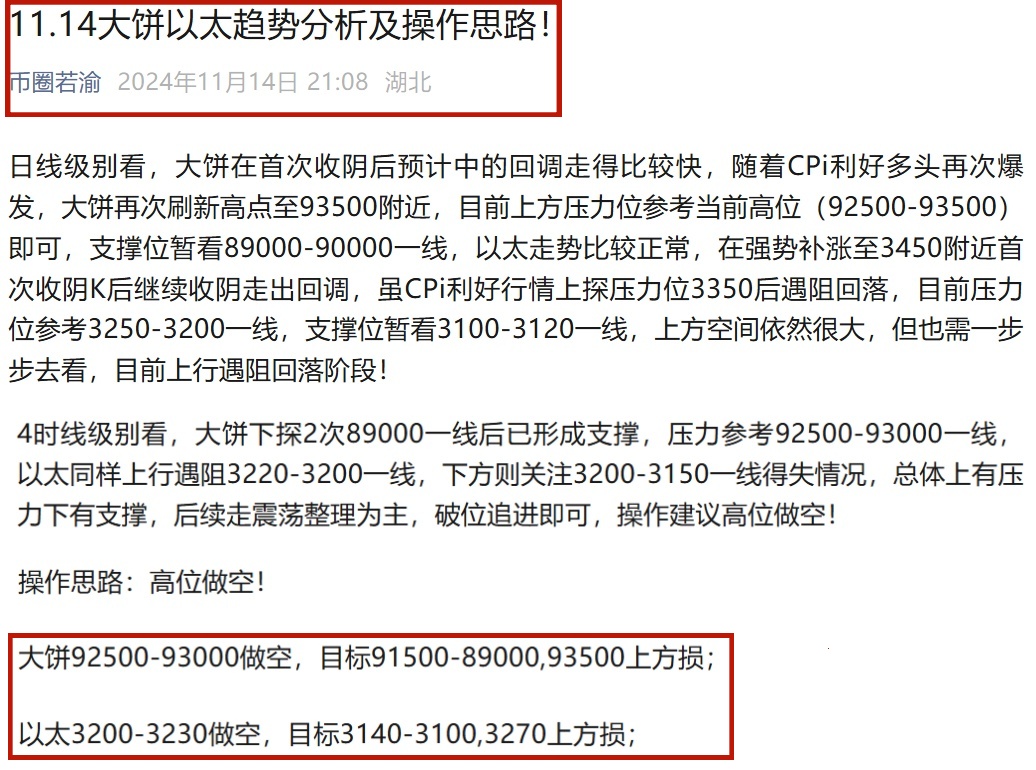

Operational strategy: Short at high levels!

Short Bitcoin at 88,700-89,300, targeting 87,000-86,000, with a stop loss above 90,000;

Short Ethereum at 3,080-3,110, targeting 3,020-2,950, with a stop loss above 3,150;

The strategy is time-sensitive, and specific guidance will be provided in private real-time!

Professional team gold medal analyst Ruo Yu focuses on contract trading guidance. Follow the WeChat public account "Coin Circle Ruo Yu" to understand real-time market analysis and operational strategies!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。