The Asian market has become a key region for Web3 development, driven by a large population of digital natives, consumer-centric innovations, and a robust super app ecosystem. On-chain data further reveals its growth potential.

Author: Jay Jo

Translation: Blockchain in Plain Language

Summary:

The Asian market is complex and diverse, with different regulations and cultures. To participate in the Web3 industry, one must have a deep understanding of the characteristics of each country.

Asia has a large population of young digital natives, providing significant potential for its leading position in the Web3 market, especially in super apps and consumer applications.

On-chain data shows that the Asian Web3 market is growing, primarily reflected in increased usage of stablecoins, developer activity, trading volume on decentralized exchanges (DEX), and interactions on Web3 social media.

1. The Diversity and Complexity of the Asian Market

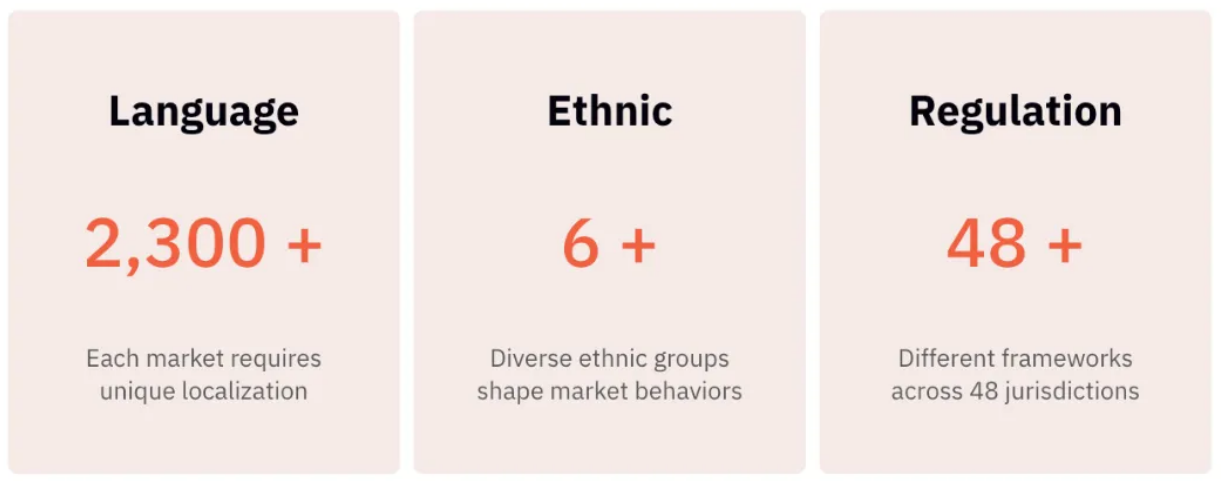

To understand the Asian market, one must first recognize its diversity and complexity. Asia has over 2,300 languages, covering different regions such as Northeast Asia, Southeast Asia, Southwest Asia, and South Asia, and there are over 48 regulatory frameworks. The cultural differences within Asia are often greater than those between Western countries.

This diversity profoundly impacts Asia's Web3 industry. In Northeast Asia, countries have unique approaches: China implements strict regulations, South Korea combines regulation with incubation support, while Japan promotes Web3 development through government initiatives. This unique combination in Asia requires strategies tailored to specific markets and a detailed understanding to succeed.

2. Strong Growth Foundations in Asia

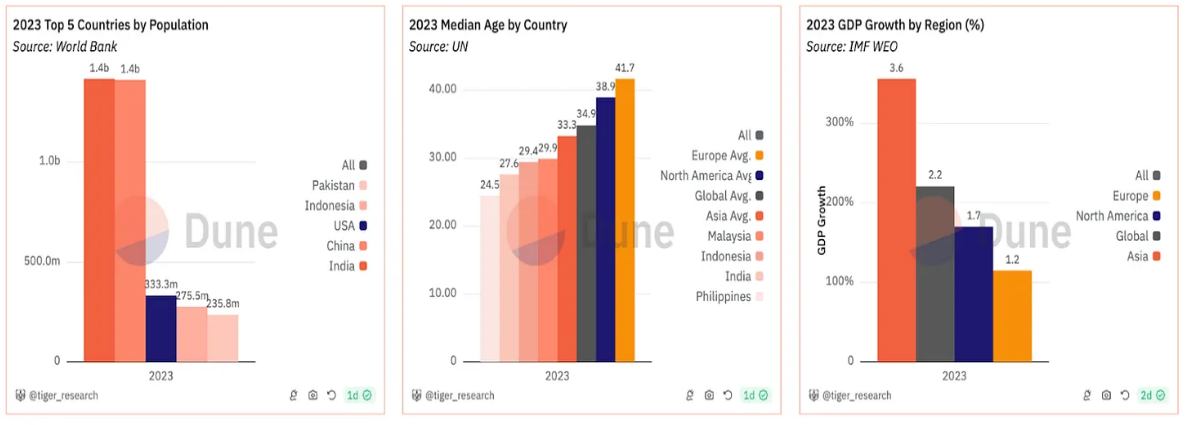

Asia's diversity presents challenges, but its importance cannot be overlooked. It is home to over 60% of the world's population, contributing 34% of global GDP, and has outpaced North America and Europe with a growth rate of 3.6%.

Asia is leading in the Web3 industry for three main reasons:

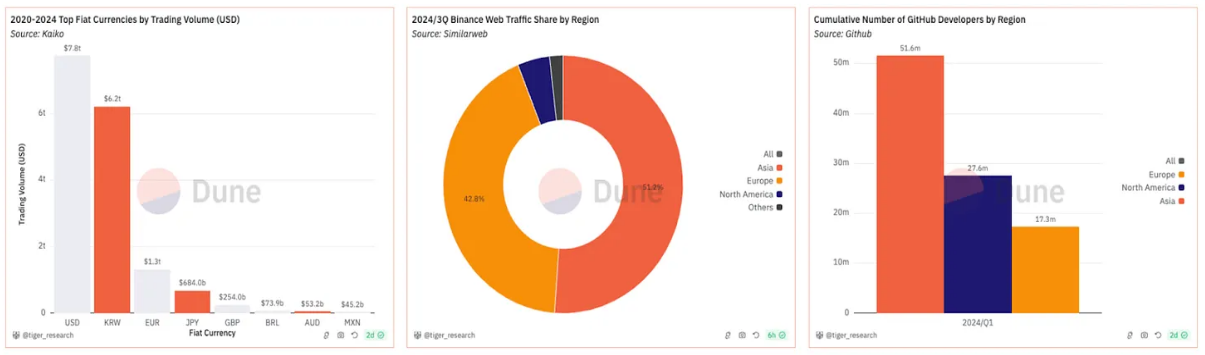

First, Asia has a large cryptocurrency user base, with about 60% of global crypto users (320 million people) coming from the region, primarily driven by a young and digital native population (data source: Triple-A).

Second, Asia excels in trading activity: At the beginning of 2024, trading volume based on the Korean won exceeded that of the US dollar, and recently more than half of the traffic to BN websites also came from Asia.

Finally, Asia has a strong pool of technical talent, including 50 million GitHub developers and 40% of the world's Web3 game developers.

3. Advantages of the Asian Web3 Market: Consumer-Centric and Super Apps

To popularize the Web3 industry, the key is to develop consumer applications that are easy for the public to use; merely building technical infrastructure is not enough. This is similar to the past development path of the internet, where killer applications like email drove rapid internet adoption. Similarly, Web3 is expected to gain widespread popularity through consumer applications that can naturally integrate into daily life.

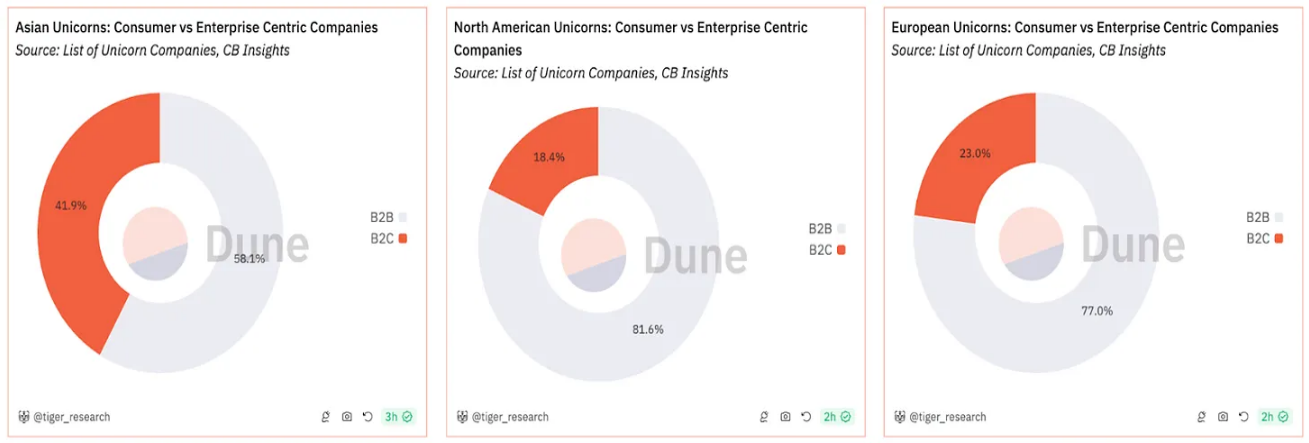

Asia excels in two areas. First, Asia is at the forefront of consumer-centric innovation. As of October 2024, 42% of Asia's unicorn companies are B2C, surpassing North America and Europe (data source: CB Insights). This advantage stems from Asia's large population of digital natives and advanced mobile payment systems. The consumer-driven development approach positions Asia as a potential center for new Web3 applications.

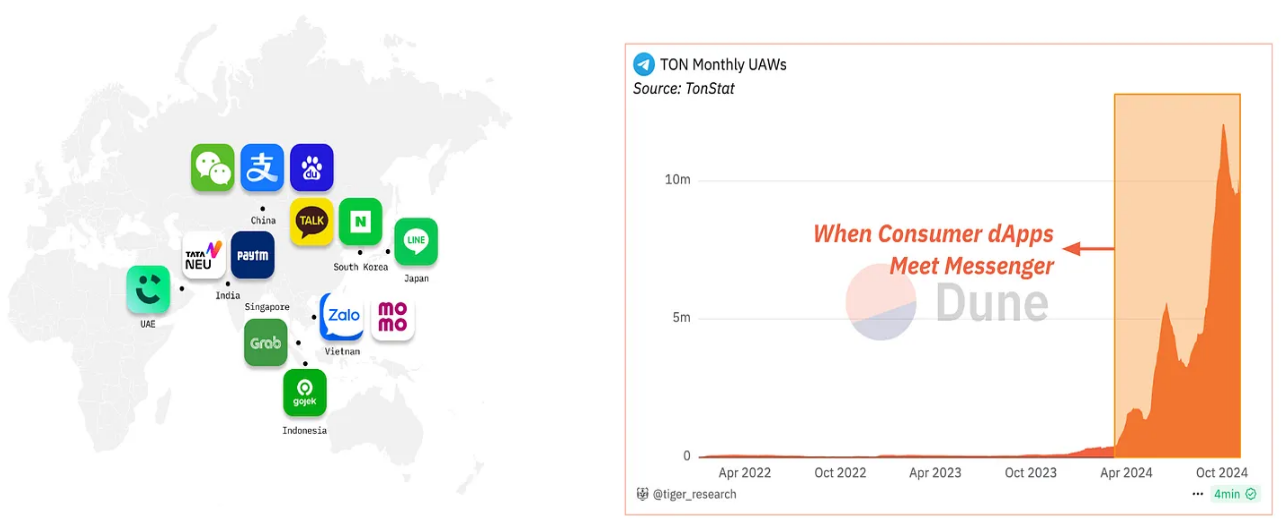

Asia's second major advantage lies in its unique super app ecosystem. Leading platforms like WeChat, Alipay, Kakao, Line, and Grab initially started as single-service applications but have now evolved into comprehensive digital ecosystems. These super apps have become part of the daily lives of millions of users, covering various services such as payments, shopping, and entertainment.

The TON blockchain demonstrates the potential of combining Web3 with super apps. By integrating Web3 features into the popular social app Telegram, user numbers surged due to its convenience. These cases show that super apps can lower the barriers to entry for Web3. Introducing new services in familiar environments will drive the adoption of Web3.

4. Data-Driven Analysis of the Asian Web3 Market

The Asian market shows strong potential, but relying solely on expectations and indicator analysis may be superficial. Analyzing real user activity through on-chain data is crucial for a deeper understanding of the market.

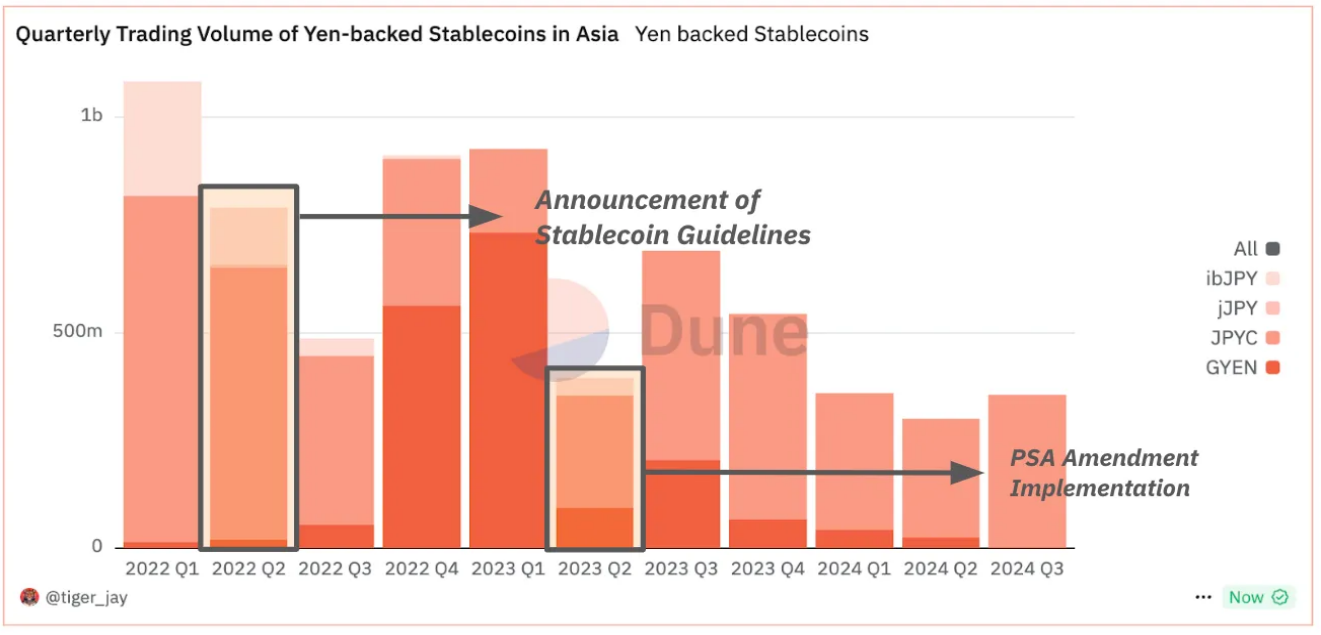

Japan's evolving stablecoin policy highlights the need for in-depth analysis. Although stablecoin guidelines were introduced in June 2022 and legal revisions in 2023 allowed for the issuance of stablecoins, there has yet to be a significant on-chain impact. This is due to limited use cases and regulatory barriers to issuing trust-based stablecoins on public blockchains. To bridge the gap between policy and adoption, more detailed on-chain analysis is necessary.

Next, we will assess whether the anticipated growth in the Asian market is being realized through on-chain data analysis.

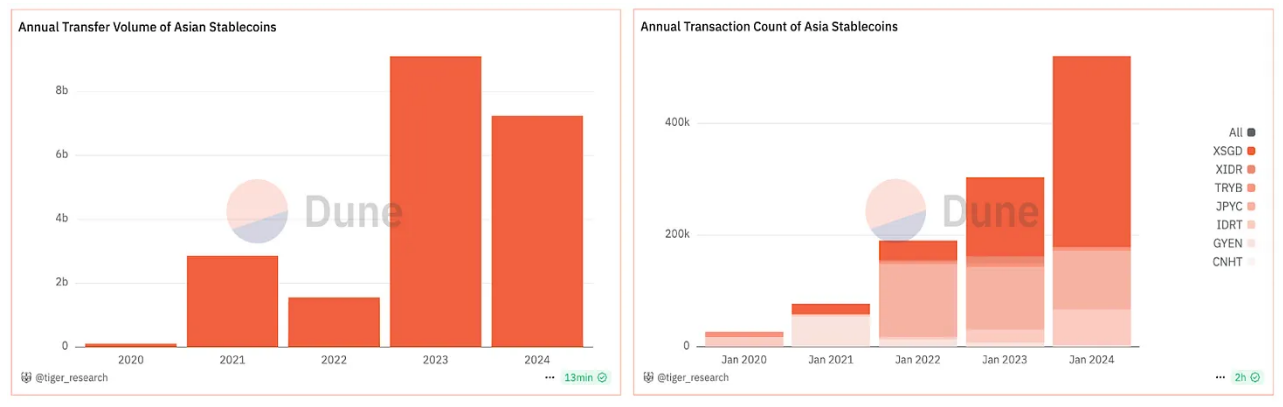

4.1. Stablecoins in Asia

The use of stablecoins in the Asian market is steadily increasing. This trend is significant as stablecoins represent one of the best product-market fits for Web3. On-chain data indicates that stablecoin transfer volumes in Asia have surged to nearly $8 billion, with further growth expected from 2022 to 2024.

Stablecoins pegged to national fiat currencies are creating more real-world use cases. Several locally supported stablecoins have emerged, such as Singapore's XSGD and Indonesia's XIDR. For example, XSGD connects with services like Grab, driving practical applications. This localized approach and integration with real services are increasing stablecoin transaction volumes. The sustained growth indicates that structural changes are occurring in the Asian market rather than short-term trends.

4.2. On-Chain Activity of Asian Developers

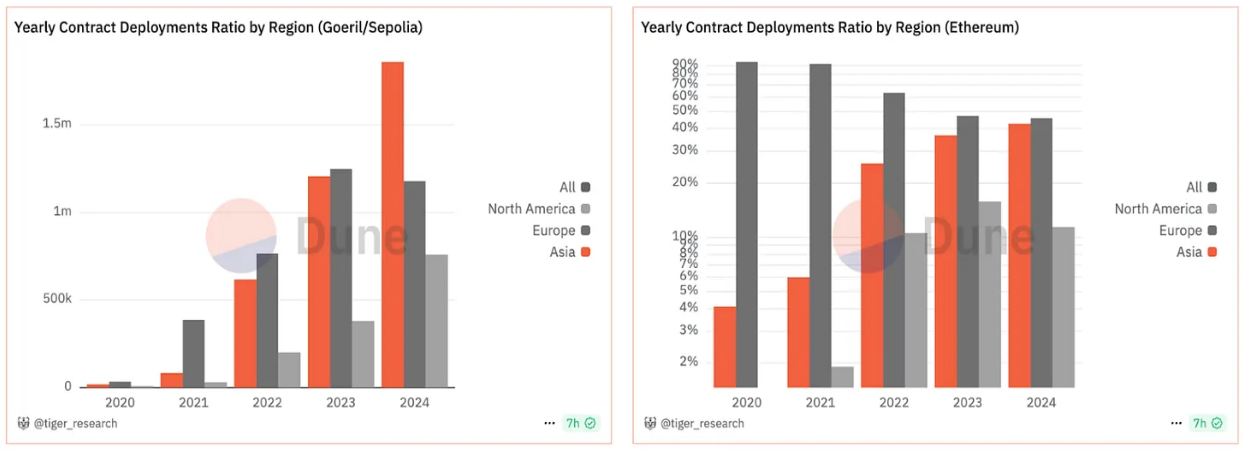

Asian developers are increasingly participating in smart contract development. On-chain data from Ethereum's mainnet and testnets (Goerli and Sepolia) confirms this trend.

In 2024, Asian developers created approximately 1.7 million contracts on these testnets, far exceeding activity in North America and Europe. Since 2022, the growth rate has been rapid, with a similar trend observed on the Ethereum mainnet. Asia's share of contract creation has grown from 4% in 2020 to 40% in 2024.

This change highlights two trends. First, Asian developers are driving blockchain innovation. Second, blockchain development is expanding from its Western origins to a global scale. The high activity levels on testnets reflect positive experimentation and indicate that Asian developers are key contributors to the future of Web3.

4.3. Participation of Asian Retail Investors in Decentralized Exchanges (DEX)

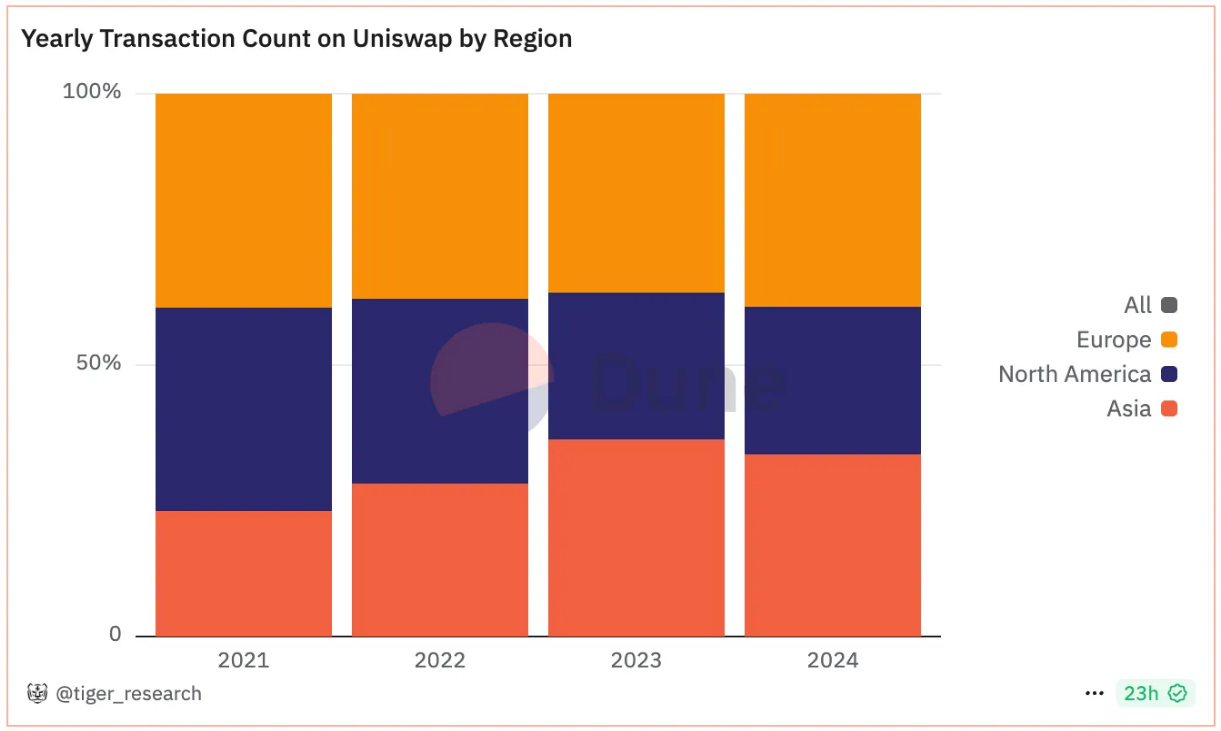

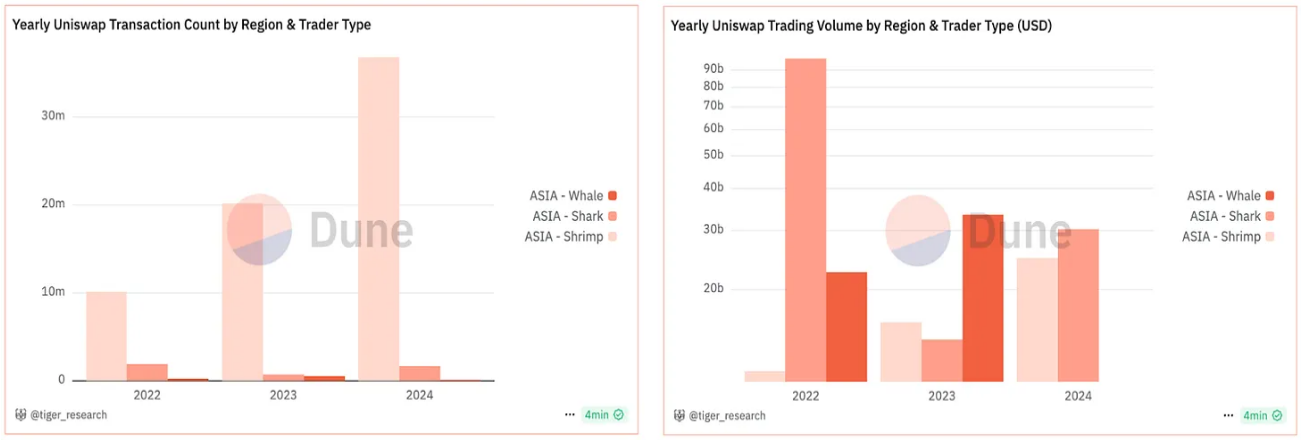

Uniswap's trading data shows high participation from Asia. From 2021 to 2024, Asia consistently accounted for a significant share of total trading volume. During this period, trading activity has steadily increased.

It is also noteworthy that there are differences in participation rates among different types of investors in Asia. When we categorize trading sizes into whales (over $100,000), sharks ($10,000–$100,000), and minnows (under $10,000), significant changes can be observed. In 2021, minnow investors accounted for a small proportion of trading volume. However, by 2024, their share in both the number of trades and trading volume has steadily increased. This change is a positive sign, indicating that users in the Asian market are increasingly utilizing Web3 services. They are not only participating in trades on centralized exchanges (CEXs) but are also active on decentralized exchanges (DEXs).

4.4. Activity of Asian Users on the Web3 Social Network Farcaster

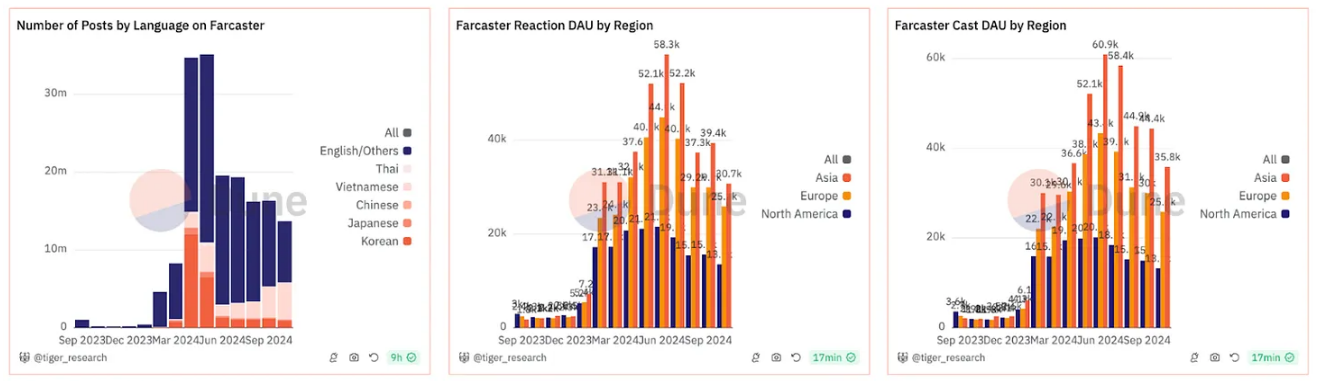

The activity of Asian users on Farcaster is drawing attention within the Web3 ecosystem. Daily active user (DAU) analysis shows that the activity level of Asian users surpasses that of North America and Europe. Although English is the primary language of Web3, posts in local languages such as Vietnamese, Chinese, Japanese, and Korean are steadily increasing. This indicates that Web3 growth in Asia is occurring, and not just as anticipated. Asia is leading in Web3 usage.

5. Conclusion

The Asian market is diverse, with unique regulations, cultural differences, and varying practices among countries. This complexity presents both challenges and opportunities for Web3. Understanding the unique roles of each country is crucial. On-chain data reveals the potential of the Asian Web3 market by capturing real user behavior.

Regional analysis based on on-chain data is vital for the growth of the ecosystem. Advances in digital credentials and regional analysis will enhance the accuracy of insights into user behavior. These tools will help provide a clearer understanding of the regional context and preferences of the Asian Web3 market.

Link to the article: https://www.hellobtc.com/kp/du/11/5534.html

Source: https://reports.tiger-research.com/p/dunecon2024-asia-eng?utmsource=%2Finbox&utmmedium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。