Cryptocurrency regulation under Trump may bring hope, seamlessly combining with Ethereum's supply tightening and awakening institutional interest.

Written by: David C, Bankless

Translated by: Deng Tong, Golden Finance

In the two weeks since Trump's re-election, our feelings about cryptocurrency regulation look very hopeful, especially for ETH.

Although ETH has stabilized since its surge post-election, institutional demand continues to rise, and with staking levels reaching all-time highs, supply will only further contract. This attractive market setup, combined with expectations of loose regulation, paves the way for ETH ETFs' staking and the fee switches of crypto protocols.

As Ethereum is poised to capitalize on these trends, its outstanding performance and the performance of its strongest L2 Base provide ample justification.

In this article, we will delve into Ethereum's supply-side mechanisms, its institutional interests, post-election price trends, and how the Base ecosystem can benefit from such a favorable environment.

Supply Reduction

With staking levels at historical highs and the possibility of entering a new burn cycle, Ethereum's supply situation suggests some particularly favorable market dynamics.

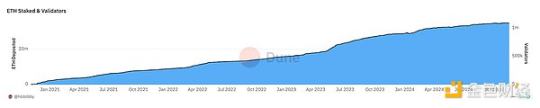

Currently, a significant portion of ETH is locked, with about 29% of ETH staked, most of which are liquid staking tokens, indicating that ETH is widely used in DeFi and re-staking protocols. Overall, this suggests that the staked ETH has a strong locking effect, giving it exceptional scarcity among blue-chip tokens.

Moreover, as ETH issuance trends downward, Ethereum seems to be on the brink of a new burn cycle, which will further increase the token's deflationary pressure. With gas fees on the rise and transaction volumes surpassing the 30-day average, demand for block space appears to be causing the amount of ETH burned to exceed the issuance.

The last burn cycle began in early 2023, illustrating how these dynamics drive value appreciation as ETH becomes scarcer and more valuable.

With ETH at historical highs and signs indicating that block space demand is once again exceeding supply, this deflationary pressure could help drive ETH's price growth beyond performance.

Increasing Institutional Demand

If there is one thing that has become clear since Trump's re-election, it is that Ethereum's appeal among institutional investors has strengthened.

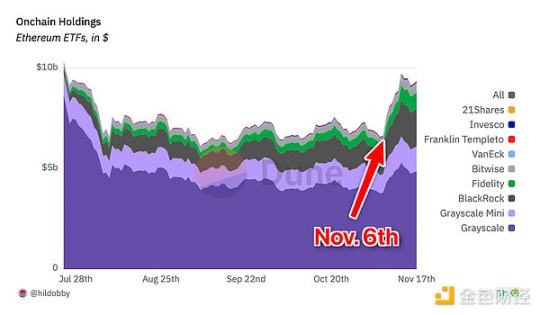

Since Trump's victory, ETH ETF flows have surged, achieving positive total flows for the first time since its launch in July. Given the initial surge of blue-chip DeFi tokens post-election and the anticipated fee conversion, the spike in ETH ETF flows indicates that the market expects the new government to take a friendly stance towards yield-bearing assets, potentially allowing Ethereum staking through ETFs.

Previously, there were concerns about Wall Street's understanding of Ethereum's value proposition. However, with this new upward trend, it is clear that institutional investors are beginning to view Ethereum as a yield-bearing crypto asset. Further evidence of this understanding is Bitwise's acquisition of institutional-grade Ethereum staking provider Attestant, preparing for this future.

Overall, these developments suggest that institutions are deepening their understanding of Ethereum's value proposition as the only regulated, yield-generating crypto asset, a point that may accelerate with the prospect of stake-supporting ETFs.

Base Case

While Ethereum has promising market dynamics, its star Base seems ready to become the primary environment to fully leverage its price growth.

First, let’s revisit May, when ETH experienced a massive ETF reversal candle. While many alternatives like LDO and ENS achieved impressive gains, the overall top performer was the Base ecosystem. On L2, while leaders like DEGEN gained 30%, lesser-known memes achieved triple-digit growth. Now, we have multiple "larger" memes achieving triple-digit increases within a week, with MIGGLES up about 330%, KEYCAT up about 150%, Ski Mask Dog up about 100%, and many smaller memes seeing even larger gains.

In addition, there is a thriving ecosystem around the Virtuals Protocol, which has spawned a series of AI agents and incorporated Base into one of the leading narratives.

Moreover, from a fundamental perspective, Base's performance has significantly outpaced all other L2s, with surges in total value locked (TVL), daily active addresses, and daily transaction volumes. All these actions position Base to become the dominant L2 and the primary environment for everything related to ETH in the near future, further supported by Coinbase's funding and its infrastructure and marketing engine.

That said, Base's outstanding performance, thriving ecosystem, and unparalleled growth metrics place it in a unique position to benefit from this growth in the coming years.

Conclusion

Cryptocurrency regulation under Trump may bring hope, seamlessly combining with Ethereum's supply tightening and awakening institutional interest, creating a compelling case for its outstanding performance.

With ETH staking reaching all-time highs and a burn cycle on the horizon, Ethereum is poised to benefit from an increasingly scarce supply. These trends perfectly align with the growing institutional demand, as evidenced by the surge in ETF flows and Bitwise's acquisition of Attestant, indicating that Wall Street is increasingly recognizing Ethereum as the premier yield crypto asset.

Base, as Ethereum's strongest L2, has consistently demonstrated outstanding performance and ecosystem growth, positioning itself uniquely to benefit from this growth. From its dominance in TVL and daily activity metrics to its rich on-chain environment closely tied to top trends like memes and AI, Base is sure to become the primary stage for leveraging Ethereum's growth, with strong support from Coinbase.

Overall, Ethereum seems capable of becoming a leader in the next cycle, highlighting that it is ready to seize the opportunities presented by an increasingly friendly regulatory and market environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。