More than a month later, Binance's new round of Launchpool has finally arrived. However, contrary to what many expected, this time the new project Usual is not as popular, and many seasoned investors, including myself, missed out.

The reason lies in the fact that Usual is focused on stablecoin issuance, which leads many seasoned investors to subconsciously associate it with the previous bull market's algorithmic stablecoins, often recalling the disasters that followed. To this day, I still remember the time I paid hundreds of dollars in gas fees to rush into an algorithmic stablecoin, and then nothing happened afterward.

In fact, Usual is completely different from what people understand about algorithmic stablecoins. Their stablecoin is 1:1 backed by real-world assets (RWA) and is fully compliant, which is a stark contrast to the original algorithmic stablecoins.

According to the official introduction, Usual is a multi-chain infrastructure that integrates the growing tokenized real-world assets (RWA) from BlackRock, Ondo, Mountain Protocol, M0, and Hashnote, transforming them into a permissionless, on-chain verifiable, and composable stablecoin called USD0.

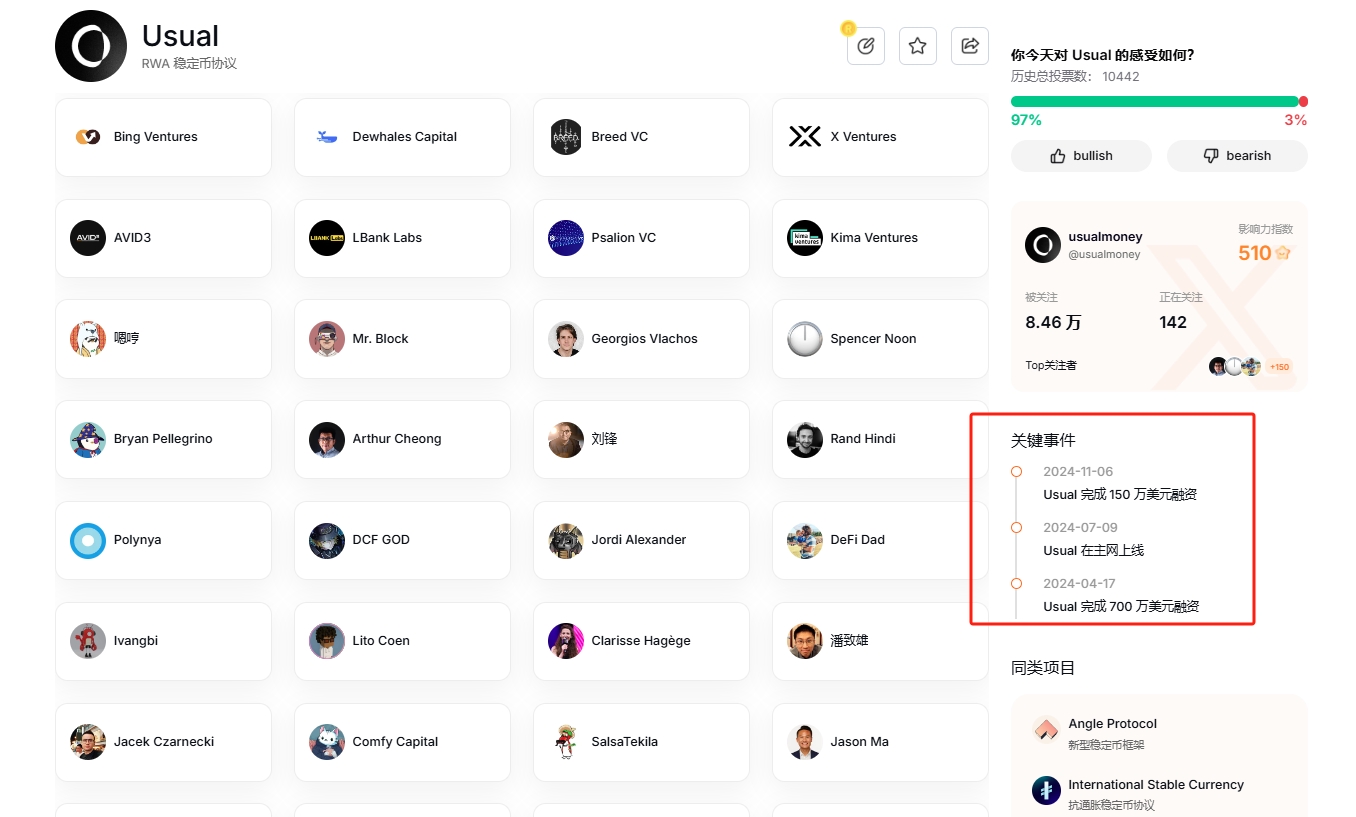

In April of this year, Usual announced the completion of a $7 million funding round, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, Starkware, Flowdesk, Avid 3, Bing Ventures, Breed, Hypersphere, Kima Ventures, Psalion, Public Works, and X Ventures.

Seven months later, Usual announced the completion of a new funding round of $1.5 million, with participation from Comfy Capital, early crypto project investor echo, and Breed VC founder Jed Breed, though specific valuation data was not disclosed.

In other words, the publicly disclosed funding amount for Usual is only $8.5 million, which is clearly not on the same scale as those projects that often raise tens of millions or even over a hundred million. However, while most people are focused on those top-tier projects, Usual has made its way directly to Binance, allowing those who haven't participated before to join the Launchpool mining.

Missing out is one thing, but research on the Usual project should not be overlooked, as they have indeed made it to the cosmos and have some solid capabilities.

1. Founder: Former Political Advisor to the French President

Usual CEO Pierre Person was a member of the French National Assembly, primarily working on monetary policy, and he also served as a political advisor to French President Macron.

In 2022, he founded Usual with the aim of rebuilding a stable feedback mechanism through decentralized data, allowing users to gain more data ownership.

As of today, Usual's total TVL has exceeded $370 million.

2. USD0: The First Liquid Deposit Token

USD0 is the first liquid deposit token (LDT) offered by Usual, backed 1:1 by real-world assets (RWA) with ultra-short maturities, ensuring its stability and security. At the same time, USD0 serves as an RWA stablecoin that aggregates various U.S. Treasury bond tokens and can be minted in two different ways:

① Direct RWA Deposit: Users deposit eligible RWA into the protocol and receive an equivalent USD0 at a 1:1 ratio.

② Indirect USDC/USDT Deposit: Users deposit USDC/USDT into the protocol and receive USD0 at a 1:1 ratio. This indirect method involves third-party collateral providers who supply the necessary RWA collateral.

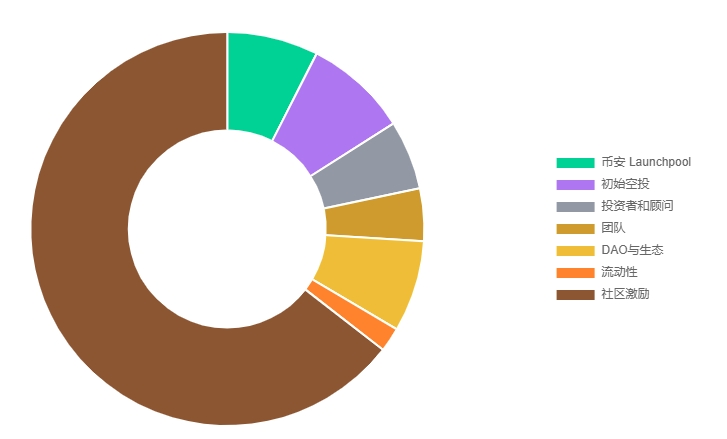

3. $USUAL: 90% of Total Supply Allocated to the Community

The total supply of $USUAL is 4 billion tokens, with an initial circulation of 12.37%, of which 7.5% is allocated to Binance Launchpool.

The official documentation emphasizes that 90% of the total token supply will be allocated to the community, while 10% will be distributed to insiders (team, advisors, investors), ensuring fair distribution and genuine participation for users.

As the official governance token, $USUAL holders will have rights to the platform's actual revenue, future income, and infrastructure ownership.

It is worth noting that USUAL is deflationary, similar to Bitcoin's halving mechanism, meaning that the earlier you participate in the token distribution, the more tokens you will receive.

For more project information, you can refer to the Binance research report: https://www.binance.com/en/research/projects/usual

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。