"Don't overlook the crazy buying from Korea" is an old saying.

Author: MORBID-19

Translation: Deep Tide TechFlow

I hope everyone can earn life-changing money on the chain. Not happening? Maybe it's because of the sell-off in the Korean market. I've seen dozens of profit and loss screenshots, with profits in the hundreds of thousands or even millions of dollars. I've even heard in real life that some people I know, not too far removed, have made quite a bit of money. Yes, if you don't trade Meme coins, you won't make money.

Until now, the public perception has been that Koreans only trade on centralized exchanges, mainly on Upbit. This is only partially true. What use is a centralized exchange when there are 1000x opportunities on-chain?

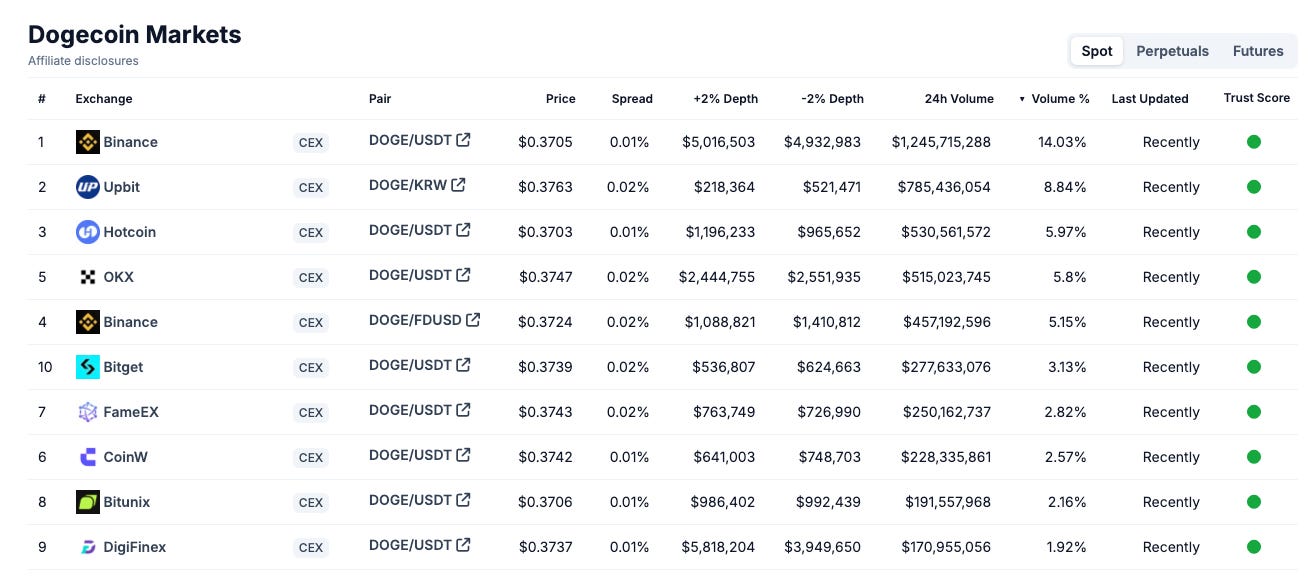

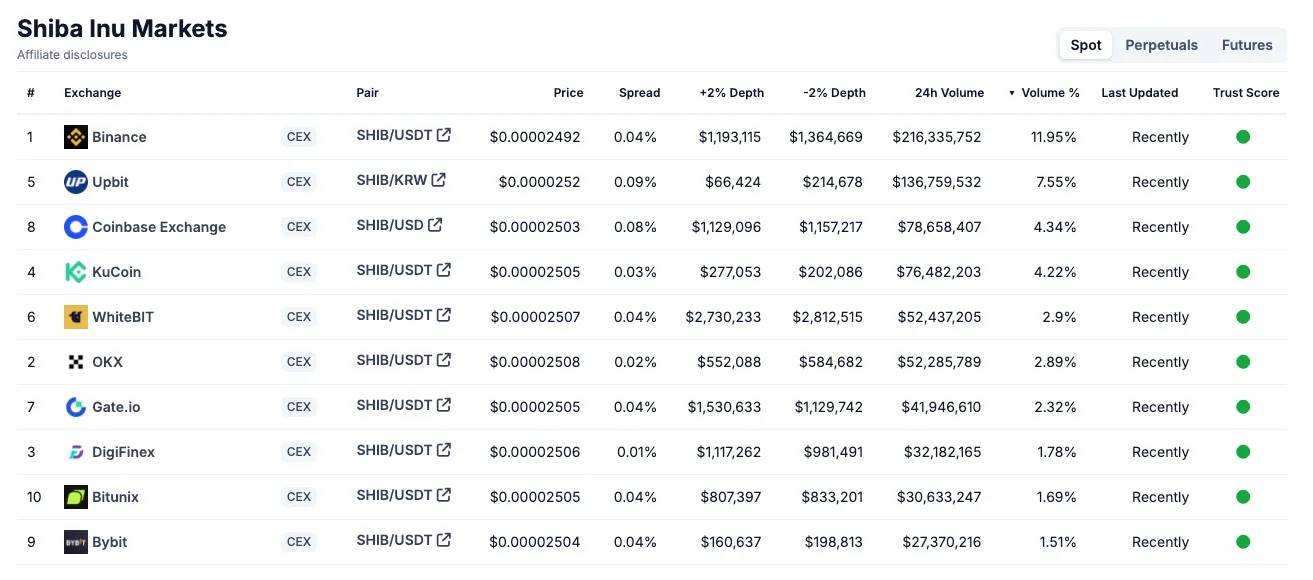

However, when you look at $DOGE and $SHIB, Upbit is still the second-largest spot market.

"Don't overlook the crazy buying from Korea" is an old saying.

This time, the Korean market feels different

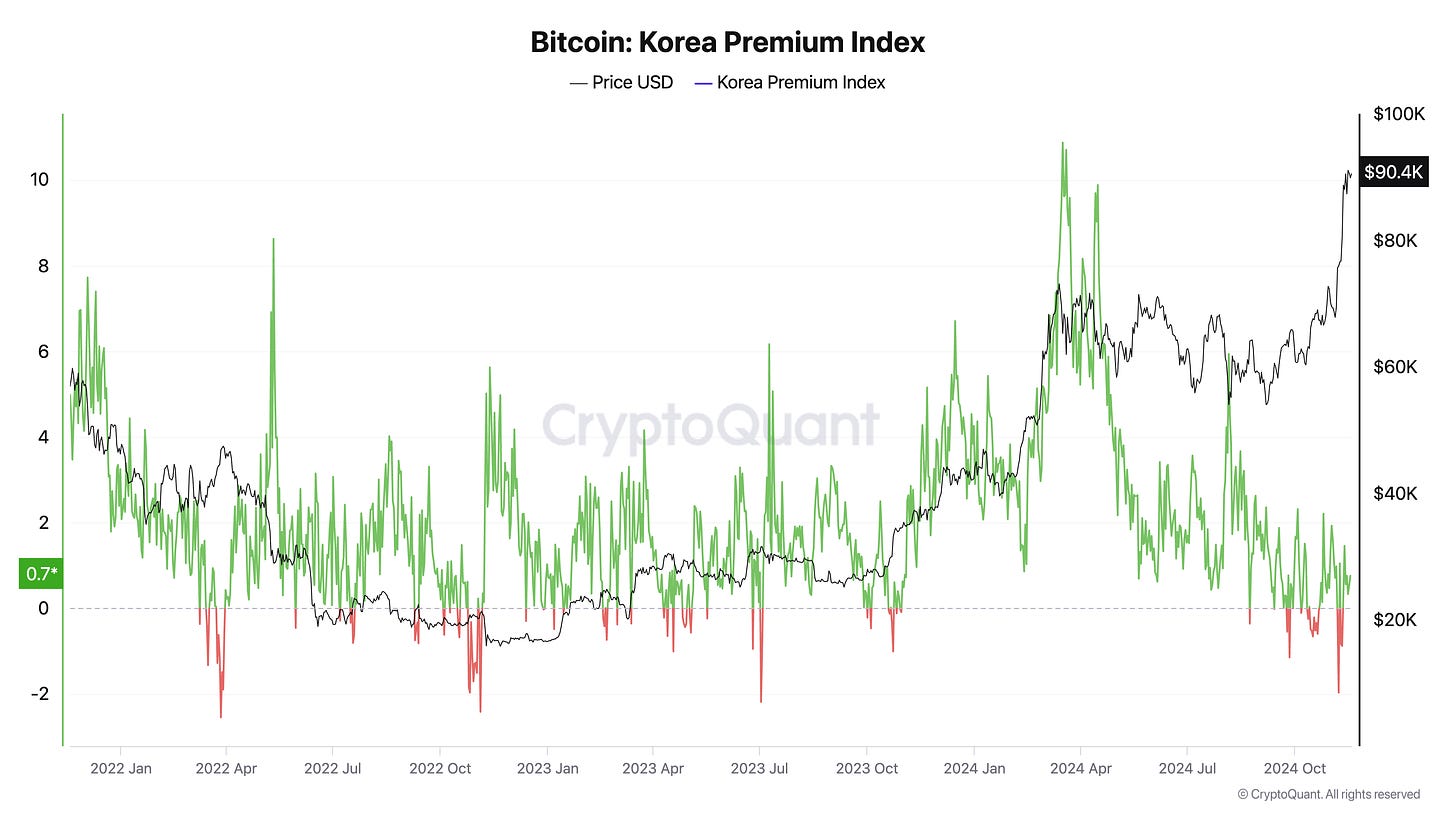

But where is the premium? For the past few weeks, I've been discussing the Korean market premium as a sentiment index. If the Korean market premium reaches +10%, it's time to stabilize slowly. But this time seems different. I've seen people checking their Binance portfolios on the subway, and friends asking about DOGE.

But why is there no 10% premium in the Korean market?

Bitcoin's price has reached $90,000, which is hard to believe. But this chart looks nonsensical. What is going on?

Are Koreans not buying? Not at all. Recently listed projects on Upbit have experienced significant increases.

Are there no new users? Not really. Korean crypto apps have recently ranked high in app stores.

Have we gotten better at arbitrage? Not really.

If that's the case, why didn't we perform better earlier this year?

In fact, we have found better ways to arbitrage the Korean market premium. The team at Presto Research has done an excellent job in this regard: while it may just be because "we are still in the early stages," Upbit's recent trading volume has exceeded $18 billion, far surpassing the $14 billion in March 2024, when the Korean market premium reached 10% and maintained at 5%. So why is there no premium now?

So, what has changed from March 2024 to now? I believe the main reasons are: 1) the listing of USDT, 2) macro market conditions, 3) the implementation of the "Virtual Asset User Protection Law." Although Bithumb listed $USDT in December 2023, Upbit followed relatively late, only catching up in June 2024. Before this, most Korean investors used $TRX or $XRP to transfer cryptocurrencies from Korean exchanges to global platforms like Binance, Bybit, and OKX. With the listing of USDT, it has become easier for people to arbitrage the premium and invest directly in dollars.

Especially as the Korean won weakens and the Korean stock market significantly underperforms compared to cryptocurrencies and the US stock market, interest in investing in dollars has surged. This has led to an increase in USDT trading volume, which currently holds about 9% market share, up from just 2.6% in December. It is important to note that most trading pairs on Korean exchanges are denominated in Korean won (e.g., BTC/KRW, ETH/KRW), rather than stablecoins. This means that most of the USDT trading volume comes from the USDT/KRW trading pair.

Thus, one of the historically easiest ways for Koreans to make money has been through trading the Korean market premium. This includes buying USDT, transferring it to foreign exchanges, earning profits, and returning to the Korean market when the premium appears (while also earning profits in won after the law is implemented + Bithumb's zero trading fee promotion) — or simply buying USDT when the Korean market premium is low and selling when it is high. This trading has become more active, and I believe it is suppressing the Korean market premium.

—Min Jung (For the full article, click here)

Oh my, I had never thought of this before. Therefore, the assumption I previously held that the Korean market premium would disappear as institutional accounts were enabled as a bull market indicator now seems completely outdated. The Korean market premium may have become meaningless!

But is this a good thing or a bad thing?

I'm not sure. For Koreans, a lower Korean market premium means prices are fairer. For the broader market, they have lost an indicator for judging market peaks.

However, I think Koreans are slowly losing something as well. Just today, the Financial Supervisory Service (FSS) of Korea suggested allowing exchanges to freeze crypto trading accounts without notifying users.

According to the "Virtual Asset User Protection Law," exchanges must disclose the reasons for freezing accounts before taking action. However, the FSS wants to allow exchanges to preemptively freeze accounts in certain "special circumstances" to respond to emergencies such as hacking, fraud, and the familiar attempts at money laundering.

In principle, prior notification is required, but they emphasize that the predictability of the reasons for account freezing and the purpose and intent of prior notification should be comprehensively considered.

This also applies when the National Tax Service or investigative agencies request account freezes and ask for delayed notification to achieve their investigative purposes.

The FSS emphasizes that if there are no unavoidable circumstances preventing it after careful consideration, prior notification must be provided.

Wait, what does this mean? They are not only allowing preemptive account freezes to protect consumers but also to protect national interests? Who would have thought? This is yet another reason not to keep money in Korean exchanges. Imagine a random altcoin on Upbit making five times its value, only to have the funds frozen by the tax office.

Needless to say:

Paju City in Gyeonggi Province has announced plans to become the first local government in Korea to directly sell virtual assets confiscated from local tax delinquents to collect owed taxes.

To implement this plan, Paju City issued notifications to 17 individuals who collectively owe 124 million won in local taxes on the 13th, warning them of the impending transfer and sale of their virtual assets.

The city has already confiscated the virtual assets of these tax delinquents through cryptocurrency exchanges. If these individuals fail to pay their overdue taxes by the end of this month, the city government plans to transfer virtual assets worth approximately 50 million won to its account to offset the unpaid taxes.

According to the city government, virtual assets have recently been used by tax delinquents to hide or transfer assets. A city official explained, "The collection through virtual assets sends a clear message to delinquents that they cannot hide their assets, and we will continue to track the properties of delinquents until we ultimately enforce tax measures." — KBS News

Why would Koreans choose to keep their funds on exchanges? Why would they want to convert cryptocurrencies into Korean won? As the market scales up, this question becomes more apparent. If everyone knows that crypto assets can be so easily confiscated, who would still want to store them in Korean exchanges?

If cryptocurrency truly represents a trillion-dollar opportunity, and the government is willing to support it, then funds must be able to flow freely. There is a reason people prefer to use dollars over yuan, as the latter may be confiscated.

It is precisely because of the "potential for confiscation" that the crypto industry was born. Imagine an industry being accepted yet reverting to past mindsets; that is unreasonable.

These protectionist and high-control measures will only increase capital outflow, especially in high-risk on-chain activities. Assets will remain on-chain, and what they want to protect will be destroyed by the fear of loss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。