Author: Josiah Makori

Translation: Baihua Blockchain

What is Crypto Narrative?

Crypto narrative refers to the popular ideas, stories, or beliefs in the cryptocurrency space that influence people's perceptions and value judgments about cryptocurrencies. They can sway investor sentiment, market trends, and the adoption of new technologies.

Key Points

Crypto narrative refers to the popular ideas, stories, or beliefs in the cryptocurrency space that influence people's perceptions and value judgments about cryptocurrencies, and can sway investor sentiment, market trends, and the adoption of new technologies.

One of the most important trends in 2024 is the focus on accessibility, meaning anyone can participate without needing in-depth knowledge of cryptocurrency and blockchain. This is reflected in the popularity of memecoins and prediction markets.

Narratives to watch in 2024 include: Memecoins, Liquid Restaking Tokens, Liquid Staking Derivatives, Blockchain Modularity, Layer 1, Layer 2 (Optimistic Rollup and Zero-Knowledge Rollup), BRC-20, Decentralized Physical Infrastructure Networks (DePIN), Telegram Crypto Trading Bots, Prediction Markets, and Real-World Asset Tokenization (RWAs).

Crypto narratives can also be misleading or even harmful, especially when built on false assumptions or excessive hype. Therefore, it is crucial to critically assess narratives and make investment decisions based on solid analysis and research.

Market participants are always looking for trends to better understand what is happening in the current market, why it is happening, and its potential impact. Historically, they have often anticipated future market conditions through the dynamics of market cycles. From Elon Musk's tweets driving DOGE price fluctuations to the belief that Bitcoin halving brings a bull market every four years, many investors predict price movements through crypto market narratives.

For example, the narrative of cryptocurrency as a "store of value" has attracted many investors who see it as a hedge against economic uncertainty. Similarly, the narrative of blockchain as a "disruptive technology" has drawn many entrepreneurs and developers committed to building new applications on the blockchain.

1. What is Crypto Narrative

This article was updated in January 2024 by the CoinGecko team to reflect new and emerging crypto narratives.

Market participants are always seeking trends to better understand what is happening in the current market, why it is happening, and its potential impacts. Historically, people have leveraged the dynamics of market cycles to take more proactive actions in future market environments. From Elon Musk's tweets driving DOGE price fluctuations to the belief that Bitcoin halving brings a bull market every four years, many investors predict price movements through crypto narratives.

For instance, the narrative of "cryptocurrency as a store of value" has attracted many investors who believe cryptocurrencies can serve as a hedge against economic uncertainty. Similarly, the narrative of "blockchain as a disruptive technology" has attracted many entrepreneurs and developers dedicated to building new applications on the blockchain.

Why are Crypto Narratives Important?

The emergence of crypto narratives stems from various factors, including the technological capabilities of crypto and blockchain, social and economic events, and the beliefs and motivations of individuals in the cryptocurrency industry. Mainstream media, social media, online forums, influencers, and market trends can all drive the formation of narratives. In 2024, we see an increasing number of narratives exploring the capabilities and applications of blockchain, such as Decentralized Physical Infrastructure Networks (DePIN). However, narratives like memecoins and prediction markets have also rapidly risen. These narratives make the crypto market more accessible to anyone, as they do not require in-depth knowledge of the crypto space.

Narratives are important because they play a significant role in shaping public perception and subsequently market trends. They provide a framework for understanding the potential risks and rewards of different types of cryptocurrencies and may influence the trajectory of the entire cryptocurrency industry.

However, crypto narratives can also be misleading or even harmful due to false assumptions or excessive hype. Therefore, it is crucial to critically evaluate these narratives and make investment decisions based on solid analysis and research.

Today, several emerging trends and themes are attempting to define 2024. In this guide, we will introduce the top crypto narratives to watch in 2024:

2. Memecoins

Memecoins remain one of the most profitable narratives in 2024, with growing expectations for a memecoin supercycle. CoinGecko data shows that SPX6900 and Gigachad topped the charts in Q3. Additionally, other memecoins have reached new heights, such as GOAT becoming the first token to surpass a market cap of $1 billion on Pump.fun. As of the writing of this article, the total market cap of memecoins has reached $107.5 billion.

As the name suggests, memecoins are based on internet memes and popular trends, supported by enthusiastic communities. They are often positioned as entertainment tokens, relying on a growing community for viral spread and growth. Memecoins also provide traders with an easy way to participate in popular blockchain speculation, as these tokens are typically sold for just a few cents at launch. Unlike other narratives, potential buyers do not need to have an in-depth understanding of the cryptocurrency world to join the speculation, as most memecoins have little to no practical use at launch.

2024 has also seen the emergence of memecoin generators, simplifying the token creation process, allowing anyone to issue their own memecoin without a technical background. The biggest player in this space is Pump.fun, based on Solana. To date, over 3 million tokens have been issued on Pump.fun, generating total revenue exceeding $187 million.

As of the writing of this article, Solana and Base are among the most popular blockchains for memecoins.

3. Prediction Markets

Prediction markets allow users to bet on ongoing and future events using cryptocurrency, where users can buy shares of "yes" or "no." Once the event concludes, users who chose the correct option will earn returns based on the number of shares purchased.

Among these prediction markets, Polymarket is the largest, with its recent "2024 Presidential Election Winner" prediction trading volume exceeding $732 million. Other popular categories in prediction markets include sports, business, and pop culture.

4. Liquid Restaking Tokens

Restaking is an increasingly popular narrative focused on improving capital efficiency, allowing users to stake the same token across different protocols simultaneously, providing security for multiple networks. This mechanism helps protocols address the challenge of building their own validator clusters while providing scalable security based on the needs of their respective protocols. In return, restakers can earn additional rewards through their restaking strategies (but also face additional slashing risks).

EigenLayer is a pioneer in the restaking space, with a total value locked (TVL) exceeding 3.5 million ETH as of the writing of this article. Users can restake their liquid staking tokens, such as stETH, rETH, and cbETH, to provide security for Active Validation Services (AVS).

You can view the top liquid restaking tokens on CoinGecko.

5. Liquid Staking Derivatives (LSDs)

Liquid staking derivatives are cryptocurrencies issued by liquid staking platforms that allow stakers to unlock their liquidity-constrained staked assets and earn more returns. In standard staking, stakers provide security for proof-of-stake (PoS) blockchains by depositing assets into the protocol. However, this approach leads to capital inefficiency, as stakers' assets are locked and cannot generate additional returns.

Liquid staking emerged in this context. The value of derivative assets is tied to the underlying assets (the assets locked when staked on a proof-of-stake blockchain) and accumulates rewards over time, increasing in value. Meanwhile, derivative tokens can be used for other DeFi activities, such as borrowing and providing liquidity. In return, most liquid staking providers take a 5-10% share of staking rewards as income.

Liquid staking derivatives address the issue of capital inefficiency, lower the entry barrier for staking, and enhance the security and stability of the network.

You can view the top liquid staking tokens on CoinGecko.

6. Blockchain Modularity

Early blockchains, such as Bitcoin and Ethereum, were monolithic structures, meaning the blockchain needed to perform all tasks. However, as the focus of competition has shifted from performance to cost and flexibility, the era of blockchain modularity is gradually emerging. Modularity breaks down blockchains into independent components, allowing them to overcome current scalability limitations.

Modular components include:

- Execution Layer: Responsible for transaction execution

- Settlement Layer: Responsible for settlement, fraud proofs, and connecting other execution layers

- Consensus Layer: Responsible for achieving consensus on transaction order

- Data Availability Layer: Provides accessible data to all network participants

Transaction execution typically occurs on Layer 2 chains, such as Optimism and Arbitrum, which are responsible for executing transactions and sending packaged transactions to the main chain. Additionally, Layer 2 chains themselves are also gradually becoming modular, such as OPStack, which modularizes all elements of Layer 2 chains into standardized open-source modules that developers can use to create new blockchains.

Meanwhile, EigenDA is a decentralized data availability layer built on Ethereum, currently used by Layer 2 chain Mantle to provide data availability support.

Layer 1 blockchains like Celestia are also adopting modular architectures. In the case of Celestia, the focus is on consensus and data availability, optimizing storage. This allows Layer 2 chains built on Celestia to focus on creating the optimal execution environment for their applications.

6. Layer 1 Blockchains (Layer 1s)

Layer 1 (L1) blockchains serve as the foundational infrastructure for building other blockchain applications, such as smart contracts. They execute most on-chain transactions and act as a "trusted source" for public blockchains. Traditional L1 blockchains, like Ethereum, often face issues such as slow transaction speeds, low scalability, and high fees. This is where Layer 2 blockchains (L2s) come into play, responsible for executing transactions so that L1 can focus on publishing and verifying these transactions. However, new L1 networks are changing the landscape in terms of transaction speed, cost, and interoperability.

Here are some noteworthy L1 projects that are gaining attention as the L1 narrative heats up:

1) Solana

Although Solana launched in 2020, its ecosystem has become one of the most popular blockchain ecosystems in 2024, accounting for 38.8% of on-chain narrative interest among crypto investors. One major reason for the popularity of the Solana ecosystem is the current memecoin craze, combined with Solana's high speed and low fees, along with the viral spread of Pump.fun, a memecoin generator, making it one of the primary chains for memecoin speculation.

2) Sui

Sui is an "infinite platform" for building rich and dynamic on-chain assets ranging from games to finance. It is the first permissionless L1 network designed from the ground up for creators and developers, aimed at serving the upcoming billion Web3 users. Sui was created by the Mysten Labs team, composed of former Meta engineers.

Sui meets application demands through horizontal scaling, enhancing scalability without limits while ensuring cost-effective transaction fees. Additionally, it significantly improves scalability by supporting parallel consensus for simple transactions (such as NFT minting and transfers). Complex transactions (such as asset management and DeFi applications) are handled by the DAG-based Narwhal and Bullshark memory pools and Byzantine Fault Tolerance (BFT) consensus mechanism.

7. Layer 2: Rollups

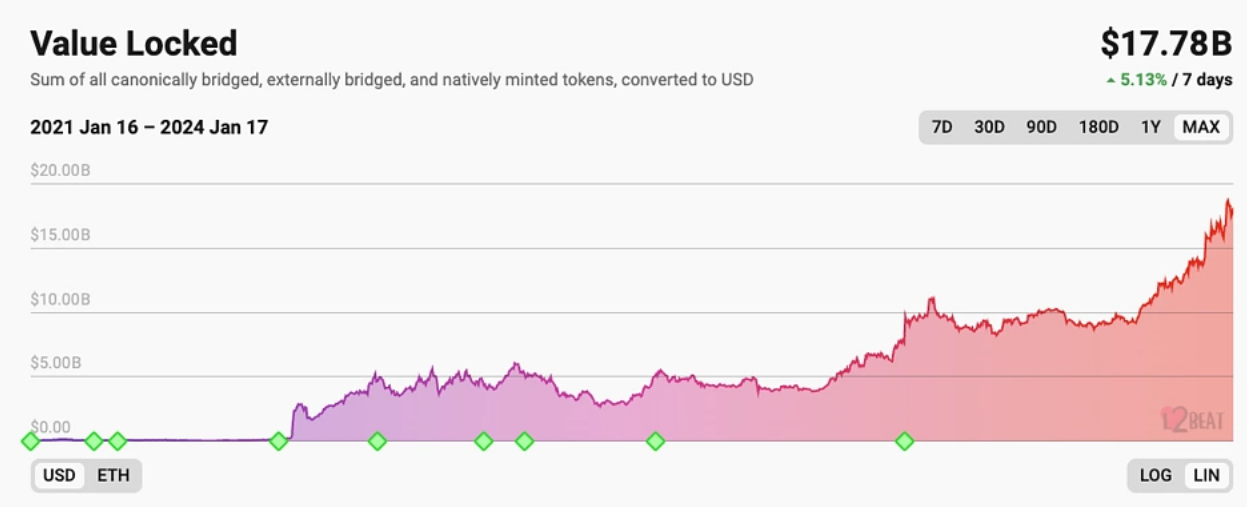

The narrative of vertical scaling focuses on Layer 2 (L2), which are protocols built on top of L1 to further expand and enhance them. L2 significantly reduces the computational burden on L1 by moving transactions off-chain, thereby greatly increasing transaction throughput. The total value locked (TVL) in L2 has been steadily growing, maintaining strong performance even in the face of negative sentiment in the DeFi market and the overall crypto market.

A. Optimistic Rollups

Optimistic Rollups are L2 scaling solutions designed to increase transaction throughput and reduce fees while maintaining the security guarantees of the underlying blockchain. They utilize a trust-based model, confirming transactions off-chain, which are then added to the underlying blockchain after being verified by a small group of "witnesses."

Source: Beat

Here are some L2 Optimistic Rollup projects to continue watching in 2024:

1) Base

In February 2023, Coinbase launched Base, an L2 blockchain built using Optimism's OP Stack, aimed at serving the upcoming millions of Web3 users, leveraging Coinbase's large user base. The Base network provides creators with a secure, low-cost, and developer-friendly solution for building Web3 applications. Since its launch, Base's popularity has been on the rise, with increased investor interest in 2024, making it the second hottest chain after Solana. Base is also popular among memecoin traders, with its top memecoin BRETT's market cap exceeding $1 billion.

2) Arbitrum

Arbitrum is an L2 scaling solution that utilizes Optimistic Rollups to achieve high throughput and lower user transaction costs. Even after Ethereum's Merge, Ethereum's speed and gas fees remain higher compared to other networks like Arbitrum. This has led many Web3 users and creators to turn to the Arbitrum network, driving its total value locked (TVL) to a peak of $3.2 billion in November 2021.

The recent ARB airdrop injected significant liquidity into the Arbitrum network. Many users who received ARB tokens were incentivized to use these tokens for trading, staking, or providing liquidity for various decentralized exchanges and protocols on the Arbitrum network. This airdrop also helped raise awareness of the Arbitrum network, showcasing its potential as an Ethereum L2 scaling solution.

3) Optimism

Optimism is positioned as "a fast, stable, and scalable L2 protocol designed by Ethereum developers for Ethereum developers." It is built as a minimal extension of the current Ethereum blockchain to seamlessly scale Ethereum applications. Unlike common EVM-compatible chains, Optimism is EVM-equivalent, meaning it fully complies with the formal specifications of the Ethereum blockchain and runs in sync with Ethereum. Optimism has also launched OPStack, which standardizes the various modular elements of L2 chains, allowing developers to build new chains that interoperate with Optimism. According to Defillama data, Optimism's TVL reached an all-time high of $1.15 billion in August 2022.

B. Layer 2: ZK Rollups

ZK Rollups are a Layer 2 scaling solution that enhances Layer 1 throughput by moving computation and state storage off-chain. They can batch process a large number of transactions and publish summary data on-chain. The core of ZK Rollups lies in their ability to prove knowledge of something without revealing the information. Therefore, they are very attractive in applications requiring high privacy, such as digital identity verification and confidential transactions.

Here are some ZK Rollup projects to watch in 2024:

1) zkSync Era

zkSync Era is an L2 rollup solution that utilizes zero-knowledge proofs to scale the Ethereum network without sacrificing its security and decentralization features. zkSync Era keeps most computations and data storage off-chain, allowing users to enjoy Ethereum's security while achieving higher transaction speeds and lower costs.

2) Polygon zkEVM

Polygon zkEVM launched Mainnet Beta on March 27, 2023, marking an important step towards scaling Ethereum and achieving mainstream Web3 adoption. Similar to Optimism, Polygon zkEVM is EVM-equivalent, meaning most Ethereum-native applications can run directly on zkEVM without requiring developers to modify or reimplement their code.

3) Scroll

Scroll is an L2 solution dedicated to achieving infinite scalability, high throughput, complete decentralization, and trust-minimized privacy. It aims to achieve this by combining ZK Rollup with high-performance off-chain decentralized systems.

4) Taiko

Taiko is designed to be the ZK Rollup Layer 2 that is closest to Ethereum equivalence, providing dApps with a scalable and efficient platform without requiring any changes to existing protocols. Unlike many other ZK Layer 2 solutions, Taiko focuses on achieving full compatibility with Ethereum rather than pursuing ZK proof generation speed, allowing developers to reuse execution clients without significant adjustments. Users can experience Taiko's capabilities by participating in the protocol availability testing of the Taiko testnet.

8. Bitcoin Layer 2

Similar to other Layer 2 solutions, Bitcoin Layer 2 projects aim to scale the Bitcoin blockchain by developing an execution layer that offers higher throughput and more operations than the mainnet. Layer 2 on the Bitcoin network provides an execution layer that supports operations such as virtual machines (like EVM) and smart contracts, distinct from the mainnet. However, Bitcoin Layer 2 networks face challenges, such as ensuring secure cross-chain bridging between Bitcoin and its Layer 2 networks, as well as maintaining high speed and low costs when settling proofs on the Bitcoin network.

Layer 2 on the Bitcoin network includes state channels (like the Bitcoin Lightning Network), sidechains (like Stacks and Rootstock), and even rollups like Merlin.

Bitcoin: Ordinals, BRC-20 Tokens, and Runes

Ordinals are one of the latest hot trends on Bitcoin. In January 2023, software engineer Casey Rodarmor deployed the Ordinals protocol on the Bitcoin blockchain, making it possible to mint NFTs on the mainnet. This move elicited mixed reactions from the Bitcoin community, with some viewing it as a threat to the Bitcoin blockchain, while others were excited and began creating works known as "Inscriptions"—essentially Bitcoin's version of NFTs.

Similar to NFTs, Ordinal Inscriptions are digital assets recorded on a Satoshi (the smallest unit of Bitcoin). However, unlike NFTs that use decentralized file storage systems, Ordinals are stored directly on-chain. The implementation of these inscriptions was made possible by the Taproot upgrade introduced to the Bitcoin blockchain in November 2021.

The number and order of BTC Ordinals are closely monitored, with several well-known series and high-priced sales already occurring, including Ordinal Punks, Taproot Wizards, Bitcoin Rocks, Timechain Collectibles, Ordinal Loops, Ripcashe's Power Source, Bitcoin Shrooms, The Shadow Hats, The Dan Files, and Toruses.

In addition to Ordinals, BRC-20 Tokens are also gaining attention. BRC-20 Tokens utilize Ordinals inscription technology to enable the minting and transfer of fungible tokens on the Bitcoin blockchain. BRC-20 Tokens are similar to the ERC-20 standard on Ethereum and EVM networks, minted by the community. Once BRC-20 Tokens are deployed, Ordinal wallets can freely mint these tokens. Although still in the early stages, several platforms already support the decentralized minting and trading of BRC-20 Tokens.

In 2024, with the fourth Bitcoin halving, Rodarmor will launch a new fungible token protocol for the Bitcoin ecosystem, making it easier and more efficient for users to create tokens on Bitcoin. Runes may benefit from the popularity of meme coins. Rodarmor even stated, "99.9% of fungible tokens are scams and jokes." However, with this more efficient protocol, significant transaction fee revenue, developer attention, and user growth are expected to be brought to Bitcoin.

9. Decentralized Physical Infrastructure Networks (DePIN)

DePIN refers to decentralized physical infrastructure networks that develop real-world infrastructure through blockchain and token rewards, covering various fields such as wireless connectivity, geospatial mapping, transportation, health, and energy.

The goal of DePIN is to create resource-efficient physical infrastructure by incentivizing providers to contribute their physical resources to a decentralized network. DePIN then offers these resources to users seeking relatively low service fees, generating revenue through the fees paid by users.

Check out popular DePIN Tokens on CoinGecko.

10. Real World Assets (RWA)

Real World Assets (RWAs) refer to assets that exist in the real world or off-chain, which are tokenized and transferred on-chain to serve as yield sources in DeFi. Such assets include real estate, precious metals, commodities, and artworks. RWAs are a core component of the global financial system; for example, the global real estate valuation reached $326.5 trillion in 2020, while the total market value of gold was $12.39 trillion. An increasing number of RWA projects are looking towards U.S. Treasury bonds and high interest rates to provide investors with lower-risk yields, including companies like Ondo Finance.

MakerDAO has also entered the RWA space, investing idle assets into short-term bonds and using the yields to drive the MKR buyback program and increase DAI savings rates, which is a typical case of the protocol benefiting from RWA investments. MakerDAO demonstrates how value can flow back to token holders, with its buyback program driving MakerDAO's growth.

The potential impact of RWAs on DeFi is significant:

- They can provide sustainable and reliable yield sources for DeFi, as they are backed by traditional assets.

- They can help DeFi become more compatible with traditional financial markets, ensuring higher liquidity, capital efficiency, and investment opportunities.

- They can bridge the gap between DeFi and traditional finance (TradFi).

Maple Finance (MPL), Goldfinch (GFI), and Centrifuge (CFG) are other projects focused on RWA lending that are worth a look.

Check out popular RWA Tokens on CoinGecko.

11. Telegram Trading Bots

In 2023, the usage of Telegram cryptocurrency trading bots surged, providing users with convenience and efficiency in executing trades. Users no longer need to connect wallets to a computer and approve transactions; they can simply copy and paste the token's contract address and send it in the chat to purchase tokens. This also speeds up the selling process, as transactions can be pre-approved and signed.

Some Telegram trading bots also have additional features, such as multi-wallet sniping, which can bypass the single wallet limit for tokens; and liquidity sniping capabilities, which execute buy orders immediately upon detecting liquidity additions to maximize profits from new tokens.

Check out our article on "Top 5 Telegram Trading Bots" to learn more about the features of different Telegram crypto trading bots.

12. Conclusion

In 2023, we saw narratives such as artificial intelligence, China concept tokens, decentralized social media, as well as Layer 1, Layer 2, liquid staking derivatives, real-world assets, Bitcoin Ordinals, and BRC-20. Looking ahead to 2024, emerging narratives include Restaking, DePIN, DeSci, GambleFi, and a focus on blockchain modularity.

Please remember that this article is for educational purposes only and should not be considered financial advice. Conduct your own research (DYOR) before investing in any asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。