Does Trump have the power to make BTC a reserve asset for the United States? Can his pre-election promises be fulfilled? What would be the impact if Bitcoin becomes a reserve asset?

Article by: laolibtc

Recently, there has been increasing news about BTC potentially becoming a reserve asset for the United States. The Economic Daily published an article yesterday titled "Will Bitcoin Become a Reserve Asset for the United States?" I briefly reviewed the content, which is quite lengthy. Here, I will summarize it for everyone. The article mainly explores the possibility of Bitcoin being classified as a national strategic reserve asset for the United States. It also mentions that Bitcoin's price has surged significantly due to multiple factors, including the Federal Reserve's interest rate cuts and the results of the U.S. elections, attracting high attention from the international market. Reports suggest that the U.S. will promote Bitcoin as a national strategic reserve asset, but the implementation is quite challenging.

The rise in Bitcoin's price is driven by multiple factors, including the Federal Reserve's interest rate cuts, cryptocurrency support policies during the Republican campaign, the Bitcoin mining reward halving mechanism, and a stabilizing global economic growth trend. Although the incoming U.S. government, including Trump, Vance, and Musk, has shown strong interest in cryptocurrencies, making Bitcoin a true national reserve asset still requires overcoming several hurdles.

From a policy perspective, classifying Bitcoin as a strategic reserve asset requires a complex legislative process and faces opposition from interest groups such as traditional financial institutions and conservative lawmakers. In terms of market and regulation, there is a gap between the volatility of Bitcoin's price and the stability required for national reserves, and the U.S. cryptocurrency regulatory framework is also not well-established. Additionally, Bitcoin is not a good inflation hedge; its price is more closely related to speculative stocks, such as large U.S. tech stocks and the trends of the Nasdaq and S&P 500 indices.

Therefore, despite the market discussions triggered by the rise in Bitcoin's price, the path to becoming a national strategic reserve asset for the United States remains fraught with challenges and uncertainties.

Now, returning to the topic of our discussion: Does Trump have the power to make BTC a reserve asset for the United States? Can his pre-election promises be fulfilled? What would be the impact if Bitcoin becomes a reserve asset? This three-part question.

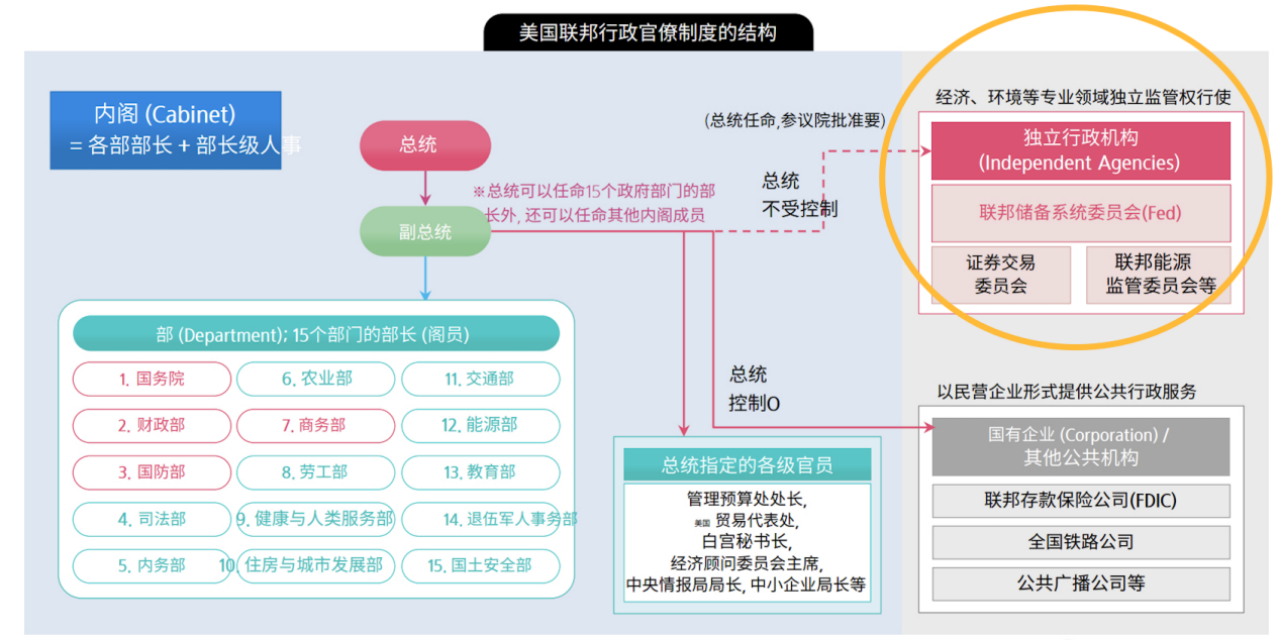

Here’s my answer: 1. Trump personally does not have the power; it requires a relatively complex legislative process and negotiations with interest groups. Currently, agencies like the SEC have relatively strict regulations on Bitcoin, and the SEC and the Federal Reserve are not influenced by presidential transitions; their chairs are not controlled or appointed by Trump.

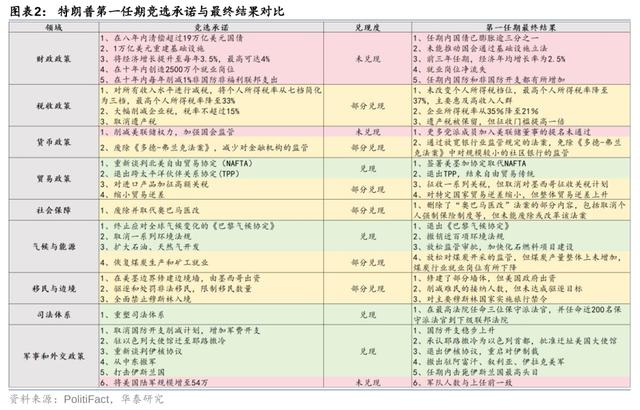

So, can Trump's pre-election promises be fulfilled? Looking back at history, Trump's promise fulfillment rate during the 2016 campaign was only 23%. In the 2016 U.S. election, Trump made campaign promises including massive tax cuts, revitalizing manufacturing, combating illegal immigration, repealing Obamacare, renegotiating trade agreements, and increasing military spending. These promises were largely fulfilled in broad terms, but the fulfillment rate in specific policy details was low. For example, Trump had a low fulfillment rate on economic and immigration issues, while he largely fulfilled his campaign promises in trade, military, and foreign affairs. Economic and immigration issues were central to Trump's campaign promises, accounting for about one-third of his total promises, and these positions played a significant role in his eventual victory. However, due to a lack of like-minded executors and a chaotic cabinet, many of Trump's grand visions proposed during his first term were not realized. Overall, Trump's fulfillment rate in matters within presidential authority is relatively high, while areas requiring congressional support and more complex economic issues have seen relatively poor results. Therefore, based on historical data, there is about a 77% probability that the promise to include BTC as a reserve asset for the U.S. may not be fulfilled.

Of course, from a historical probability perspective, there is also a 23% chance that the promise could be fulfilled, making BTC a reserve asset for the U.S. For instance, this time Trump has consolidated power, holding the presidency, Congress, the Supreme Court, and the executive branch, achieving a rare concentration of power, which may increase the likelihood of legislative passage. This term may allow the fulfillment rate to exceed 23%. If BTC is indeed included as a U.S. reserve asset, countries around the world may follow suit, and the currently mined fewer than 20 million Bitcoins could be rapidly purchased, leading to a significant price increase. The current price of $92,000 may only be a fraction of future prices, with possibilities of $500,000 or even $1 million, somewhat akin to the stock price of Berkshire Hathaway before its split; a million-dollar price tag is not a dream!

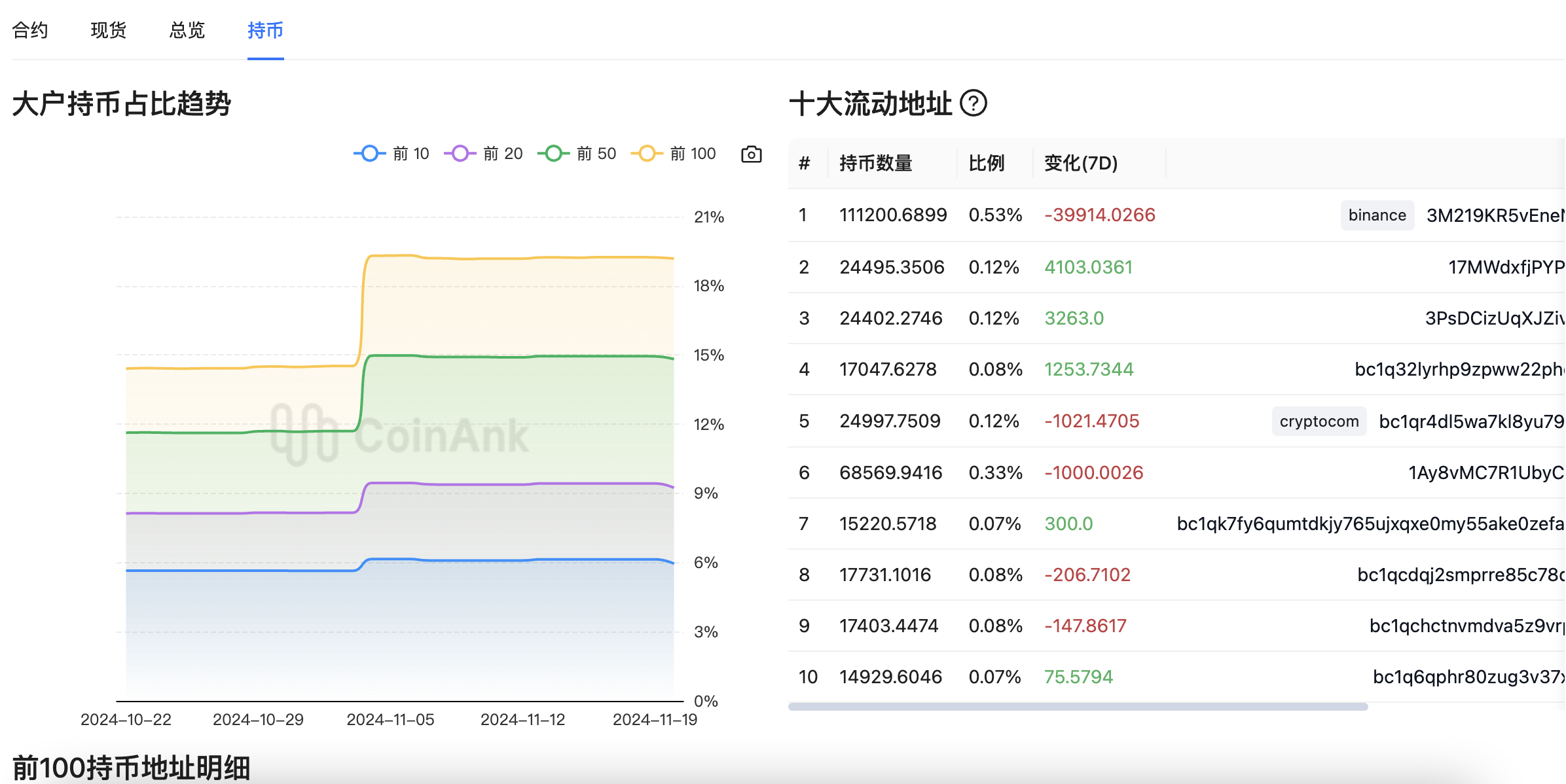

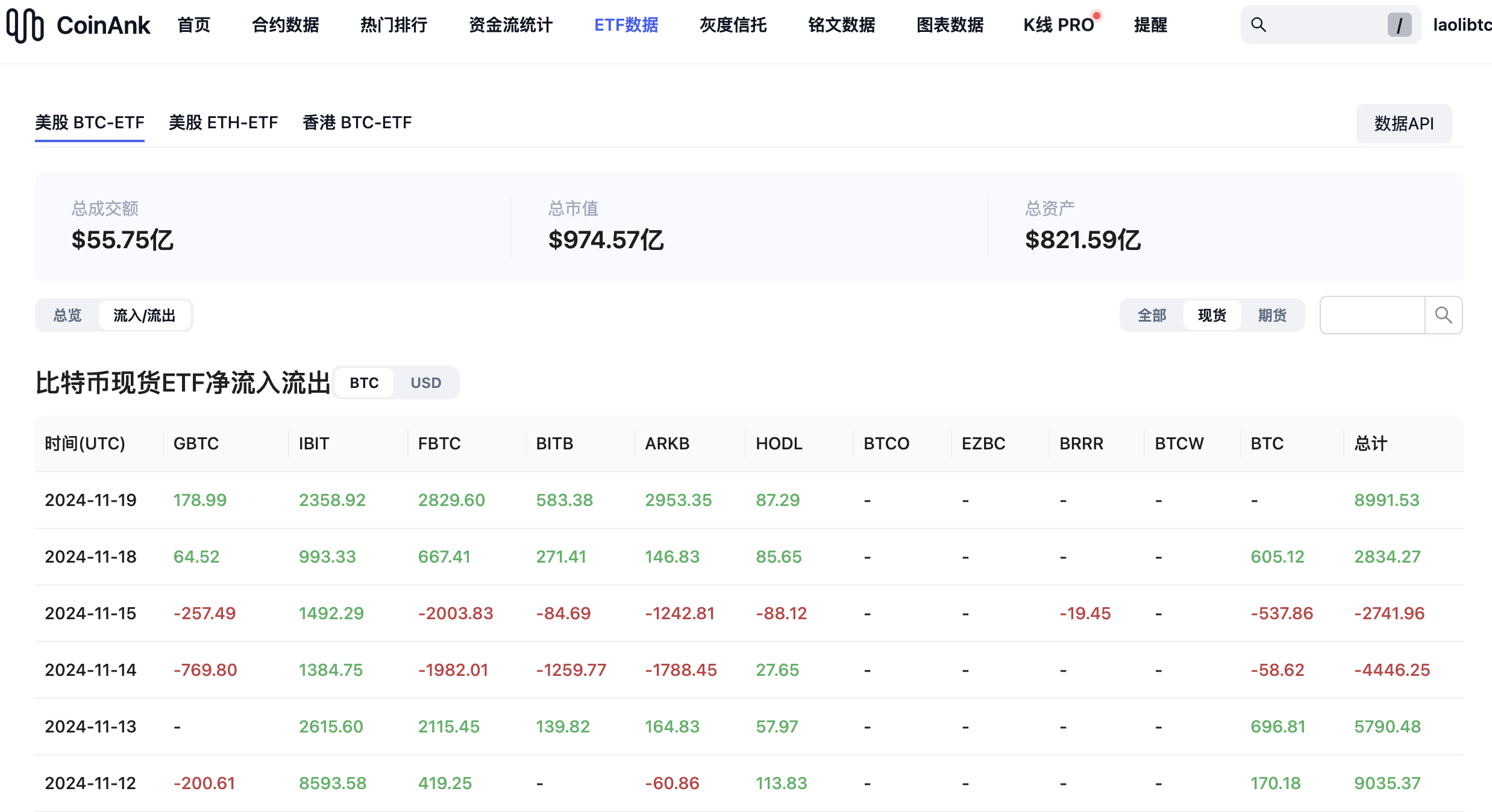

Through Coinank data, we can clearly verify the holding dynamics of the top 100 BTC addresses and the marked addresses, such as those belonging to U.S. exchanges, companies, and investment banks. We can also understand the holdings of U.S. Bitcoin spot ETFs and changes in inflows and outflows. It is even possible to monitor changes in the amount of Bitcoin held by the U.S. government through some known wallet addresses. Whether Bitcoin can truly become a reserve asset for the U.S. is not solely determined by Trump, but we can use real-time data to understand how much Bitcoin Americans are actually buying.

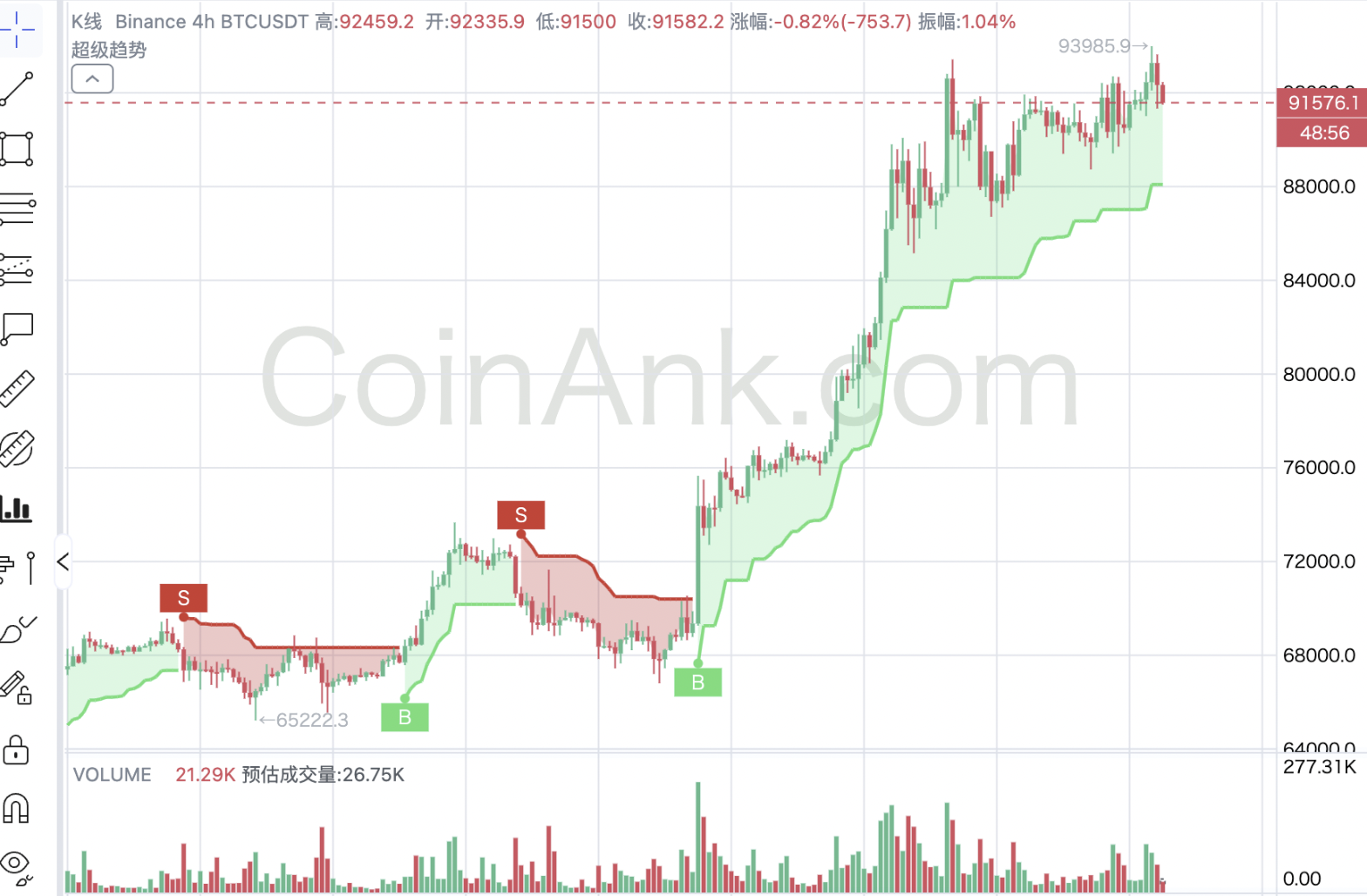

The 4-hour chart of BTC shows that since Trump's victory in the U.S. election, it has been in a clear bullish trend. The super trend indicator shows support around $88,000, and it is currently slightly moving upwards into a slowing state, as it has been in high-level fluctuations recently. Attention should be paid to the performance near the support test, as the position of the bullish and bearish reversal will affect the future direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。