After hitting a new high of 93,905 in the evening, Bitcoin retraced. The high-level consolidation has been prolonged. The overall direction remains bullish, but short-term operations will become increasingly difficult. My personal suggestion is to reduce the frequency of trades and observe more while acting less. This bull market is characterized by a volatile and complex structure, but such a trend can lead Bitcoin to higher levels of 150,000 to 200,000. However, the process will not allow everyone to profit like in the previous two bull markets.

The next four years will be the best yet most complex years for BTC!!!

Trump is back in the White House; this is the best four years for Crypto, and we must seize the opportunity!

This bull market is an institutional bull market, a bull market for ETFs, with BTC and ETH (SOL, XRP, LTC have not yet passed) in the first tier.

The trend of this bull market is volatile and structurally complex; BTC is increasingly resembling American market trends, with a long and slow bull market…

Altcoins are experiencing a bifurcation; the strong get stronger, and the weak get weaker. Choosing coins is a necessary skill.

For retail newcomers, hoarding BTC and also converting profits from altcoins into BTC for long-term holding is advisable. Swing traders will be tested on their skills and patience…

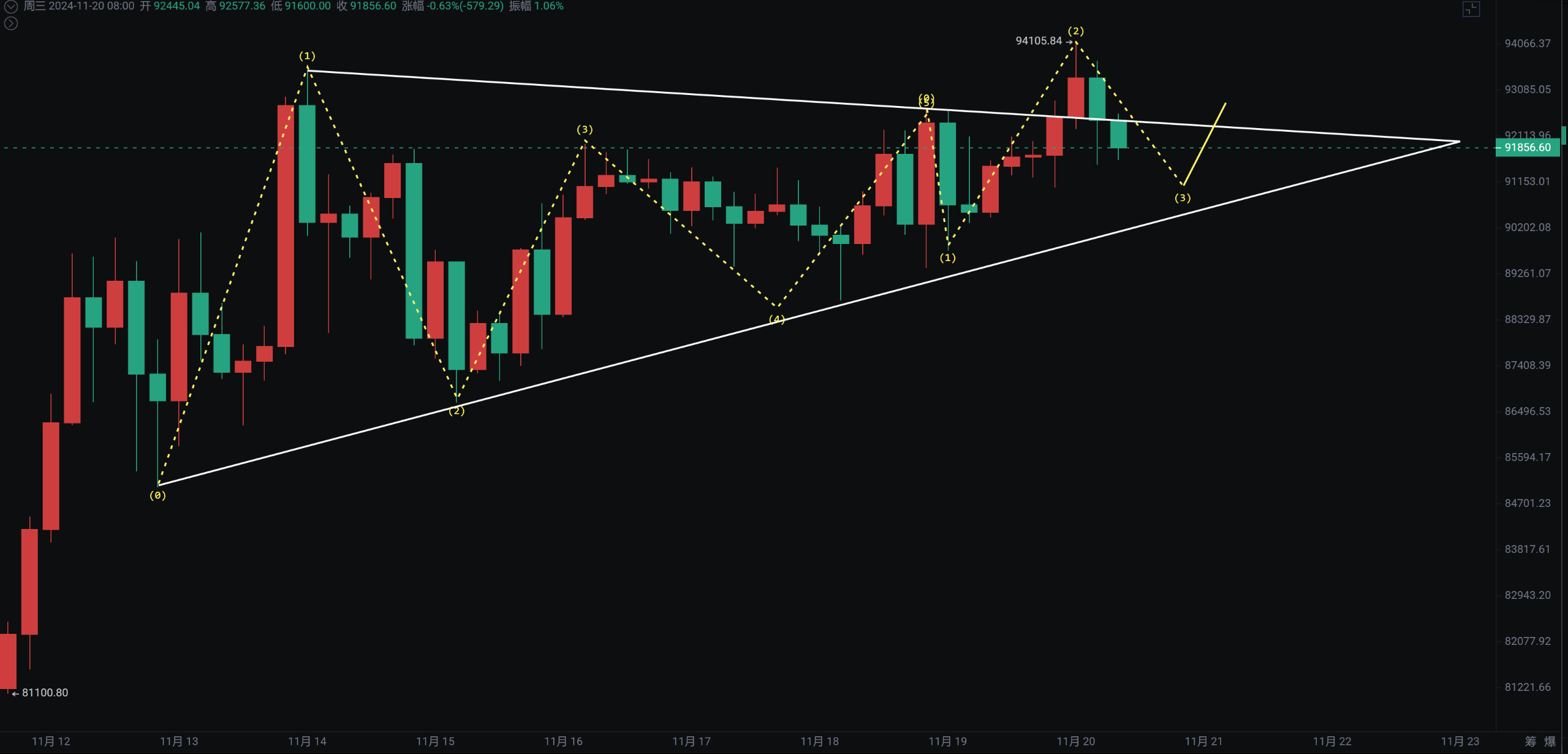

Bitcoin

After hitting a new high of 93,905 in the evening, it retraced, and the overall trend remains a high-level consolidation. The K-line briefly pierced the previous high before facing pressure, consistent with our mid-November predictions. The lows are continuously rising, and the highs are consistently breaking through, but it keeps falling back into the consolidation range.

As long as the 4-hour rising support line is not broken, we continue to expect consolidation. Even if it breaks, it will still oscillate within the range of 85,000 to 95,000. This kind of crazy up-and-down movement in the short term is generally a washout rather than a trend reversal.

Support: Pressure:

Ethereum

Ethereum's daily line has retraced to the Fibonacci 0.382 area, which is a weak correction, but the market continues to oscillate within a narrow range of 3,000 to 3,220. If it breaks below 3,000, it will enter wave C, reaching 2,778 to 2,860, which is where we can consider adding positions for the medium term. For now, staying close to 3,000 without breaking is also a short-term entry opportunity, with the precaution of not falling below 3,000.

Support: Pressure:

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

This article is time-sensitive and for reference only; it will be updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。