Zhou Yanling: 11.20 Bitcoin perfectly reached 94000 yesterday, today it retraced and continues to go long

On the Federal Reserve side, several officials will speak this week, and market expectations for its interest rate policy are still changing. Fed's Schmid stated on Tuesday that the extent of interest rate cuts is still unclear, and the Fed's confidence in returning inflation to the 2% target needs to be strengthened. Currently, the market believes there is a 59% chance that the Fed will cut rates by 25 basis points in December, which will provide some support for cryptocurrency prices. Recent economic data from the U.S. shows that single-family housing starts plummeted by 6.9% in October, indicating that rising mortgage rates may put pressure on the real estate market, further affecting economic growth. Weak economic data may prompt the Fed to adopt a more accommodative monetary policy, which will also support cryptocurrency prices. Additionally, due to the ongoing geopolitical tensions, risk aversion remains high, and recent news will have a certain impact on the market, so everyone should continue to pay attention.

From the market trend perspective, Bitcoin continues to show strength in the short term. Yesterday, the market continued to fluctuate and rise, hitting around 94000 overnight and reaching a new high before retracing, forming a pattern of oscillation and forced upward movement. Currently, the short-term upward momentum has temporarily slowed down, showing a slow rising pattern, and the current 4-hour level rebound and daily level rebound have reached the previous oscillation high point near 92300. The short-term downside retracement space is limited, and the trend remains strong. This kind of movement can easily lead to a retracement followed by a rapid surge to a peak or a prolonged consolidation at a high level before a decline. Today's response strategy is still to look for long positions after a retracement. Even if there are short positions, a retracement of one or two thousand points in the short term is an opportunity to exit short positions, and continuing to go long at lower levels is key to capturing larger spaces.

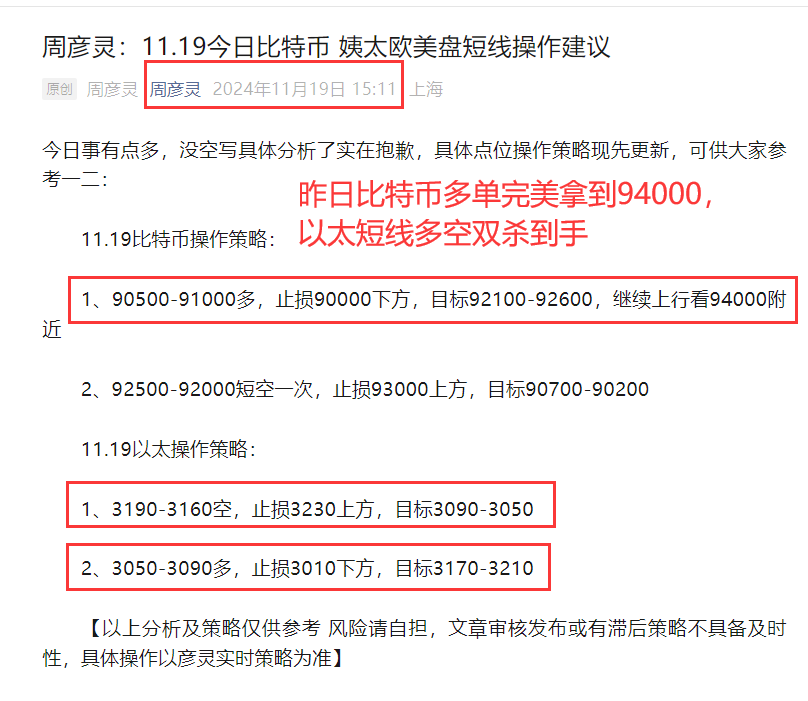

11.20 Bitcoin Trading Strategy:

Go long at 91200-91800, stop loss below 90600, target 93500-94000, continue to break upwards looking at around 95000.

Go short at 95000-94600, stop loss above 95500, target 93400-92800.

11.20 Ethereum Trading Strategy:

Go long at 3040-3080, stop loss below 3000, target 3160-3200-3240.

Go short at 3230-3200, stop loss above 3260, target 3120-3090.

【The above analysis and strategies are for reference only. Please bear the risk yourself. The article review and publication may have delays, and the strategies may not be timely. Specific operations should follow Yanling's real-time strategies.】

This article is exclusively shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for over ten years, currently mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV, and other cryptocurrency contracts/spot operations. For more real-time community guidance, consultation on unblocking positions, learning market observation skills, etc., you can follow the teacher's public account: Zhou Yanling to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。